Finance

Favorite Money Quotes

Here are a few of my favorite quotes about money:

- “Live like no one else so later you can live like no one else.” – Dave Ramsey

- “If you aim at nothing, you will hit it every single time.” – Zig Ziglar

- “You can either play now and pay later, or you can pay now and play later. The choice is yours.” – John C. Maxwell

- “The question is not, ‘Can I afford this?’ The better question is, ‘How can I afford this?'” – Robert Kiyosaki

- “Early to bed, early to rise, keeps you healthy, wealthy and wise.” – Benjamin Franklin

- “Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery.” – Charles Dickens

- “What good will it be for someone to gain the whole world, yet forfeit their soul?” – Matthew 16:26 (The Holy Bible – NIV)

- “Act your wage.” – Dave Ramsey

- “The principles of money are basic: Live on less than you make and save money for a rainy day.” – Anonymous

- “People buy things they cannot afford to impress people they don’t even like.” – Attributed to various people

- “Your pay raise becomes effective when you are.” – Anonymous

For more great money quotes, visit this great page.

Do YOU have any favorite money quotes? Please share them in the comments!

5 Things Money Can Not Buy

We all know that money can’t buy us everything. It can’t buy love, true happiness, or ensure a stress-free life.

Here is a list of five (frustrating, humorous, maddening) things I’ve discovered money can not purchase.

5 Things Money Can Not Buy

- A toilet that will never stop up, overflow, or leak. It will leak, hiss, or overflow at TERRIBLE times (which is pretty much any time a toilet messes up)

- Rain. I’ve lived in South Carolina for most of the past 15 years. Our local lake (reservoir) has ALWAYS been in some level of drought condition. Money couldn’t buy rain. Of course, this summer we’ve hardly had a day without rain and the reservoir is bursting at the seams.

- Children who obey perfectly. Turns out that a 3 year old will be a 3 year old whether or not you have money. Can I get an “Amen” from some parents?!?!?

- A car that won’t break down. I’ve had nice cars, and I’ve driven scary bad cars. Like 1981 Datsun B-210 bad. I’ve discovered ALL of them break down. One of my vehicles just started to have a “brake squeal.”

- Print cartridges that never run out. My print cartridge arrives at empty with impeccable timing – right when we must have it to finish the seven hour assignment from the teacher who believes a bridge built out of toothpicks somehow equals practical real world experience.

Any other frustrating, humorous, or maddening things you can think of that money can not buy? Please share!

SERIES: Investing Fundamentals Part 5 – Practical Opportunities for Investing

Welcome to the latest series at JosephSangl.com – “Investing Fundamentals” Investing is consistently rated by our audience as one of the most confusing topics they face. In this series, we are going to share some foundational principles that can really help you understand investing better!

Five Practical opportunities for Investing

Stocks When you own stock in a company you technically become a part owner of that company. You have some claim to the assets and earnings of the company. Stocks are foundational to most investment portfolios. They are known to be very volatile in the short term but have historically outperformed other investments in the long run.

Mark Twain has famously said this about investing in stocks:

“October: This is one of the particularly dangerous months to invest in stocks. Other dangerous months are July, January, September, April, November, May, March, June, December, August and February.”

There are two major different types of stocks

- Common Stock Common stock allows the holder to vote in shareholder meetings, depending on the amount of stock owned, and provides access to dividends (profit sharing) produced by the company.

- Preferred Stock Preferred stock holders are a step above common stock holders because they have priority over common stock holders. This applies in many areas including when dividends are being paid to shareholders.

Bonds A bond is generally less risky. A bond is a large debt owed by a company, government, or even a school, where the borrowing institution has agreed to repay an established amount of interest payments for a set period of time. When this time expires, the borrower then returns all of the principal back to the lender(s). Bonds can vary in maturity times anywhere from 1 year to 30 years (or more)! The longer the time, the more interest you could accumulate.

I like to think of my personal residence as a bond investment.

Mutual Funds & Exchange Traded Funds (ETFs) Mutual funds and ETFs let you accumulate a wide variety of investments you couldn’t normally obtain without consuming large amounts of time and money. Mutual funds and ETFs are funded “mutually” by you, me and millions of our closest friends. Our money is pooled together and then used by the “mutual fund managers” to invest in hundreds of other company stocks, bonds, and other sorts of investments. Usually mutual funds and ETFs have specific charters that direct their investments. One mutual fund might only focus on established companies in the United States while another could focus on investing in up-and-coming companies in third world countries.

Other Investing Opportunities People so often hold themselves to these common types of investing and never branch out. Investing opportunities are all around you! You can invest in a small home and rent it out. You could invest in small businesses in your community. When you are investing you can think outside the box. Some of the greatest returns can be found when investing in unorthodox ventures.

