Archive for July 2012

Why I Do What I Do

A reader of JosephSangl.com shared her story with me, and it really sums up why I do what I do. With her permission, here is her story …

I was OVERWHELMED with JOY as I dropped my oldest child off for college last weekend! NOT because I was happy to have her leave the house … she has been such BLESSING and a BIG part of my life since I was 17 years old and learned I was pregnant … but because I have PRAYED, PLANNED & PREPARED for this day for YEARS.

I made a lot of COSTLY mistakes. I turned my back on God and did things my way! I maxed out my first credit card at 15 YEARS OLD! That was the beginning of several bad financial decisions since I didn’t put any thoughtful planning into them! They were “this will do ’til the next bill arrives” solutions which is NO solution at all!

I hit rock bottom and was in BONDAGE financially, spiritually & emotionally by my early 20s. After a divorce, I was living in an apartment I couldn’t afford and my car was being repossessed so I swallowed my pride, went to D.S.S. and applied for assistance. I was denied for everything. I was told that my full time job paying minimum wage put me over the limit for any assistance for myself and two children. I was devastated. I asked the lady how anyone would qualify if the standards were so low. She advised me to lose my job and showed me that if I would stay home with my children instead of working then I would actually make MORE money on welfare. I left and never went back. I got sick of hot dogs, grilled cheese and pb&j sandwiches but kept working.

I EVENTUALLY came to the conclusion that this wasn’t the life that I wanted for myself or my children!! I was raised in a Christian household and accepted Christ at seven years old. I KNEW that how I was living was wrong. I wasn’t going to church, tithing, or budgeting my money. I felt the conviction of the Holy Spirit when I made bad decisions whether they were moral or financial. God had more in store for me than I could ever imagine and I was cheating myself by cheating Him!

I began going to church, budgeting my money and planning for the future. I saved what I could … as often as I could. I got life insurance on myself and my children. I started a Future Scholar 529 College Savings plan (direct so I managed it myself and didn’t pay anyone a fee) for both of my children. I started saving the minimum amount allowable. $50 per month. It was A LOT to me but I am so thankful that I did. I was able to raise the amount over the years and I am pleased to say that my daughter’s first tuition payment was paid in full directly from that account!! AND she is driving a car that is completely paid for!! I think I was the happiest mom at the college last weekend. I literally found myself skipping with joy as I transported her belongings from the car to the dorm!!

If I could say anything to the moms & dads out there it would be this, “Don’t let time get away from you! Start saving NOW!” Ideally, you should save $200 per month per child to plan for their college expenses but WHATEVER you save will help!! God has great things in store for you and your children!! I am still saving every month for college expenses because I know there are more tuition bills on the way.

My goal now is to help my daughter through college with NO student loan debt. I don’t know what’s in store for us over the next four years but I know that I will keep PRAYING, PLANNING and PREPARING every day!!

THIS READER’S STORY FIRES ME UP! How about you? Do you have a story that you want to share with the readers of JosephSangl.com? Send it to me at joe@iwbnin.com along with written permission to share it with our readers. Your story could be used to inspire tens of thousands of other people!!!

Is Home Mortgage Interest Deduction A Good Idea?

Is home mortgage interest deduction a good idea?

This is one of the most frequently asked questions at our live events. Below is my answer.

If you have a mortgage and are paying interest, it is ABSOLUTELY very important to take the mortgage interest deduction. BUT there are a few key facts to consider as well.

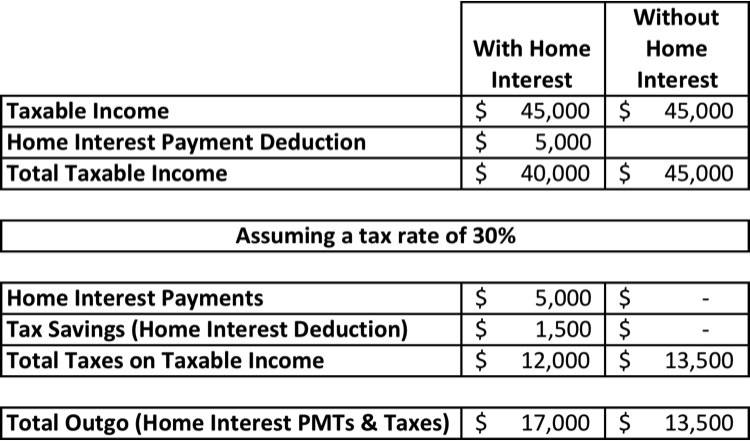

One thing I have heard commonly stated is “I am not going to pay off my mortgage early because I do not want to lose the mortgage interest deduction.” I believe this saying was initiated by banks because it is much more costly to keep the mortgage than to pay the taxes owed without the interest deduction. See the example illustrated below.

