THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

Is This Mutual Fund A Good Investment?

Many people are hesitant to begin investing because they think that it is some incredibly complicated venture that is only for the uber wealthy. I am here to tell you that it is not that difficult and you can (and should!) get started today at some level. Most people feel this apprehension towards investing because…

Read MoreMONDAY MONEY TIP PODCAST: Making a Good Investment

The Monday Money Tip Podcast is back! Investing can be such a complicated venture so this week, Joe is sharing how he determines if an investment is a good deal or not. For those who are new to investing, Joe has some helpful mobile apps that you can download to learn more of the basics…

Read MoreThe Basics of Oxen

Where there are no oxen, the manger is empty, but from the strength of an ox comes an abundant harvest. Proverbs 14:4 This verse had a profound impact on me as I went through my financial freedom journey. From this verse, I realized that I could either live a life with an empty manger or…

Read MoreInvestment Value Calculator Tool

Are you ever tempted to pull money out of your investment accounts? Sometimes it can sound like a good idea to withdraw money from retirement funds or other accounts to pay a debt or even go on a vacation. However, most of the time taking money out of the market is not a good idea!…

Read More5 Year Buckets For Investing

What is the most important thing to do when it comes to investing? START! Often when you are looking at making an investment, it can seem like a daunting task so taking that first leap is the most essential. Once you have taken that crucial first step, it does not have to be a confusing…

Read MoreMONDAY MONEY TIP PODCAST: 5 Basics of Investing

Have you ever felt completely overwhelmed by the thought of investing? Are you confused as to where to start? If so, you’re certainly not alone. In Episode 20 of the Monday Money Tip Podcast, we’re here to give you 5 Basic Steps to Investing that you can implement TODAY! In today’s podcast, you’ll be sure…

Read MoreAbout Joe

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

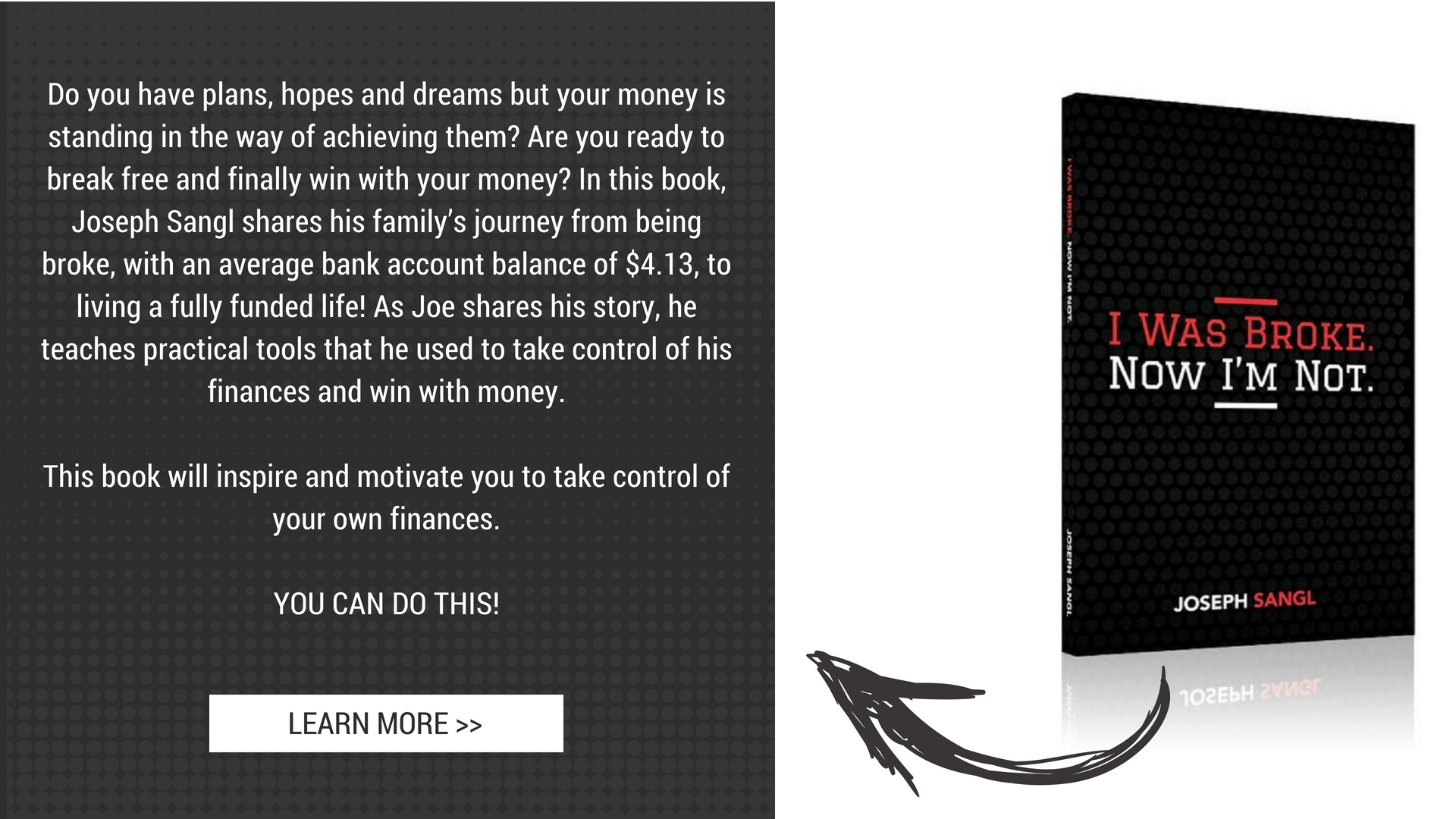

He is the founder of I Was Broke. Now I’m Not., the president and CEO of INJOY Stewardship Solutions, and Co-Founder of Fully Funded.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.