Finance

The Mutual Fund Series: Vanguard

Welcome to a new series at JosephSangl.com – The Mutual Fund Series.

During each part of this weekly series, I will be looking at a specific mutual fund company.

Today's company is The Vanguard Group.

Vanguard is one of the largest mutual fund companies in the world. Based in Valley Forge, Pennsylvania, they currently manage $1.3 TRILLION dollars for their clients and offer 150 domestic funds and additional funds in international markets.

What I Like About Vanguard

- Target Retirement Funds. Vanguard was one of the first companies to offer target retirement funds. It is a fantastic idea to address the complete confusion that some people feel when making retirement mutual fund choices. All one has to do is select their target retirement date and Vanguard will automatically shift the mutual fund to become less risky/volatile as one approaches retirement. It really helps address the need to rebalance one's portfolio.

- Very low annual expense ratios. Vanguard is client-owned. This means that the company is owned by those who invest with the company. This results in Vanguard having the lowest management costs in the mutual fund industry. The average expense ratio for their mutual funds is 0.20% (the industry averages around 1.50%). This means that I get to keep more of the annual growth of my money.

- Lots of mutual fund options. With over 150 domestic funds and additional funds in the international markets, I have a lot of choice. I like choices.

- Full-service investment company. Vanguard offers mutual funds, IRAs, Roth IRAs, 401(k) rollovers, 529s, ESAs, and brokerage services.

What I Would Like To See Improved At Vanguard

- Lower "initial investment requirement". Most of Vanguard's funds require an initial investment of at least $3,000. This rules out a lot of beginning investors. Of course, this is not a problem when someone is investing within the bounds of their company 401(k), 403(b), or other retirement plan where minimum investment requirements are usually removed.

Vanguard Mutual Funds I Own

- I currently own one Vanguard mutual fund – Vanguard Institutional Index Fund [Ticker: VINIX]. I own this mutual fund as part of a 401(k). You can see other mutual funds that I currently own by clicking HERE.

- This mutual fund has a minimum investment requirement of $5,000,000. The reason that I am able to own shares of this mutual fund is because it is offered as part of the company 401(k) plan.

- It is a large-cap blend fund.

Vanguard Mutual Funds That I Am Considering Purchasing

- Vanguard Target Retirement 2040 Fund [Ticker: VFORX] This fund will automatically rebalance for me as I approach retirement. I chose the 2040 fund because that is a target retirement year for me. Vanguard has Target Retirement funds for every five year period from year 2005 to 2050.

- Vanguard 500 Index Fund Investor Shares [Ticker: VFINX] This fund tracks the performance of the S&P 500. It has very low expense ratios. It does need $3,000 to begin an individual investment.

What Vanguard funds do you own? Do you have any Vanguard funds that you really like? Dislike?

Receive each post automatically in your E-MAIL by clicking HERE

Who I am learning about finances from right now

It is so important to continue learning about personal finances. I thought I would share who I am learning about finances from right now.

- Clark Howard – his daily radio show

- Dave Ramsey – his daily radio show (I've read all of his books)

- CNN Money – I love the web site

- Those I counsel – I learn so much from the people I meet with!

- Mary Hunt – Her website (she has good books too!)

- Those who write in questions/comments through the website – I love helping others work through their financial decisions!

That is how I am learning right now.

Who should I be adding to the list?

Receive each post automatically in your E-MAIL by clicking HERE

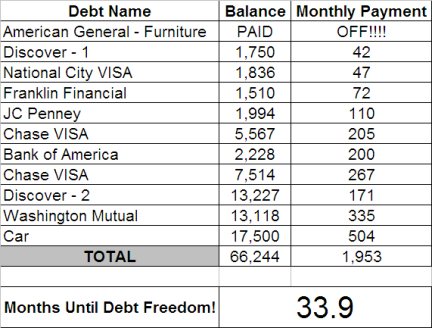

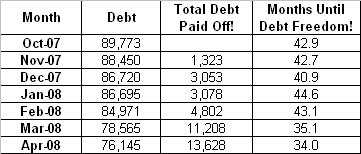

Marching To Debt Freedom – Couple #3 – Month 04

Introduction

This couple has been married for many years and have one child. They have HAD IT with their debt and have been marching toward debt freedom since November 2007. They are THROUGH with credit cards.

What went well this month …

We transferred part of our Bank of America balance to the “Discover – 2” card at a much lower interest rate. We are trying to eliminate the Bank of America card due to the fact that they are increasing interest rates, even though they have not “attacked” us yet. We also transferred the 29.9% VISA to a 0% Citi Card. We are also able to TITHE (give to the church)! That is so exciting to us!

What were the challenges/struggles this month …

The bonus we were expecting was not nearly what we had hoped for. We decided to plop it in the Capital One 360 Savings Account and save it for property taxes.

Updated Debt Freedom Date …

Month By Month Progress …

![]()

Sangl Says …

Couple #3 transferred a 29.9% balance to a 0% interest card. That is AWESOME! The balance on that card was $5,629. With this one change, they are able to save over $1,600 a year in INTEREST! That means that nearly $140 of the $205 monthly payment was going toward interest. It is now going to principal reduction. WAY TO GO!

Continue working the interest rates to 0% or close to it. It will really speed up your Debt Freedom March!

Couple #3 has been able to start tithing to their home church as well. That is AWESOME! I know that if Jenn and I were not able to give, I would be very unhappy. I love giving! There is something so powerful in being able to support someone or something that you really believe in.

