THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

Why I Do What I Do

A reader of JosephSangl.com shared her story with me, and it really sums up why I do what I do. With her permission, here is her story … I was OVERWHELMED with JOY as I dropped my oldest child off for college last weekend! NOT because I was happy to have her leave the house…

Read MoreIs Home Mortgage Interest Deduction A Good Idea?

Is home mortgage interest deduction a good idea? This is one of the most frequently asked questions at our live events. Below is my answer. If you have a mortgage and are paying interest, it is ABSOLUTELY very important to take the mortgage interest deduction. BUT there are a few key facts to consider as…

Read MoreAccountability

In school, if you did not pay attention in class and did not study the subject matter, you would receive an undesirable letter grade. It would be the dreaded one-legged “A” – also known as a big ole “F”. I don’t know what would have happened in your family, but if would have ever brought…

Read MoreWhy Smart People Sometimes Do Stupid Things With Money

Why do smart people sometimes do stupid things with money? I’ve seen really smart people make strange financial decisions. Bought a brand new car and financed 106% of it (sales tax and all!) Go to college and finance it 100% with student loans while obtaining a degree comparable to a degree in basket weaving Go…

Read MoreKnown, Upcoming, Expenses – Capital One 360 Sub-Account Tracking

//This blog post was written by Joe Ziska – I loved this idea so much that I personally implemented it with my Capital One 360 accounts!// Q) What two things do the following have in common? Christmas; A flat tire; Your son going to college; Vacation in Hawaii; Your daughter getting married A) 1. They all cost money. 2. …

Read MoreStrategies For Saving Money

One of the largest issues I see during our one-on-one financial coaching meetings is the inability to save money. Here are some facts about saved money: Saving money is essential to long-term sustainability Saved money relieves stress Saved money allows you to take a chance Saved money allows life to happen (job loss, disability, pay cut,…

Read MoreAbout Joe

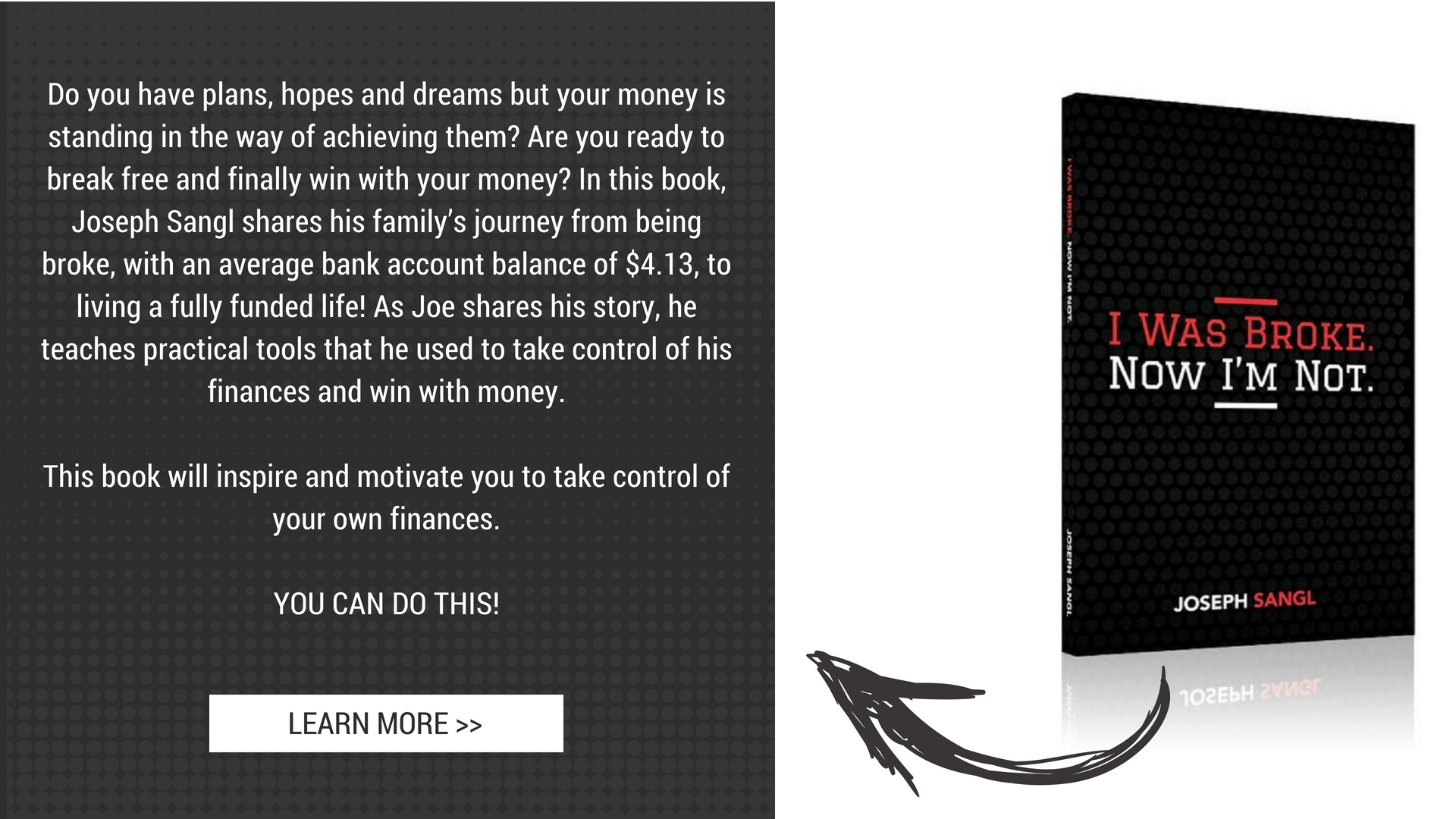

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

He is the founder of Fully Funded Life (previously I Was Broke. Now I’m Not.), the president and CEO of INJOY Stewardship Solutions, and Co-Owner of MinstryDeal.com.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.