Archive for March 2008

Choosing Mutual Funds – Part 5

Welcome to the latest series on JosephSangl.com – "Choosing Mutual Funds"

In this series, I will be sharing how I choose mutual funds. It should be noted that I do not sell investment products nor am I professional in the mutual fund industry. This is my own personal philosophy for choosing mutual funds.

In this series, I will be sharing how I choose mutual funds. It should be noted that I do not sell investment products nor am I professional in the mutual fund industry. This is my own personal philosophy for choosing mutual funds.

Part One What is a mutual fund?

Part Two Establish investment goals

Part Three Types of mutual funds

Part Four Locate mutual funds that meet individual criteria

Part Five Start Now!

What a great series this has been! I love talking about investing because it is what allows us all to achieve dreams! As you might guess, I am FIRED UP!!!

I end the series with Nike's slogan – Just Do It!

I carry this crusade to help others win with their money all over the place, and I still can't believe the number of people that have not begun to invest. People in their 30s! People in their 40s! People in their 50s! People in their 60s!

So no matter where you are, I have to tell you what Charles Schwab once said …

"The best place to start is where you are with what you have."

It is time to get started. At least invest enough to get the company's match. It's FREE money!!!

If you have non-house debt, I recommend that you follow my hero's (Dave Ramsey) 7 Baby Steps. Click HERE to print your very own copy of his 7 Baby Steps. Invest enough to catch the free company match and then kill your debt. Then get a huge emergency fund of three to six months expenses and invest at least 15% of your gross income into tax-advantaged investments. That is where the real fun begins – when you are able to fund your God-given hopes/plans/dreams!!!

My first book, "I Was Broke. Now I'm Not.", was released on January 20th. It is available via PAYPAL or AMAZON or BORDERS.

Automatically receive each post in your E-MAIL

Read the entire "Choosing Mutual Funds" series by clicking HERE.

Choosing Mutual Funds – Part 4

Welcome to the latest series on www.JosephSangl.com – "Choosing Mutual Funds"

In this series, I will be sharing how I choose mutual funds. It should be noted that I do not sell investment products nor am I professional in the mutual fund industry. This is my own personal philosophy for choosing mutual funds.

In this series, I will be sharing how I choose mutual funds. It should be noted that I do not sell investment products nor am I professional in the mutual fund industry. This is my own personal philosophy for choosing mutual funds.

Part One What is a mutual fund?

Part Two Establish investment goals

Part Three Types of mutual funds

Part Four Locate mutual funds that meet individual criteria

Once I have determined the category of mutual funds that meet my criteria, it is time for me to review actual mutual funds. To find the mutual funds, I use a three-part approach.

- Mutual Fund Screens – I really like CNN's Mutual Fund Screener and Morningstar's Mutual Fund Screener. For example, I used the CNN screener to select Small Growth Diversified Funds that have delivered an average of 10% annual return OR LARGER for the past 10 years. It delivered 36 mutual funds that met that criteria! This really helps me narrow down the search!

- Review Retirement Plan Mutual Funds – If your employer has a retirement plan such as a 401(k), 403(b), Simple IRA, or TSP then be sure to review the options available. My employer has a Simple IRA with American Fund investment options. Usually an employer helps absorb some of the fees or the fees are reduced by the plan administrator. This can really help preserve financial gains!

- Seek Professional Guidance – I meet with a financial advisor about once a year. This professional advice helps me look at my investments with more clarity.

Once I have found funds to look at, I look at the following characteristics of each fund:

- Age of the Mutual Fund I like mutual funds that are older than me!

- Investment Growth I look at the 1, 5, 10, and Lifetime track records.

- $ Needed To Start This is really important for beginning investors.

- The Fund's Objective This helps me understand the direction of the fund.

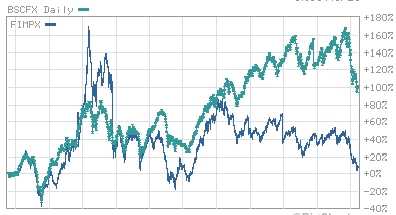

I used the CNN screener in part one above and found two funds to use as an example – First American Small Growth Opportunities Class Y Mutual Fund (FIMPX) and Baron Small Cap Fund (BSCFX).

I use the CNN Money Snapshot feature to analyze funds. Click on the "Stock Ticker" symbols next to each mutual fund above to see the Snapshot for each of the two funds above.

I also like to compare mutual funds to each other using the "Advanced Charts" feature on CNN Money. You can view the actual chart and details on CNN Money by clicking the below chart.

Looking at the two charts over their lifetimes, which would you choose? 🙂 Hmmmmmm. One thing I always remember is that history is just that: history. But it is all I have to go on, so that is why I really like mutual funds that have proven track records and have been around longer than I have. These two mutual funds are not even teenagers yet, so the jury is still out for me (Maybe that's why I don't OWN either of these).

So that is a glimpse into how Joe chooses mutual funds. Many times it ends up with a dead end, and I go back to the starting point again to get more mutual funds to compare.

Tomorrow, this series includes with the most important part of the entire process!

Read the entire "Choosing Mutual Funds" series by clicking HERE.

Choosing Mutual Funds – Part 3

Welcome to the latest series on JosephSangl.com – "Choosing Mutual Funds"

In this series, I will be sharing how I choose mutual funds. It should be noted that I do not sell investment products nor am I professional in the mutual fund industry. This is my own personal philosophy for choosing mutual funds.

In this series, I will be sharing how I choose mutual funds. It should be noted that I do not sell investment products nor am I professional in the mutual fund industry. This is my own personal philosophy for choosing mutual funds.

