Tools

How Do I Stop Impulsive Spending?

Recently, I was teaching the Financial Learning Experience at my local church when I had a gentleman raise his hand and asked this question.

“How Do I Stop Being Impulsive?”

My answer? I don’t know to stop the impulsive nature, but I DO know how to control my impulse to spend recklessly.

I am a SPENDER. I am the type of person who would go out and accidentally buy a truck. I am a spender to my very core. I like buying things. You could say impulsive spending comes naturally to me. The best way I’ve found to combat my impulse to spend is being intentional about my finances.

Here are some steps I have taken that helped me reign in my impulsive spending nature, and it has allowed us to win financially!

A Written Spending Plan

The first thing that helped me reign in my impulse to spend is putting together a written spending plan EVERY month BEFORE the month begins. Jenn and I continue to do this EVERY month BEFORE the month begins. Did you catch that? EVERY month.

The first thing that helped me reign in my impulse to spend is putting together a written spending plan EVERY month BEFORE the month begins. Jenn and I continue to do this EVERY month BEFORE the month begins. Did you catch that? EVERY month.

It reinforces the fact that we cannot flippantly spend our money and expect to succeed. When you have personally helped prepare the spending of your money on paper, you are much more aware about whether or not you can afford the “I WANT THAT!” item.

Having a written plan means that each month you have already told your money where to go on paper before the month even starts. Instead of wondering, “Can I afford this?” or thinking “Maybe it will be okay just this once,” you already know the answer. You know what you have allocated for each category, and if you spend impulsively how it will break the budget.

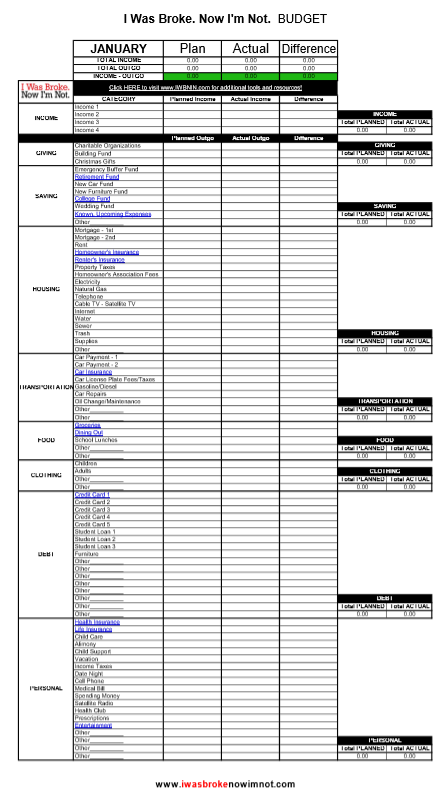

Jenn and I use the budget forms that are available on the TOOLS page of our website. If you want more information about how to start budgeting check out our post “How Do I Budget?” for tips on how to get started. Trust me, the word budget doesn’t have to send chills up your spine. I can, and it will help you win with you money!

Cash Envelopes

Like I said before, I am an impulsive spender, but even I will not impulsively spend money on the electric bill. I won’t impulsively purchase gasoline. I don’t impulsively send extra money to the cable company. There are some things that I am not going to impulsively spend money on.

However, there are some things that I am VERY impulsive about. Items like groceries, dining out, clothes, spending money, and entertainment. I can go through some money really fast with these items! Since I know that I am impulsive for these spending categories, I use cash envelopes.

However, there are some things that I am VERY impulsive about. Items like groceries, dining out, clothes, spending money, and entertainment. I can go through some money really fast with these items! Since I know that I am impulsive for these spending categories, I use cash envelopes.

At the start of the month we add up the amount we have put in the budget for these categories. We then pull that amount out in CASH. The rule is that we can not pull more money out from the bank AND we can not use the ATM or debit card. I can not overspend cash.

To read more about why I LOVE cash envelopes check out this post.

Chop Up Credit Cards

You may pay yours off every month, but the vast majority of Americans do not. I was part of the vast majority, and I had to admit that I was a completely loser with credit cards. I ran those stupid things up three different times. I was stupid with them. They really catered to my impulsive nature. So I did what had to be done and applied the scissor blades to them and shut the accounts down.

You may pay yours off every month, but the vast majority of Americans do not. I was part of the vast majority, and I had to admit that I was a completely loser with credit cards. I ran those stupid things up three different times. I was stupid with them. They really catered to my impulsive nature. So I did what had to be done and applied the scissor blades to them and shut the accounts down.

