Finance

Marching To Debt Freedom – Couple #1 – Month 14

Introduction

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now over a year into their Debt Freedom March.

Couple #1's Thoughts This Month

It was a good month. We are upping the payment on the HELOC and are close to paying off car 2. With the financial world blowing up around us, it is such a great feeling not to have to make payments on all of that debt!

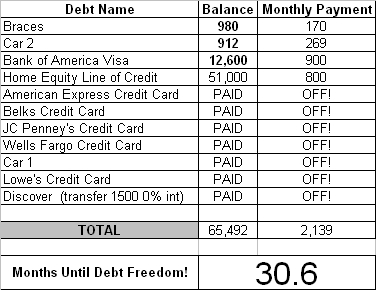

Updated Debt Freedom Date

Month By Month Progress

Sangl Says …

Couple #1 is making huge strides toward debt freedom. It takes time, but it is awesome to see the progress being made!

Readers …

How is your Debt Freedom March progressing? You can get started on your own Debt Freedom March HERE.

Read Previous Monthly Updates For Couple #1 HERE

Marching To Debt Freedom – Couple #3 – Month 11

Introduction

This couple has been married for many years and have one child. They have HAD IT with their debt and have been marching toward debt freedom since November 2007. They are THROUGH with credit cards.

Thoughts from Couple #3 this month

It is nice to see our balances decreasing as well as our years 'til Debt Freedom! It seems like it will take forever, but we will get there. It is also nice to see gas prices coming down.

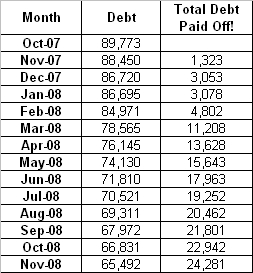

Updated Debt Freedom Date

Month By Month Progress

![]()

Sangl Says

Couple #3 is closing in on one full year of attacking their debt. It was a rough start since the interest they were paying toward debt was very high. They restructured their debt by surfing their debt to low and zero percent balance transfer credit cards. Now, the pay-off is here! They are averaging around $1,600 of debt elimination each month.

Yes, they could spend that $1,600/month elsewhere, but they have had their IHHE Moment. They have reduced their debt by over $10,000! Outstanding!

Readers

Have you started your March To Debt Freedom? You CAN do it!

Read previous updates from Couple #3 HERE

Budget Booster – Swagbucks

I am a big fan of receiving money for doing something that I already do, and that is why I am pumped about Swagbucks.

Let me tell about Swagbucks. It is a search engine that you use to find stuff on the internet. By signing up for and using Swagbucks for your internet searches, you can earn Swagbucks – a currency that can be converted into rewards ranging from five dollars to hundreds of dollars.

A single Swagbuck has a value of around $0.08, but it can add up! At the rate I have been earning Swagbucks, I believe that I will be able to obtain a $50 gift card every three months or so.

Based on what I have seen, Swagbucks returns the same results as Google.com but pays you to use it!

You can register for your own Swagbucks account HERE.

Find dozens more budget boosting ideas on the Next Steps site.

IWBNIN Home Group Study

As I wrote the Group Study that accompanies my book, I begged God that it would help others accomplish far more than they ever thought possible with their personal finances.

That is why I am so pumped to see what is happening with the I Was Broke. Now I'm Not. Group Study. Right now, over one thousand people are going through this six week study as part of their home group as part of a church group. That is unbelievable!

If your church or organization is looking for PRACTICAL and relevant teaching on personal finances, this study can work for you.

As part of the study, the team has developed an IWBNIN Group Study site to further enhance the study's effectiveness.

Check it out HERE!

Marathon Training Is Like … Investing

NOTE: If you are a runner or athlete of any type, you will know exactly what I mean by this post.

Ever had days where you feel invincible? I had one of those days on Monday. I went to the gym for my planned lunch hour run, and I felt incredible. I cranked up the treadmill to a fast pace (for me), and I ran for five miles. I felt GREAT! I ran five miles at a pace of 7:54/mile. No stress. No problems. Cake.

Have you ever had a day where you feel like you were up to your neck in concrete? On Tuesday, I went to the gym for my planned lunch hour run, and I felt awful. AWFUL. I cranked up the treadmill to a speed slightly faster than a turtle could craw, and it hurt so bad. It was dreadful. It was so bad that I wanted to stop after running one mile. ONE mile. I was thinking, "If it is hurting this bad to run one mile, why on earth have I signed up to run 26.2 miles again!!?!" I stuck it out and ended up running three miles before quitting. It felt horrible. Even after I had stopped, I still felt horrible.

That is exactly what it feels like when I am investing. My money is there for the long haul, and I continue to invest because it makes a lot of sense to do so. There are times that I want to check the investment account every day because it is going up up up up up … There are other times that I can not even bear to look at the account. It takes everything in me to check on it because it is going down down down down …

See marathon training is like investing! There is a long-term pay-off even with all of the ups and downs. At the end of all this training, I will be able to run 26.2 miles and celebrate with an awesome dinner at Ruth's Chris Steakhouse. At the end of all of this investing, I will be able to leave a legacy for my family. There will ups. There will be downs. The joy of the journey and the pay-off is worth every up and down.