Saving

Retirement Nest Egg Calculator

Do you know how much money you will need per year in retirement? Do you know how that number will be affected by inflation? I would encourage you to check out our Retirement Nest-Egg Calculator Tool. While it may trigger a shock to your system when you see the numbers, it can help you get into gear to retire well.

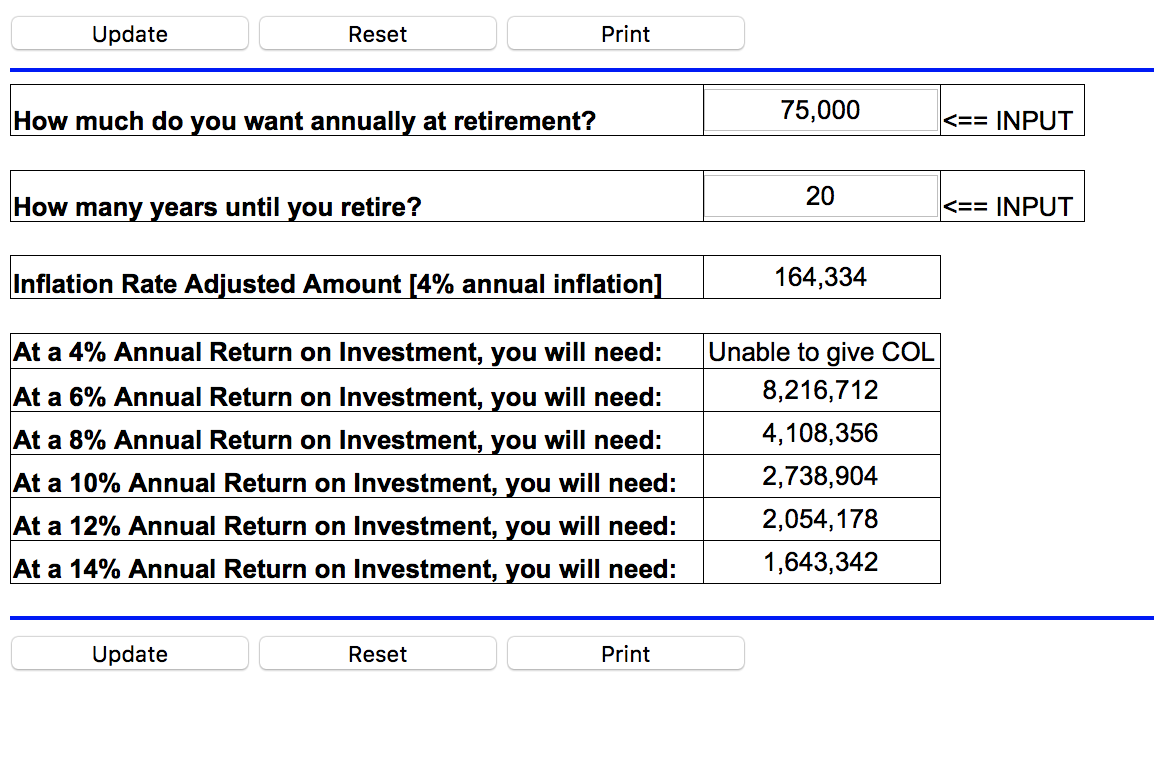

This calculator is incredibly easy to use and only needs two pieces of information from you! All you need to do is enter the amount of money you would like annually in retirement and how many years until you expect to retire. After that, the calculator will compute the amount of money that you need to have saved and how different annual rates of return will change that number.

Below you can see a calculation that I ran for an “annual amount I want” of $75,000 if I hypothetically retire in 20 years:

As you use this calculator, keep a couple of things in mind:

As you use this calculator, keep a couple of things in mind:

- The calculator assumes that you will never touch the principal.

- The calculator assumes that you will give your nest-egg a “cost-of-living-raise” of 4% each year.

- This calculator adjusts the “annual amount your want” for an average annual inflation of 4%.

So, at 4% annual inflation, I will need $164,334 per year in 20 years to have the same purchasing power that $75,000 has today.

The bottom six rows tell you what you need to have in your nest-egg at different rates of annual growth. At 8% annual return, I would need $4,108,356 when I retire. That number drops significantly if I expect growth of 12% and I would only need $2,054,178 when I retire.

These numbers may seem astronomical and you might feel like you will never build a nest-egg of that size. But remember, the power of compound interest can work in your favor! By starting early and investing consistently, you can watch your nest-egg grow to numbers you may have only dreamed of.

