Archive for April 2008

529 Plan Series: Pennsylvania’s “PA 529 Investment Plan”

Today marks another installment in the "529 Plans" series at www.JoeSangl.com!

Today, I will review Pennsylvania's 529 plan – the PA "529 Investment Plan".

This 529 program is managed by Upromise Investments and the investments are managed by Vanguard [I have reviewed Vanguard HERE].

What I Like About The PA 529 Investment Plan

- Investment Management By Vanguard. I really like Vanguard's performance and low expense ratios.

- Upromise Linked. You can link your Upromise qualifying purchases to this 529 which can help boost your savings.

- Tax Deduction For PA Taxpayers. From the PA 529 Investment Plan website: "For each beneficiary, PA residents may deduct up to $12,000 in contributions annually from their Pennsylvania state taxable income ($24,000 if married filing jointly, provided that each spouse has taxable income of $12,000)." If you have two children and have established two separate 529 accounts, then you can take an even larger deduction!

- Investment Options. There are three age-based options and ten individual investment portfolio options available. I like choices!

What I Would Like To See Improved

- This is a general improvement that I would like to see with all 529 plans, not just the PA 529 Investment Plan. I would like to see an option that allows one to withdraw money from the 529 plan penalty-free if one has paid for a child's college and there is no need for the college savings plan any longer. Right now, there is a 10% federal penalty tax if one pulls the money out of any 529 plan for anything other than qualified educational expenses. I would like to at least have the option to roll any extra money over to a Roth IRA – free of penalties.

Read reviews of other state 529 college savings plans HERE.

Receive each post automatically in your E-MAIL by clicking HERE.

529 Plan Series: South Carolina Future Scholar

Welcome to another series on JoeSangl.com – 529 Plans.

In this series, I will be reviewing 529 college saving plans offered by different states.

It might be helpful to first review what a 529 plan is. A 529 plan is a tax-advantaged college savings plan that is named for the section of tax code that outlines how they may operate – Section 529.

Today's 529 Plan is South Carolina's plan – Future Scholar.

The South Carolina Future Scholar 529 College Savings Plan is managed by Columbia Management (a division of Bank of America).

What I Like About The Future Scholar Plan

- Columbia Management. I like some of the funds that are offered by Columbia Management.

- Tax Deduction. Although there are some restrictions, most South Carolina residents can deduct their Future Scholar contributions from their SC state tax return!

- Self-Directed Option. Through the "Direct Program" SC residents can manage their own investments, and if one chooses to do so the "load" (sales charge) is $0! If one chooses to invest in the Future Scholar plan with the help of an advisor, there will be a sales charge of around 5%. The sales charge should not deter someone from investing for college however! If you are really intimidated by investing and mutual funds, it would be worth the sales charge to ensure you are getting good advice!

- Learning Center. The Future Scholar plan offers a great site to help one understand and plan for education costs. It is located HERE.

- Investment Options. The Future Scholar plan offers three investment options.

- Automatic Allocation Choice – This option allows one to "set it and forget it" in regard to adjusting the portfolio. It is really aggressive when the beneficiary is very young and moves steadily to become more stable as the child approaches college time.

- Asset Allocation Choice – This option allows one to make a more specific decision on how one's investments are allocated. This requires a more hands-on approach if one wants to adjust the portfolio.

- Single Fund Portfolio – This option allows one to invest in specific mutual funds offered via Columbia Funds.

What I Would Like To See Improved

- Expense Ratios. I would love to see the expense ratio of the funds reduced. The average expense ratio is around 1.40% to 1.50%. This is an every year fee and erodes the growth of the investment.

My daughter's college savings is in the SC 529 Future Scholar plan. The tax benefit was the final straw for me to move the investment from another state's plan to the SC plan.

Receive each post automatically in your E-MAIL by clicking HERE or via RSS Feed HERE

The Mutual Fund Series: American Funds

The is the latest installment in the weekly series featured at JoeSangl.com – The Mutual Fund Series.

During each part of this weekly series, I will be looking at a specific mutual fund company.

Today's company is American Funds.

![]()

American Funds has been around since 1931 and is one of the largest mutual fund companies in the world with over $900 Billion in investments and over 40,000,000 shareholder accounts. American Funds is owned by a larger company – The Capital Group Companies.

What I Like About American Funds

- Great performance long-term. The track record of American Funds has been terrific!

- Long-Term Approach. They use a team-approach to manage their mutual funds. They manage money extremely well in down markets. They have absorbed hits like the 1987 crash and the bear market of the early 70s and have performed well.