After years of not using credit cards I do have them again now. How do I keep myself in check? Well, I still don’t use them on things I am impulsive about. Can I use them to pay utility bills? Yes! Can I use them to book travel for work trips? Yes! Do I use them for my spending money that I have budgeted for each month? Absolutely NOT!

Many of you are like me – you need to kill the bad spending habits, and the only way to do that is to get rid of the card. If you are able to have them later on you have to make sure you have accountability in place – like a budget that you review with your spouse or not using them for things you are tempted to overspend on.

How do I eliminate the credit card debt I already have from impulsive spending?

Maybe you are thinking, “Joe, that sounds great, but I’ve already wracked up credit card debt.” If you have questions about how to pay off credit card debt check out our post “You Can Be Debt-Free.” You can also listen to our Monday Money Tip podcast episode on “0% Balance Transfer Credit Cards” or check out options of 0% balance transfer credit cards on our Next Steps page to see if they can help you eliminate your credit card debt.

If you are a fellow spender, what have you done to control your impulsive spending habits?

Let there be…TIME

Sometimes the best cure for the “I wants” is time. The moment we see it we want it, however if we wait to purchase sometimes the desire fads.

If today you see the shiny new motorcycle your neighbor just bought you may think “I want one.” Don’t run down the street to your local dealership and purchase it right away. If you wait a few weeks it will bring clarity. “That motorcycle is awesome, however I really would rather save up for a boat that my whole family can enjoy.”

The more time between the “I WANT THAT!” moment and the actual “Purchasing Decision” moment, the clearer the decision will be. Impulsivity can lead to buyers remorse, and a slue of unnecessary things filling your home that you really don’t need (or want for that matter).

Seek Advice

One of the best ways to stop impulsive spending is to seek guidance from someone you trust and wants to see you prosper. I’ve said this before and I’ll say it again (and again and again), find wise financial counsel. If you are married include your spouse.

Having someone else invested in seeing you succeed financially creates accountability and will encourage you along the way. It’s a lot easier to stay the course, and stop the impulsive spending when you know you are going to have to answer for the purchases you’ve made.

Stay The Course

We are ALL impulsive. It seems to be different things for each of us, but we all have a case of impulsiveness every now and then.

If you do get off course – make the rash purchase – don’t let it derail you. Tomorrow is a new day, and a new opportunity to make wise spending choices. Look at what lead to your impulse purchase, and think about ways to prevent something like that in the future.

I wonder if any of you out there would share some “near misses” where you almost made a horrible, snap-judgment financial decision but you did not. What helped you make the decision to back out? How does it feel now as you look back on the situation?

Budgeting When You Have Irregular Income

Do you have irregular income? Maybe it is seasonal or cyclical.

There is a large group of folks whose family economy is powered by irregular income.

Real estate agents, hair stylists, commissioned salesmen, and business owners all experience seasonal or cyclical income.

Folks who live with this type of income often tell me that it is impossible to budget. They say that they have no idea what they will make this month, so it is just impossible.

I say that not only is it possible, but that folks with irregular income need to be budgeting more than anyone!!!

In this post, I will explain how to prosper while earning irregular income. It is my goal to help you stop living the feast and famine lifestyle that is so often associated with irregular income. Here’s a hint – It’s EZ!!!

Step 1 – Recognize it!

To avoid living the feast/famine lifestyle, you must recognize that you have irregular income! If you have ever suffered during the “off” season, you KNOW what I am talking about! In order to stop having your life severely impacted by “off” seasons, you must prepare! It’s not enough to acknowledge you have irregular income, you have to decide to do something about it.

Question: If your family economy is powered by irregular income, what do you do to prepare for “off” seasons?

Step 2 – Determine monthly expenses

The next step is to determine how much money is necessary to make the household operate efficiently for each month. This is key to living free from the feast and famine lifestyle. To determine your monthly expenses, you should pull up a monthly budgeting form and do the following.

-

Fixed Expenses

Enter all your fixed expenses – house payment, utilities, gasoline, car payments, credit card payments, groceries, cell phone, childcare, etc. This also includes SAVING for retirement!

-

Variable Expenses

Enter the average of all your variable expenses – clothing, spending money, entertainment, dining out, etc.

