Archive for April 2008

Save Money – Student Loans

Student loans. They are so nice to have around. NOT!

I remember inviting this gal named Sallie Mae over to my house and she did not leave for 8.5 years!

After 8.5 years, I decided that it was time to break up with Sallie Mae. She was not really pleased about it.

Anyway, about four years into the pay-off, I received a letter in the mail that said …

"Congratulations. Because you have made 48 consecutive on-time payments, your interest rate has been reduced by 2%!"

That was awesome!

If you have student loans, did you know that YOU could receive the same interest rate deduction?

In fact, I checked out several of the larger Student Loan companies to find out their current policies. Here is what I found.

- Sallie Mae – If you make your first 33 monthly payments on time, you will receive a check for 3.3% of the amount borrowed! If you opt to have the 3.3% credit applied to your loan amount (I would), it will save about 5.35% of the amount borrowed due to interest savings! Click HERE for Sallie Mae's Cash Back details.

- SC Student Loan – Through their Quarterback Program, borrowers can automatically receive a 0.25% interest rate reduction for allowing monthly drafts for your payments. Through their Best Interest Program, after making 36 consecutive on time payments, borrowers will receive a 2% interest rate reduction. If you make all of your payments on time, then the last portion of your loan will be forgiven – up to $750! Read all about SC SLC's benefits HERE.

- Wachovia Student Loan – They will provide a 1% rebate when loan repayment begins. Another 1% rebate after 12 months of consecutive on time payments. Another 1.5% rebate after making 24 on time payments! You can read about that HERE.

The common thread through all of this is ON TIME PAYMENTS!!!

Have fun saving money! By the way, I love the automatic draft feature. I use automated drafts for all of my investments. It really helps me stay on the wagon (it is one of my wagon staplers!).

Receive each post automatically in your E-MAIL by clicking HERE

Save Money – Get Rid Of The Home Phone

At NewSpring Church, we are able to provide FREE one-on-one financial counseling for hundreds of people each year. I have a crew of awesome volunteer financial counselors who help people develop a plan that works! I love it!

One thing we have all seen is the fact that over HALF of the people that we meet with no longer have a home phone. They have dumped the home phone and are using their cell phones instead.

For those who still have a home phone, I am seeing a cost ranging from $35 to $50/month.

Let's think about this in a larger way.

$50/month = $600/year

How much money do you need to earn to bring home $600? Think about it. If you want to bring home $600 extra in your paycheck, you will need to earn something like $900.

So … By getting rid of the home phone, you are giving yourself a $900/year raise!

I LOVE giving myself pay raises!

Have you dumped your home phone? Select your answer in the survey below!

Receive each post automatically in your E-MAIL by clicking HERE or via RSS Feed HERE

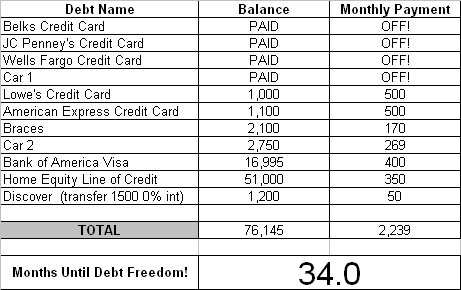

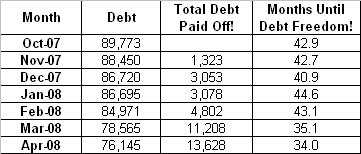

Marching To Debt Freedom – Couple #3 – Month 04

Introduction

This couple has been married for many years and have one child. They have HAD IT with their debt and have been marching toward debt freedom since November 2007. They are THROUGH with credit cards.

What went well this month …

We transferred part of our Bank of America balance to the “Discover – 2” card at a much lower interest rate. We are trying to eliminate the Bank of America card due to the fact that they are increasing interest rates, even though they have not “attacked” us yet. We also transferred the 29.9% VISA to a 0% Citi Card. We are also able to TITHE (give to the church)! That is so exciting to us!

What were the challenges/struggles this month …

The bonus we were expecting was not nearly what we had hoped for. We decided to plop it in the Capital One 360 Savings Account and save it for property taxes.

Updated Debt Freedom Date …

Month By Month Progress …

![]()

Sangl Says …

Couple #3 transferred a 29.9% balance to a 0% interest card. That is AWESOME! The balance on that card was $5,629. With this one change, they are able to save over $1,600 a year in INTEREST! That means that nearly $140 of the $205 monthly payment was going toward interest. It is now going to principal reduction. WAY TO GO!

Continue working the interest rates to 0% or close to it. It will really speed up your Debt Freedom March!

Couple #3 has been able to start tithing to their home church as well. That is AWESOME! I know that if Jenn and I were not able to give, I would be very unhappy. I love giving! There is something so powerful in being able to support someone or something that you really believe in.

I can not wait to see next month’s update!

Readers …

As you can see from Couple #3’s Debt Freedom March, it takes work to get some traction. Couple #3 is doing the work necessary to take their finances to the next level. Are you doing the work necessary to manage your money to the ABSOLUTE BEST of your ability?