The Mortgage Interest Deduction

Let’s say you paid $5,000 in interest on your mortgage last year. By taking the deduction, you effectively reduce your taxable income by $5,000. You receive back the tax rate on that home mortgage interest deduction. If your tax rate is 30%, you will receive a refund of $1,500 because of the home mortgage interest deduction (30% of $5,000). Of course, the bank keeps the $5,000 you paid in interest. Uncle Sam receives 30% of your taxable income which is now $40,000 because you were able to reduce your taxable income by the $5,000 interest you paid. The total net OUTGO from your bank accounts to Uncle Sam and the bank is $17,000!

The Paid-Off House Scenario

Well, you are living life pretty good in your debt-free condition! You have paid off your house, so now you no longer pay interest to the bank (yay!). This means you will be taxed on your full income of $45,000. If your tax rate is 30%, the total net OUTGO paid to Uncle Sam is $13,500!

NET RESULT: By eliminating your mortgage, you have $3,500 LESS OUTGO from your bank account to someone else.

Accountability

In school, if you did not pay attention in class and did not study the subject matter, you would receive an undesirable letter grade. It would be the dreaded one-legged “A” – also known as a big ole “F”.

I don’t know what would have happened in your family, but if would have ever brought home a “F” on my report card, I am pretty sure that I would have become the first person who achieved near-earth orbit via an explosion from my parents.

This is an example of near-instantaneous feedback. If I choose not to study, it would take no more than a few months later to receive the dreaded “F” and ultimate accountability with my parents.

It is NO DIFFERENT with your finances! You might think that you are getting away without studying the subject. You might have convinced yourself that you do not really need to take time to plan your finances. You could even believe that you are doing well enough without learning more about finances.

I will tell you that you are dead wrong.

If you do not learn about the subject of your personal finances, you WILL have accountability.

It will come in the form of:

- Not being able to pay for your children’s wedding

- Not being able to pay for your children’s college

- Not being able to retire

- Not being able to take that vacation that the rest of your friends/family are taking because you are broke

- Daily FINANCIAL STRESS that just will not go away

- Questions from your children on why you and your spouse are always arguing about money

- Having to work tons of overtime just to pay the bills

- Having to take a second job just to pay the bills

- Not being able to be a stay-at-home mother because bills have forced you into the workplace

- Not being able to start that business you always wanted to start

- Not being able to realize a lifelong dream to travel around the world

I do not know if any of these have hit home with you, but I made a decision long ago that I would NOT allow money to dictate what I do and do not do. I will take the money that I have and tell every single George Washington where to go. I will ensure that quite a number of George’s are given away and that large quantities are saved BEFORE I start spending them on anything else.

My PRIORITY is to get an “A” on my finances. The only way I will accomplish this is to continue learning and applying what I learn to my finances.

Every. Single. Day.

Looking for financial accountability? The I Was Broke. Now I’m Not. Group Study is the perfect tool to learn about winning with money in a setting where accountability is created. Click HERE to get your group started or learn more.

Why Smart People Sometimes Do Stupid Things With Money

Why do smart people sometimes do stupid things with money?

I’ve seen really smart people make strange financial decisions.

- Bought a brand new car and financed 106% of it (sales tax and all!)

- Go to college and finance it 100% with student loans while obtaining a degree comparable to a degree in basket weaving

- Go on a very expensive vacation to Hawaii and put 100% on their credit card and have no money to immediately pay it off

- Withdraw all the equity out of their home to start an unproven new business

These types of decisions are made every day by very smart people! Perhaps even YOU have made one or more decisions like this. You may have to only look into the mirror to see someone who has done one or more of these financially horrendous items. I know that is as far as I have to look!!!

Back to my question. Why do smart people sometimes do stupid things with money?

