Debt

8 Ways To Speed Up Debt Elimination

In a recent live event, 58% of respondents shared that “reducing or eliminating debt” was their top goal for the year.

If this is one of your top financial goals, here are some key ways you can speed up your debt freedom date.

8 Ways To Speed Up Debt Elimination

- Reduce Interest Rates Many people with substantial consumer debt do not realize that 50% to 75% of their payments are merely going to the lender as interest – greatly reducing their ability to lower their debt. If you have high interest rate credit card balances, consider transferring to a 0% interest card (like these 0% Balance Transfer Credit Card Offers). Is your mortgage interest higher than those listed at BankRate.com? If yes, consider refinancing the mortgage. It is amazing what a few hours of focus on interest rate reduction can do to speed up your Debt Freedom Date!

- Pay Raise Are you being compensated fairly? Check out Salary.com for current pay rates of positions similar to yours. Take some moments to document how you are adding substantial value to your organization. If it makes sense to have a conversation with your leader, do it! Nothing like some more income from your current job to speed up debt elimination.

- Tax Refund A tax refund might be an “interest free loan to the government,” but it also represents an opportunity to impact debt in a big way.

- Bonus A bonus can also help kill some debt. One great thing about debt freedom is it allows future bonuses to be used to fund future dreams – instead of paying for things from the past.

- Found Money From Better Budgeting When I started preparing and living by a budget, it literally transformed my finances. I freed up hundreds of dollars that was going to “miscellaneous cash withdrawals” and impulsive grocery shopping trips.

- Sell Some Possessions Sell the boat, motorcycle, extra car, and collectibles. Eliminating possessions will free up space, eliminate stress, and greatly speed up your pace toward accomplishing debt freedom.

- Overtime If you have the chance to work overtime, it can really help speed up debt reduction. Plus, you’ll be too tired to spend the extra income on frivolous things.

- Second Job If you don’t have the opportunity to work overtime at your existing job, take a second job – or start a small side business. The key here is to focus on something that is short term. You don’t want to sign up for a permanent second job. Instead, commit to applying all additional money to your debt elimination plan. The reward when you become debt free? Quitting the second job and still prospering because you’ve freed up all of the money that was previously committed to payments.

You can do this!

Read the How To Pay Off Debt Series

How 0% Balance Transfer Credit Card Offers Work – And Save THOUSANDS of Dollars!

NOTE: I wrote this post to help people who are paying high interest on their credit cards. I maintain a running list of 0% Balance Transfer Credit Card offers HERE.

Here’s a fact: Many people possess credit card debt they are unable to pay off each and every month.

They want to pay it off each month, but they are unable to. As a result, they feel stuck. The interest rate being applied to their credit card balance is one of the primary reasons they feel that way.

0% balance transfer credit card offers provide a way to eliminate a credit card debt very quickly and can provide HUGE savings over keeping a balance on a high interest card.

Here’s an example:

- Credit Card Balance: $16,000

- Interest Rate: 21.99%

- Minimum Payment: 1% of balance plus interest charges (or $10 – whichever is greater)

If this person were to keep the balance on this card, they would pay $44,895.36 and take 36 years 4 months to eliminate!

By transferring the balance to a 0% transfer offer and making the same payment, they would pay $17,039.51 TOTAL (only $1,039.51 in interest and fees) – and they would be free of credit card debt in 49 months!

Rolling a high interest credit card balance to a 0% balance transfer credit card offer SAVED $27,855.86 and become debt free 387 months (32 years and 3 months) sooner!

Here’s the process of how this type of offer works:

- THE OFFER An offer and application for a zero percent balance transfer credit card is completed online or through a mail-in offer. During the application process, the applicant is asked if they wish to transfer a balance.When this option is selected, the application process includes the opportunity to provide information regarding existing loan balances that they wish to be transferred. This requested information is detailed including – current provider, account numbers, and loan balance.It is important to understand that the application process requires the applicant to provide their social security number and that a credit check will be performed.Once the application is submitted, a decision is typically rendered within a time range of a few minutes to a few days.

- THE EVALUATION Once the application has been submitted, the credit card provider evaluates the information provided to determine credit-worthiness. This evaluation is completed based upon several factors that vary between lenders. It always involves a check of one’s credit score and the loan amount requested.This evaluation also ensures that the person listed on the application is really the person requesting credit. This is an extremely important step to prevent identity theft and fraud and should make the applicant feel much more comfortable with this process.

- THE DECISION Once this evaluation is complete, a decision is rendered. The lender’s decision will be one of three alternatives:

- ACCEPTED: ALL of the balances to be transferred to zero percent

- ACCEPTED: SOME of the balances to be transferred to zero percent

- DENIED: NONE of the balances will be transferred

If ALL of the balance transfer requests are accepted, the new credit card provider will send money directly to each of the lenders. Within a few short days, the balances due each previous lender will be lowered by the requested amount and that new balance will transfer to the new card provider.

