5 Essentials to Paying Off Debt – Step 3

In this series, I want to equip you to become debt free!! Jenn and I became debt free in just 14 months by following this process. I can tell you this – there is NOTING like living life without the weight of debt!

STEP 1 – Understand the WHY before the HOW

STEP 2 – Calculate your Debt Freedom Date

STEP 3 – Accelerate your debt elimination

DEBT – This four letter word often consumes so much of our lives, thoughts and actions. But, it doesn’t have to!

When it comes to debt, I understand how stressful and frustrating it can be. I understand the weight and fiction it can bring to a family. However, I also know the freedom that comes when one become debt free and I want you to experience this freedom!

When you are ready to start attacking your debt, here are a few ways to accelerate debt elimination. (But before you begin, make sure you’re not making the #1 Debt Mistake – HERE.)

3 Ways to Accelerate Debt Elimination:

- Reduce Interest – Many people with substantial consumer debt do not realize that 50% – 75% of their payments are merely going to the lender as interest. This greatly reduces your ability to lower your debt. So, here are a few ways to lower your interest:

- Transfer to a 0% Interest Credit Card (Learn more HERE)

- Call & ask for a lower rate

- Pay on-time

- Establish automatic payments

- Increase Income – Since we’re all friends here, if we’re being completely honest, we all vote for this option, right? But a lot of people don’t realize that there are numerous ways to increase income that are within your hands. Here are a few:

- Pay Raise (see salary.com)

- Tax Refund

- Bonus

- Work Overtime

- Extra Job

- Sell Some Possessions

- Decrease Outgo – This is an option that is always available to us, but it’s probably not fun. If you can decrease the outgo to other things, you can increase the outgo to liberating your life from debt!

- Create and follow a budget!

- Sell some possessions

You can learn more about each of these steps in my book, I Was Broke. Now I’m Not.

5 Essentials to Paying Off Debt – Step 2

In this series, I want to equip you to become debt free!! Jenn and I became debt free in just 14 months by following this process. I can tell you this – there is NOTING like living life without the weight of debt!

STEP 1 – Understand the WHY before the HOW

STEP 2 – Calculate your Debt Freedom Date

When I meet with people, it’s a guarantee that I will calculate their debt freedom date. When I do this, it’s clear that people do not like debt! It’s also apparent that people have not been paying attention to their finances and do not have a well-defined plan for their life. Otherwise, they would not have incurred most of the debt. However, there is always HOPE and a way out!

In these meetings, I often use the example of a dragon. Follow me here! How can you effectively defeat a dragon if you don’t know how many heads it has or how large the dragon is? So, before we calculate your debt freedom date, let’s establish three things:

- Who do you owe

- How much do you owe

- What are the payments that you are ACTUALLY making

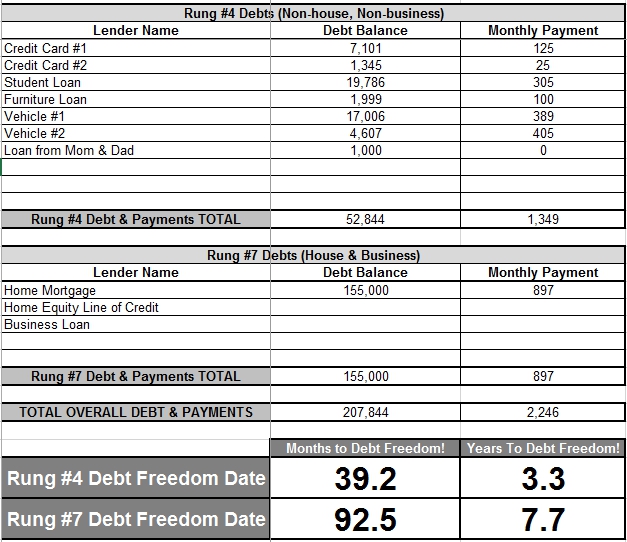

You can list these on the Debt Freedom Date Calculator. Now we can calculate your debt freedom date! This date is simply the date that you will be debt free (including and excluding the house).