STEPS TO TAKE:

- Review your investments and know what you are invested in.

- Start to think OUTSIDE of the stock market when you are investing!

- Start investing!

RECOMMENDED RESOURCE:

- OXEN – The KEY to an Abundant Harvest In this book, Joe shares the steps you can take to maximize your money through investing!

- This book is also available via Amazon and Kindle.

NOTE: This post contributed by IWBNIN intern – Craig Fatt

SERIES: Investing Fundamentals Part 4 – Unleash the Power of Compound Interest

Welcome to the latest series at JosephSangl.com – “Investing Fundamentals” Investing is consistently rated by our audience as one of the most confusing topics they face. In this series, we are going to share some foundational principles that can really help you understand investing better!

Four Unleash the power of compound interest

Compound interest is the payment of money to you from companies you have allowed to use your money.

For example let’s say we have $100 in an investment account that grew to $105 in one year. This is the equivalent of 5% interest.

Now suppose the $105 is left alone for another year and continues to grow at a rate of 5%. Will it be paid another $5 interest when the second year is up? No! It will be paid $5.25 because interest was received on $105 – not just $100. In other words, the interest money also earns interest! This is why you hear people say, “My money is working for me.”

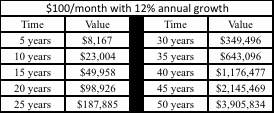

Take a look at the below example of a $100/month investment growing at an annual compounded rate of 12%.

Remember you are only investing $100 each month! Even though after 40 years you will have only invested $48,000 of your own money, your account balance will be $1,176,477! This means that $1,128,477 is the interest you have gained!

Now do you see the POWER of compound interest?

Where do you find investments that offer 12% return? I have found no investments that return 12% every single year, but I have found several mutual funds that average over 12% return over the past 50 years. Some years could lose 15% while others could gain 30%. You can see a list of my current investments HERE.

How to maximize your investment growth:

- Invest enough to receive the entire company match. By investing in an employer-sponsored retirement plan that matches some of your contributions, you could even receive a 50% or 100% return!

- Monitor your investments at least every six months. I track my investments at the end of every single month. This helps me understand how each one is performing and allows me to make necessary adjustments.

- Consider investments beyond the stock market. The stock market is just one place to invest. Consider small businesses, real estate, and intellectual property – like patents and licensing rights. Remember a higher interest rate almost always means a higher risk.

STEP TO TAKE:

- Establish a consistent investing habit. Invest every single paycheck into your retirement account for the rest of your working life. Even if you can only invest a small amount, it will add up to more than you can imagine!

RECOMMENDED RESOURCE:

- OXEN – The KEY to an Abundant Harvest In this book, Joe shares the steps you can take to maximize your money through investing!

- This book is also available via Amazon and Kindle.

NOTE: This post contributed by IWBNIN intern – Craig Fatt

SERIES: Investing Fundamentals Part 3 – Get the Free Money

Welcome to the latest series at JosephSangl.com – “Investing Fundamentals” Investing is consistently rated by our audience as one of the most confusing topics they face. In this series, we are going to share some foundational principles that can really help you understand investing better!

Three Get the Free Money

Yes, I said FREE money. Many employers will match a portion of your contributions into a self-directed retirement plan! I encourage you to go to your employer’s human resources department and sign up for the retirement plan. Start investing money into it immediately! Contribute enough money to obtain the entire employer match. Remember this is really just FREE money!

The company you work for will usually match you up to a certain percent of your pay. I worked for an employer that matched me dollar-for-dollar up to 8% of my pay (100% automatic rate of return!!!). Another matched dollar-for-dollar up to 6% of my pay. Still another matched dollar-for-dollar up to 3% of my pay. Whatever your employer is willing to give you is FREE MONEY!

It is baffling that many people don’t take advantage of these free money opportunities. I have heard several excuses about why people choose not to, excuses like:

- “I can’t afford to contribute.”

- “I’m living paycheck to paycheck already.”

These people are basically saying they can’t afford to be given free money. Doesn’t make a whole lot of sense, huh? This is an opportunity to receive a 100% return on your investment! DO NOT WASTE THIS CHANCE!

STEPS TO TAKE:

- Talk to your employer TODAY and sign up for your company’s retirement plan. Start contributing something – at least enough to get the full match.

- As quickly as possible, increase your investing contribution to at least 10% of your gross income. I know this is a lot of money, but you will NEVER regret this decision.

RECOMMENDED RESOURCE:

- OXEN – The KEY to an Abundant Harvest In this book, Joe shares the steps you can take to maximize your money through investing!

- This book is also available via Amazon and Kindle.

NOTE: This post contributed by IWBNIN intern – Craig Fatt