Archive for June 2010

Sangl Home Pay-Off Spectacular – June 2010

Every month there will be an update of Joe & Jenn’s Home Pay-Off Spectacular!

Here’s this month’s update!

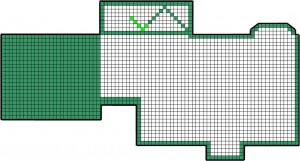

Total Squares: 2,426

Paid-For Squares: 847 852

Squares Remaining: 1579 1574

% of House Owned By The Sangl’s: 34.9% 35.1%

% of House Owned By Wells Fargo: 65.1% 64.9%

Here is the updated Sangl Home Pay-Off Spectacular

Another five squares paid off this month. We continue to pay extra each month, but are mostly focused on rebuilding our emergency fund. We do have another fund of cash that we are building to make lump sum payments toward the house as long as other emergencies do not arise that require the use of that money. I would not be surprised if we were able to make some large payments toward the house toward the end of the year. Exciting!

How are you doing on YOUR house payoff spectacular? If you do not have one, you can get one here => Pay Off Spectacular – House.

Read previous Sangl Home Pay-Off Spectacular Updates