Let’s look at a sample. In this sample, the couple listed all of their non-house, non-business debts, as well as their house debt. After all of the debts are inputted, the debt freedom date is calculated. This couple will be debt free, excluding the house, in just 3.3 years and completely debt free, including the house, in 7.7 years!! Get fired up!

Are you ready to take your next step? You can calculate your debt freedom date HERE!

IMPORTANT NOTE: When you take this next step to become debt free, you must eliminate the potential for new debt! If you keep swiping the credit cards and running up the balance, you’re just eliminating your potential of becoming debt free.

Have you calculated your date? How many months until you’re debt free?

5 Essentials to Paying Off Debt – Step 1

I have found that a large group of those who attend one of my events, are living paycheck-to-paycheck AND carrying debt. In fact, statistics from a recent survey I conducted show that 57% of people are living paycheck-to-paycheck and 73% of people are in debt (excluding the mortgage). When asked how people are doing with managing their money, 45% said that they were barely keeping their head above water or drowning! Only 9% of people feel like they are winning with their money!

No matter where I go, I see the footprint of debt on people’s lives – marriages failing, stress and depression taking over, and hopelessness closing in. And all of this is happening in the wealthiest country on the planet! This is entirely unacceptable!

I WANT YOU TO BECOME DEBT-FREE!! It changes your life! It enables you to accomplish far more than you ever thought possible with your personal finances! It allows you to do exactly what you were put on earth to do – regardless of the income! In this series, I’m going to share the process that I followed to become debt free. Are you ready?

STEP 1 – Understand the WHY before the HOW

I believe this is the most important step in becoming debt free! In the hundreds of financial coaching sessions that our team has led, it’s amazing how many people do not have a plan for their lives. We ask them the “why” and they stare at us like we’re speaking a different language.

Unfortunately, this is the first time that many of these people have ever seriously thought about what they want to accomplish with their lives. As a result, they are bumbling through life just trying to make it through the day. What a miserable way to live!

I cannot overstate this fact – YOUR LEVEL OF EXPECTATION DETERMINES YOUR LEVEL OF PREPARATION!

When Jenn and I wrote down our plans, hopes & dreams on paper, we realized that our lack of money management proved we had no real expectations of accomplishing these plans, hopes & dreams. We wanted to move back to South Carolina to take a job that paid way less than what we were making, but every single dinner at Outback was robbing us of that opportunity. Every single debt payment went off to make the bank wealthy while at the same time robbing us of our God-given dreams!

That made me MAD! It made me FURIOUS! It made me realize how incredibly stupid I was to be managing our money so crazily! I had a significant amount of our income going to pay car debt, credit card debt, and student loan debt. Add in the stupid house payment, and I had thousands of dollars per month running off to make the bank wealthy!

By writing out our plans, hopes, & dreams on paper, Jenn and I were motivated to manage our money differently. It caused us to view debt differently.

Take your first step today by writing down your plans, hopes & dreams. If you are married, you need to do this separately and then take time to discuss it with each other. By the way, one of my plans, hopes, & dreams is for you to become debt-free!

Why do you want to be debt free? It’s not easy! After you get started, it might be easier but it’s not going to be easy. There are so many things that compete for your money. So, why do you want to break free from debt? One of the most common responses I get is, “so I can do whatever I want”. I don’t believe this is the best response. I believe a better response is, “so I can live a fully funded life doing exactly what I’ve been put on this earth to do!”

What has kept you from attacking your debt?

5 Basic Steps to Investing – Step 5

Investing! This is consistently given as one of the most confusing topics individuals face. In this series, I wanted to share some basic investing fundamentals. My goal is to help you understand this topic better and walk away with practical steps.

STEP ONE Evaluate & Diversify

STEP TWO Automate Your Investments

STEP THREE Get the Free Money

STEP FOUR Unleash the Power of Compound Interest

STEP FIVE Continue to Learn about Practical Investing Opportunities

There are so many different types of investment opportunities, so I’ve broken down a few of them.

Stocks – When you own stock in a company, you technically become a part owner of that company. You have some claim to the assets and earnings of the company. Stocks are foundational to most investment portfolios. They are known to be very volatile in the short term but have historically outperformed other investments in the long run.

