Marching To Debt Freedom – Couple #3 – Month 05

Introduction

This couple has been married for many years and have one child. They have HAD IT with their debt and have been marching toward debt freedom since November 2007. They are THROUGH with credit cards.

What went well this month …

We changed car and homeowner's insurance companies saving us $672 a year! UNBELIEVABLE!

What were the challenges/struggles this month …

Well, we are so frustrated! We have called our credit card companies, and they are still not wanting to reduce interest rates. We have applied for transfers and can't get them right now b/c our balances are too high. So we are really focusing on paying these off even faster so we can tell these crooks to TAKE A HIKE! We are still calling and harassing them trying to get reduced rates – 1% here and there but it is lower than the previous month.

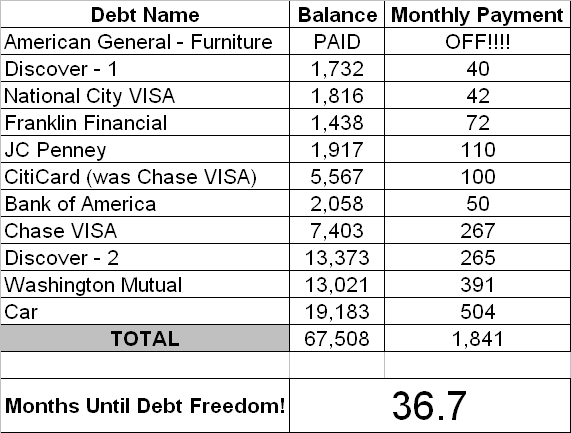

Updated Debt Freedom Date …

Our car balance is higher than it has been because we have the actual balance now and not a guess. Also, the Citi card stayed the same as it was a balance transfer and the Discover went up a little for the balance transfer fee.

Month By Month Progress …

![]()

What is your favorite tool on JosephSangl.com …

Why, the budget form by far! It really keeps us in line telling our money where we want it to go and also being able to account for all of it. We couldn't do this without it!

Sangl Says …

When you have a pile of debt, it can take a little time to get the Debt Freedom March fully on track with a full head of steam! This is exactly what Couple #3 is experiencing. They are getting their debt balances organized and working hard to improve the interest rates on the debt. In just a couple of months, all of the restructuring will be complete, and I can not WAIT to see what happens to this debt then!

Readers …

As we all know, this is tough stuff! It is even harder when you put all of your financial information out there for the world to see. Will you encourage Couple #3 by leaving them a note in the "comments" section?

My book, I Was Broke. Now I'm Not, is available via AMAZON.COM, BORDERS.COM, and PAYPAL. You can read the Introduction HERE.

Couple #3 keep up the great work. It is tough & does take a bit of time to get organized. Don’t be discouraged & keep plugging on. It will be so worth it in the end. I personally am still working on the organization part. The encouraging part to me is seeing when I’ll be done with debt!

God Bless!

Couple #3, you are doing great! Before you started this process, did you ever think that you’d be able to tackle the things that you’ve already accomplished? That is a huge step in itself. Stick with it and keep sharing. Even the victories that you think are small/insignificant, are a great inspiration to others!

Stay on track, stay focused and KEEP UP THE GOOD WORK! Believe me you will not be sorry.

I also had a card that would not budge on thier interest rate. It was the card I had the longest and I had always paid on time, never over the limit etc. I was MAD MAD MAD and called them every 60 days but still no luck. I waited until my balance was below $10k (almost a year!) and started saving the credit card offers that came in the mail to find the best one for me to do a balance transfer… I called them one last time.. and still – NO ! So I transferred the whole amount and got almost a 10% interest rate reduction! Finally! So keep up the good work! Slow and steady wins the race!

I say “Yeah!” for them trying to get their finances under control. If I could, I’d give them a Wilkie button. However….

So we are really focusing on paying these off even faster so we can tell these crooks to TAKE A HIKE!

I don’t like some of the things credit card companies do either, but why are they always the “crooks”? Couple #3 comes across as if it wasn’t them that racked up all that debt. That all those credit companies forced them into it. Sort of reminds me of all the housing “problems” we’ve been having. Man up and just say, “I screwed up and I have nobody to blame but myself!”.

On top of that $67,000 worth of debt! Good grief. I thought my credit problem many moons ago was bad, but I never called the creditors, “crooks”. The blame was squarely on me.

One other thing Joe, how about putting all these couple’s monthly income and occupation up along with their debt? I’d really like to know how much folks like couple #3 make given that they can dump almost $2,000 a month towards their debt.

To “AMAZED”….

The reason we think the credit card companies are “crooks” is that they charge an INSANE amount of interest to people that pay on time and pay more than the minimum and are NOT over their credit limit. We have NEVER blamed them for our stupidity of using the cards…..that is our mistake…but it is one we will NEVER make again. We just think it is awful how they will not cut rates to help people, and instead they increase them with NO GOOD REASON!

As far as your question about how we can dump $2000 a month towards debt, it is all about telling our money where to go! We control it, not vice versa. We have made decisions (not eating out, not wastefully spending on things we don’t need, cutting TV service down to basic, etc) to be able to do this! That is how we can do it!

My hats off to Couple #3 for hanging in and slugging it out. Toe to Toe, inch by inch you will win! My wife and I were in a similar situation just over 3.5 years ago. Almost 70k in debt, but now we’re debt free except the house. We’re currently building up the emergency fund and will pay 4-6k cash for a car in the next couple of weeks. You can do it! It’s hard, tedious and frustrating at times, but you will succeed as long as you stick with the plan. God bless!

Stick with it couple#3. We started the same process 4 yrs ago when Paul Marshall was teaching Financial Peace University. We were able to get almost out of debt when unexpectedly my husband died of a heart attack. We did not have life insurance because his poor health put him in a high price bracket, and his monthly medical expenses were high as well. BUT, we were ALMOST debt free and the process taught me how to manage our money!!!!! I was able to pay off the last $3000 and pay for his last expenses by selling his PAID FOR car and I now live on less than $2000/ mo. With two small children I am able to work from home and I am saving to pay cash for a small house. We live the best life I could ever imagine!!