Archive for July 2018

10 Things You Can Do With Extra Money to Improve Your Financial Situation

Whenever you obtain extra money, it is an opportunity to take your finances to another level. Instead of racing out to spend it frivolously, I encourage you to consider how you can put that money to use in a way that propels your financial situation forward.

- Pay off a debt When you pay off a debt, it will instantly increase your monthly cash flow. This is something we call “monthly margin” around here at I Was Broke. Now I’m Not. Plus, what other financial decision is more rewarding than making a debt leave your life?

- Buy yourself out of a membership/subscription Things like cell phone contracts, gym memberships, satellite tv subscriptions, etc. Many people keep an unwanted subscription around simply because they don’t have the money to buy out the few months ‘cancellation fee’ required to cease service. This allows you to gain monthly margin and makes an annoying expense begin to fade in your rear view mirror!

- Build savings Increasing your financial reserves/cushion/margin – something we call “reserves margin” around here at I Was Broke. Now I’m Not. – is never a poor decision! This positions you to accommodate unexpected financial challenges or pursue an opportunity.

- Invest for retirement $1,000 extra today will be worth $3,300 in 10 years, $10,893 in 20 years, $35,950 in 30 years and $118,648 in 40 years. Get #FiredUp!

- Invest for college $100/month will be worth $8,167 in 5 years, $23,004 in 10 years, and $75,786 in 18 years. Excellent decision!

- Obtain more education/certifications Knowledge is power and can equal a substantial increase in your income and your value to the business you conduct.

- Purchase a(nother) home Real estate is one of the time-tested ways for people to build wealth. Plus it can produce additional income using a service like VRBO, Homeaway, or AirbNb

- Become a private investor There are lots of ways to become a private investor. You could start a small business. Maybe acquiring a minority stake in a larger existing business is more your style. Angel investing has been very popular over the past decade. Hard money lending is another way to put your extra money to work. Perhaps being a silent partner in a franchise could be more suitable for you.

- Vacation A great leader once shared this formula with me: Change of pace + Change of place = Change of perspective | I’ve found it to be true. There is something about “getting away from it all” that helps you achieve clarity on your next steps.

- Give it away There’s something powerful about giving money away. One friend told me that he “gives because it keeps him from becoming greedy.” When I give money away, it makes me want to make better money decisions so I can give even more. It connects to the “perspective” part of the equation I shared in #9.

No matter what decision you make, choose to put the extra money to work for you. Your future self is depending on you!

Investment Value Calculator

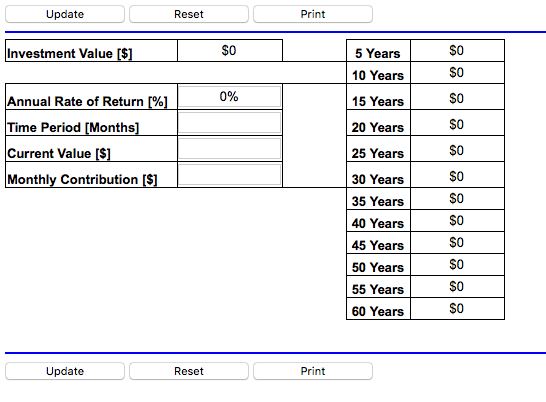

How much would you be able to save by trimming the fat on your different insurance policies? A couple hundred dollars per month? Now, how much would you have if you took those savings and invested the difference? Insert our Investment Value Calculator tool!

This tool is incredibly easy to use and can be manipulated to show a multitude of scenarios. Simply enter an annual rate of return, the amount of months you would invest the money, the current value of the account, if any, and the amount you will be contributing monthly.

This tool is incredibly easy to use and can be manipulated to show a multitude of scenarios. Simply enter an annual rate of return, the amount of months you would invest the money, the current value of the account, if any, and the amount you will be contributing monthly.

For example, say you have a whole life insurance policy that is costing you $4,000 each year and decide to instead apply for a thirty year term policy that will only cost you $380 each year. That is a difference of $3,620 (about $300 each month) in savings every single year! Yes, you could use this extra money towards a vacation but think long term. Try putting this into the calculator and see what it could be worth down the road.

Not only will this tool allow you to see your Investment Value after the time period you selected, but it also allows you to see the investment value at 5 year increments. Try it out on your life, auto and home insurance policies! Save on your insurance and put your money to work for you today!

Not only will this tool allow you to see your Investment Value after the time period you selected, but it also allows you to see the investment value at 5 year increments. Try it out on your life, auto and home insurance policies! Save on your insurance and put your money to work for you today!

=======================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

SPECIAL OFFER: This month only, get your own copy of Joe’s book, I Was Broke. Now I’m Not. for 25% off plus free shipping! Get your copy HERE before July 31st!

“I can promise that if you read and apply what has been written here then you will eliminate financial regret from your life.” – Joe Sangl

Whole Life vs. Term Life Insurance

One of the most popular questions I get asked is, “What is the difference between whole life insurance and term insurance and which do you recommend?”. Both types of insurance can and will protect your family in the event of your premature death but there are a couple of key differences.

