Archive for September 2008

SERIES: Sell Car With Negative Equity – Part 1

Welcome to the latest series – "Sell Car With Negative Equity"

The fact that most cars drop in value by sixty percent in the first four years causes an enormous part of the American population to struggle with huge car payments and an inability to rid themselves of the car without acquiring yet another new car and rolling in the negative equity to the new loan.

It is my hope through this series, that you will be equipped to sell a car that has negative equity.

Part 1 – Recognize How Much A Car Really Costs

Some of the actions in this series might be difficult to execute, but when one recognizes how much a car really costs it can really help solidify sound financial decisions.

I believe that having a car payment is a HUGE financial mistake. Here is why.

First, cars drop in value. New cars drop in value FAST. Most new cars drop in value by around sixty percent in the first four years. This is called depreciation, and it causes one's net worth to drop.

Second, car payments reduce one's ability to gain financial freedom. Loan interest can range from 0% to 20% or higher depending upon one's credit. Even 0% loans are negative financial events because the money is going toward a car that is dropping in value. What else could one do with a monthly car payment? Give more? Invest more? Spend more?

When I recognized how much my debt was costing me, it solidified my commitment to achieving financial freedom. I was so dad-blamed sick of debt and what it was doing to my family.

Read the entire "Sell Car With Negative Equity" series HERE.

Receive each post automatically in your E-MAIL by clicking HERE.

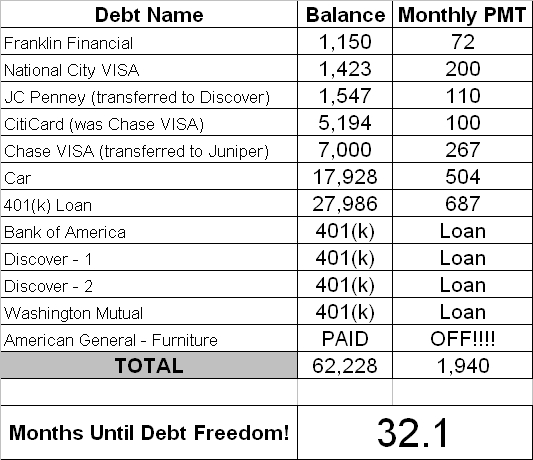

Marching To Debt Freedom – Couple #3 – Month 09

Introduction

This couple has been married for many years and have one child. They have HAD IT with their debt and have been marching toward debt freedom since November 2007. They are THROUGH with credit cards.

Good things this month

We transferred JC Penney balance which was 21.99% to a 2.9% on Discover AND we transferred Chase that was 26% to a Juniper Mastercard at 7.9%. We were VERY excited about those transfers.

It is also very encouraging to see the balance on the National City card come down!! It won't be long until that one is GONE!

Challenges this month

Challenges this month have been the rising cost of gas and food, but we have just budgeted a little differently in some areas and made it work out fine! Again, this month I have to say THANK GOODNESS for the budget form!!! We were able to pay cash for all back to school items this year and MAN! Does that ever feel good!!!

Updated Debt Freedom Date …

Month By Month Progress …

![]()

Sangl Says …

It is so nice to see Couple #3 reap the rewards of the hard work they put forth to restructure their debt. Look at the tremendous progress they are making. Instead of twenty percent of their payments going toward principal and eighty percent to banks, they have switched it around. Now, over 80% of all of their payments are going toward principal reduction! AWESOME!

Readers …

If you have debt, have you considered restructuring it? This can really help your debt freedom march gain a ton of traction and speed up your journey to ZERO DEBT! I encourage you to read the series of posts I wrote called Restructuring Debt.

My book, I Was Broke. Now I'm Not, is available via AMAZON.COM, BORDERS.COM, and PAYPAL. You can read the Introduction HERE. In this book, you will learn exactly how Jenn and I became debt-free in just fourteen months.

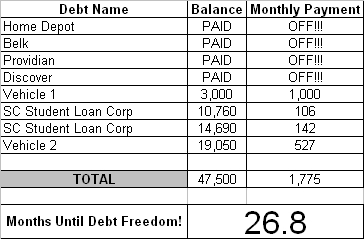

Debt Freedom March – Couple #2 – Month 12

Introduction

This couple is THROUGH with debt! They announced that they were breaking up with debt in October 2007. They have agreed to share their Debt Freedom March with everyone in the hopes of inspiring others to do the same!

Here is this month's update.

Here is their updated Debt Freedom Date calculation …

Month By Month Progress …

![]()

Sangl Says

This is the one year anniversary of Couple #2's Debt Freedom March and look at how much debt they have paid off! They started out in the $70,000 range and are now in the $40,000 range. They have paid off $24,410 in ONE YEAR!

I am so excited for Couple #2. They are being blessed financially and instead of running out and blowing all of it, they are using it as an opportunity to completely change their entire financial future!

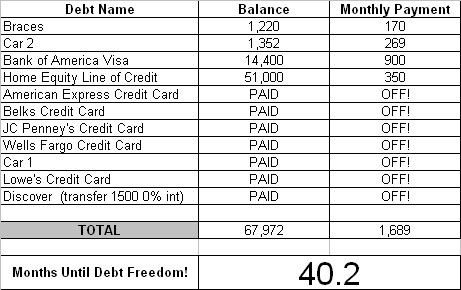

Marching To Debt Freedom – Couple #1 – Month 12

Introduction

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now ELEVEN months into their Debt Freedom March.

Good/Bad This Month

This month went to plan. It is great to see these balances going down. On the other hand, it is difficult for expenses to go up so much. It seems as though all of our extra spending money is going in the tank and into the grocery cart, but I can't complain. I feel very lucky. We have a house that is not in foreclosure, and we have two great jobs with benefits and insurance. We are so blessed.

Updated Debt Freedom Date

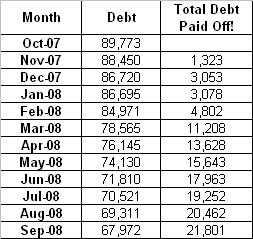

Month By Month Progress

Sangl Says

Couple #1 is now twelve months into their debt freedom march. What a fantastic year it has been! They have paid off $21,801. This is what can happen when one is intensely focused on debt freedom and recognizes what life will be like when there is ZERO DEBT.

When Couple #1 started out, they had $35,695 in non-house debt. They now have only $16,000 of non-house debt remaining. Outstanding!

Couple #1 is doing a great job of sticking to their debt freedom march. There are times that it seems almost unattainable, but it IS attainable and it IS so worth it!

Readers …

How is your own Debt Freedom March progressing?

In my book, I Was Broke. Now I'm Not., I share the story of my Debt Freedom March and teach the exact tools that Jenn and I used to become debt-free. You can do it too! You can read the book's introduction HERE.

Receive each post automatically in your E-MAIL by clicking HERE.