========================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

10 Things You Can Do With Extra Money to Improve Your Financial Situation

Whenever you obtain extra money, it is an opportunity to take your finances to another level. Instead of racing out to spend it frivolously, I encourage you to consider how you can put that money to use in a way that propels your financial situation forward.

- Pay off a debt When you pay off a debt, it will instantly increase your monthly cash flow. This is something we call “monthly margin” around here at I Was Broke. Now I’m Not. Plus, what other financial decision is more rewarding than making a debt leave your life?

- Buy yourself out of a membership/subscription Things like cell phone contracts, gym memberships, satellite tv subscriptions, etc. Many people keep an unwanted subscription around simply because they don’t have the money to buy out the few months ‘cancellation fee’ required to cease service. This allows you to gain monthly margin and makes an annoying expense begin to fade in your rear view mirror!

- Build savings Increasing your financial reserves/cushion/margin – something we call “reserves margin” around here at I Was Broke. Now I’m Not. – is never a poor decision! This positions you to accommodate unexpected financial challenges or pursue an opportunity.

- Invest for retirement $1,000 extra today will be worth $3,300 in 10 years, $10,893 in 20 years, $35,950 in 30 years and $118,648 in 40 years. Get #FiredUp!

- Invest for college $100/month will be worth $8,167 in 5 years, $23,004 in 10 years, and $75,786 in 18 years. Excellent decision!

- Obtain more education/certifications Knowledge is power and can equal a substantial increase in your income and your value to the business you conduct.

- Purchase a(nother) home Real estate is one of the time-tested ways for people to build wealth. Plus it can produce additional income using a service like VRBO, Homeaway, or AirbNb

- Become a private investor There are lots of ways to become a private investor. You could start a small business. Maybe acquiring a minority stake in a larger existing business is more your style. Angel investing has been very popular over the past decade. Hard money lending is another way to put your extra money to work. Perhaps being a silent partner in a franchise could be more suitable for you.

- Vacation A great leader once shared this formula with me: Change of pace + Change of place = Change of perspective | I’ve found it to be true. There is something about “getting away from it all” that helps you achieve clarity on your next steps.

- Give it away There’s something powerful about giving money away. One friend told me that he “gives because it keeps him from becoming greedy.” When I give money away, it makes me want to make better money decisions so I can give even more. It connects to the “perspective” part of the equation I shared in #9.

No matter what decision you make, choose to put the extra money to work for you. Your future self is depending on you!

The Non-financial Benefits of a Healthy Savings Account – Benefit #3

We all know that it is a good idea to prioritize our savings accounts. Yet, more than 7 out of 10 Americans live paycheck-to-paycheck (in this article, it was almost 8 out of 10!) and would experience major financial complications from one missed paycheck.

I used to live this way. In addition to the expected financial challenges, my poor money management skills carried stress into every facet of my life. If I had known all of the non-financial benefits of prioritizing the establishment of financial margin, I’m convinced I would have avoided a lot of unnecessary stress. Perhaps by sharing these benefits in this series of posts, I can help give someone the final nudge needed to begin to prioritize saving money.

Benefit #3 MARGIN = SPEED

Have you ever had to park a car in a garage that had a narrow entrance? An garage entrance so tight that you feared that you would knock both mirrors off of the car each time you tried to park in it? As a result, you approached the entrance very slowly and cautiously.

If you had to park in a garage with a double door entrance, you could screech in at 30 mph and still safely make it into the entrance.

This is exactly the case with financial margin! Without financial margin, a person is forced to proceed with great caution for fear of making a major financial error. One misstep and there will be financial damage! With a lot of savings, you are able to move more freely and with greater speed. This is a wonderful benefit!

Have you ever noticed that people with money tend to get the better financial deals? They are the ones who purchase a house, business, land, and investment at a major discount. Why? Because they had money ready to do the deal! They had margin!

Back when I was broke without financial margin, I attempted to purchase a business. Think about that statement for a minute. I tried to purchase a business without any money. Do you think I was successful? Absolutely not! They looked at me incredulously and laughed me out of the building. I resolved to get better instead of bitter.

“I resolved to get better instead of bitter.” – Joseph Sangl

Flash forward to six years later. I had indeed gotten better by prioritizing financial margin, and I found a farm for sale at a steep discount (it was in the middle of the Great Recession). Because of margin, I was able to close on the deal in 11 days from the date I first walked on the land.

Speed. Enabled by financial margin.

It’s a wonderful benefit.

========================================

Ready to take your finances to the next level? Get your copy of I Was Broke. Now I’m Not. and get started on your path to a fully funded life!

