Investing

Different Types of Mutual Funds

There are literally THOUSANDS of mutual funds available in the marketplace today. Each mutual fund is usually assigned to a particular family of mutual funds.

Here are some common categories of mutual funds…

- International Stock Fund

- Aggressive Growth Stock Fund

- Growth Stock Fund

- Growth & Income Stock Fund

- Equity-Income Fund

- Balanced Fund

- Bond Fund

- Value Fund

- Industry-Specific Funds (like Healthcare Fund or Pharmaceutical Fund)

- Index Funds (S&P 500, Russell 2000, etc.)

If you purchase ownership in an International Stock Mutual Fund, you can bet that it is primarily investing in international companies. If it is an Aggressive Growth Stock Mutual Fund, you would expect to see the mutual fund purchasing shares of companies that are growing like crazy.

Each family of funds has a general “feel” to it. The International and Aggressive Growth Stock Mutual Funds tend to have wild swings in performance. One year it could grow 40% and the next it could lose 25%. It feels like you are on a great roller coaster ride at Six Flags!

Growth & Income, Equity-Income, and Balanced Funds are more stable and predictable.

Index Funds track specific market indexes like the S&P 500 and the Russell 2000.

Interested in learning more about investing? Check out my book on investing: “Oxen: The Key to An Abundant Harvest” HERE.

Establish Investment Goals

Goals! I love GOALS!! My goals spur me to save and invest. Today, I’m sharing about how my personal investment goals guide my mutual fund choices. First you should know a couple of things about me.

- I view my investments as money that I will not touch for at least five years.

- I prefer mutual funds over individual company stocks. I do own several individual company stocks, but I will not allow an individual company stock to exceed 10% of my overall portfolio. (See my current investment portfolio HERE)

My investment goals are GROWTH, GROWTH, and more GROWTH. I do not need my investments to produce income for me as I am in my early 40s. I want my money to GROW. This means that I invest in mutual funds that are purchasing stock of companies that are experiencing major growth (like Google).

Now, if I were retired, I would want my investments to produce income so I would be searching for mutual funds that invest in companies that are paying dividends to its shareholders (like Wal-Mart, Microsoft).

If I were approaching retirement, I would be moving the money that I would need in the next five years to much more stable and secure investments.

What are your investment goals?

What is a Mutual Fund

One of the questions that I get asked the most at an event is: “What is a Mutual Fund?” Mutual funds can certainly sound confusing – especially when there are so many options available. So for those who do not know what a mutual fund is, let me explain it the best I know how.

If something has been FUNDED, it means that money has been given to it.

If you and I come to a MUTUAL agreement, it means that we both were involved in making the agreement.

So if you and I have MUTUALLY FUNDED a project, then it means that we both provided money for the project.

A MUTUAL FUND means that you and I have both put our money in the same place. It is not unusual for a mutual fund to have over 5,000,000 people MUTUALLY FUNDING the same investment.

So we have mutually funded an investment along with three or four million of our closest friends. The amount you have invested is different from how much I have invested, but it is all in the same place.

So, we now all understand that we have mutually funded this investment and that it is called a mutual fund. The next question to answer is: “Where does the money go once it is in the mutual fund?”

Well, each mutual fund has a specific objective. Some mutual funds have an objective to produce income. Others have an objective to maximize the long-term growth of the invested money. Still others may have an objective to invest only in international companies. The bottom line is that each mutual fund has a specific objective or charter.

Based upon a mutual fund’s charter, the mutual fund managers will purchase part-ownership in a lot of companies.

The Mutual Fund managers use the money provided by you, me, and three million of our closest friends to purchase ownership in anywhere from 50 to over 1,000 companies. As these companies earn profits and grow, the value of the investment grows. This means that each individual who owns a portion of the mutual fund can enjoy that growth as well.

I hope this post has helped understand exactly what a mutual fund is. Let me know below if you have any additional questions about mutual funds.

The Definition of Investing

I recently conducted a survey and received hundreds and hundreds of responses. One of the questions I asked was:

Which (if any) of the following financial areas do you feel CLUELESS about?

The top response was Investing.

With phrases like mutual funds, ETFs, stocks, bonds, brokers, margin accounts, rate of return, yield rate, P/E, market capitalization, and current ratio, it can literally feel as if investing is another language!

I know the feeling as I’ve been there! Because of the results of this survey, I am tasking the I Was Broke. Now I’m Not. team to aggressively address this issue. We are hard at work developing resources that are going to help take people from “clueless about investing” to “financially confident and competent investor!” You will be seeing these resources being released over the next several month, and we can’t wait to share them with you!

In the meantime, let’s start by presenting a working definition of “investing.”

Investing Using your money and possessions to create more money and possessions.

The goal for any investment is to gain more in return. There are countless ways to do this, and we are creating resources to help people maximize their investing efforts.

I look forward to sharing more in the very near future!

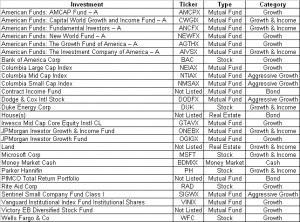

Joseph Sangl’s Current Investments

It has been over three years since I provided an update on the investments that I hold. Anyone who has attended a Financial Learning Experience has heard me say that it is important to INVEST money and to do so every single time you are paid money.

At the end of our live events, I am regularly asked or emailed the following question:

“What mutual funds do you recommend?”

My answer is always, “I don’t recommend mutual funds. I can only tell you the investments I own. In general, they have worked well for me. The investments you choose are up to you.”

So today, for those inquring minds who want to know … I am publishing some of the mutual funds/investments that I own. Click the image to see a larger version.

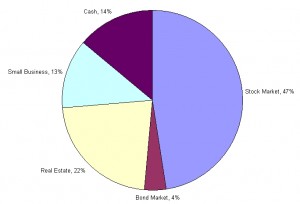

I have went even further in my analysis this time to indicate my portfolio diversification. Over the past several months, I have been writing and speaking to the fact that I am diversifying my investment portfolio to include land and real estate. The portfolio below indicates some of those decisions.

NOTES

- As you may have noticed during the latest recession, a rising tide will lift all ships and a lowering tide lowers all ships. If you have market funds, you saw this happen. There were many great companies that retained profitability throughout the market downturn, but their stock value was pummeled due to the overall market conditions. While I have been greatly diversified in my investment choices, I was diversified WITHIN the stock market. This is one of the reasons that I have made a focused effort to diversify my holdings beyond the open market.

- I believe it is important to maintain margin. Cash on hand is essential to the long-term success of any effort – personal, small business, or large business.

- Some of these funds are not open to the general market, which is why they do not have a “Ticker Symbol”, but I am able to invest in them through my previous employer’s 401(k) plan.

- One reason I hold so many mutual funds is because of a variety of 401(k), 403(b), Roth IRA, and 529 holdings – each plan has different mutual fund selections available.

- I do not “eat, sleep, and breathe” the stock market on a daily basis. I update my net worth once per month, but rarely jump in and out of funds. Day trading is definitely not for me.

Investment Junkies: What are your thoughts on my portfolio? What are some key funds that you really like that have worked well for you?

Looking for additional Personal Finance Resources? You can obtain FREE FINANCIAL TOOLS by clicking HERE and purchase books/materials by clicking HERE.