Archive for December 2007

Marching To Debt Freedom – Couple #1 – Month 03

Introduction

Couple #1 has HAD IT with debt! They have been married for many years and have two children.

It has now been three full months since they embarked on their Debt Freedom March! That means that the hardest months are behind them!

On to the update for this month!

What went well this month …

I can see improvement not just in the numbers but in the actions of me and my family. The kids are starting not to hound me for things that cost so much.

Challenges and struggles for this month …

Christmas is LOOMING and I have not planned ahead. I think what I have decided to do is to pay cash for Christmas and to pay the minimums on the debt just for this month and resume the march in Jan. This will be the last year of a Christmas not planned ahead.

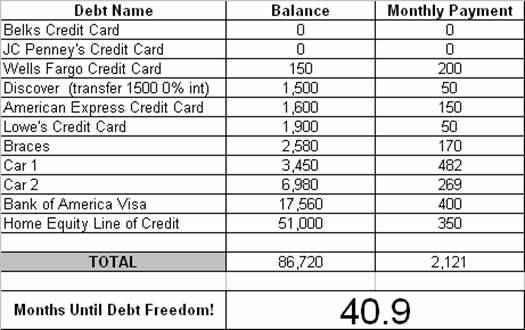

Updated Debt Freedom Date …

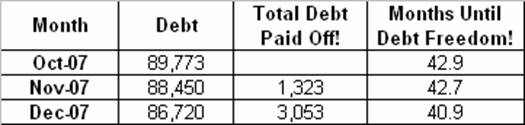

Month By Month Progress …

Sangl says …

I am FIRED UP by the progress that Couple 1 has made! In just three short months, they have made two debts leave and paid off over $3,000 in debt!

Even more important, the family is getting on board! The children are realizing how huge of a lifestyle change this is and are jumping on board! There is NOTHING like a united family attacking debt.

I am thrilled to see that Couple 1 is going to start saving for Christmas 2008 in January! It is SO MUCH EASIER to save for known, upcoming expenses over the course of months instead of absorbing the entire budget-crushing expense in a single month.

While they are going to pay less on debt, I am PUMPED to see that they are avoiding Christmas debt by paying cash! This is so important! As you attack debt, you will encounter expenses that threaten your ability to avoid debt. You have to make the decision that NOTHING is important enough to go get debt. Way to go!

Readers …

You can save for Christmas (and property taxes, annual insurance premiums, and other known, upcoming expenses) in advance as well with your own monthly escrow account. THIS ARTICLE shows you exactly how to do it!

It is encouragement time for Couple 1. Would you take a moment to share your thoughts with Couple 1?

You can receive each article FREE via E-MAIL by clicking HERE!