Finance

Marching To Debt Freedom – Couple #1 – Month 09

Introduction

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now NINE months into their Debt Freedom March.

What went well this month?

Everything went reasonably well. We had a few unexpected bills but that is life. The rising cost of living is eating into our monthly budget a little but we are on track.

What were the challenges/struggles this month?

GAS, FOOD!!!

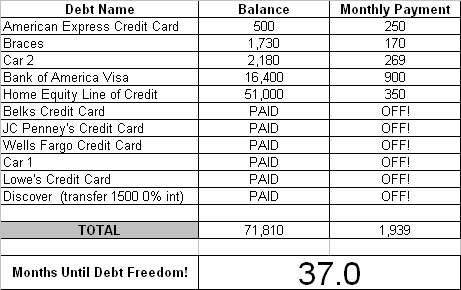

Updated Debt Freedom Date

Month By Month Progress

What has helped you stay on this Debt Freedom March?

The prize at the end of this is not being indebted to the leeches. I want to be free of the weight of debt. It is a cancer.

How has this Debt Freedom March impacted your marriage relationship?

It has created a sense of trust and unity. Together we are invincible, and we have a little change in our pocket.

Sangl says …

There are several success stories this month! Did you notice that Couple #1 paid off TWO credit cards this month? Lowe's and Discover both went into the "PAID OFF!" area this month. AWESOME! Also, they have paid off $17,963 in debt in just nine months. That is INCREDIBLE! That is a new car's worth of debt. Couple #1 could have continued living like they had in the past, and they would have been able to pay the bills fine. But they have caught a glimpse of what life is going to be like without debt, and nothing can stop them.

This is what this entire crusade is all about. Helping others accomplish far more than they ever thought possible with their personal finances! I LOVE THIS STUFF!

Readers …

What is your Debt Freedom Date? I hope it is zero or approaching it quickly!

Read Previous Monthly Updates For Couple #1 HERE

In my book that was released in January, I share the story of my Debt Freedom March and teach the exact tools that Jenn and I used to become debt-free. You can do it too! You can read the book's introduction HERE.

WINNER! Mutual Fund “You Pick ‘Em” Game

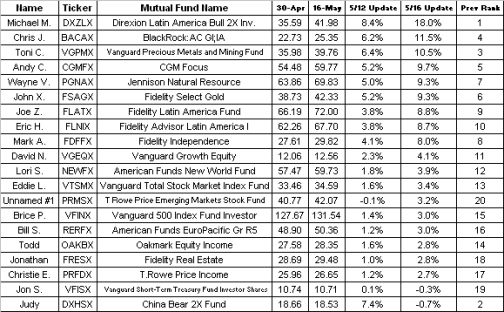

It was an exciting month to watch all of the mutual fund selections race each other. Thanks to all of the competitors who participated!

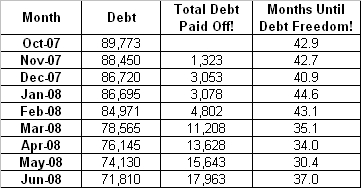

In the end, Michael (from New Hampshire) held the lead the entire month and walked away with the prize pack consisting ofL:

- "Financial Freedom Experience" T-Shirt

- Copy of I Was Broke. Now I'm Not.

- A blog post recognizing the winner's amazing ability

He chose the Direxion Latin America Bull 2X Inv [DXZLX] mutual fund, and it experienced an increase of 16.6%! That is in ONE MONTH! Incredible. Apparently, Michael has a special power to choose mutual funds that grow more in one month than most of mine do in one year.

Michael, your prize pack is on its way and your competitors all look up to you for your superior selection. Nice!

Here are the final standings.

I hope everyone learned from this contest! I would especially want each person to note the following:

- I view mutual funds as appropriate investments for the long term (five years or longer). Mutual funds go up and down in value over the short term, and tend to go up in value over the long term.

- Mutual funds can go up or down in a hurry. This is another reason that I hold my mutual funds for the long term. I am not good enough to predict when a mutual fund will experience rapid growth or when it will cease rapid loss. So I invest and let it ride. This strategy has worked well for me so far! I rebalance my portfolio once a year.

- Did you notice the variety of mutual funds in this contest? My hope is that each person will at least learn about the mutual funds available within one's 401(k) or similar retirement plan.

Readers: What have you learned as a result of watching this contest unfold? Please share your comment!