Mark Twain has famously said this about investing in stocks: “October: This is one of the particularly dangerous months to invest in stocks. Other dangerous months are July, January, September, April, November, May, March, June, December, August and February.”

There are two major types of stocks:

- Common Stock: Common stock allows the holder to vote in the shareholder meetings (depending on the amount of stock owned) and provides access to dividends or profit sharing produced by the company.

- Preferred Stock: Preferred stock holders have priority over common stock holders. This applies in many areas including when dividends are being paid to shareholders.

Bonds – A bond is a large debt owed by a company, government, or even a school, where the borrowing institution has agreed to repay an established amount of interest payments for a set period of time. When this time expires, the borrower then returns all of the principal back to the lender(s). Bonds can vary in maturity times anywhere from 1 year to 30 years. I like to think of my personal residence as a bond investment. A bond is generally less risky.

Mutual Funds & Exchange Traded Funds (ETFs) – Mutual funds and ETFs let you accumulate a wide variety of investments that couldn’t normally obtain without consuming large amounts of time and money. Mutual funds and ETFs are funded “mutually” by you, me and millions of our closest friends. Our money is pooled together and then used by the “mutual fund managers” to invest in hundreds of other company stocks, bonds, and other sorts of investments. Usually, mutual funds and ETFs have specific charters that direct their investments. Our mutual fund might only focus on established companies in the USA while another could focus on investing in up-and-coming companies in third world countries.

Other Investing Opportunities – People so often hold themselves to these common types of investing and never branch out. Investing opportunities are all around you! You can invest in a small home and rent it out. You could invest in small businesses in your community. When you are investing, you can think outside the box. Some of the greatest returns can be found when investing in unorthodox ventures.

Next Steps

– Review your investments and know what you are invested in

– Start to think OUTSIDE of the stock market when you’re investing

– Start investing!

– Recommended Resource ==> OXEN: The Key to an Abundant Harvest – Learn how to maximize your money through investing

5 Basic Steps to Investing – Step 4

Investing! This is consistently given as one of the most confusing topics individuals face. In this series, I wanted to share some basic investing fundamentals. My goal is to help you understand this topic better and walk away with practical steps.

STEP ONE Evaluate & Diversify

STEP TWO Automate Your Investments

STEP THREE Get the Free Money

STEP FOUR Unleash the Power of Compound Interest

Have you ever heard the say, “my money is working for me”? This is exactly what compound interest does for you! When you utilize the power of compound interest, you’re allowing the interest you’re making to also earn interest.

For example, let’s say we have $100 in an investment account that grew to $105 in one year. This is the equivalent of 5% interest. Now suppose the $105 is left alone for another year and continues to grow at a rate of 5%. Will it be paid another $5 interest when the second year is up? No! It will be paid $5.25 because interest was received on $105 – not just $100. Interest earning interest!

Take a look at the below example of a $100/month investment growing at an annual compound rate of 12%.

Remember, you are only investing $100 each month! After 40 years, you’ve only invested $48,000 BUT your account balance is $1,176,477! This means that $1,128,477 is the interest you have gained!

Now do you see the POWER of compound interest?

Where do you find investments that offer 12% return? I have found no investments that constantly return 12% every single year, but I have found several mutual funds that average over 12% return over the past 50 years. Some years could lose 15% while others gain 30%. You can see a list of my current investments HERE.

How to maximize your investment growth:

- Invest enough to receive the entire company match: By investing in an employer-sponsored retirement plan that matches a portion of your contributions, you could even receive a 50% or 100% return!

- Monitor your investments at least every six months: I track my investments at the end of every single month. This helps me understand how each one is performing and allows me to make necessary adjustments.

- Consider investments beyond the stock market: The stock market is just one place to invest. Consider investing in a small businesses, real estate, and intellectual property – like patents and licensing rights. Remember, a higher interest rate almost always means a higher risk.

Next Steps

– Establish a consistent investing habit. Invest into your retirement account every paycheck for the rest of your working life. Even if you can only invest a small amount, it will add up to more than you can imagine!

– Recommended Resource ==> OXEN: The Key to an Abundant Harvest – Learn how to maximize your money through investing