Archive for January 2012

Biblical Financial Lessons – Proverbs 13:22

This is a series that appears on a weekly basis here at JosephSangl.com – “Biblical Financial Lessons”

I believe that the Bible is the best money book ever written, and I really want to take some time each week to share the money lessons I have learned from the Word.

Proverbs 13:22 A good man leaves an inheritance for his children’s children, but a sinner’s wealth is stored up for the righteous.

There are two distinct parts to this verse. Let’s focus on each part separately.

“A good man leaves an inheritance for his children’s children”

This is a very challenging statement. It forces us to understand that we are not just supposed to look at the “here & now”, but also to the future. Here are some key learnings I take from this:

- It’s not all about me

- I’m supposed to bless my children and my grandchildren

- The way I live my life will affect my descendents

- Blessings are generational

“but a sinner’s wealth is stored up for the righteous”

What an interesting statement to follow the first portion of the verse with! This part is making an observation that God will bless the righteous and that those who ignore Him and His commands will have their wealth transferred to those who will pursue Him.

Question: If you keep managing money the way you are currently managing it, will you leave an inheritance for your children’s children?

Biblical Financial Lessons – Proverbs 13:11

This is a series that appears on a weekly basis here at JosephSangl.com – “Biblical Financial Lessons”

I believe that the Bible is the best money book ever written, and I really want to take some time each week to share the money lessons I have learned from the Word.

Proverbs 13:11 Dishonest money dwindles away, but he who gathers money little by little makes it grow.

The part of this verse that speaks strongest to me is “he who gathers money little by little makes it grow.” For some reason when I was broke, I felt like the only way to win with money and gain margin was to save money in HUGE CHUNKS. Since that was impossible, it almost felt pointless to even get started.

BUT when I started saving money a little at a time, I STOPPED being broke and have been able to live to financial margin.

Questions:

- Do you BELIEVE that you can save money little by little?

- How much are you saving from each paycheck?

- How much (or how much more) could you start saving from each paycheck?

What is ONE THING you could do today that would make a difference tomorrow?

Featured Tool Of The Month: Mini-Budget

It is so important to PLAN the spending of each and every dollar earned. Planning is THE REASON why my family started winning with money.

TOOL OF THE MONTH: MINI-BUDGET

The Mini-Budget was created for two specific uses:

- Planning the use of non-normal or unusual found money – such as tax refunds, bonuses, inheritance money, or money received by selling something

- Planning a major expenditure – such as a kitchen refurbishment project, daughter’s wedding, or finishing the basement

This budget tool is unique because it has THREE different budget forms. This is because I have found that it is essential to think through the alternative ways to spend the money. The first way that comes to mind is usually the most immediate or urgent use, BUT it is not always the best or most impactful use.

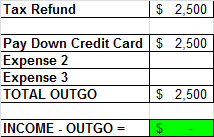

Let’s look at an example. Suppose you were receiving a $2,500 tax refund. Your first thought was to put all of the money toward an existing credit card balance.

This, of course, is a decent way to spend the money. But is just one way. There are several ways this money could be utilized, and that is why there are THREE budgets placed next to each other in this tool.

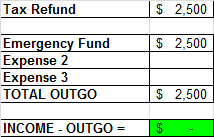

What if this money were being planned by a person who had ZERO SAVINGS? Another way to spend the money would be to put all of the money toward their Emergency Fund.

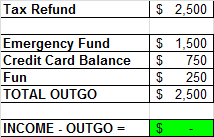

Another way would be to place some money in savings, some in FUN, and some toward the credit card balance.

Which way is the best way? I don’t know which would be right for this person, but I am confident that the first scenario would not be the best! The challenge of spending the money three different ways on paper before it is spent for real can really help you maximize your money.

Which way is the best way? I don’t know which would be right for this person, but I am confident that the first scenario would not be the best! The challenge of spending the money three different ways on paper before it is spent for real can really help you maximize your money.

QUESTION: How are YOU going to use this tool?

Win With Your Money In 2012 – 5

Welcome to the latest series here at JosephSangl.com – “Win With your Money In 2012″

It is our passion to help people accomplish far more than they ever thought possible with their personal finances.

If you apply what is taught during this series, you WILL be able to win with your money in 2012. Happy New Year!

Part 5 Make Your Goals AUTOMATIC

Despite our best efforts, we can fail to achieve the goals that we have established. One key way that we can ensure that our financial goal is achieved is to make each one AUTOMATIC.

- Want to give away $4,000 this year to your church? Set up on-line giving to make it automatic! $333.33 each month will ensure the goal is achieved.

- Saving $2,000 for your emergency fund in 2012? Establish an automated transfer of $166.66 each month from your regular bank account into a savings account and the goal will be accomplished in December!

- Want to max out your Roth IRA this year? Set up an automated transfer of $416.66 each month into your Roth IRA and you will achieve $5,000 by year’s end (or save $500/month if you are over age 50 and are catching up with $6,000/year)!

- Want to pay cash for a $1,500 vacation in July? Set up an automated savings account to save $250/month and you will be able to do so!

Trust me – it is usually NOT EASY to force yourself to set up these giving, saving, and investing goals to be automatic because:

- We KNOW that once it is set up to happen automatically – it IS going to happen, and

- We KNOW that it is going to make the monthly budget tighter

But it is so worth it! Yes, it will be tough for the first few months, but I have found that our family adjusts within a couple of months. After that, we don’t even notice anymore until …

- vacation time rolls around and the money is there to pay cash!

- you receive your giving statement and find out just how much you were able to give away!

- you recognize that you are actually moving toward your retirement savings goals!

THAT is when you will say, “I’m truly winning with my money in 2012!” GET FIRED UP!

Read Entire Series (Available after 1/9/2012)

Win With Your Money In 2012 – 4

Welcome to the latest series here at JosephSangl.com – “Win With your Money In 2012”

It is our passion to help people accomplish far more than they ever thought possible with their personal finances.

If you apply what is taught during this series, you WILL be able to win with your money in 2012. Happy New Year!

Part 4 Identify Savings Opportunities

Saved money is better than a pay raise! Think about it, you will bring home after taxes about $0.70 for every $1.00 that you earn. So if you received a $1,000 pay raise, you really get to bring home about $700.

If you save $1.00, however, you actually have an entire extra $1.00 to spend! If you save $1,000, you actually have an extra $1,000 because it is take-home money that has already been taxed!

How could YOU save $1,000 in 2012? Well, you could start by watching our FREE webinar (on-demand) HERE.

Here is a short list of other key areas where you can save TONS of money in 2012:

- Home and Auto Insurance The average person who has not gotten new quotes in the last two years will save between $500 and $700 per year! I really like THIS WEBSITE for obtaining on-line quotes.

- o% Balance Transfer Credit Cards Transfer that credit card balance that has high interest rates and surf the balance to a 0-percent balance transfer credit card and have all of your payment be applied to principal. Check out the ON-LINE OFFERS.

- Grocery Coupons Save between 20 and 30-percent on your grocery purchases by timing the use of coupons with the best sales. THESE WEBSITES are great and FREE providers of coupon lists for your favorite grocery stores.

What are some ways that YOU are planning to save money in 2012?

Read Entire Series (Available after 1/9/2012)