Finance

SERIES: YOU Answer The Question – Part 3

Welcome to the latest series – YOU Answer The Question!

One thing that I love about traveling and teaching about finances is that I learn so much from the people I meet!

So here is how this series works. I will share a question that has been sent in to me, and YOU Answer The Question!

QUESTION: I am 49 year old single person with no small children, and I am looking to purchase term life insurance for myself. Do I still need eight to ten times my salary in insurance or just enough to cover any expenses my children will face?

Do you have a question of your own? Ask me HERE!

SERIES: YOU Answer The Question – Part 2

Welcome to the latest series – YOU Answer The Question!

One thing that I love about traveling and teaching about finances is that I learn so much from the people I meet!

So here is how this series works. I will share a question that has been sent in to me, and YOU Answer The Question!

QUESTION: I want to work on getting some mutual funds, but I haven't the faintest idea where to start … Do I just go to Fidelity and say "I want some mutual funds" or what?

SERIES: YOU Answer The Question – Part 1

Welcome to the latest series – YOU Answer The Question!

One thing that I love about traveling and teaching about finances is that I learn so much from the people I meet!

So here is how this new series works. I will share a question that has been sent in to me, and YOU Answer The Question!

QUESTION: What do you do when you really want to get on the right track financially and your spouse is not as willing to participate?

Do you have a question of your own? Ask me HERE!

Marching To Debt Freedom – Couple #3 – Month 06

Introduction

This couple has been married for many years and have one child. They have HAD IT with their debt and have been marching toward debt freedom since November 2007. They are THROUGH with credit cards.

What went well this month?

We took out a 401(k) loan to pay off four high-interest credit cards. This allows us to pay a MUCH lower interest rate, and even better… we pay the interest back TO US! 🙂 We are now hoping that we can take advantage of some 0% interest offers and transfer the remaining balances to those cards.

What were the challenges/struggles this month?

Trying to not get discouraged about not getting it all paid off now! We are also planning on making higher payments on the lowest debt as soon as we see what the 401(k) loan payment does to the paycheck.

Updated Debt Freedom Date …

Month By Month Progress …

![]()

What has helped you stay on this Debt Freedom March?

Knowing that one day we will be DEBT-FREE and not live paycheck to paycheck!

How has this Debt Freedom March impacted your marriage relationship?

We are actually closer now and get this: WE DON'T FIGHT ABOUT MONEY!!! We both know what we owe and we are both on the same page to GET IT PAID OFF!

Sangl says …

Couple #3 has completed part two of their three part plan to restructure their debt. Their credit cards had hugely punitive rates – all of them 20% or higher. This was really killing their ability to attack the debt principal. With the majority of their debt now at a much lower interest rate (some of it at 0%!), they are now positioned to make tremendous strides toward Debt Freedom!

In my meetings with thousands of people, I have seen situations like this completely intimidate someone and they allow it to prevent them from taking charge of their finances. Couple #3, I applaud you for sticking with this! You guys CAN do this, and you will! And all of us will have this front row seat to cheer you on. Way to go!

Readers …

Would you leave some words of encouragement for Couple #3 in the comment section?

If you are totally intimidated by your financial situation, I would be glad to help in any way that I can. We offer FREE one-on-one financial counseling through NewSpring Church in Anderson, SC. I have even begun offering a very limited number of on-line appointments. If you are interested in receiving financial counseling, please contact me HERE.

Debt Freedom March – Couple #2 – Month 09

Introduction

This couple is THROUGH with debt! It has now been eight months since they announced that they were breaking up with debt. They have agreed to share their Debt Freedom March with everyone in the hopes to inspire others to do the same!

Here is this month's update.

What went well this month?

Everything went well. We have really got a handle on our budget, and we don't seem to have many struggles.

Challenges and struggles this month?

We both are in sales, so sometimes we have extra money come in that is not budgeted. Our goal is to put that money toward debt. This month we had a little extra money, and we did not put it toward debt… we used it as play money. We want to work on this for the future so we can shorten our Debt Freedom date. But, we didn't beat ourselves up for it. We work hard and enjoyed doing a little extra spending this month. We expect a bonus or two next month, and we are going to try and put a little bit of it toward debt. Wish us luck!

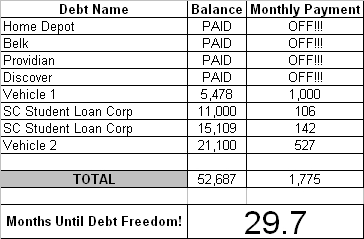

Here is their updated Debt Freedom Date calculation …

Month By Month Progress …

![]()

What has helped you stay on this Debt Freedom March?

There are several reasons why we have stuck to the plan. The Debt Freedom March has provided structure for our money. We have enjoyed paying our bills all at one time and not having to worry about paying bills again until the next month. We never worry about having "unexpected expenses" because we have the "known upcoming expenses" account set up. Another bonus is we don't noticed "pay day" anymore because we are not living paycheck to paycheck. All in all, this plan helps us feel in control of our money and our future. We are starting to see the light at the end of the tunnel, and that keeps us going along. We are looking forward to being debt free, and there is no way we are going to stop now.

How has this Debt Freedom March impacted your marriage relationship?

Luckily, we have always had the same view about how we spend our money and what we want for the future. Believe it or not… we have never fought about money. So, I guess I would have to say the debt freedom plan has helped us work as a team and look toward our future in a different way. We see ourselves having the life we want without the headache of worrying how we are going to pay for it. I am sure it has impacted us in other ways that we are not aware of at this time. But, I have no doubt that we will be able to look back in 10 years and see that sticking to the Debt Freedom March impacted our lives more that we could have ever imagined.

Sangl says …

Nine months ago, Couple #2 caught a vision of what life could be like without payments. In this nine month period, they have been able to knock fifteen months off their Debt Freedom Date! At this current rate, they will become debt-free in around eighteen months (January 2010) and it will have taken them only 27 months total to do it!

When they become debt-free, they will have freed up $1,775 in take-home pay every single month! How much does one have to earn to bring home $1,775? About $2,500 if their total tax rate is 30%! This means that they are going to give themselves a $30,000/year raise in about eighteen months!

I love this stuff!

Readers …

How much do you send to debt each month? Why not pay it off and give yourself a massive pay raise?

You can do this too! I share my story and teach these tools in my book, I Was Broke. Now I'm Not.

This stuff FIRES ME UP!!!!