THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

Home mortgage interest deduction a good idea?

Absolutely! If you have a mortgage and are paying interest, it is very important to take the mortgage interest deduction. One thing I have heard commonly stated is the statement that “I do not pay off my mortgage early because I do not want to lose the mortgage interest deduction.” I believe this saying was…

Read MoreSave at the dentist …

A lady who went through the personal finance course that I coordinate told me of her trip to the dentist. The dentist told her that she needed a crown. The cost of the crown was to be $650. She told the dentist, “I am paying cash. $250!” The surprised dentist responded, “$325.” What a deal!…

Read MoreHow to pay for your next car.

In conversation with a friend recently, he mentioned that he is starting to check out the new cars because he is going to be buying a car in three years. He has owned his current vehicle for seven years. His goal is to keep it for ten years. NOTE: This is how you win financially.…

Read MoreStop living from paycheck to paycheck!

A recent study from ACNielsen revealed that about 1 in 4 Americans say that they do not have any spare cash. No wiggle room. No room for an error. No room for an emergency. No room for life to happen. Question: That new car – is it worth being broke over? Question: That student loan…

Read MoreWhat is Financial Peace?

I am going to attempt to put together my definition of financial peace. If you have other thoughts, please send them to me or comment on them below. Financial Peace – n. a condition where one does not have to continuously worry about their ability to meet their financial obligations; they have financial peace –…

Read MoreA sign that your financial plan is working!

A friend was so excited to tell me today that they received their real estate property tax bill and it was $100 less than they had saved up for it! There was not one hint of sadness that the bill was large (it is a fact of life). There was just jubilation that they had…

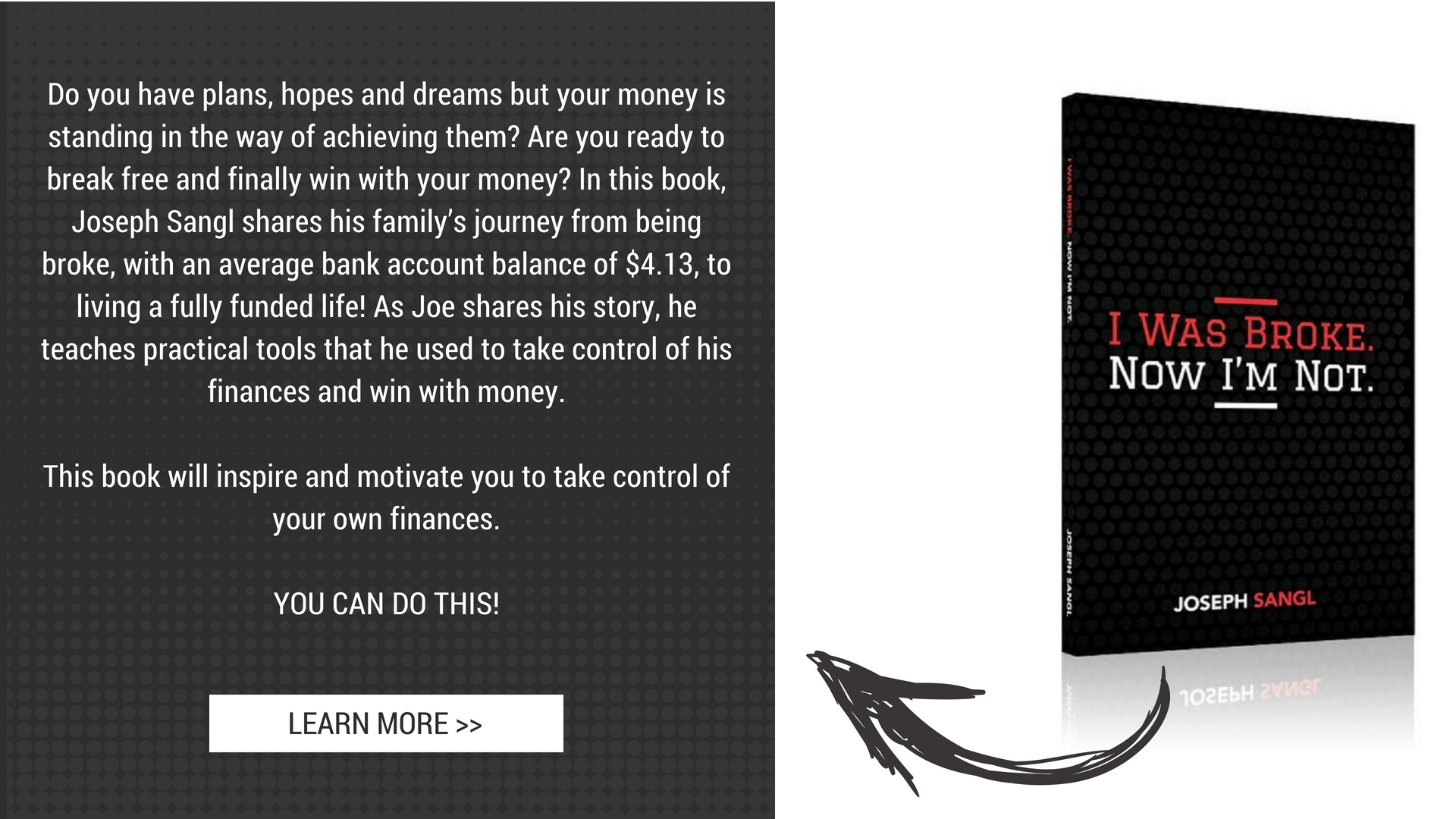

Read MoreAbout Joe

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

He is the founder of I Was Broke. Now I’m Not., the president and CEO of INJOY Stewardship Solutions, and Co-Founder of Fully Funded.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.