THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

Managing Money As A Single Parent – Part 05

Welcome to the latest series here at the wildly popular JosephSangl.com – “Managing Money As A Single Parent”! Part Five Establish automatic long-term investments – then monitor In the midst of the busyness and chaos of being a single parent, retirement and college expenses are approaching – one day at a time. It is vitally…

Read MoreManaging Money As A Single Parent – Part 04

Welcome to the latest series here at the wildly popular JosephSangl.com – “Managing Money As A Single Parent”! Part Four Establish financial margin Nothing will create financial pain and agony like having no savings. Without financial margin, you will always be on the brink of financial disaster. If you are a single parent with no…

Read MoreManaging Money As A Single Parent – Part 03

Welcome to the latest series here at the wildly popular JosephSangl.com – “Managing Money As A Single Parent”! Part Three Move to equal payments where possible. As a single parent, surprises are unwelcome, especially financial ones! Seek to eliminate these sorts of issues by moving to “equal payment plans.” Many utility companies offer these options…

Read MoreManaging Money As A Single Parent – Part 02

Welcome to the latest series here at the wildly popular JosephSangl.com – “Managing Money As A Single Parent”! Part Two Eliminate as much work as possible! Your time is extremely valuable. As a single parent who must run kids to practice, go grocery shopping, ferry kids back and forth from school, and, oh yeah, work,…

Read MoreManaging Money As A Single Parent – Part 01

Welcome to the latest series here at the wildly popular JosephSangl.com – “Managing Money As A Single Parent”! Part One Prepare and live by a monthly budget A monthly budget allows you to tell your money where to go instead of wondering where it all went. Without this basic financial tool in place, you will…

Read MoreManaging Money As A Single Parent – Part 00

Welcome to the latest series here at the wildly popular JosephSangl.com – “Managing Money As A Single Parent”! So many people are faced with this very situation, and it is a key issue many people face today. Life as a single parent is very challenging. Balancing your children’s needs with the demands of your job…

Read MoreAbout Joe

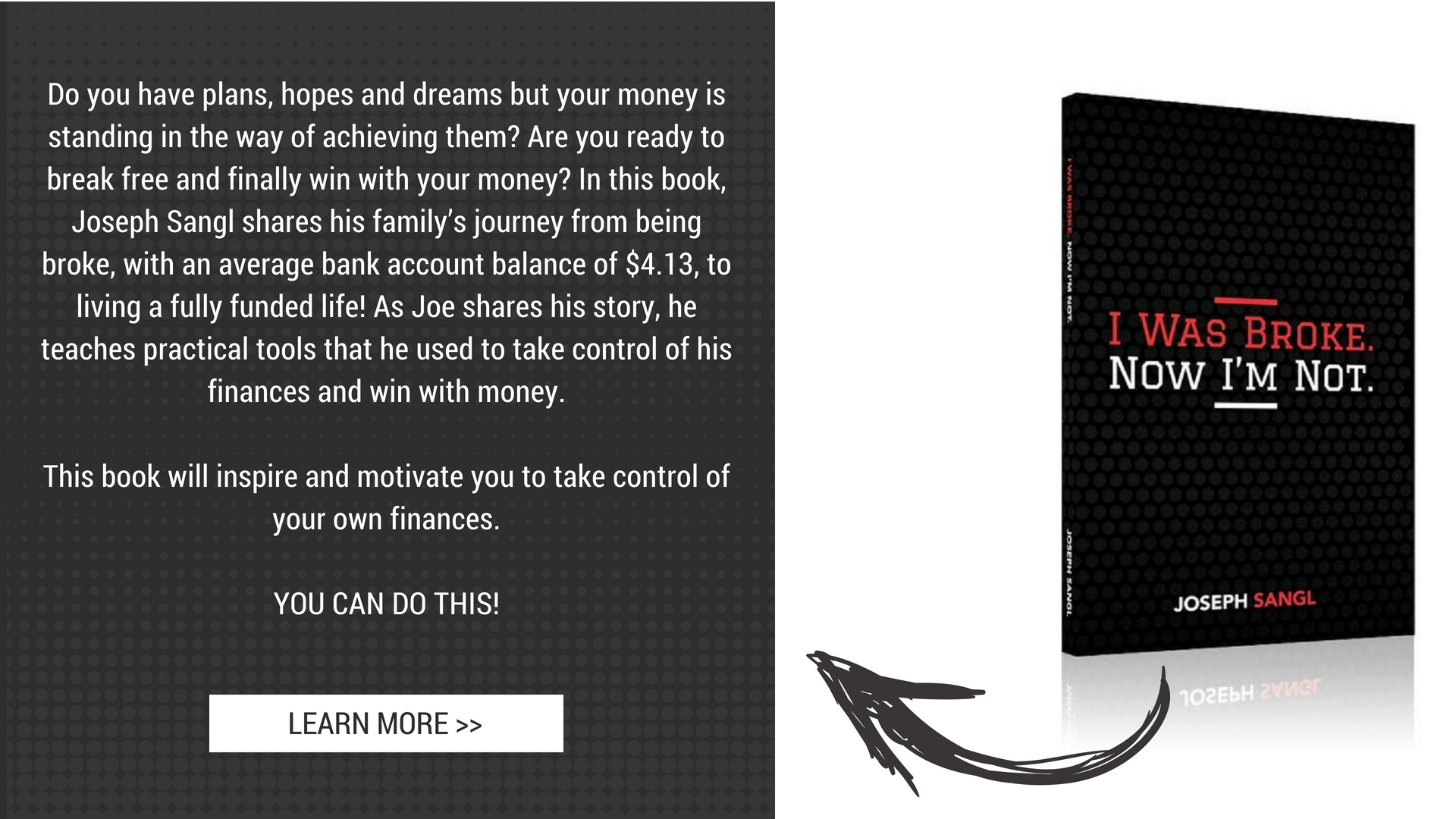

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

He is the founder of I Was Broke. Now I’m Not., the president and CEO of INJOY Stewardship Solutions, and Co-Founder of Fully Funded.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.