Featured Tool Of The Month: Mini-Budget

It is so important to PLAN the spending of each and every dollar earned. Planning is THE REASON why my family started winning with money.

TOOL OF THE MONTH: MINI-BUDGET

The Mini-Budget was created for two specific uses:

- Planning the use of non-normal or unusual found money – such as tax refunds, bonuses, inheritance money, or money received by selling something

- Planning a major expenditure – such as a kitchen refurbishment project, daughter’s wedding, or finishing the basement

This budget tool is unique because it has THREE different budget forms. This is because I have found that it is essential to think through the alternative ways to spend the money. The first way that comes to mind is usually the most immediate or urgent use, BUT it is not always the best or most impactful use.

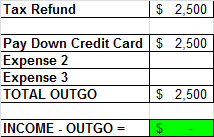

Let’s look at an example. Suppose you were receiving a $2,500 tax refund. Your first thought was to put all of the money toward an existing credit card balance.

This, of course, is a decent way to spend the money. But is just one way. There are several ways this money could be utilized, and that is why there are THREE budgets placed next to each other in this tool.

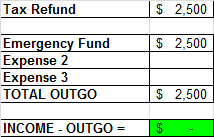

What if this money were being planned by a person who had ZERO SAVINGS? Another way to spend the money would be to put all of the money toward their Emergency Fund.

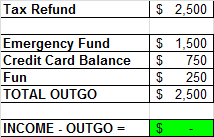

Another way would be to place some money in savings, some in FUN, and some toward the credit card balance.

Which way is the best way? I don’t know which would be right for this person, but I am confident that the first scenario would not be the best! The challenge of spending the money three different ways on paper before it is spent for real can really help you maximize your money.

Which way is the best way? I don’t know which would be right for this person, but I am confident that the first scenario would not be the best! The challenge of spending the money three different ways on paper before it is spent for real can really help you maximize your money.

QUESTION: How are YOU going to use this tool?