Archive for August 2008

SERIES: Restructuring Debt – Part Three

Welcome to the latest series at JosephSangl.com – Restructuring Debt

Welcome to the latest series at JosephSangl.com – Restructuring Debt

I am excited to embark on this series of posts because interest paid toward debt is one of the largest obstacles to gaining traction for one’s own Debt Freedom March.

Of course, one way to eliminate the interest is to sell some stuff and become debt-free. But I recognize that for some people, they have debt that they are going to have to focus on and just pay it off. If this describes you, then I trust that this series helps you gain speed in your Debt Freedom March!

Part One – Know What You Are Paying

Part Two – Lower The Interest Rates!

Part Three – Lower The Interest Rates! – Continued

There are many approaches one can take to lower their interest rates. In Part Two, I covered the “negotiation” avenue. Today, we will discuss moving the debt.

Surf The Debts To Lower Interest/Zero Interest Offers

If you live in America or any other heavily-leveraged society, then the chances are that you will receive numerous offers of debt every week. Most of these offers have a “trickeration” ploy that generates consumer interest. The trickeration is typically a “Zero-percent for some number of weeks/months/years” ploy. The reason I call it a trickeration ploy is the fact that the majority of these debts are not paid off within the set timeframe and the interest rate is back-dated all the way to the date of purchase – usually at a very high rate.

But the zero-percent surfing game CAN work for you. I have seen MANY people gain substantial traction with their Debt Freedom March through this technique alone.

Here is how the surfing game works. You receive a “zero-percent for twelve months” credit card offer. There is usually a $75 balance transfer fee, but there is no interest for the twelve month period. One simply applies for the 0% card and transfers their high interest debt to the credit card. When that introductory period is drawing to a close, surf the balance to another “zero-percent for twelve months” card. Keep surfing the balance until the debt is paid off to $0.

If you successfully do this, you have actually tricked the trickeration ploy into working for you!

There are several 0% credit cards that you can apply for ON-LINE! Click HERE to view the 0% credit cards available via the Next Steps division of I Was Broke. Now I’m Not.

Receive posts automatically in your E-MAIL by clicking HERE.

SERIES: Restructuring Debt – Part Two

Welcome to the latest series at JosephSangl.com – Restructuring Debt

Welcome to the latest series at JosephSangl.com – Restructuring Debt

I am excited to embark on this series of posts because interest paid toward debt is one of the largest obstacles to gaining traction for one's own Debt Freedom March.

Of course, one way to eliminate the interest is to sell some stuff and become debt-free. But I recognize that for some people, they have debt that they are going to have to focus on and just pay it off. If this describes you, then I trust that this series helps you gain speed in your Debt Freedom March!

Part One – Know What You Are Paying

Part Two – Lower The Interest Rates!

There are several ways to lower the interest rate that you are paying on your debt. Here are several ways that have been used very successfully.

Call The Debt Owner

This really catches some people off-guard. For some reason, they believe that the interest rate is truly fixed on their debt. Well, just as "fixed rates" on credit cards are not truly fixed and can be (will be) changed at any time, your "fixed rates" are negotiable.

Paying high interest on a debt? Call the customer service line and try some of these lines out (only if they are true, of course!).

- "I am really trying to eliminate my debt, but these high interest rates are really hurting my ability to do that. Can you please lower the interest rate?"

- "Can you please lower the interest rate on this loan? I have been a very loyal customer, and I could really benefit from some help right now."

- "What can you do to help me lower the interest rate on this loan?"

Things NOT to say …

- "You stink. Your company stinks. You are lying, cheating, good-for-nothing scammers. I wish a 1,000 SPAM e-mails per minute upon your life."

- "You're ugly. You're responsible for the recession. I am going to talk about you on my Facebook page."

The first person you talk to will probably not have the authority to change the terms of your loan. Be persistent and ask to speak to their manager. I have had people tell me that it has taken several separate phone calls before they got their interest rates lowered. Many times in spite of a great effort, folks have been unsuccessful and the interest rate was not lowered at all. That brings us to another option. – Move The Debt – and this will be discussed in the next part of the Restructuring Debt Series.

