Archive for February 2008

Discount Codes – Great web site!

I recently discovered a new web site that is helping me save money.

It is called www.RetailMeNot.com.

This web site has discount codes and promo numbers that allow you to save money at thousands of different e-tailers.

Home Depot, Wal-Mart, Victoria's Secret, Barnes & Noble … There are over 10,000 companies represented.

One thing I really like about this web site is it allows the users to rate the promo codes. If it did not work for you, you can communicate that to the next user so that they don't waste their time with it.

Try it out, and see if you can save some money!

Receive each post automatically in your E-MAIL by clicking HERE

What was your first credit card?

My first credit card was an Advanta VISA card with a really low limit.

How did I get it? I signed up for a free t-shirt during my first few weeks as a freshman on the campus at Purdue University.

What did I do with it when I received it? I went and charged it up!

It was so easy! Yet, it began a ten year mess of debt. I was a huge loser with credit cards. Maybe you have done better. Maybe not.

So my question today is:

What was YOUR first credit card?

AND

Did it help you or hurt you?

Receive posts automatically in your E-MAIL by clicking HERE.

Marching To Debt Freedom – Couple #2 – Month 05

Introduction

This couple is THROUGH with debt! It has now been five months since they announced that they were breaking up with debt.

Here is this month's update!

What went well this month …

This is month five, and as you can see (from our Debt Freedom Date calculation) we are on the way to debt freedom. Joe's system gets much easier with time! We've really changed our financial lifestyle.

Challenges and struggles this month …

This month was fairly easy. We'd like to pay more than $325 on the Discover, but some other things came up and we had to plan for them. However, we didn't accumulate any new debt! We'll use our tax refund to pay off the Discover balance, and begin working to pay vehicle #1 off about ten months early!

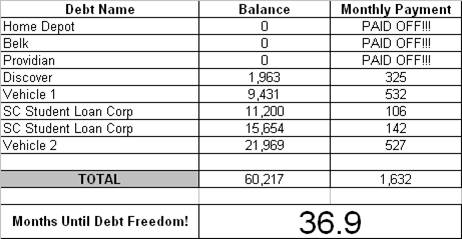

Here is their updated Debt Freedom Date calculation …

Month By Month Progress …

![]()

Anything else you want to share?

We get paid on the 15th and 30th every month. A few months ago I couldn’t wait for those checks to come in because we were dependent on them.

About three months in to this, the “pay days” became regular days.

Any challenges you want to issue to others who are reading the web site?

My wife basically dragged me to our first meeting with Joe. Our finances weren’t horrendous, but weren’t great either. We had a few thousand dollars in savings, but were living pay check to pay check with some debt. I was embarrassed for an outsider to look into our personal business. My first question to Joe was, “What qualifies you to tell me how to handle my money?” Joe briefly told his story and I began to listen and realized I wasn’t going to be judged on my past financial decisions. This put me at ease.

We’ve been doing this for 4-5 months now, and it has changed our lives. I still buy what I want, eat what I want and go where I want, it’s just budgeted. We are paying off debt quickly, and working towards financial freedom.

My point … I know someone out there is skeptical or embarrassed about their situation, its okay. Call Joe!

Sangl says …

I am so fired up by Couple #2's progress! I am ready to CRY!

Couple #2 is ON FIRE! They have been on this journey for just FIVE months, and they have already paid off $11,693! They are experiencing a time of blessing, and they are taking full advantage of this time to knock out their debt! While they did not totally eliminate a debt this month, they did reduce their debt by $1,720. Simply amazing.

Readers – What you are seeing unfold before you with Couples #1 and #2 is what I am seeing literally HUNDREDS of people do! There are HUNDREDS of people who have taken control of their finances, developed a written spending plan, and are absolutely changing their entire financial future!

Couple #2 – You guys are inspiring others to take their finances to the next level! Thank you so much for sharing!

Readers …

Have you had enough? Have you had your "I Have Had Enough" Moment? It's time to put together a plan that helps you win with your finances. You can start by putting together a written plan using one of the budget forms available on the "TOOLS" page. Just click on the word "TOOLS" at the top right-hand corner of the page.

Want to read my story and learn how to take your finances to a new level? Purchase a copy of I Was Broke. Now I'm Not. I can promise you that it is written at a level you can understand and immediately apply to your finances!

Read Previous Updates For Couple #2

You can receive each post from www.JosephSangl.com FREE via E-MAIL by clicking HERE!

Marching To Debt Freedom – Couple #1 – Month 05

Introduction

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now five months into their march. Here is this month's update.

What went well this month …

Well, it's January, and we are back on track. I am jacked because this year we are putting a lot of debt in our rear view mirror. Look for next month's update, big things are going to happen. Thank you, Joe, and thanks to all with encouraging words! It is great to do something really meaningful. Now if I can shed about 20 lbs along with my debt.

Challenges and struggles for this month …

The challenge is being impatient. I want to pay everything all at once. I must remember that I did not get here overnight, and I won't be paid up overnight. I'm Not Broke is big medicine, share it with your friends!

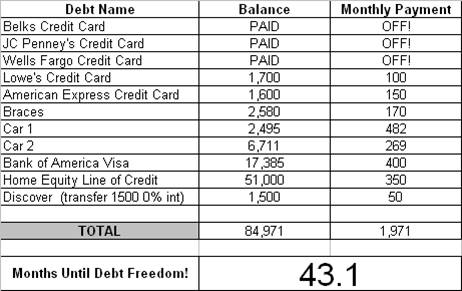

Updated Debt Freedom Date …

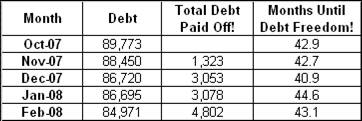

Month By Month Progress …

Sangl says …

Couple #1 PAID OFF ANOTHER CREDIT CARD! Couple #1 is making excellent progress. Based upon their update this month, I suspect that they are going to be receiving a tax refund or bonus! They also gained 1.5 months toward debt freedom! This couple are beginning to emerge from the toughest months – the beginning months. Pretty soon this is going to be second nature and this debt will start dropping like flies!

Think about it – Couple #1 has paid off $4,802 in just FIVE months! That is nearly one thousand per month! It is amazing what you can do when you have had your IHHE Moment!

Readers …

Are you receiving a tax refund this year? You might want to read the series "Best Utilize Your Tax Refund" before you spend it!

Also, take a moment to consider your own personal finance situation. What would it be like to share it with the world like Couple #1 is? Will you take a moment to thank them and encourage them on their journey?

Read Previous Monthly Updates For Couple #1 HERE

Like what you are reading? Receive each post automatically in your E-MAIL by clicking HERE.

“I Was Broke. Now I’m Not.” Podcast

Have you taken the opportunity to listen to the "I Was Broke. Now I'm Not." podcast?

A new podcast is released weekly on Thursdays. It is a high-energy, five to eight minute podcast where you will hear a success story and a question from the web site.

I am FIRED UP by the success stories and questions being sent in via the blog! Thanks for sharing!

To subscribe to the podcast via iTunes, click HERE. If you do not have iTunes, you can download an mp3 by clicking HERE.