If SOME of the balance transfer requests are accepted, the new credit card provider will send money directly to some of the lenders. IT SHOULD BE NOTED that it varies between lenders on which balances will be accepted. On one of Discover’s applications, it stated the following in their terms and conditions:

“We process multiple balance transfers in the order they are requested on the application. Your credit line may be less than the amount of balance transfers you request. In addition, balance transfers may be limited to a portion of your credit line. If a balance transfer will exceed the credit available for a balance transfer, you authorize us to process any balance transfer for less than the amount requested, up to the amount of your credit available for balance transfers.” – SOURCE: Discover’s website

If NONE of the balance transfer requests are accepted, then it means that requested balance transfers will not occur and the current lenders will remain the owners of each debt.

That’s how this type of offer works – hopefully it can help you save tons of money!

Is Home Mortgage Interest Deduction A Good Idea?

Is home mortgage interest deduction a good idea?

This is one of the most frequently asked questions at our live events. Below is my answer.

If you have a mortgage and are paying interest, it is ABSOLUTELY very important to take the mortgage interest deduction. BUT there are a few key facts to consider as well.

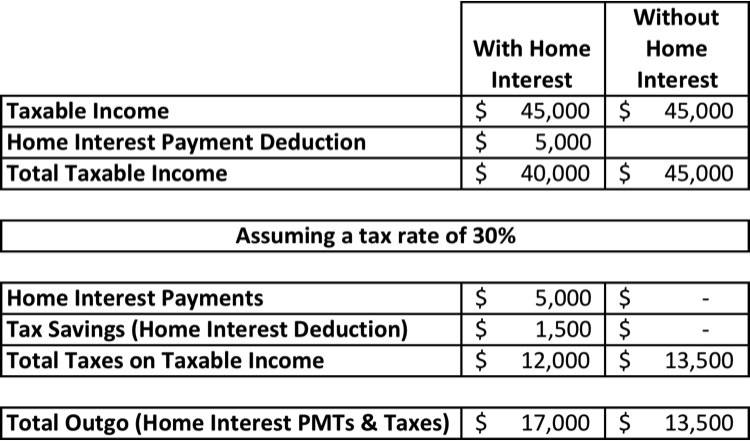

One thing I have heard commonly stated is “I am not going to pay off my mortgage early because I do not want to lose the mortgage interest deduction.” I believe this saying was initiated by banks because it is much more costly to keep the mortgage than to pay the taxes owed without the interest deduction. See the example illustrated below.

The Mortgage Interest Deduction

Let’s say you paid $5,000 in interest on your mortgage last year. By taking the deduction, you effectively reduce your taxable income by $5,000. You receive back the tax rate on that home mortgage interest deduction. If your tax rate is 30%, you will receive a refund of $1,500 because of the home mortgage interest deduction (30% of $5,000). Of course, the bank keeps the $5,000 you paid in interest. Uncle Sam receives 30% of your taxable income which is now $40,000 because you were able to reduce your taxable income by the $5,000 interest you paid. The total net OUTGO from your bank accounts to Uncle Sam and the bank is $17,000!

The Paid-Off House Scenario

Well, you are living life pretty good in your debt-free condition! You have paid off your house, so now you no longer pay interest to the bank (yay!). This means you will be taxed on your full income of $45,000. If your tax rate is 30%, the total net OUTGO paid to Uncle Sam is $13,500!

NET RESULT: By eliminating your mortgage, you have $3,500 LESS OUTGO from your bank account to someone else.

BROKE MENTALITY QUESTIONS: How Much Are The Payments?

I am passionate about helping people win with their money. This means that I really focus on the statements that people make and how they make them. I observe their body language, tone, pitch, and wording.

There are some statements that are particularly telling of what I call a “broke mentality” – the thinking of a financially broke individual.

One of those statements is “How much are the payments?”

People who are not broke ask the better question – “How much is the total cost – the purchase price AND the ongoing operating expenses?”

I have observed that people who ask “How much are the payments?” are more likely to:

- Pay a much higher purchase price

- Pay a much higher rate of interest

- Be unaware of the ongoing operating expenses

- Finance their purchase versus pay cash

- Still be paying for their purchase even after that item has been discarded

We are ALL susceptible to falling into the “broke mentality” – Have you ever made decisions this way? Would you mind sharing your story in the comments?

What’s Next After Debt Freedom

I meet a lot of people these days who are in the midst of their pursuit of Debt Freedom. I call it a “Debt Freedom March.”

They have used a tool like our Debt Freedom Date Calculator to calculate their Debt Freedom Date, and they have realized just how much of their money is going to a bank or lender. For the average family with non-house debt, somewhere between $500 and $1,250 per month is being paid in monthly payments. If you include the house payment, that average amount is between $1,250 and $2,000 or more per month.

For those who remain focused and diligent, debt freedom is achieved, and it is incredible!

Then the inevitable question shows up – “What’s next?”

If you are one of those who is asking this question, here are a few things to consider using the newly-released money for:

- Pursue a dream

- Give more away to causes you really believe in

- Build a larger emergency fund

- Invest money into a dream

- Invest money into someone else’s dream

- Reward yourself with a purchase of something you’ve always wanted

What other things would you recommend using this money for?