-

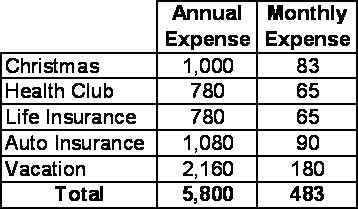

Known, Upcoming Non-monthly Expenses

This is a KEY STEP!!! If you do not add in all of those known, non-monthly upcoming expenses, you will continue to live the feast/famine lifestyle (more likely the famine lifestyle!!!!). These types of expenses are BUDGET-BUSTERS. Here is what I do. I list all the known, upcoming non-monthly expenses and place their annual cost next to them. I then divide that number by twelve to determine how much I need to save per month.

Example of Known, Upcoming Non-monthly Expenses

There are lots of expenses that we all have that are non-monthly, but we know how much they will cost us. Some examples are car insurance, car tags, life insurance, or gym memberships. In this example I have five annual expenses that I need to plan for. I would include a line item of $483 in my monthly budget for “Known, Upcoming Non-monthly Expenses”. This allows me to bring a stop to the feast, famine lifestyle by saving for items that I know are coming!!!

Want to read more about planning for known, upcoming non-monthly expenses? Click HERE.

You now have a monthly budget that will change very little through the year!

Question: What have been the biggest budget-busting expenses you have experienced?

You have successfully completed Step 2 – Determine monthly expenses!

Now, of course, the trick is to have enough cash on hand every month to make this monthly budget work! Ahhhhh, that my friend leads us to step 3!

Step 3 – Save up three months’ worth of expenses

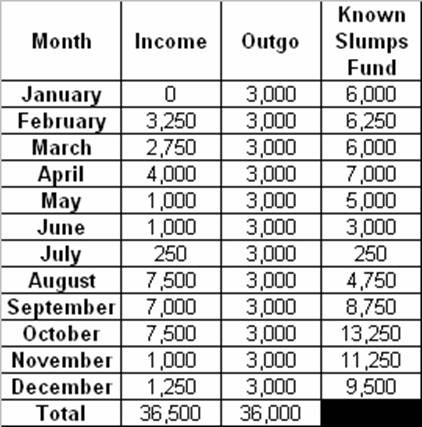

WHAT?!!!! I am sure that is what many of you are saying right now! Yes, I did say that you need to save up at least three months of expenses. Remember in step two that you calculated your monthly expenses? Multiply that number by three, and you have your savings target. I call this savings the “Known Slumps Fund”! You know that slumps are coming, so be prepared!!! This is HUGE in eliminating that horrible feast/famine lifestyle!

WHY?!!! You might be asking this question. Why on earth should I save up at least three months’ worth of expenses? Man, I am glad you asked that question!

How a “Known Slumps Fund” Works

Let’s say that you have monthly expenses of $3,000. This means that you need to have at least $9,000 in your “Known Slumps Fund”.

Let’s look at a year’s worth of expenses. Now, it is easily seen that this person has earned enough to make it this year. They have taken in $36,500 for the year. BUT look at how irregular the income is! Have you seen something like that before in your business? This causes life to be CRAZY. In January, you are eating ramen noodles like they are going out of style. February through April are decent, but then it dies again May through July. Famine of the worst degree! All of the sudden, August through October are awesome! Feasts abound! Then November and December come in with back to back terrible incomes. Back to the ramen noodles!

What should you do? Get a “Known Slumps Fund” that equals three times your monthly expenses!

Let’s see what difference that makes!

When you look at this chart you realize the POWER of having three months expenses in the bank! Whether you have a $500 month or a $6,500 month, you live on $3,000 that month. That means that you get to EAT!!! You can save money (remember the monthly expenses includes retirement savings!). That means that you can have some fun each month!

The “Known Slumps Fund” absorbs the irregularities of your income! Fill up your “Known Slumps Fund” – it will take so much stress out of your life!!!

Question: Which is more important to you – debt reduction or funding your Known Slumps Fund?

Step 4 – Become personally debt-free and operate your business debt-free

Now, I am certain that you believe I have completely fell off my rocker. You might be saying, “Joe, you are crazy! There is no way I can do this!” Well, I have seen many people operate their business debt-free.

What are the advantages of operating a business debt-free? Let me count the ways!

- Monthly expense load drops! There are no interest payments to make!

- Your business can absorb downturns much more effectively. Again, there are no interest payments to absorb!

