Finance

Marching To Debt Freedom – Couple #1 – Month 03

Introduction

Couple #1 has HAD IT with debt! They have been married for many years and have two children.

It has now been three full months since they embarked on their Debt Freedom March! That means that the hardest months are behind them!

On to the update for this month!

What went well this month …

I can see improvement not just in the numbers but in the actions of me and my family. The kids are starting not to hound me for things that cost so much.

Challenges and struggles for this month …

Christmas is LOOMING and I have not planned ahead. I think what I have decided to do is to pay cash for Christmas and to pay the minimums on the debt just for this month and resume the march in Jan. This will be the last year of a Christmas not planned ahead.

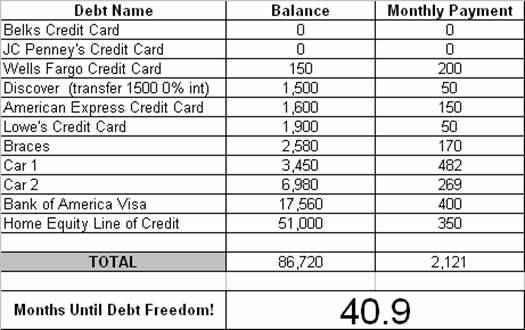

Updated Debt Freedom Date …

Month By Month Progress …

Sangl says …

I am FIRED UP by the progress that Couple 1 has made! In just three short months, they have made two debts leave and paid off over $3,000 in debt!

Even more important, the family is getting on board! The children are realizing how huge of a lifestyle change this is and are jumping on board! There is NOTHING like a united family attacking debt.

I am thrilled to see that Couple 1 is going to start saving for Christmas 2008 in January! It is SO MUCH EASIER to save for known, upcoming expenses over the course of months instead of absorbing the entire budget-crushing expense in a single month.

While they are going to pay less on debt, I am PUMPED to see that they are avoiding Christmas debt by paying cash! This is so important! As you attack debt, you will encounter expenses that threaten your ability to avoid debt. You have to make the decision that NOTHING is important enough to go get debt. Way to go!

Readers …

You can save for Christmas (and property taxes, annual insurance premiums, and other known, upcoming expenses) in advance as well with your own monthly escrow account. THIS ARTICLE shows you exactly how to do it!

It is encouragement time for Couple 1. Would you take a moment to share your thoughts with Couple 1?

You can receive each article FREE via E-MAIL by clicking HERE!

Christmas Shopping

This morning I am going to go Christmas shopping.

I will join the masses of people who are engaging in one of America's great events – buying stuff.

I get to shop for Jenn (my wife) and that is it. My bride woke up this morning at 4:45AM to go shopping, and she has the list for everyone else. I am thankful that we save for Christmas every single month of the year as it really makes Christmas more fun when I am not worried about spending money that we don't have!

I was handed an updated "Wish List" from Jenn last night. The items on it now exceed the budgeted amount by at least five times! I really need help from The Saving Freak to show me a frugal way to increase the purchasing power of my Christmas shopping money!

I also get to take my daughter Christmas shopping with me. She has a few people on her list, and I love watching her shop!

Perhaps while I am out and about I will pick up a Clay Aiken Christmas album for Perry this year!

Marching To Debt Freedom – Couple #2

Introduction

This couple has announced to their debt that they are breaking up with it. Their friendship with debt has waned and frankly, it's time for them to cut debt out of the picture.

It has now been three months since Couple #2 began their March Toward Debt Freedom! This PUMPS me up! Why? Because I know that the third monthly spending plan is when financial plans really begin to take off!

On to the update.

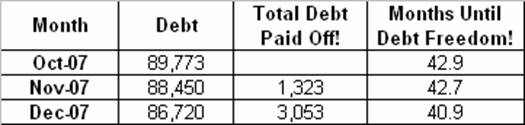

Here is their updated Debt Freedom Date calculation.

What went well this month …

Great news!! We paid off two credit cards; Belk and Home Depot!!! This will free up $125 to put toward paying off the Providian. We are so excited!! We did not accumulate any new debt this month either. The cash envelopes have really helped us to “live within our means.” We never thought of ourselves as “living above our means” before, but that is exactly what we were doing over the last several months. Thank God for Joe and his plan to help us become debt free. We have a ways to go, but I feel like a different person…like I have more control over our future.

