Marching To Debt Freedom – Couple #1 – Month 11

Introduction

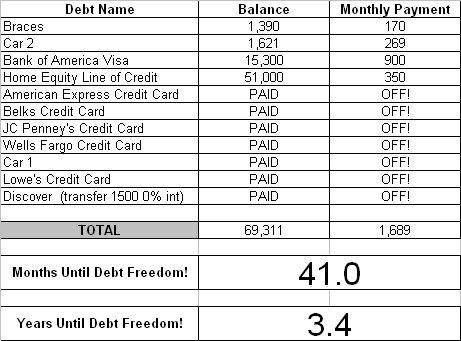

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now ELEVEN months into their Debt Freedom March.

Good/Bad This Month

We are really struggling with the economy right now. We are in sales and am currently way below last year's figures. For the first time in twenty years, we laid off people in our home office. Things are really scary. On the bright side, we are not carrying near as much debt as this time last year so we are not creating new debt which to me is the most important thing. I thank God for all we have and pray for those who are struggling way more than my family. Thanks for all of your help and wisdom.

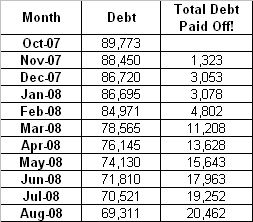

Month By Month Progress

Sangl Says

Another debt has left Couple #1's household! The American Express has been kicked out forever. Nice!

Here is what is so incredible – Couple #1 began attacking their debt just eleven months ago, and they have paid off $20,462! Way to go Couple #1 – I can't wait to see where you guys stand at the end of your first full year of attacking your debt!

Readers …

How is your own Debt Freedom March progressing?

In my book, I Was Broke. Now I'm Not., I share the story of my Debt Freedom March and teach the exact tools that Jenn and I used to become debt-free. You can do it too! You can read the book's introduction HERE.

Receive each post automatically in your E-MAIL by clicking HERE.

Financial Counseling Experience

I am so PUMPED to be teaching the Financial Counseling Experience TODAY at NewSpring Church! The Financial Counseling Experience is where I train volunteers who have "the knack" and a passion to help people put together a financial plan that works. I will be training folks on the process that we have used at NewSpring to provide one-on-one FREE financial counseling to over 800 people in less than two years.

Since I was conducting the training for our NewSpring volunteers, I decided to invite a few other people from around the area to see if they would be interested in attending. And the response has been … well … I will be training around 25 volunteer financial counselors today! And, get this, we will have people representing churches from Alabama, Georgia, South Carolina, North Carolina, and maybe Tennessee!

As I train our NewSpring volunteers, others will be there to take this stuff back to their churches!

All I can say is WOW. I can't believe I get to do this stuff for a living!

By the way, this won't be the last time I conduct this training. If you are interested in starting up a financial counseling ministry at your church and are interested in attending the next Financial Counseling Experience, you can contact me HERE. And of course if you attend NewSpring Church and would love to become a trained financial counselor, I would love to hear from you!

Receive each post automatically in your E-MAIL by clicking HERE.

Is Your Pastor Managing Money Well?

As I travel and teach at a variety of churches, it is always important for me to understand if the pastor and the church staff are managing their money following biblical principles. I mean, if the pastor is blowing all of their money without a plan, 100% financing everything, and unable to say "NO!" to a purchase, then it is impossible for them to stand up with any credibility and teach biblical principles such as:

Proverbs 13:22 A good man leaves an inheritance for his children's children. (Long-term saving!)

Proverbs 13:11 … He who gathers money little by little makes it grow. (Invest!)

Proverbs 22:7 The rich rule over the poor and the borrower is servant to the lender. (Avoid debt.)

Romans 13:8 Let no debt remain outstanding, except the continuing debt to love one another … (Always pay off debts that you owe!)

Not too mention the Parable of Talents (Matthew 25:14-30 – sound money management) and Giving (Malachi 3).

I have said it many times in the Financial Counseling Experience training that the number one reason NewSpring Church has a successful financial counseling ministry is the fact that Perry (senior pastor) lives this stuff!

So the question today is: If you are a pastor or a church leader, are you managing money the way that God commands you to?

The question for everyone else (and today's poll question) is:

Receive each post automatically in your E-MAIL by clicking HERE.

Gift Cards – A good deal?

The Saving Freak wrote an excellent post about gift cards becoming a risky purchase.

Have you ever thought about what a gift card really is? A gift card is where someone takes the national currency (US Dollar, British Pound, Euro, etc.) and converts it into a store currency. This severely limits the use of the currency.

And if the company issuing the gift card declares bankruptcy and shuts its doors? The currency becomes useless.

Read The Saving Freak's article HERE.

Receive each post automatically in your E-MAIL by clicking HERE.

Air Conditioner

I have written before about the fact that I have a thirty-year-old house that has thirty-year-old house problems. One of the problems is that the downstairs AC is the original AC for the house.

Problem 1 – January 2008

It was making a "banging" sound.

Diagnosis: Low on refrigerant – $75.

Problem 2 – May 2008

It was not cooling at all, and it was making a loud electrical "HUMMMMMMMM" sound.

Diagnosis: Condenser unit fan was not operating – $200+

Problem 3 – June 2008

It stopped cooling again. It was a day before vacation so I decided to have it looked at when I got back home two weeks later.

Diagnosis: Electrical wiring insulation had worn through and was shorting out the fan – $105

So we are back to enjoying the nice cool air conditioning in the dead-middle of a South Carolina summer.

I wonder when I will have to replace this unit? Part of me wants to bury my head in the sand and hope that it runs another thirty years. The realistic side of me says I should go ahead and start pricing out units. Initial looks have shown a cost of $5K – $7K. Just what I want to spend my money on … an air conditioner.

Why do I bring all of this up? Because it is so important to look ahead when preparing a financial plan. Jenn and I could pretend that this issue does not exist and then have a financial "emergency" when this AC really does fail permanently. In the past (when we were always broke), we would ignore this issue and then be surprised when it failed. Now, we recognize it as a known, upcoming expense, and we plan for it.

I do hope that it lasts another thirty years, though.

Receive each post automatically in your E-MAIL by clicking HERE.