Possible Answers

- No plan. They wanted to spend the money on the item, but they did not plan for the expense. Consequently, they only money available when the purchase was made was very expensive debt.

- No self-control. They wanted it! They wanted it now! They did not want to wait. No! Must have item … Must have item now … Will be emotionally scarred for life if item is not obtained now …

- Hope I can pay for this. Not willing to face up to the fact that they can’t have an item now, but they buy it anyway hoping that “the money will come from somewhere.” The reality is that “hope is not a strategy” and this usually leads to tremendous financial penalties.

- Talked into it. See #1, #2, and #3. You’ve seen it happen. The friends start talking about it. The friends are going on the vacation. The friends have the new car. Your friends are going to college and are not having to work while there. Justification is found through others’ circumstances.

If I were to attempt to sum the reasons that smart people sometimes do stupid things with money, I would say it is because they were ignorant of the REAL and LONG-TERM COST of those major financial decisions. If they truly knew the COST of those decisions, many tears of sorrow and regret and many money fights with their spouse could be avoided.

Known, Upcoming, Expenses – Capital One 360 Sub-Account Tracking

//This blog post was written by Joe Ziska – I loved this idea so much that I personally implemented it with my Capital One 360 accounts!//

Q) What two things do the following have in common?

Christmas; A flat tire; Your son going to college; Vacation in Hawaii; Your daughter getting married

A) 1. They all cost money. 2. We forget that they cost money until the bill comes!

Let’s face it. Even the most organized of us tend to forget things now and then. Whether misplaced car keys or forgotten reservations for Valentines Day, our imperfect memories always seem to make life more difficult. In my experience, forgetting large upcoming expenses is one of the most demoralizing things that can happen to you. Unlike true emergencies, such as a sudden illness or job loss, known upcoming non-monthly expenses (KUEs) such as these listed above, can and should be expected! As Joe always asks, “Should it be a surprise if your car breaks down?” Of course not. That’s what cars do!

Many of you reading Joe’s blog are trying desperately to get out of debt and gain financial freedom. For my wife and me, one of the most disheartening things in that process was a big expense wiping out our emergency fund. Just when we felt we were finally getting traction, a $500 car repair or having to pay for Christmas presents would knock us off course. We constantly felt like we were starting over. I knew that we should be saving for these expenses but didn’t have a good way to separate this from our emergency fund. We’d generally leave a decent balance in our checking account and just hope that it would absorb most of these expenses when they came up.

I wanted to save for these KUEs. However, the mathematical part of me rebelled at the idea of gaining no interest on our savings (especially as some of these expenses can be quite costly). Wouldn’t it be better to just pay down some debt or invest the money?

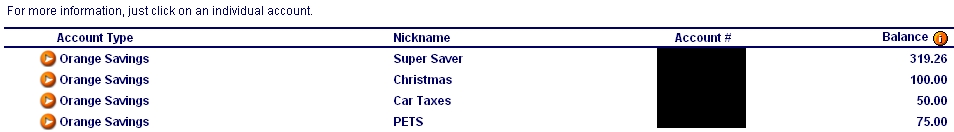

Enter Capital One 360. I’d been using HSBC and Capital One 360 to earn good interest on money we were saving for a down payment for our house. However, it wasn’t until almost a year after opening our accounts that I realized how they could help with my KUE problem.

One day, I was checking my account balance online and I noticed a large button labeled “Open an Account”. I figured this was used for investing or to open a new CD but clicked on it anyway. After browsing for about 30 seconds, I realized that Capital One 360 will let you create numerous new savings accounts linked to your original account. Not only that, you can give each a unique name to help you identify them. We created categories for all of our Known Upcoming Expenses to keep them separate from actual emergencies. Below is an example screenshot from an account (click on it to see it better):

We have also set up automatic transactions to each individual account. So now, at the beginning of every month we move $12 to our pet fund (unfortunately, our dog doesn’t pay her own vet bills), $40 to our Christmas fund, and so on. When we need the money for these expenses, it takes only 3-4 days to move it back to our primary checking account. Meanwhile we’ve been earning interest on our money instead of paying interest to a credit card company when these events sneak up on us. Last time I checked, Christmas is still in December so you’ve got 5 months to save up for all those gifts. Why not create an account for it and make it automatic?

========= End of Guest Post by Joe Ziska ===========

Thanks for the article, Joe!