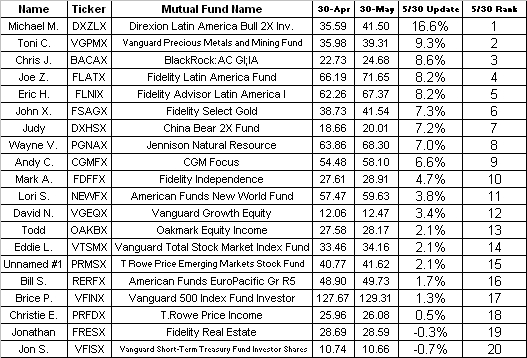

STANDINGS: Mutual Fund You Pick ‘Em Game [thru 5/23]

Here are the standings for the Mutual Fund "You Pick 'Em" Game with just one week remaining.

Michael M. has retained the lead, but took a hit over the past week and a couple of the competitors have closed the gap.

Judy's mutual fund selection, China Bear 2X Fund, has demonstrated what investing in a true international growth fund is like. In week one, it was #2 on the list. In week two, it dropped all of the way to #20. Now, it is back to #2! This is why I define an investment as money that I will leave alone for at least five years! I would have a heart attack if I was day-trading a fund like Judy's choice!

John X has closed the gap to hold #3 position after holding the #6 position the previous two weeks.

It is going to be a lot of fun to watch the performance over this last week to see who wins!

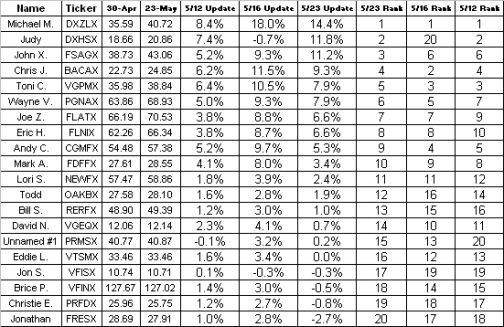

STANDINGS: Mutual Fund You Pick ‘Em Game [thru 5/16]

Here are the standings at the midway point of the exciting Mutual Fund "You Pick 'Em" Game.

Michael M. is absolutely CRUSHING the competition with the Direxion Latin America Bull 2X Inv. with a whopping 18.0% return IN JUST 16 DAYS. This is exactly why I say that investing is for the long term. Once can not really pinpoint when an investment is going to make huge gains, but the money needs to be there when it happens.

The biggest loss of the week is Judy who dropped all the way from #2 to dead last with the China Bear 2X Fund. The most improved is Unnamed #1 who ventured from dead last to vault seven other competitors.

Overall, the returns indicate an overall market that is growing nicely. I must say that it has been much more pleasing to view the Sangl Family mutual fund account balances in recent weeks!

I really believe that it is important for folks to have exposure to the wide variety of mutual funds that are available. I hope that this contest is helping you learn more about the mutual fund markets and investing in general.

Has there been a particular mutual fund or funds that has caught your attention?

So, there are NINE more trading days. Will Michael M. hold his lead or will Andy C. erase the lead and win the huge Mutual Fund "You Pick 'Em" Game Prize?

529 Plan Series: Virginia College Savings Plan

Today, I review another state's 529 college savings plan as part of the 529 Plan Series at JoeSangl.com!

Let me introduce you to the Virginia College Savings Plan.

This 529 plan is managed by one of my favorite mutual fund companies – American Funds.

What I Like About The Virginia College Savings Plan

- CollegeAmerica. This is the partnership between the Virginia College Savings Plan and American Funds. You can read about it in detail HERE. I really like American Funds' mutual fund offerings.

- Choices. American Funds offers 22 different mutual funds as part of the CollegeAmerica plan. You can also choose to put together a selection of the 22 different mutual funds and take an age-based approach toward your investment.

- Low Initial Investment Requirement. You only need $250 to get started with the CollegeAmerica plan. That makes this available to everyone!

- State Tax Deduction for Virginia Taxpayers. If you are a Virginia resident and contribute to this fund, you are most likely eligible to deduct those contributions from your state taxes! Virginia residents are allowed to deduct up to $2,000 PER ACCOUNT per year with unlimited carryforwards. NICE!

What I Would Like To See Improved

- This is a general improvement that I would like to see with all 529 plans, not just the Virginia College Savings Plan. I would really like to see contributions to ANY state's plan be DEDUCTIBLE from one's own state taxes. I know. I know. I am dreaming again, BUT it would really provide a huge incentive for states to have a great and competitive 529 plan.

Read reviews of other state 529 college savings plans HERE.

Receive each post automatically in your E-MAIL by clicking HERE.