Part One What is a mutual fund?

Part Two Establish investment goals

Part Three Types of mutual funds

There are literally THOUSANDS of mutual funds available in the marketplace today. Each mutual fund is usually assigned to a particular family of mutual funds.

Here are some common categories of mutual funds …

- International Stock Fund

- Aggressive Growth Stock Fund

- Growth Stock Fund

- Growth & Income Stock Fund

- Equity-Income Fund

- Balanced Fund

- Bond Fund

- Value Fund

- Industry-Specific Funds (like Healthcare Fund or Pharmaceutical Fund)

- Index Funds (S&P 500, Russell 2000, etc.)

If you purchase ownership in an International Stock Mutual Fund, you can bet that it is primarily investing in international companies. If it is an Aggressive Growth Stock Mutual Fund, you would expect to see the mutual fund purchasing shares of companies that are growing like crazy.

Each family of funds has a general "feel" to it. The International and Aggressive Growth Stock Mutual Funds tend to have wild swings in performance. One year it could grow 40% and the next it could lose 25%. It feels like you are on a great roller coaster ride at Six Flags!

Growth & Income, Equity-Income, and Balanced Funds are more stable and predictable.

Index Funds track specific market indexes like the S&P 500 and the Russell 2000.

In the next post, I will be sharing how to find mutual funds that meet your investment goals.

Automatically receive each post in your E-MAIL

My first book, "I Was Broke. Now I'm Not.", was released on January 20th. It is available via PAYPAL or AMAZON or BORDERS.

Choosing Mutual Funds – Part 2

Welcome to the latest series on JosephSangl.com – "Choosing Mutual Funds"

In this series, I will be sharing how I choose mutual funds. It should be noted that I do not sell investment products nor am I professional in the mutual fund industry. This is my own personal philosophy for choosing mutual funds.

In this series, I will be sharing how I choose mutual funds. It should be noted that I do not sell investment products nor am I professional in the mutual fund industry. This is my own personal philosophy for choosing mutual funds.

In Part One, I reviewed what a mutual fund is.

Part Two – Establish Investment Goals

My personal investment goals guide my mutual fund choices. First you should know a couple of things about me.

- I view my investments as money that I will not touch for at least five years.

- I prefer mutual funds over individual company stocks. I do own one individual company stock, but I will not allow an individual company stock to exceed 10% of my overall portfolio.

My investment goals are GROWTH, GROWTH, and more GROWTH. I do not need my investments to produce income for me as I am in my early 30s. I want my money to GROW. This means that I invest in mutual funds that are purchasing stock of companies that are experiencing major growth (like Google).

Now, if I were retired, I would want my investments to produce income so I would be searching for mutual funds that invest in companies that are paying dividends to its shareholders (like Wal-Mart, Microsoft).

If I were approaching retirement, I would be moving the money that I would need in the next five years to much more stable and secure investments.

In the next part of this series, I will be reviewing the different types of mutual funds. Knowing one's individual investment goals makes the selection of a mutual fund category much easier.

Automatically receive each post in your E-MAIL

My first book, "I Was Broke. Now I'm Not.", was released on January 20th. It is available via PAYPAL or AMAZON or BORDERS.

Choosing Mutual Funds – Part 1

Welcome to the latest series on JosephSangl.com – "Choosing Mutual Funds"

In this series, I will be sharing how I choose mutual funds. It should be noted that I do not sell investment products nor am I professional in the mutual fund industry. This is my own personal philosophy for choosing mutual funds.

In this series, I will be sharing how I choose mutual funds. It should be noted that I do not sell investment products nor am I professional in the mutual fund industry. This is my own personal philosophy for choosing mutual funds.

Part One – What is a Mutual Fund?

This is THE number one question that I receive when I am teaching the Financial Learning Experience and Financial Freedom Experiences. Mutual funds can certainly sound confusing – especially when there are so many options available. So for those who do not know what a mutual fund is, let me explain it the best I know how.

If something has been FUNDED, it means that money has been given to it.

If you and I come to a MUTUAL agreement, it means that we both were involved in making the agreement.

So if you and I have MUTUALLY FUNDED a project, then it means that we both provided money for the project.

A MUTUAL FUND means that you and I have both put our money in the same place. It is not unusual for a mutual fund to have over 5,000,000 people MUTUALLY FUNDING the same investment.

So we have mutually funded an investment along with three or four million of our closest friends. The amount you have invested is different from how much I have invested, but it is all in the same place. I have drawn a picture to illustrate this. Please marvel at my graphic art skills.

So, we now all understand that we have mutually funded this investment and that it is called a mutual fund. The next question to answer is: "Where does the money go once it is in the mutual fund?"

Well, each mutual fund has a specific objective. Some mutual funds have an objective to produce income. Others have an objective to maximize the long-term growth of the invested money. Still others may have an objective to invest only in international companies. The bottom line is that each mutual fund has a specific objective or charter.

Based upon a mutual fund's charter, the mutual fund managers will purchase part-ownership in a lot of companies. I have employed my terrific graphics skills to illustrate this.

The Mutual Fund managers use the money provided by you, me, and three million of our closest friends to purchase ownership in anywhere from 50 to over 1,000 companies. As these companies earn profits and grow, the value of the investment grows. This means that each individual who owns a portion of the mutual fund can enjoy that growth as well.

So that is what a mutual fund is. I hope that it helped those who may have been confused. In the next part of this series, I will discuss how individual investment goals help guide one's mutual fund selection decisions.