- Breathing room. It is amazing how much stress a pile of debt brings on.

- When you spend your own real money, you will manage it better. I don’t know why this is, but if I am spending someone else’s money (i.e. the banks) I am much more susceptible to make a riskier decision! When I am spending my money, I am much more likely to do thorough due diligence before doing a deal!

Question: What are some other advantages of operating a business debt-free?

Budgeting with Irregular Income is Possible

So, don’t let your irregular income keep you from budgeting. Recognize that you have seasonal or cyclical income so you can avoid the feast or famine lifestyle. Next determine what your monthly expenses are. These include your fixed monthly expenses, variable expenses, and your know upcoming non-monthly expenses. Then save up three month’s worth of expenses in a “Known Slumps Fund” to help you weather those months when your income dips drastically or stops. Finally, live personally debt-free and operate your business debt-free. This isn’t something you can achieve overnight, but this goal will help you make tough choices along the way to set yourself up for long term success. Remember, budgeting with irregular income is possible!

Looking for additional Personal Finance Resources? You can obtain free tools by clicking HERE and purchase books/materials by clicking HERE.

How Do I Budget?

Budget. The word alone sends chills to many people. Here are some things that people equate with budgets.

Budget = Restricting

Budget = I Am Broke

Budget = Controlling

Budget = No Fun

Budget = Constricting

Budget = Not going to do it!

Most people have tried budgets … and failed! It was a bad experience, and many will say that they aren’t EVER going to budget again.

I want to make a deal with you. How about reading this post, trying for just one month this method that I will teach you? Just give it one shot. Just one. My hope is that you will try a budget for the next month.

I am going to share with you the exact process that Jenn and I took to prepare a budget that works. Guess what? THE VERY DAY that we started budgeting was THE VERY DAY that we started WINNING WITH MONEY!

Some might say “I hate budgets” and “I don’t need no stinkin’ budget”, but I would ask them the following questions:

- How are you paying for Christmas this year? I am paying cash.

- How much is your car payment? I paid cash for my car.

- How much did you invest this month? I have invested for retirement for 287 months in a row and my kids’ college since February 2002.

- How much money do you owe to your credit cards right now? I owe $0.

- When is the last time you had a great discussion on finances with your spouse? Not a fight. A great discussion. Jenn and I develop a spending plan TOGETHER every single month.

- If your car broke down tomorrow, do you have money in the bank to pay for it? Car repairs are not financial emergencies. I am not surprised when my car breaks down. Why? There is a car repair joint on every corner of every street of every town and city in the country! It is normal for cars to break down!

At the end of this post some might call me crazy, some might call me insane, and some might call me a wacko. I would say to them – call me whatever you want, just don’t call me broke anymore!

You see … I Was Broke … Now, I’m Not!

In reality, a budget is nothing more than telling your money where to go. I have heard Dave Ramsey take the definition a humorous step further – a budget is nothing more than telling your money where to go instead of wondering where it went!

EXACTLY!

So, our first step in budgeting is:

STEP ONE – Understand that budgeting is nothing more than “telling your money where to go.”

Step One is the largest hurdle of any part of budgeting. The rest of budgeting is a breeze once you understand what a true budget is. Once you have internalized Step One, it is time for Step Two.

STEP TWO – Determine the income (take-home pay) you will receive during the NEXT month.

There is a very key word in Step Two – the word “NEXT”. I have learned that preparing a budget for money that has already been spent is not very fruitful. It is like being a Monday-morning quarterback for your finances. You want to get that money back. You wish you could have that money back. But it is GONE!

The budget must be completed BEFORE the month begins and BEFORE the money ever arrives. You are developing a spending plan for your money BEFORE you ever get it. The only way I have found to stop saying “I can’t believe I spent my money that way” and “I wish I could have that money back” is to develop a spending plan BEFORE the money was paid to me for the month.

So, think about it. What income will you receive during the next month?

Here are some common ways that people receive money during the month.

- Paycheck

- Bonus

- Side Job Income

- Child Support

- Alimony

Whatever your source of income is, write it down. In fact, write it down and put the dates that you will be paid this money during the next month. If your income is unpredictable, write down the amount of money that you can count on.

If you have at least one month’s worth of expenses in the bank, download the [Monthly Budget].

Because you have at least one month’s worth of expenses in the bank, you can sum up your total income and enter the total income in the Income section at the top of the budget form.

