How Much Money Do You Need To Retire Well

Do you know how much money you will need to retire well (independent of Social Security)?

There are many ways to calculate an estimate, but I really like the Retirement Nest-Egg Required calculator that we have placed in the FREE TOOLS section.

To calculate your number, you will need to know two numbers:

- The annual amount you want to live on at retirement (in today’s dollars)

- The number of years until you retire

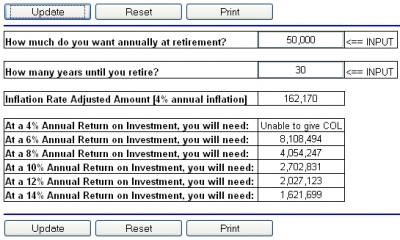

Suppose one wants $50,000/year (today’s dollars) during retirement and plans to retire in thirty years. Punch the numbers into the Retirement Nest-Egg Required calculator and this is what you will see:

Because inflation erodes the spending power of money, the annual amount we want must be adjusted. Using an assumed inflation rate of 4%, one will need $162,170/year in thirty years to have the same spending power of $50,000 today.

At different rates of return, you can see different amounts that need to be saved. Eight percent is a common rate of return on investment that financial planners use.

What is your number? Are you going to achieve it?

help , i have no clue how much i need or what shape i’m in.

i’m 58 ,my wife is 57 . our annual net is$140,000. our house is paid off .it’s worth $700,000 .WE HAVE INVESTMENTS IN RETIREMENT OF $400,000 savings of $200,000. we have no outstanding debts. we would like to retire in 8 years. are we on track? we know we have to downsize when we retire.

thanks

based on my last comment i would like to have $5,000 per month not includung social security.