SERIES: YOU Answer The Question – Part 4

Welcome to the latest series – YOU Answer The Question!

One thing that I love about traveling and teaching about finances is that I learn so much from the people I meet!

So here is how this series works. I will share a question that has been sent in to me, and YOU Answer The Question!

QUESTION: We have had our car insurance with the same company for twenty years. We know we are paying too much so we are obtaining new car insurance quotes. Once I get the new quotes, should I contact my current insurer and ask for a counter-offer? I am hesitant because we have been with them for so long.

Do you have a question of your own? Ask me HERE!

SERIES: YOU Answer The Question – Part 3

Welcome to the latest series – YOU Answer The Question!

One thing that I love about traveling and teaching about finances is that I learn so much from the people I meet!

So here is how this series works. I will share a question that has been sent in to me, and YOU Answer The Question!

QUESTION: I am 49 year old single person with no small children, and I am looking to purchase term life insurance for myself. Do I still need eight to ten times my salary in insurance or just enough to cover any expenses my children will face?

Do you have a question of your own? Ask me HERE!

SERIES: YOU Answer The Question – Part 2

Welcome to the latest series – YOU Answer The Question!

One thing that I love about traveling and teaching about finances is that I learn so much from the people I meet!

So here is how this series works. I will share a question that has been sent in to me, and YOU Answer The Question!

QUESTION: I want to work on getting some mutual funds, but I haven't the faintest idea where to start … Do I just go to Fidelity and say "I want some mutual funds" or what?

SERIES: YOU Answer The Question – Part 1

Welcome to the latest series – YOU Answer The Question!

One thing that I love about traveling and teaching about finances is that I learn so much from the people I meet!

So here is how this new series works. I will share a question that has been sent in to me, and YOU Answer The Question!

QUESTION: What do you do when you really want to get on the right track financially and your spouse is not as willing to participate?

Do you have a question of your own? Ask me HERE!

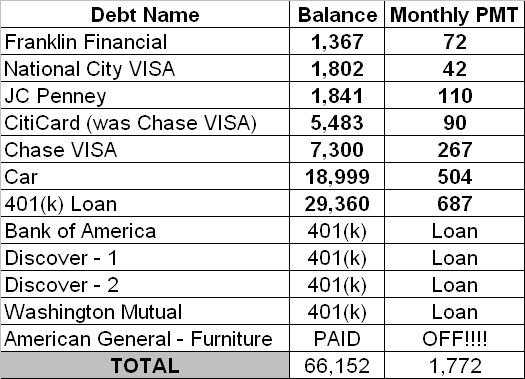

Marching To Debt Freedom – Couple #3 – Month 06

Introduction

This couple has been married for many years and have one child. They have HAD IT with their debt and have been marching toward debt freedom since November 2007. They are THROUGH with credit cards.

What went well this month?

We took out a 401(k) loan to pay off four high-interest credit cards. This allows us to pay a MUCH lower interest rate, and even better… we pay the interest back TO US! 🙂 We are now hoping that we can take advantage of some 0% interest offers and transfer the remaining balances to those cards.

What were the challenges/struggles this month?

Trying to not get discouraged about not getting it all paid off now! We are also planning on making higher payments on the lowest debt as soon as we see what the 401(k) loan payment does to the paycheck.

Updated Debt Freedom Date …

Month By Month Progress …

![]()

What has helped you stay on this Debt Freedom March?

Knowing that one day we will be DEBT-FREE and not live paycheck to paycheck!

How has this Debt Freedom March impacted your marriage relationship?

We are actually closer now and get this: WE DON'T FIGHT ABOUT MONEY!!! We both know what we owe and we are both on the same page to GET IT PAID OFF!

Sangl says …

Couple #3 has completed part two of their three part plan to restructure their debt. Their credit cards had hugely punitive rates – all of them 20% or higher. This was really killing their ability to attack the debt principal. With the majority of their debt now at a much lower interest rate (some of it at 0%!), they are now positioned to make tremendous strides toward Debt Freedom!

In my meetings with thousands of people, I have seen situations like this completely intimidate someone and they allow it to prevent them from taking charge of their finances. Couple #3, I applaud you for sticking with this! You guys CAN do this, and you will! And all of us will have this front row seat to cheer you on. Way to go!

Readers …

Would you leave some words of encouragement for Couple #3 in the comment section?

If you are totally intimidated by your financial situation, I would be glad to help in any way that I can. We offer FREE one-on-one financial counseling through NewSpring Church in Anderson, SC. I have even begun offering a very limited number of on-line appointments. If you are interested in receiving financial counseling, please contact me HERE.