If you are living paycheck-to-paycheck, download the [Weekly Budget].

Because you cannot pay all your bills at the start of the month, you will need to develop a budget for each individual paycheck. Make the dates at the top of the budget form match up to your income dates and enter the income in the Income section at the top of the budget form.

This income is what you will be spending on paper BEFORE the month, the money, and the bills ever arrive!

STEP THREE – Enter all of your expenses for the NEXT month.

This is where you spend your money on paper! In Step Two, you determined your total income for the next month, and it is now time to spend it on paper BEFORE the month arrives!

These expenses are the real, actual expenses that will happen. I have seen many people include average expenses for the year. Averages don’t work!!! Enter the real expense because this budget needs to be highly relevant to the next month!

If the expenses are not relevant to the next month, it is highly possibly that you will consider the budget irrelevant for the next month!!!

If you don’t know the ACTUAL cost (utilities, gasoline, etc.), enter an educated guess based on recent spending.

Enter all of the expenses into your budget. You can obtain your FREE COPY of budgets by clicking TOOLS at the top right-hand corner of the page.

The budget form has some excellent features built into it.

- If OUTGO exceeds INCOME, the TOTAL will turn RED and tell you how much you have overspent!

- If INCOME exceeds OUTGO, the TOTAL will turn YELLOW and tell you how much more money needs named!

- When INCOME = OUTGO, the TOTAL will turn GREEN … This is the ultimate goal!

Even if the budget TOTAL turns RED, keep typing in the expenses that you know are going to happen in the upcoming month. The goal is to get all of the known expenses for the next month on paper.

YES, you will later have to remove some expenses or boost your income to get to GREEN, but the goal right now is to get all of the expenses into the budget form! By having all of the expenses in the budget, you can make a much more informed choice on what will be removed from the budget.

Click on the HERE to see an example budget with all of the expenses loaded.

STEP FOUR – INCOME – OUTGO = EXACTLY ZERO

Your income is limited. If you bring home $3,000 during the next month and spend $3,320, your spending plan will not work! Where will the $320 come from? It will have to come from savings OR from debt – usually in the form of a credit card.

YOUR INCOME IS LIMITED! Let me take it one step further. Let’s say you are really blessed and bring home $70,000 during the next month (don’t laugh – many people do!). If you spend $71,320, your spending plan will not work! The $1,320 will have to come from somewhere – and many times it is made up with debt.

In STEPS TWO and THREE, we entered all of the income and expenses into the budget and, no surprise, the OUTGO exceeded the INCOME. You can see the entire budget HERE.

There are two options when the OUTGO exceeds INCOME:

- Increase the INCOME – 2nd job, Overtime, side job

- Decrease the OUTGO – Decrease the expenses

In this budget, let’s say that this family receives salary. They cannot quickly increase their income, so they are going to focus on reducing their outgo! They need to eliminate $320 of spending.

NOTE: This is not a “perhaps, perhaps, perhaps” type budget! This is how the family will ACTUALLY spend their money next month! Remember – if your budget is not 100% relevant to you and your family THIS MONTH, you will ignore the budget and use it to start a fire in your fireplace!

What expense can they eliminate? Again, you can pull up a copy of the budget HERE.

After working together on their budget, the family decides on the following changes.

SUCCESS!!! INCOME – OUTGO = EXACTLY ZERO!!!

If you want to see the entire EXACTLY ZERO budget, you can view it by clicking HERE!

You might be saying, “These people are CRAZY! They cut out 1/2 of their dining out, entertainment, blow money, and all of their babysitting money! They are crazy!”

I would say – “NOPE, they have had enough. They are so sick of living paycheck-to-paycheck that they are willing to live differently and change their lives forever! All because of a little sacrifice now!”

Jenn and I prepare a written spending plan every single month before the month begins and before any of the money gets to us. This is THE REASON we have won with money.

STEP FIVE – Follow the budget!

You have followed all of the steps. You now have a spending plan for the next month. It is time to live by it! After all, it was YOU who told your money where to go! Why wouldn’t you follow YOUR plan?

As I have helped others develop their own spending plans, I have seen people completely break free of debt. I have seen people pay off their mortgages, marriages restored, and the hopeless become hopeful!

That is what your budget will allow you to do! Develop a spending plan every single month BEFORE the month and the money arrives and then FOLLOW it! You will never regret this decision.

Will this work?