Receive posts automatically in your E-MAIL by clicking HERE.

SERIES: Restructuring Debt – Part One

Welcome to the latest series at JosephSangl.com – Restructuring Debt

I am excited to embark on this series of posts because interest paid toward debt is one of the largest obstacles to gaining traction for one's own Debt Freedom March.

Part One – Know What You Are Paying

I have said and will continue to say that I believe that the top causes of financial failure are disorganization and the lack of a plan. If you want to gain the maximum traction on your Debt Freedom March, you need to pay the minimum interest possible.

In many of my financial counseling appointments, we add up the amount of interest that is being paid each year, and it SHOCKS the ones who have been paying it! There is something about SEEING IT ON PAPER that really connects us to the fact that paying interest is not a healthy financial plan.

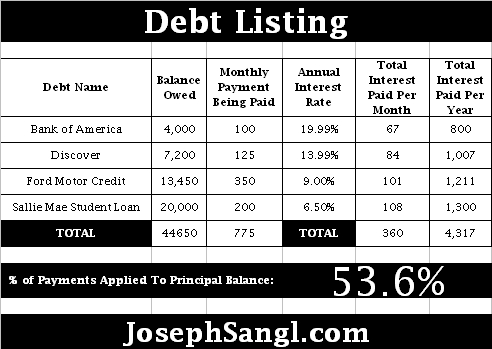

I have developed a tool to help you easily calculate the amount of interest you are paying every month and year. The [download#70#nohits] is an Excel spreadsheet tool that will help you organize your debts and clearly understand the amount of interest that is being paid on the debt.

The form is very user-friendly. All you have to do is enter the debt name, the balanced owed, the monthly payment you are actually paying, and the annual interest rate of the debt. Below is an example.

In this example, you can see that this person has four debts totaling $44,650. The big issue is that $4,317 is being paid in interest every year. In fact, only 53.6% of the monthly payments is being applied to principal reduction.

Now that we are organized it is time to look for ways to reduce/eliminate the interest being paid. That will be covered in Part Two of "Restructuring Debt"!

Receive posts automatically in your E-MAIL by clicking HERE.

Great Leadership Book – Tony Morgan

If you are a leader or are developing yourself to be a leader, I highly recommend you jump over to Amazon.com and pre-order Tony Morgan's new book – Killing Cockroaches. Tony serves as the Chief Strategic Officer on the Strategic Management Team here at NewSpring Church, and he is freakishly smart when it comes to leadership and strategy. As a plus, he is a funny. I would also subscribe to his website. His blog is on my short list of every day must-reads.

If you are a leader or are developing yourself to be a leader, I highly recommend you jump over to Amazon.com and pre-order Tony Morgan's new book – Killing Cockroaches. Tony serves as the Chief Strategic Officer on the Strategic Management Team here at NewSpring Church, and he is freakishly smart when it comes to leadership and strategy. As a plus, he is a funny. I would also subscribe to his website. His blog is on my short list of every day must-reads.

Oh, and this other no-name guy named Andy Stanley wrote the foreword for Tony's book.

Watch a GREAT introduction to Tony's book by clicking on the YouTube video below

While you are at it, you might want to pick up Tony's other three books on strategy that he co-authored with Tim Stevens.

Find other great resources at the I Was Broke. Now I'm Not. Amazon.com Resource Center.

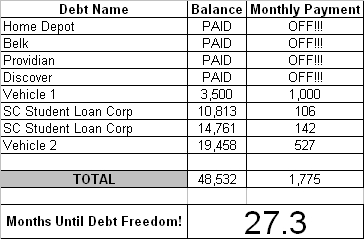

Debt Freedom March – Couple #2 – Month 11

Introduction

This couple is THROUGH with debt! It has now been eight months since they announced that they were breaking up with debt. They have agreed to share their Debt Freedom March with everyone in the hopes to inspire others to do the same!

Here is this month's update.