Saving

How To Save Money On Groceries

I am a huge fan of learning from others and that is why I am sharing the following links today. I want you to take the five minutes to learn from these individuals on how they are saving a TON of money on groceries using coupons. I personally have been using the same methods and regularly save between 35% and 60% on my grocery bill – on stuff that I was going to buy anyway! It takes thirty minutes or so to prepare a list, but it is worth it to save $30 – $50 on my grocery bill. That is a great hourly wage!

- The Saving Freak shares a recent success story HERE. Read some of his strategies HERE and HERE.

- Jenny at Southern Savers writes about it every single day. She has swiftly become a must-use resource before visiting the grocery store – especially if you are in the South. A great place to start is reading the FREE guides she has written HERE.

If you are paying retail price at the grocery store, you are wasting hard-earned money.

How Much Money Do You Need To Retire Well

Do you know how much money you will need to retire well (independent of Social Security)?

There are many ways to calculate an estimate, but I really like the Retirement Nest-Egg Required calculator that we have placed in the FREE TOOLS section.

To calculate your number, you will need to know two numbers:

- The annual amount you want to live on at retirement (in today’s dollars)

- The number of years until you retire

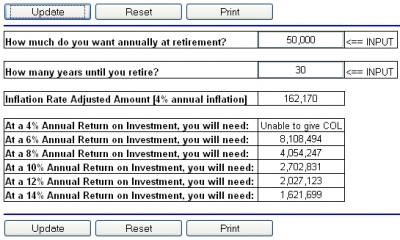

Suppose one wants $50,000/year (today’s dollars) during retirement and plans to retire in thirty years. Punch the numbers into the Retirement Nest-Egg Required calculator and this is what you will see:

Because inflation erodes the spending power of money, the annual amount we want must be adjusted. Using an assumed inflation rate of 4%, one will need $162,170/year in thirty years to have the same spending power of $50,000 today.

At different rates of return, you can see different amounts that need to be saved. Eight percent is a common rate of return on investment that financial planners use.

What is your number? Are you going to achieve it?

Ways To Save Money

My team has been working on a page on our Next Steps site to provide practical ways that people can save money on common items that people purchase.

We want your ideas!

For example, what are some ways you have saved money on:

- Groceries

- Internet

- Cable TV

- Cell phone service

- Car insurance

- Purchasing a new appliance

- Purchasing a new home

- Buying plane tickets

- Hotel

- Dining out

Share your ideas and check out the "Budget Boosters" section of our Next Steps site to see if there are any ways YOU can save money right away!

How To Save Money On Groceries – Guest Post

A couple who attend NewSpring were sharing with me how much money they have saved purchasing groceries with coupons. I was blown away and asked them to write it up for me to share with everyone on the blog. They did and here it is!

You asked how we’ve saved so much money on groceries and household items. This is our story.

My husband and I attended both your one night lecture (FLE) and 6 week class last year (FFE) and knew that we had to make some major changes in our spending habits. After making a budget, I started to investigate areas that I could cut costs.

I had already developed an interest in green alternatives to toxic chemicals and started to make my own cleaners and detergents from common household items such as vinegar, baking soda, washing soda, and castile soap. The best side effect was that I was able to save money on both the cleaners and my allergy medication… I did not need it every day anymore!

We also slowly switched to cloth napkins, towels, and unpaper towels (you can get 18 paper towel sized face cloths at Walmart for under $4). We keep a cloth bag in the kitchen and throw the dirty cloths in as we use them. One extra load of laundry a week is much cheaper than paper towels and napkins, especially when you make your own detergent for about 3 cents a load.

Our biggest money saver has been my newfound coupon hobby. My mother did not coupon so I really did not understand it, and was shocked by how much I could save. I learned about couponing on diaperswappers.com (yes we cloth diaper as well, and boy has cloth changed in the past generation!) and was linked to a great site thethriftymama.com. The gist of couponing breaks down to these 3 points:

1. Get the coupons. Clip them out and organize them in a way that makes sense to you. Where do you find coupons? (a) Sunday papers (b) Online company sites and coupon sites like smartsource.com (print and clip) (c) Company and store flyers (usually in a rack near the front of a grocery store) (d) Upromise.com has coupons that you can link to your Upromise card

2. Match up your coupons with store deals. Grocery and pharmacy stores send out flyers on Wednesdays and Sundays, plus post their deals online as well. Look for deals like BOGO (Buy One Get One Free), 2/$4, Instore special prices and closeouts, competitor store coupons accepted, etc. Then match up your coupons to those specials to pay little or no money for items that you use! Sound like too much work? These sites have done the work for you!

a. thethriftymama.com (Publix, Kroger, CVS, Walgreens-WAGS, plus others)

b. hotcouponworld.com (just about every grocery store I have ever seen)

c. couponmom.com (tons of stores)

d. thegrocerygame.com (you have to pay for this one, but the first month is free)

3. Stock pile so you can only buy what is on sale. Once you start saving money it’s easy to buy non perishable items (rice, pasta, canned goods, soap, etc) and frozen items (meat, vegetables, complete meals, etc) that your family uses when they are really cheap, or even free with your coupons, and keep them stored away. When you need the item you visit the stock pile instead of the store. Small trips for perishable items and special needs are much cheaper than paying full price for everything you use! Also, I think it’s important to add … only buy what you need or will use. Paying a dollar for an item that you will not use or give away is a waste of a dollar.

To show you how we’ve saved … I used to shop at Walmart and spent an average of $120 a week. I loved to shop at Publix for fruits and vegetables, but thought it was too expensive for entire grocery trips. Publix has BOGO deals every week, doubles coupons up to 50 cents, and accepts competitor $5/$25 type coupons from stores like Bloom and Whole Foods. The past month I have been able to shop at Publix and spent about $40-$50 dollars a week. The one week I spent $80 I saved over $90 with specials and coupons and completed a one moth stockpile. It takes a little while to clip and print online coupons but it is so worth it! Couponing our way to financial freedom,

Thanks so much for sharing, Kestlyn and Mike!

Feed The Pig

Has anyone seen the TV commercials with the talking guy dressed up as a pig and saying "Feed Me"?

It always ends with a fade-to-black and promotes a website – www.feedthepig.org

Well, it worked because I went and checked it out. I think it is a good site!

All this great stuff is part of a national campaign sponsored by the American Institute of Certified Public Accountants (AICPA) and The Advertising Council. The goal of the campaign is to encourage and help Americans aged 25 to 34 to take control of their personal finances.

You can check out their site HERE.