Maybe you have read this post in a guarded, protected way while wondering “I wonder if this will work for me? I don’t want to get my hopes up. I’ve tried this before.” I say that YOU CAN DO THIS!!! I believe in you! Why? BECAUSE I WAS THERE!!! I had an average bank balance of $4.13 and the STRESS was awful! The shame was real. I did not know how to break free.

Planning my spending one month in advance was what broke Jenn and I free! It will work for you too!

Why not pull up a free budgeting tool and get started winning with your money today?

If you have enough money in the bank to pay all of your bills at the start of the month, use the [Monthly Budget].

If you are living paycheck-to-paycheck, use the [Weekly Budget].

Help! I Can’t Pay My Bills

“I can’t pay my bills!”

How many of you have said this recently? Have you heard friend or family member say this?

Unemployment rates a skyrocketing, more lay offs are being announced daily, and pay cuts are now seemingly common. Many people are finding themselves in a situation where they can’t pay their bills.

Before this current financial crisis 40% of Americans said they couldn’t handle an unexpected expense of $400 or more. What do you do when the world economy is in a state of suspended animation?

This is post is written for those who are struggling mightily with their finances and tough decisions are being made about who will be paid and who will not be paid.

These practical steps and tools can help you walk out of this situation and into financial freedom.

Step 1 – Prepare A Written Spending Plan

There is so much power in a written spending plan! I never realized where all of my money was going until the day that I began planning my spending.

You might say, “But Joe, I know that I can’t pay my bills. My expenses are more than my income so why should I even bother with preparing a spending plan?”

I would respond with this answer. “It is hard to slay a dragon if you do not know how many heads it has!” A spending plan will ensure that you know the ACTUAL situation instead of the IMAGINED situation.

Prepare your plan – even if you know it is going to be awful. This is the start of your journey to financial freedom!

You can access the free budget tools HERE to get started on your plan.

Step 2 – Ask Questions

It is extremely important to ask questions that help define the true root cause of the issue.

When I am counseling someone experiencing this sort of situation, I have a series of questions I ask to help me grasp the issues. Here are some of the questions for which I am seeking answers. These are not in any particular order.

-

“What was the cause of this situation?”

Ultimately, I am trying to determine if the current situation is the result of a long series of financial decisions or the result of a catastrophic event (job loss, medical issue without insurance, death of income provider, etc.).

-

“Is this an INCOME or an OUTGO issue?”

I want to see where the money is going. That is why Part 1 is so important. The spending plan will help you more clearly determine the answer to this question. From experience, I have seen that it is an OUTGO issue in most cases.

-

“What are the required debt payments?”

Is this unsecured revolving debt (credit cards) or is this installment debt on an asset (car, boat, motorcycle, etc.)? This question will be key for Step 3 of this post.

-

“Is there something that can be sold?”

If there are items that can be sold, this needs to be fully investigated to understand how it can help the situation. Selling something like a motorcycle can help bridge your “gap” to help you prevent racking up debt.

-

“What expenses can be stopped?”

Are there any “extras” in the OUTGO? One example of this are nonessential subscription services like Netflix or Hulu.

-

“How can INCOME be increased?”

An extra job or tons of overtime may not be appealing, but living in a squalor of debt with no hope is even worse! It is very important to investigate short-term ways to increase income to get out of the current late bill payment situation.

Step 3 – Prioritize Your Bills

When the financial sky is falling down and the walls are closing in on you, it is imperative that spending is prioritized. Here is my suggested order of priority for spending when there just is not enough to pay everything.

1. Housing

You must take care of the mortgage and utilities first. Now if the mortgage payment has run out of control and it is 60% of one’s take home pay, then it is high time that the house be sold or income be tripled within a couple of months.

2. Food & Prescription Medication

I am going to eat before one single bill is paid! We must be able to eat. I am not talking about Olive Garden or fast food. I am talking about groceries bought with coupons and much attention to frugality. Likewise, I need to make sure my family has the medication they need.

3. Transportation

If transportation is required to produce income, then it is imperative that the vehicle payments, insurance, taxes, gasoline, and maintenance be funded. If you have an expensive car payment you may need to trade your vehicle for something with a lower payment or no payment at all.

4. Back Taxes

Owing the government back taxes is a terrible thing, and it must be addressed. I would rather owe anyone besides owing Uncle Sam!

