Archive for May 2008

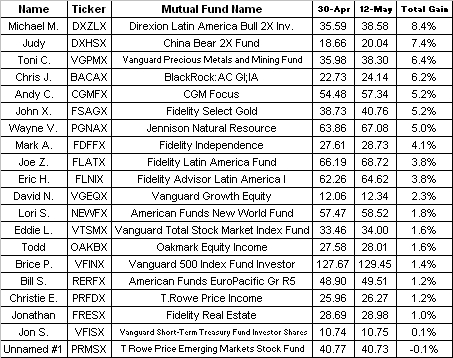

STANDINGS: Mutual Fund You Pick ‘Em Game

Here are the latest standings for the Mutual Fund "You Pick 'Em" Game. Michael M. is absolutely slaughtering the competition twelve days into the contest. It is interesting to note that every single person who entered the contest has had a positive gain – except one – our unnamed contestant. This means that the overall markets have been doing really well over the past twelve days.

One reason I am holding this contest is to expose folks to the variety of mutual funds that are available. We have a lot of different types of funds – international, precious metals, index, treasury, and domestic growth funds. Pick a couple that you do not know much about and plug them into the quote page at CNNMoney.com (HERE) to learn more about them.

Another reason I am holding this contest is to highlight the fact that mutual fund investments should be for the LONG TERM (5 years or longer). Why? Because mutual funds go up and down, many times very swiftly. By holding LONG TERM, you will be able to realize the gains when they happen quickly. Not too many people are great at accurately day-trading. I know that I am not! If I would have jumped out of this crappy market, I would have missed the great improvement that the markets have shown recently!

So, we have 13 more trading days before the contest ends. Will the market keep going up? Will Michael M. hold his lead? Or will John X. creep up into the standings?

By the way, NO!, I am NOT the unnamed contestant!

A Frugal Weekend: Tent Camping

Well, this weekend the family ventured out into the wild world of tent camping at a state park in the foothills of the mountains.

It was a very cheap weekend, AND we had a blast!

Cost Breakdown

- Camp Site (2 nights): $45.10

- Food (no extra cost – we brought our regular groceries): $0.00

- Stupid Tax (left our pan at home): $14.95

Total Cost: $60.05

We had an AWESOME time. Here are the highlights.

- We put up the tent. Our tent attracts rain. It POURED both nights. BUT both days were nice and sunny.

- We saw a copperhead snake up close. That always makes me feel comfortable.

- I ate three smores in one sitting and then proceeded to cook another dozen marshmallows. INCREDIBLE!

- We saw a pileated woodpecker up close. Beautiful.

- I got to spend time with my wife and daughter without the computer, internet access, or my cell phone.

- We all got our first sunburns of the season.

- There is nothing like breakfast cooked over a campfire. Bacon sizzling. Eggs frying. 100% purple grape juice. Yum.

- Melea started the fire herself with matches. I taught her how to responsibly use matches. I hope she remembers all of the rules.

- I had to make an emergency run to a Dollar General store for a frying pan, clothesline, and clothes pins. I need to go to Dollar General more often! They really have good prices, and the store was really neat, organized nicely, and clean.

- I caught ZERO fish. First time I have been skunked all year. I don't like that.

I need to put camping on the calendar more often!

Like what you are reading? Receive each post automatically in your E-MAIL by clicking HERE.

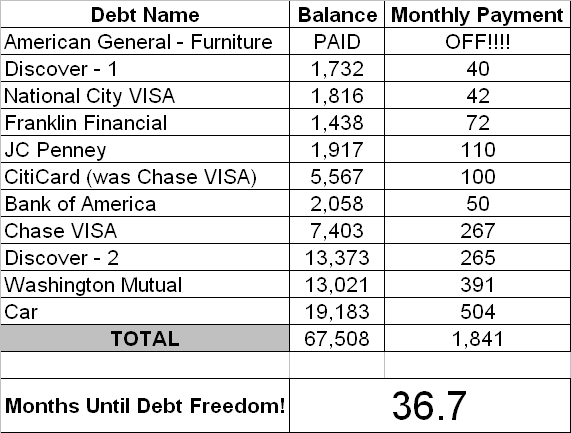

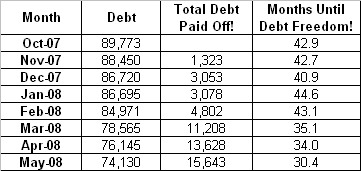

Marching To Debt Freedom – Couple #3 – Month 05

Introduction

This couple has been married for many years and have one child. They have HAD IT with their debt and have been marching toward debt freedom since November 2007. They are THROUGH with credit cards.

What went well this month …

We changed car and homeowner's insurance companies saving us $672 a year! UNBELIEVABLE!

What were the challenges/struggles this month …

Well, we are so frustrated! We have called our credit card companies, and they are still not wanting to reduce interest rates. We have applied for transfers and can't get them right now b/c our balances are too high. So we are really focusing on paying these off even faster so we can tell these crooks to TAKE A HIKE! We are still calling and harassing them trying to get reduced rates – 1% here and there but it is lower than the previous month.

