Archive for February 2015

5 Easy Steps to Budgeting – Step 4

In this series of post, I am sharing the process that Jenn and I followed to develop a budget that actually worked!

Here are the steps that have already been shared.

STEP ONE Decide to decide

You can not start winning with your money until you decide that budgeting is crucial to taking your finances to the next level.

STEP TWO Determine the income (take-home pay) you will receive during the NEXT month

The key word in Step Two is NEXT. A budget must be completed BEFORE the month begins and BEFORE the money ever arrives.

STEP THREE Enter all of your expenses for the NEXT month

This is where you get to actually spend your money on paper before the month arrives!

STEP FOUR INCOME – OUTGO = EXACTLY ZERO

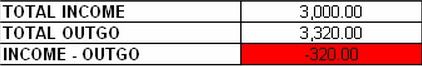

YOUR INCOME IS LIMITED! If you bring home $3,000 during the next month and spend $3,208, your spending plan will not work! Where will the extra $208 come from? It will have to come from savings OR from debt – usually in the form of a credit card. If you spend more than you make, no matter how much you make, you WILL have to make that up somehow!

In Steps Two and Three, we entered all of the income and expenses into the budget and, no surprise, the OUTGO exceeded the INCOME. You can see the entire budget HERE.

So OUTGO exceeds INCOME…now what? We have two options.

- Increase the INCOME – you could get a 2nd job, work overtime, turn a hobby into a business

- Decrease the OUTGO – get rid of some expenses

NOTE: This is not a “perhaps, perhaps, perhaps” type of budget! This is how the family will ACTUALLY spend their money next month! Remember – if your budget is not 100% relevant for you and your family, you will ignore the budget and use it to start a fire in your fireplace!

What expenses can be eliminated from the example budget? Again, you can pull a copy of the budget HERE.

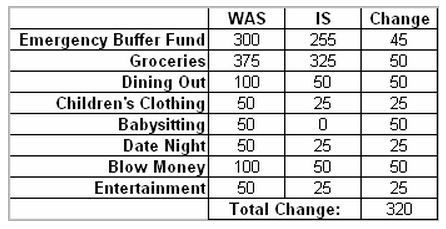

After working together on their budget, the family decides on the following changes.

SUCCESS!! INCOME – OUTGO = EXACTLY ZERO!

If you want to see the entire EXACTLY ZERO budget, you can view it HERE. You might be saying, “These people are CRAZY! They cut out 1/2 of their dining out, entertainment, blow money, and all of their babysitting money!” I would say – “NOPE! They have had enough. They are so sick of living paycheck-to-paycheck that they are willing to live differently and change their lives forever. All because of a little sacrifice now!”

We only have ONE step left!!

5 Easy Steps to Budgeting – Step 3

First, let’s review Steps One and Two.

STEP ONE Decide to decide

You have to decide that you’ve had enough! The very day that Jenn and I started budgeting was the very day that we started winning with money!

STEP TWO Determine the income (take-home pay) you will receive during the NEXT month

This income is what you will be spending on paper BEFORE the month, the money, and the bills ever arrive!

STEP THREE Enter all of your expenses for the NEXT month

This is where we get to actually spend our money on paper! So we have already determined our income for next month, now it is time to actually spend the money BEFORE the month arrives! The absolute best way I have found to input my expenses is to use real, actual expenses that will happen. NOT averages for the year. If you don’t know the actual cost, enter an educated guess based on recent spending.

If the expenses are not relevant to the next month, it is highly possible that you will consider the budget irrelevant for the next month!!

Enter all of the expenses into your budget. You can obtain a FREE COPY of our budgets by clicking HERE. To find out which budget is right for you, check out Step Two of this series.

Each budget form has some excellent features built into it:

- If OUTGO exceeds INCOME, the TOTAL will turn RED and tell you how much you have overspent! Do not stop if the total goes red! Can you live with a total in the RED? Absolutely, with the help of credit cards! Living in the red is how people get into debt and stay in debt.

- If INCOME exceeds OUTGO, the TOTAL will turn YELLOW and tell you how much more money needs to be named!

- When INCOME = OUTGO, the TOTAL will turn GREEN…This is the ultimate goal!

- There is an ACTUAL column that can be used throughout the month to track your progress.

Our goal for this step is to get all the expenses into the budget. We’ll work on getting it green next.

How are you doing so far entering all your income and expenses into the budget?

5 Easy Steps to Budgeting – Step 2

I’m answering one of the most common questions that people ask me – “how do I budget?” In Step One, I wrote about the negative feelings that people have when they hear the word “budget”.

Just remember that a budget is nothing more than telling your money where to go.

So let’s review before we move on to Step Two!

STEP ONE Decide to decide

This is where it begins! You must decide to live differently and not paycheck-to-paycheck.

STEP TWO Determine the income (take-home pay) you will receive during the NEXT month

The key work in Step Two is “NEXT”. Preparing a budget for money you’ve already spent is not very fruitful. A budget must be completed BEFORE the month begins and BEFORE the money ever even ARRIVES!

The best way to stop saying, “I can’t believe I spent my money that way” and “I wish I could have that money back” is to develop a spending plan BEFORE the money is received that month!

So, what income will you receive during the next month?

- Paycheck

- Bonus

- Side Job

- Child Support

- Alimony

If you get paid monthly or you have at least one month of expenses in the bank, we recommend you use our Monthly Budget Form (It’s FREE). If your income is unpredictable, write down the amount of money you can count on. (If your income is irregular or unpredictable, stay tuned for specifics of how to deal with that later this month!)

If you are living paycheck-to-paycheck, all the bills probably cannot be paid at the start of the month. You will need to develop a budget for each individual paycheck. We recommend using our Weekly Budget Form (It’s FREE). Make the dates at the top of the weekly budget form match up to your income dates and enter the income in the INCOME section.

Stay tuned for Step Three…

5 Easy Steps to Budgeting – Step 1

One of the most common questions I get asked is, “how do I budget?” Many people have tried budgets…and failed! That leaves people frustrated and in turn they say they will NEVER use a budget again. Here are some things people equate with budgets:

Budget = Restricting

Budget = I’m Broke

Budget = Controlling

Budget = No Fun

Budget = Not worth it

I would ask them the following:

- How are you paying for Christmas this year? I am paying cash.

- How much is your car payment? I paid cash for my car.

- How much did you invest this month? I have invested for retirement for over 220 months in a row and my daughter’s college for over 150 months in a row.

- How much money do you owe to your credit cards right now? I owe $0.

- When is the last time you had a great discussion on finances with your spouse? Not a fight. A great discussion. Jenn and I develop a spending plan TOGETHER every single month.

Well I want to make a deal with you. Will you give budgeting one more shot? I’m going to do my best in this series to try and teach you a method of budgeting that works. A method I used and still use today. My hope is you will try a budget for the month of March.

In reality, a budget is nothing more than telling your money where to go. I have heard Dave Ramsey take the definition a humorous step further – a budget is nothing more than telling your money where to go instead of wondering where it went! EXACTLY!

So our first step in budgeting is:

STEP ONE Decide to decide

Until you decide that budgeting is crucial to taking your finances to the next level, you will always find a way to avoid this “unsavory” task. The very day that Jenn and I started budgeting was the very day that we started WINNING WITH MONEY! From this moment on, decide to live differently. Decide to not live paycheck-to-paycheck and in debt.

Decide to decide!

Make sure to check back for Step Two on Thursday!