5. Secured Debts

If there is additional money remaining after housing, food, and transportation are taken care of, it is time to pay the secured debt payments. This is debt where the lender can come take something – like a car, boat, motorcycle, tractor, etc. If the lender repossesses the item, they will sell it at a wholesale auction and come after you for the difference.

6. Family & Friends Debts

If you owe family and friends, and you still have some money left, it is essential to pay on debts owed to them. Unpaid debts to family and friends have been the cause of untold relationship issues since time began. Avoid this!

7. Unsecured Debts

It is time to address the unsecured debts. Credit cards, student loans, signature loans, etc.

One thing to note is that unsecured debt holders will be screaming and hollering the loudest because there is nothing they can come take from you. As a result, they will try to play upon your emotions to get you to pay them before you pay anyone else.

And it works! I have met with a lot of people who have kept their credit cards current while letting the house payments fall behind. Not good!

Go back to the spending plan you have prepared and ensure that your priorities are in order. When you run out of money you stop paying bills. Communicate kindly with those you can’t pay at this time that you want to repay your debts, and have a plan to do so.

Step 4 Take Action!

When you find yourself in a place where you can’t pay your bills don’t stop!

I have found that whenever I am overwhelmed, I move toward doing nothing. I just want to shut down and ignore everything. Running away feels like the right thing to do.

Yet, the FACT is that running away will just make the situation worse. Will it be extremely difficult to work through this situation? AB-SO-LUTE-LY! But the cost of NOT doing something is even more difficult! You CAN do this.

Below are some practical tips that have worked for me when I have wrestled with overwhelming situations.

-

Create an Action List of Payments

I prepare a list of items and prioritize them. Identify who you need to call to communicate that you can’t pay them at this time. All those that you are going to pay, list what actions you have to take to do so (ie what are you going to sell or what expenses are you eliminating so you have money to make those payments).

-

Establish Financial Accountability

I find someone who I trust who will hold me accountable to my actions. They can encourage you as you make difficult choices along the way.

-

Seek Help

Seek help from a financial coach who can help you prepare a budget.

We have trained over 4,000 financial coaches across the US and Canada. You can email us on the I Was Broke. Now I’m Not. Contact Page. We will connect you with a one of the churches where we’ve trained coaches, and they will meet with you for free.

Our counselors are winning with their money and are passionate about helping folks do the same!

“I Can’t Pay My Bills” but I CAN Do Something!

Not being able to pay your bills can feel crippling, but I want you to know that you CAN help your situation.

Let’s review our four steps .

First, write it down so you know what situation you are actually facing, instead of what you imagine you are. Second, ask yourself those six questions. Third, prioritize your bills in order to figure out who will be paid and who can’t be. Finally, take action!

We want to be able to help you along the way. Visit our Next Steps and Tools pages on our website for free resources to equip you on your journey.

By identifying your gap and taking action it will allow you to maximize the dollars you do have and minimize how much you spend. These actions will enable you to prosper on the other side of this. You can do this!

For more resources to help you with your finances during the COVID-19 pandemic visit our website.

March 2020 Update From I Was Broke. Now I’m Not.

Do your finances cause you frustration, fear, and anxiety? Discover how you can handle financial anxiety and become more comfortable dealing with money.

**CLICK HERE TO LEARN HOW TO DEAL WITH FINANCIAL ANXIETY

DEBT!!! Is it all equal? Are there different kinds of debt? What type of debt should you avoid, and is there any debt that’s ok to have? Everyone has a different opinion, so we’re breaking it down for you.

**CLICK HERE TO LEARN ALL ABOUT DEBT

Are you making progress when it comes to budgeting, but then something happens that blows up your budget? Discover how to prevent issues from messing with your financial progress.

**CLICK HERE TO FIND TIPS FOR PAYING CASH FOR YOUR VACATION

We’re sharing all our money saving tips. If your monthly budget is tight, this is for you! Check out ways you can save money in your budget now!

**CLICK HERE FOR MONEY SAVING TIPS

DON’T FORGET YOUR MARCH BUDGET

If you still need helping creating this month’s budget, check out our free budgeting tools HERE.

Don’t forget these expenses in your budget:

- St. Patrick’s Day

- Spring Break

- Easter

- Taxes

- New Clothes for Warmer Weather

- Outdoor Activities

- Yard Upgrades [mulch, plants, patio furniture]

- Christmas 2020

- Summer Vacation Savings