THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

MONDAY MONEY TIP PODCAST: How to Become a Millionaire

Happy Monday! It’s my favorite day of the week because another episode of the Monday Money Tip Podcast is LIVE! Is it possible for you to become a millionaire? (Spoiler Alert – YES!) In today’s episode, we’re sharing some tips that can your finances to the million-dollar level. In our Current Money Events segment, we’re…

Read MoreMONDAY MONEY TIP PODCAST: Budgeting Tips

Happy Monday! It’s my favorite day of the week because another episode of the Monday Money Tip Podcast is LIVE! Today, we’re giving you all our budgeting tips, tricks, and hacks so you can become great at budgeting. We’ll also talk about a helpful resource that can truly take your finances to the next level.…

Read MoreMONDAY MONEY TIP PODCAST: The Right Retirement Account

Another episode of the Monday Money Tip Podcast is LIVE! In today’s episode, we’re discussing what type of retirement account you should have – 401k or Roth 401k. We’re also diving into how to choose the right investment options within your retirement account. In our Current Money Events segment, hear our quarterly stock market update.…

Read MoreMONDAY MONEY TIP PODCAST: Choosing the Right Insurance

Another episode of the Monday Money Tip Podcast is LIVE! In today’s episode, we’re discussing how to make wise decisions when it comes to insurance providers. Everyone says they can save you money, but what do you really need? In our Current Money Events segment, I’m talking about how our mini-budget tool can help your…

Read MoreMONDAY MONEY TIP PODCAST: How to Win With Your Money While on Disability

Another episode of the Monday Money Tip Podcast is LIVE! In today’s episode, we’re diving into the topic of disability, specifically how to win with your money (including saving and investing) while on disability. In our Current Money Events segment, I’m talking about how to utilize the “Principle of 5 Swings of an Ax.” Also,…

Read MoreMONDAY MONEY TIP PODCAST: Social Security

Another episode of the Monday Money Tip Podcast is LIVE! In today’s episode, we’re answering the question: “What should people know about Social Security, and how will it affect them?” Find out if you know the facts and what you should be doing today to prepare for the future. In our Current Money Events segment,…

Read MoreAbout Joe

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

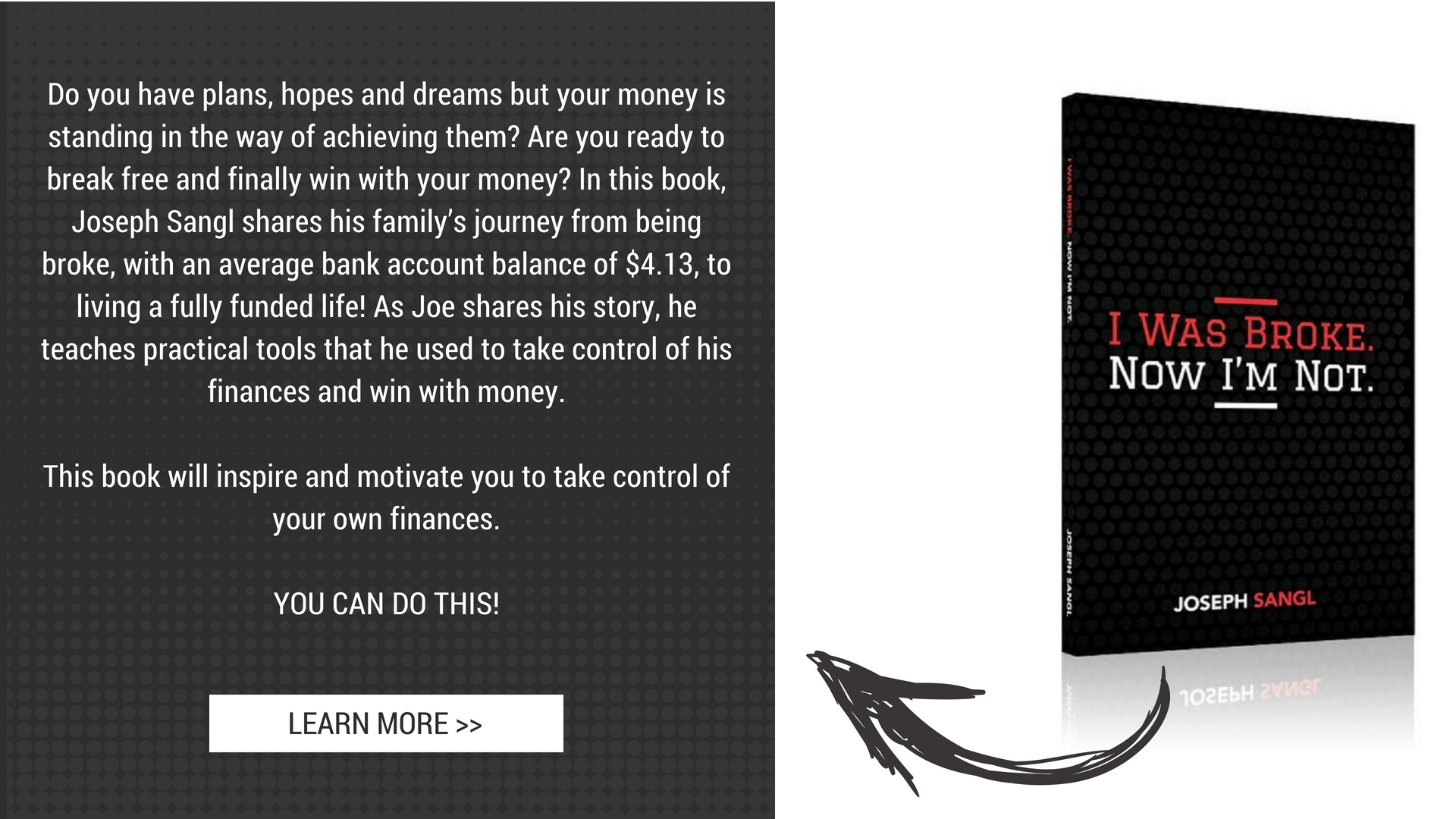

He is the founder of I Was Broke. Now I’m Not., the president and CEO of INJOY Stewardship Solutions, and Co-Founder of Fully Funded.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.