Archive for December 2008

Marching To Debt Freedom – Couple #3 – Month 12

Introduction

This couple has been married for many years and have one child. They have HAD IT with their debt and have been marching toward debt freedom since November 2007. They are THROUGH with credit cards.

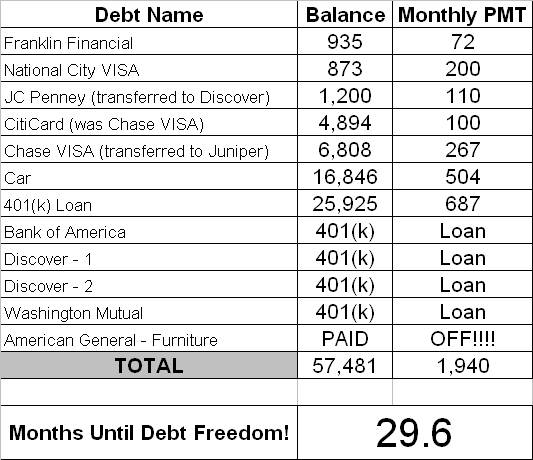

Thoughts from Couple #3 this month

Couple #3 has taken a new job this month so they are very busy right now. Below are their updated numbers.

Updated Debt Freedom Date

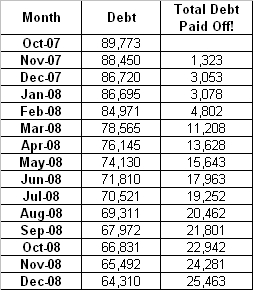

Month By Month Progress

![]()

Sangl says

Couple #3 is going through a job change so things will be interesting over the next several weeks for them. It is very easy to break the routine of planning one's spending during major life changes so it is critical that Couple #3 makes a disciplined effort to keep up with their plan. As you can see, the plan is working!

Readers

When you have went through a major job change that required a move, what did you do to maintain sanity in your financial plan?

Read previous updates from Couple #3 HERE

Marching To Debt Freedom – Couple #1 – Month 15

Introduction

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now over a year into their Debt Freedom March.

Couple #1's Thoughts This Month

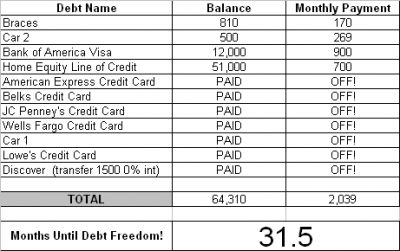

The current economic environment is flipping crazy. I can only think that God had his hand in my wife and I deciding to get out of debt long before this downturn.

- We paid half the balance of car 2 and owe just $500.

- We increased the payment on the HELOC to $700.

- The property taxes are already paid when in years past I would have to wait until my tax check came back.

- Christmas is bought and paid for and under the tree. Instead of buying useless presents for friends this year, I made gifts out in my shop.

We have a lot to be thankful for. We have our jobs, we have our health, and we have each other. May God bless you all as I have been blessed. Merry Christmas!

Updated Debt Freedom Date

Month By Month Progress

Sangl says

Another excellent month! Couple #1 has a fully-functioning Known, Upcoming Expenses account that has enabled them to stay the course even in difficult economic times. If your budget is constantly smashed by things like property taxes, quarterly insurance premiums, vacation, or Christmas, I highly recommend clicking HERE to learn how to set up a Known, Upcoming Expenses account.

Read Previous Monthly Updates For Couple #1 HERE

Upgraded Tool – Actual Cost Of Debt

The IWBNIN team has upgraded the “Actual Cost of Debt” tool.

The upgrade was made to include the “Debt Freedom Date” in its calculation as well.

Do you know how much your debt is costing you? Use this tool to find out, and then work to reduce the interest rates by restructuring your debt!