Read the Debt Freedom March updates for Couple #1 and Couple #2

Want to start your own Debt Freedom March? Check out the free tools HERE. My book also teaches you how to use all of the free tools. You can purchase your copy at AMAZON.COM or via PAYPAL!

Receive each post automatically in your E-MAIL by clicking HERE

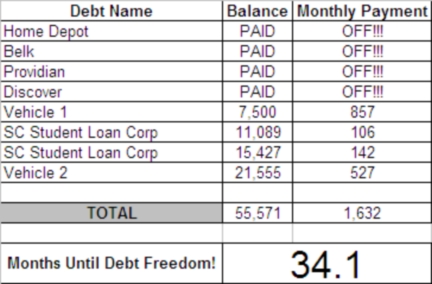

Marching To Debt Freedom – Couple #2 – Month 07

Introduction

This couple is THROUGH with debt! It has now been seven months since they announced that they were breaking up with debt.

Here is this month's update!

What went well this month …

This was a good month. We stuck to our cash envelopes and, of course, did not add any new debt. We got money back from our taxes, which we used to PAY OFF OUR LAST CREDIT CARD!!!! Yes, that's right…no more credit card debt!!!!!! As Joe suggested, we saved a little of our tax reFUNd for ourselves, and used the rest to pay toward debt. We had enough money to put an EXTRA $1,000 toward paying off Vehicle #1. It was a great month!!

Here is their updated Debt Freedom Date calculation …

Month By Month Progress …

![]()

What has kept you on track for seven months? What motivates you to stick with it?

When we first started this we had meetings with Joe every month or so. The fact that we had someone holding us accountable for our actions made a difference in the beginning. Of course, we wanted to do what he said and be able to show him we were making progress each month. But, as time went by we really got into it. The fact that we could be debt free in 2 or 3 years (other than our home) was really exciting to us. Especially since I thought I was going to pay on my student loan for the next 15 years!! Once we got started there was no turning back. We love paying for things in cash, we love having a plan (AKA: Known Upcoming Expenses Account) and we love paying off our debt and not adding to it. It is freeing!! Our focus starting in April is paying off Vehicle #1. I think that is key…taking it one month at a time, having a focus and celebrating each feat, no matter how big or small.

One last thing that has help my husband and I stay focused is we are a team. It takes 100% TEAM WORK!! When one of us is weak, the other is strong. We make decisions together and stick to the plan together!!!!

Sangl says …

It is AWESOME to see what is happening in Couple #2's lives!!! I am BLOWN AWAY every single time I see people "get it" and catch a vision of what life will be like without payments. In just SEVEN months, this couple has paid off $16,339 in debt AND eliminated ALL OF THEIR CREDIT CARDS!!! In just SEVEN MONTHS, Couple #2 has reduced their Debt Freedom Date by TEN MONTHS. They are already THREE MONTHS ahead of plan! This is typical for folks who say "I HAVE HAD ENOUGH!" (Their IHHE Moment!)

I would not be surprised to see Couple #2 achieve Debt Freedom twenty months from now. That would make Christmas 2009 and AWESOME Christmas! Think about it … Imagine saying to each other at Christmas, "Honey, I bought you Debt Freedom for Christmas! We now have over $1,600 a month that we can spend on other cool things like investments, vacations, and giving!"

Start your own Debt Freedom March by visiting the FREE "TOOLS" page or by obtaining a copy of I Was Broke. Now I'm Not on AMAZON.COM, BORDERS.COM, or via PAYPAL.

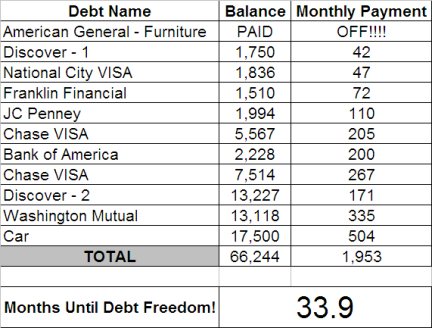

Marching To Debt Freedom – Couple #1 – Month 07

Introduction

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now SEVEN months into their march. Here is this month's update.

What went well this month …

We are working the plan. I jacked up the emergency fund to $5,000 and payed a little more on some bills.

What were the challenges/struggles this month …

NONE

What has kept you on the wagon for SEVEN months?

I sleep at night. I owe this to my family. God has blessed us with so much, and I need to take good care of it.

Updated Debt Freedom Date

Month By Month Progress

Sangl Says …

Incredible progress again this month! This is outstanding. By my calculations, this family will be debt-free except for their house (1st Mortgage and Home Equity) in less than TWELVE MONTHS! That will be INCREDIBLE!

Lowes and American Express are going to be leaving within the next few months and then the dentist is going to be VERY CONFUSED when the office receives a snowball payment of $1,170 ($500 Lowes + $500 AMEX + $170 Braces)! It is so fun to watch the debts just leave!

Readers …

THIS is what happens when you experience your IHHE Moment and get intensely focused! This debt does not stand a chance. I love it! This stuff works! I can't wait to receive an invitation to YOUR debt freedom party!

Read Previous Monthly Updates For Couple #1 HERE

Like what you are reading? Receive each post automatically in your E-MAIL by clicking HERE.