- Experience. Their advisors have an average of 22 years of experience with American Funds. That is unheard of in today's world!

- Low Initial Investment Requirement. Most American Fund mutual fund investments can be started with just $250 and a commitment to invest at least $25/month. That is great! It allows anyone to start investing!

- Low Expense Ratios. They have low expense ratios when compared to most mutual funds. They are higher than Vanguard, but are about half of comparable mutual funds.

- Tools. They have a nice retirement planning website HERE. I really like their "quick analysis" retirement planning calculator HERE. It told me good news – that they believe I can retire someday! What does it tell you? You can also check out my "retirement nest-egg required" calculator (located on the "TOOLS" page or click HERE).

What I Would Like To See Improved At American Funds

- Sales Charges. To purchase American Funds directly, one has to be savvy with on-line trading websites or else one will have to work through an advisor. This means that there will be a "load" when one purchases American Fund mutual funds through a broker. If one is just starting out, it could mean that one will have to pay up to 5.75% for all new money invested. This load drops as more money is held in one's account, but the lower charges start after one achieves six figures in their account.

American Fund Mutual Funds I Own

I currently own six American Fund mutual funds.

- AMCAP Fund A [Ticker: AMCPX]

- Capital World Growth and Income Fund [Ticker: CWGIX]

- Fundamental Investors A [Ticker: ANCFX]

- New World Fund [Ticker: NEWFX]

- The Growth Fund of America [Ticker: AGTHX]

- The Investment Company of America [Ticker: AIVSX]

American Fund Mutual Funds That I Am Considering Purchasing

- The New Economy Fund [Ticker: ANEFX] I like the growth potential of the markets this fund will be investing in.

- EuroPacific Growth Fund [Ticker: AEPGX] Same as The New Economy Fund – I really like the potential of the markets this fund will be investing in.

What American Fund mutual funds do you own? Do you have any American Fund mutual funds that you really like? Any you really dislike?

Love learning about mutual funds? Love a little competition? Maybe the "You Pick 'Em Mutual Fund Game" is for you! Contestants have until the end of April to enter their mutual fund selection.

Receive each post automatically in your E-MAIL by clicking HERE.

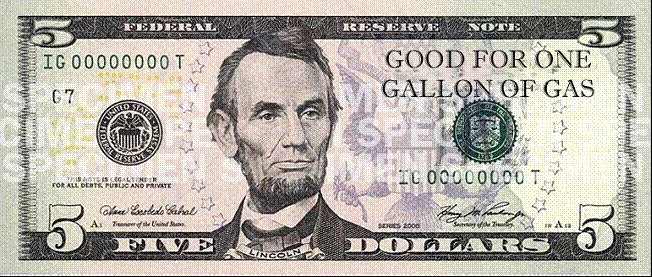

This Is About Right!

Someone sent this picture to me, and I thought it was very appropriate!

I am ready for gas prices to go DOWN for once!

My book, I Was Broke. Now I'm Not, is available via AMAZON.COM, BORDERS.COM, and PAYPAL. You can read the Introduction HERE.

Life Happens: The Transmission Edition

You may have caught in yesterday's post that I absorbed a major expense like the transmission going on my GMC truck. Well, that happened this month.

So here is the story.

I bought this truck from my brother nearly seven years ago. He had purchased it new. Early on, I noticed that the automatic transmission would shift hard whenever I drove the truck over long distances. Once it had cooled, it would go back to shiftly nice and smooth.

So way back in 2002, I took it in to my trusted car repair guy, and he said that I should just drive it until it broke.

So I did. It took nearly seven years for it to fail. I won that gamble!

I took it in to my new trusted car repair guy, and he diagnosed it as "Dead On Arrival". Upon opening the transmission, he could not believe that I was able to even put the car in reverse.

The cost? $1,953.35. That included replacing a broken door handle, an oil change, and some other small stuff.

Man, am I glad I have a savings account for just this sort of stuff! In the old days, I would have been pulling out the credit card.

Maybe I should ask you the question. Do you have money saved up for a car repair?

I am not a prophet, but I can guarantee you that your car WILL break down. It may be today. It may be ten years from now. But something is going to break. When it does, will it crush your finances or will it just be an annoyance that you have saved for?

My book, I Was Broke. Now I'm Not, is available via AMAZON.COM, BORDERS.COM, and PAYPAL. You can read the Introduction HERE.