The Non-financial Benefits of a Healthy Savings Account – Benefit #2

We all know that it is a good idea to prioritize our savings accounts. Yet, more than 7 out of 10 Americans live paycheck-to-paycheck (in this article, it was almost 8 out of 10!) and would experience major financial complications from one missed paycheck.

I used to live this way. In addition to the expected financial challenges, my poor money management skills carried stress into every facet of my life. If I had known all of the non-financial benefits of prioritizing the establishment of financial margin, I’m convinced I would have avoided a lot of unnecessary stress. Perhaps by sharing these benefits in this series of posts, I can help give someone the final nudge needed to begin to prioritize saving money.

Benefit #2 MARGIN = FOCUS

How much time do you spend thinking about your finances each day? Each week? Each month? For most people, money is a near-continual thought. Is it because they are greedy? Is it because they love money? Is it because it is their favorite topic?

I submit that the answer to all three of these questions is almost always a firm, “No!”

If these aren’t the reasons, then why do they spend so much thinking about money? The biggest reason is because they lack financial margin. As a result, they are in a constant state of “juggling” financial obligations. Because of their paycheck-to-paycheck situation, they spend inordinate amounts of time just figuring out how to survive – with little to no time left to consider how they might thrive.

“They spend inordinate amounts of time just figuring out how to survive – with little to no time left to consider how they might thrive.” – Joseph Sangl

A completely different scenario is created by the establishment of financial margin! The countless hours spent stressing about money, on the phone with creditors, and balancing various bills is instead able to be utilized to focus on the future. It is amazing how powerful focus can be in your career, with your family, and for your money.

Anyone who has attempted to focus on a task while constantly interrupted by their child knows how impossible (and maddening) it is to make progress. It is better to just stop the activity, address the issue with the child completely, and then pick up the task at hand at a time when they can remain focused.

The same is true for your finances! Take the time to address the issue (the lack of financial margin), and then pick up the task at hand again. If you’ve never experienced the power of financial margin, you will find a freedom to focus unlike any time you’ve ever enjoyed before! I’ll never forget this moment for me. It was in February 2004. I chose to put my tax refund into the bank to establish margin. It was a life-changing decision. It actually had a physiological effect on me! I could physically breathe in a way that I had never experienced before.

Once I discovered that financial margin allowed me to focus – on bigger picture items, on thriving instead of surviving, on pursuing a dream, on my career, on my family – I never allowed myself to live paycheck-to-paycheck again.

If you feel like you’re living in a constant state of distraction due to a lack of margin, take steps today to remedy the situation. You’ll never regret it!

========================================

Ready to take your finances to the next level? Get your copy of I Was Broke. Now I’m Not. and get started on your path to a fully funded life!

The Non-financial Benefits of a Healthy Savings Account – Benefit #1

We all know that it is a good idea to prioritize our savings accounts. Yet, more than 7 out of 10 Americans live paycheck-to-paycheck (in this article, it was almost 8 out of 10!) and would experience major financial complications from one missed paycheck.

I used to live this way. In addition to the expected financial challenges, my poor money management skills carried stress into every facet of my life. If I had known all of the non-financial benefits of prioritizing the establishment of financial margin, I’m convinced I would have avoided a lot of unnecessary stress. Perhaps by sharing these benefits in this series of posts, I can help give someone the final nudge needed to begin to prioritize saving money.

Benefit #1 MARGIN = SPACE

When you have a healthy savings account, it allows you to accommodate “life happens” events without having your entire financial world being thrown into chaos. In the I Was Broke. Now I’m Not. Ladder (free download here), we recommend starting with a goal to build your savings up to equal one month of expenses (Rung #2) and then, after completing a few other financial steps, build on up to a minimum of three months of expenses (Rung #5).

You know what I mean about “life happens” events, right? These are things that are going to happen regardless of whether or not you have money saved for them. Here is a list of several common “life happens” events:

- Appliance failure (dryer, washing machine, hot water heater, air conditioner, furnace, dishwasher, etc.)

- Car repair (water pump, battery, failed bearing, gasket leak, etc.)

- Home repairs (leaky roof, mold, plumbing leak, driveway wash-out, etc.)

- Emergency trip out of town

- Sickness or injury

- Job layoff or reduction in hours

When you have prioritized and built financial margin, you can accommodate these expenses without them having an immediate and direct affect on your ability to prosper.

It all adds up to less stress and better sleep. Isn’t that worth any sacrifice that is necessary to achieve margin?

========================================

Ready to take your finances to the next level? Get your copy of I Was Broke. Now I’m Not. and get started on your path to a fully funded life!