I can not wait to see next month’s update!

Readers …

As you can see from Couple #3’s Debt Freedom March, it takes work to get some traction. Couple #3 is doing the work necessary to take their finances to the next level. Are you doing the work necessary to manage your money to the ABSOLUTE BEST of your ability?

Read the Debt Freedom March updates for Couple #1 and Couple #2

Want to start your own Debt Freedom March? Check out the free tools HERE. My book also teaches you how to use all of the free tools. You can purchase your copy at AMAZON.COM or via PAYPAL!

Receive each post automatically in your E-MAIL by clicking HERE

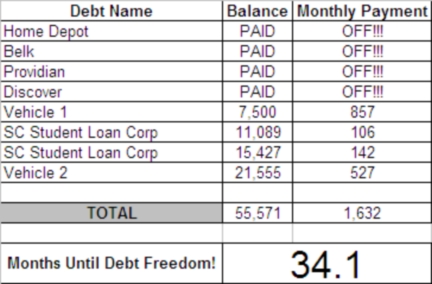

Marching To Debt Freedom – Couple #2 – Month 07

Introduction

This couple is THROUGH with debt! It has now been seven months since they announced that they were breaking up with debt.

Here is this month's update!

What went well this month …

This was a good month. We stuck to our cash envelopes and, of course, did not add any new debt. We got money back from our taxes, which we used to PAY OFF OUR LAST CREDIT CARD!!!! Yes, that's right…no more credit card debt!!!!!! As Joe suggested, we saved a little of our tax reFUNd for ourselves, and used the rest to pay toward debt. We had enough money to put an EXTRA $1,000 toward paying off Vehicle #1. It was a great month!!

Here is their updated Debt Freedom Date calculation …

Month By Month Progress …

![]()

What has kept you on track for seven months? What motivates you to stick with it?

When we first started this we had meetings with Joe every month or so. The fact that we had someone holding us accountable for our actions made a difference in the beginning. Of course, we wanted to do what he said and be able to show him we were making progress each month. But, as time went by we really got into it. The fact that we could be debt free in 2 or 3 years (other than our home) was really exciting to us. Especially since I thought I was going to pay on my student loan for the next 15 years!! Once we got started there was no turning back. We love paying for things in cash, we love having a plan (AKA: Known Upcoming Expenses Account) and we love paying off our debt and not adding to it. It is freeing!! Our focus starting in April is paying off Vehicle #1. I think that is key…taking it one month at a time, having a focus and celebrating each feat, no matter how big or small.

One last thing that has help my husband and I stay focused is we are a team. It takes 100% TEAM WORK!! When one of us is weak, the other is strong. We make decisions together and stick to the plan together!!!!

Sangl says …

It is AWESOME to see what is happening in Couple #2's lives!!! I am BLOWN AWAY every single time I see people "get it" and catch a vision of what life will be like without payments. In just SEVEN months, this couple has paid off $16,339 in debt AND eliminated ALL OF THEIR CREDIT CARDS!!! In just SEVEN MONTHS, Couple #2 has reduced their Debt Freedom Date by TEN MONTHS. They are already THREE MONTHS ahead of plan! This is typical for folks who say "I HAVE HAD ENOUGH!" (Their IHHE Moment!)

I would not be surprised to see Couple #2 achieve Debt Freedom twenty months from now. That would make Christmas 2009 and AWESOME Christmas! Think about it … Imagine saying to each other at Christmas, "Honey, I bought you Debt Freedom for Christmas! We now have over $1,600 a month that we can spend on other cool things like investments, vacations, and giving!"

Start your own Debt Freedom March by visiting the FREE "TOOLS" page or by obtaining a copy of I Was Broke. Now I'm Not on AMAZON.COM, BORDERS.COM, or via PAYPAL.

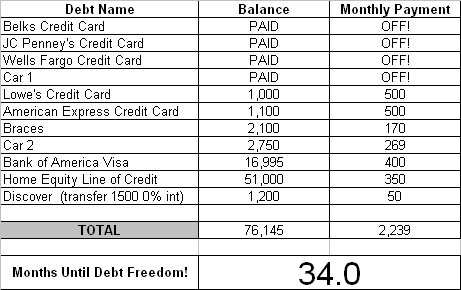

Marching To Debt Freedom – Couple #1 – Month 07

Introduction

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now SEVEN months into their march. Here is this month's update.

What went well this month …

We are working the plan. I jacked up the emergency fund to $5,000 and payed a little more on some bills.

What were the challenges/struggles this month …

NONE

What has kept you on the wagon for SEVEN months?

I sleep at night. I owe this to my family. God has blessed us with so much, and I need to take good care of it.

Updated Debt Freedom Date

Month By Month Progress

Sangl Says …

Incredible progress again this month! This is outstanding. By my calculations, this family will be debt-free except for their house (1st Mortgage and Home Equity) in less than TWELVE MONTHS! That will be INCREDIBLE!

Lowes and American Express are going to be leaving within the next few months and then the dentist is going to be VERY CONFUSED when the office receives a snowball payment of $1,170 ($500 Lowes + $500 AMEX + $170 Braces)! It is so fun to watch the debts just leave!

Readers …

THIS is what happens when you experience your IHHE Moment and get intensely focused! This debt does not stand a chance. I love it! This stuff works! I can't wait to receive an invitation to YOUR debt freedom party!

Read Previous Monthly Updates For Couple #1 HERE

Like what you are reading? Receive each post automatically in your E-MAIL by clicking HERE.