Whole life insurance is permanent insurance. As long as you are paying the premiums, the insurance will remain in force. With this permanent policy comes a cash value aspect. A portion of your premium would go to pay for insurance and a portion would go to fund the cash value. It is possible that at some point your cash value could grow to be big enough that you could stop paying premiums. In this case, the cash value would be used to fund premiums and your insurance would remain in force.

Term life insurance is exactly what it sounds like. It is insurance that will be in force for a specific term whether that be 10, 20 or even 30 years. Once that time period is up, the insurance no longer exists. This insurance is cheap and easy to understand when you compare it to other insurance products on the market.

I carry a term life insurance policy equal to ten times my annual income. If you bring home $50,000 a year, this would mean you would require a $500,000 life insurance policy. To get this type of policy in whole life coverage would be entirely too expensive to carry. Because whole life insurance policies guarantee to pay out until death, along with the accompanying cash value, they are much more expensive to maintain.

I decided to buy term insurance and invest the difference. Essentially, you would pay for term life insurance and invest the remainder of what that would cost you in whole life coverage. For example, a 30 year term policy for a healthy, 30 year old is around $380 per year. The equivalent in whole life is $4,000 per year. If you decided to buy term insurance and invest the difference of $3,620, it would equal $1,055,479 after 30 years! Under this approach, if you have made the commitment to become debt free, you could be self insured by the time your policy expires! However, the key to this approach is that you actually have to invest the difference. Notice I did not say, get term life insurance and use the savings to go shopping or take a nice vacation.

Ultimately the choice between whole and term insurance is up to you. But it is better to make an informed decision, instead of allowing insurance salesman to confuse you into buying a policy that you do not understand. It is very possible to get the coverage you need without breaking the bank!

=======================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

SPECIAL OFFER: This month only, get your own copy of Joe’s book, I Was Broke. Now I’m Not. for 25% off plus free shipping! Get your copy HERE before July 31st!

“I can promise that if you read and apply what has been written here then you will eliminate financial regret from your life.” – Joe Sangl

Do You Have Enough Insurance?

I do not like talking about death. I do not know many people that I do. But, I am not deaf to the fact that we are all going to die. Every single one of us. At this point, we all know that life insurance is important and hopefully you have taken the appropriate steps to protect your family. But, is it enough? Is your policy enough to cover your debts and provide a comfortable life for those you leave behind?

I carry an insurance policy equal to ten times my annual income. With an income of $50,000 per year, this would mean a person should obtain a $500,000 policy. If I pass away while my children are still in the household, I want my wife to be able to focus on raising them without having to worry about replacing my income.

With that being said, I also carry no debts. My home, vehicles, and school loans are paid off. I do not need life insurance in order to repay these debts. If you do have debts, you should consider these when deciding how much insurance you need.

The total amount of insurance that you require to secure your family should not break the bank. For a healthy 30 year old male who does not use tobacco products, a $500,000 policy would cost about $25 a month in term life insurance. For a healthy 30 year old female, the same coverage would cost about $20 a month. That is really cheap for such great coverage.

My personal goal is to become self-insured. If you are able to become debt-free and invest wisely, you will eventually have enough money that your need for life insurance will diminish greatly. Think about it. Suppose you die, leaving behind no debts and more than $1,000,000. You have probably become self-insured.

=======================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

SPECIAL OFFER: This month only, get your own copy of Joe’s book, I Was Broke. Now I’m Not. for 25% off plus free shipping! Get your copy HERE before July 31st!

“I can promise that if you read and apply what has been written here then you will eliminate financial regret from your life.” – Joe Sangl

MONDAY MONEY TIP PODCAST: Whole vs. Term Life Insurance

Episode 14 is LIVE and I’m here with my co-host, Megan Hibbard, to talk about Insurance! Insurance can be a daunting and challenging topic but we all know we need it. During this episode, we answer the question, “With a newborn daughter at home, I know it is important to look into life insurance. Do you suggest term or whole? What limits should I be looking for?” We also have other important tips for you including information on insurance for a stay-at-home spouse.

It’s our goal at the end of each episode that you gain hope and encouragement in your financial journey, you’re equipped to take a next step, and that you’ve had FUN with us!

Find the Monday Money Tip Podcast HERE. Please let us know what you think by leaving us a rating!

NOW AVAILABLE TO DOWNLOAD:

iTunes

Stitcher

Spotify

Website

Email info@iwbnin.com to ask questions or share success stories.

Show Notes

About the episode:

- Joe shares important information regarding mortgage rates and bank savings rates.

- Hear a success story about a couple who implemented our program for just one month and are saving while tackling debt.

- Joe will answer the question, “With a newborn daughter at home, I know it is important to look into life insurance. Do you suggest term or whole? What limits should I be looking for?”

- Joe explains the importance of having life insurance on a stay-at-home spouse.

Resources:

I Was Broke. Now I’m Not.

Quote of the Day: “You don’t buy life insurance because you are going to die, but because those you love are going to live.” – Unknown Author

Links:

Joe’s Current Investments

SelectQuote

Marcus (Goldman Sachs)

Synchrony Financial

American Express

Ally Bank

Capital One

Please note: Some rates may have changed from the time of this podcast recording