Updated Debt Freedom Date …

Our car balance is higher than it has been because we have the actual balance now and not a guess. Also, the Citi card stayed the same as it was a balance transfer and the Discover went up a little for the balance transfer fee.

Month By Month Progress …

![]()

What is your favorite tool on JosephSangl.com …

Why, the budget form by far! It really keeps us in line telling our money where we want it to go and also being able to account for all of it. We couldn't do this without it!

Sangl Says …

When you have a pile of debt, it can take a little time to get the Debt Freedom March fully on track with a full head of steam! This is exactly what Couple #3 is experiencing. They are getting their debt balances organized and working hard to improve the interest rates on the debt. In just a couple of months, all of the restructuring will be complete, and I can not WAIT to see what happens to this debt then!

Readers …

As we all know, this is tough stuff! It is even harder when you put all of your financial information out there for the world to see. Will you encourage Couple #3 by leaving them a note in the "comments" section?

My book, I Was Broke. Now I'm Not, is available via AMAZON.COM, BORDERS.COM, and PAYPAL. You can read the Introduction HERE.

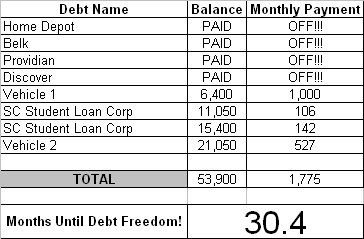

Marching To Debt Freedom – Couple #2 – Month 08

Introduction

This couple is THROUGH with debt! It has now been eight months since they announced that they were breaking up with debt. They have agreed to share their Debt Freedom March with everyone in the hopes to inspire others to do the same!

Here is this month's update.

What went well this month …

The whole process went well. We were able to pay more toward Vehicle 1, which is going to help us pay it off faster. We hope to keep doubling our payments, and pay it off eight months early. We kept to the cash envelopes and did not accumulate any new debt. Overall, it was a terrific month!!

Challenges and struggles this month …

We are doing so well now and we really don't face any challenges any more. We know what we need to do and we just stick with the plan.

Here is their updated Debt Freedom Date calculation …

Month By Month Progress …

![]()

What is your favorite tool on JosephSangl.com?

I like the blogs. It is nice to see how other couples are doing on the Debt Freedom program, as well as hear feedback from the readers.

Sangl Says …

Couple #2 has been after their debt for just eight months, but look at how much they have gained! They have cut their "Months Until Debt Freedom" by nearly fourteen months! They have paid off $18,000 in debt! They could have used that money to go on some serious vacations, buy a new vehicle, or other fun item, but they have chosen to live this way for just a little while so that they can break the cycle of debt.

Think about what life will be looking like for Couple #2 in just a short time when they achieve debt freedom! They will free up $1,775 in monthly payments. That is TAKE-HOME pay! How much money does one have to earn to take home $1,775? About $2,500! So, Couple #2 is going to be able to give themselves the equivalent of a $30,000/year raise. WOW!

Readers …

If you dumped all of your debt (and its associated debt payments), how much of a raise could you give yourself?

Start your own Debt Freedom March by visiting the FREE "TOOLS" page and by obtaining a copy of I Was Broke. Now I'm Not on AMAZON.COM, BORDERS.COM, or via PAYPAL. This book tells my story AND teaches the practical tools that my family used to win with money. You can too!

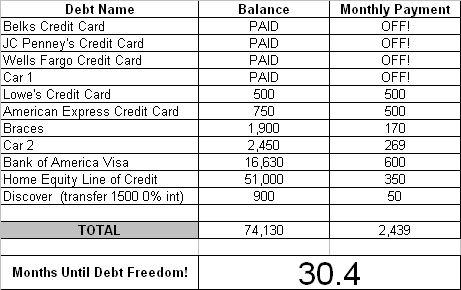

Marching To Debt Freedom – Couple #1 – Month 08

Introduction

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now EIGHT months into their march. How time flies!

What went well this month …

We are on plan!

What were the challenges/struggles this month …

I had to pay a large bill, but no sweat I had my emergency fund.

What is your favorite tool on JoeSangl.com? Why?

It's a toss-up between the monthly budget (which is the engine of saving) and the debt freedom date calculator (which is the prize).

Updated Debt Freedom Date

Month By Month Progress

Sangl Says …

Couple #1 has paid off nearly $15,000 in debt in the past eight months. That is nearly $2,000 PER MONTH! Unbelievable. In eight months, their Debt Freedom Date has dropped by TWELVE months. AWESOME!

Readers …

It is amazing to see what happens when a written plan is put together AND followed. You CAN do this too! Visit the free TOOLS page by clicking "TOOLS" link at the top right-hand corner, and get started on your own Debt Freedom March!

Read Previous Monthly Updates For Couple #1 HERE

Like what you are reading? Receive each post automatically in your E-MAIL by clicking HERE.