Challenges and struggles for this month …

We had to practice saying NO this month. Both of our envelopes ran out of cash pretty fast, so we had to "just say no." In a way it was nice, but still tough. Sometimes we think we need to do everything just because we are asked, but now we have realized if it is not budgeted, we don't do it. Our family and friends were very understanding. I simply explained to them what we were doing and they were very respectful of our decisions. The cash envelopes take time to get used to, but in the long run we know if we say no today we can say yes in the future. Next month we are going to work on making the cash envelopes last longer.

One more thing…in the beginning, we estimated on how much we owe on our Student Loans and Vehicle One. However, we realized that we estimated a little high on Student Loan Two & Vehicle One and low on Student Loan One. We owe about $900 less on Student Loan 2, $500 less on Vehicle 1 and $400 more on Student Loan 1. Lesson learned…double check everything, even if you think you are correct. Luckily, we owe less than we thought, but it would not have been encouraging to learn we had more debt. This was irresponsible on our part, but I want to tell everyone just in case someone else out there did the same thing.

Sangl says …

I am so PROUD of Couple #2! They have made it through the three most difficult months of developing good spending plans. They are well on their way to Debt Freedom! I think it is awesome to see that the Debt Freedom Date has moved up 1.6 months from last month!

Couple #2 – Make sure that you are preparing for Christmas in your spending plan. You want to make sure that you can pay cash for Christmas and continue your awesome progress!

I am so appreciative that you are willing to share your journey with thousands of others!

Readers …

How has Couple #2 inspired you to take control of your finances? Would you leave a word of encouragement in the comments?

View past updates from Couple #2

Read recent posts on www.JosephSangl.com

![]() Subscribe for FREE to www.JosephSangl.com

Subscribe for FREE to www.JosephSangl.com![]()

Marching To Debt Freedom – Couple #1

Introduction

Couple #1 has HAD IT with debt! They have been married for many years and have two children.

It has now been two full months since they embarked on their Debt Freedom March!

Here's the update for this month!

What went well this month …

The budget is in effect and being cursed daily. The debt is being taken out 1 by 1. Two Cards are ZERO and a 3rd will fall this month The emergency fund is funded.

The debt is being taken out 1 by 1. Two Cards are ZERO and a 3rd will fall this month The emergency fund is funded.

Challenges and struggles for this month …

It is hard because Christmas is coming ,and I have obviously not looked at a calendar. I am going to do the best I can to go without in other areas and cut back on total Chistmas spending. This time next year I will have Christmas already funded.

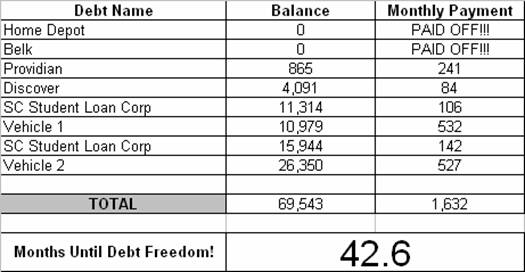

Here is what their updated Debt Freedom Date calculation looks like.

Great Blogs I’m Reading

I love to learn, and I really love to learn from people I can relate to.

These blogs are ones that I read every single day. The reason I read them? I LEARN from them!

- The Saving Freak – I am not sure "Saving Freak" does this blogger full justice, but this guy can absolutely get you some free stuff and save you some money!

- Lazy Man And Money – This guy is working to build his alternative income streams, and it is just interesting to check in on him everyday and see some of his ideas put into action!

- MyMoneyBlog – Jonathan does some incredibly insightful research into his topics. And, oh yeah, he publishes his net worth. Like ALL of it! It makes me highly uncomfortable to view his personal financial condition, but I can't stop checking in! It also reminds regularly how important is that I remember how sensitive an individuals personal financial situation is to them!

Any other blogs I should be checking in on?

Subscribe to www.JosephSangl.com

Another story of life-change was released on the podcast today! Have you listened to the Podcast from Joe? To subscribe to the podcast using iTunes, click HERE. If you do not have iTunes, you can download an mp3 by clicking HERE.