THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

MONDAY MONEY TIP PODCAST: The U.S. National Debt

Another episode of the Monday Money Tip Podcast is LIVE! In today’s episode, we’re talking about the U.S. National Debt. Over the years, this debt has continued to increase. Today, we’re discussing what we can do to begin to lower this number. In our Current Money Events segment of the podcast, we’ll discuss personal debt. In…

Read MoreDo You Have a Vision for Your Money?

Do you have a vision for your money? When you receive those precious Washingtons, Lincolns, Hamiltons, Jacksons, and Franklins, do you have a clear idea for the utilization of each one of them? Or is that money dead on arrival – doomed to be sent on their way without advancing you toward your life’s plans,…

Read More401(k)’s Explained

I’m sure by this point you know it is very important to save into a retirement account so that at one point you can stop working. But this can be confusing to navigate when you are unsure of what the different accounts are and how they work. The numbers and letters are thrown around so…

Read MoreHow Interest Rates Work

I’m sure you have seen interest rates on a variety of different credit cards, car loans, student loans or other lines of credit. But what do these numbers mean? An interest rate is simply what you are being charged on a loan. For example, if you take out a $25,000 car loan at 5% interest,…

Read MoreHow Do Payday Loans Work?

I have two words when it comes to payday loans: RIP OFF! This type of lending is what I would classify as TRBL debt. T-R-B-L. Terrible. This type of lending is awful, and it should be illegal! So how do these loans work exactly? First, these businesses set themselves up in sections of town where…

Read MoreMONDAY MONEY TIP PODCAST: How to Never Have a Car Payment

Another episode of the Monday Money Tip Podcast is live! Many people believe they will always have a car payment but we’re here to tell you that this is simply not true. On today’s episode, we’ll share what you can do in order to never have another car payment. In our Current Money Events segment,…

Read MoreAbout Joe

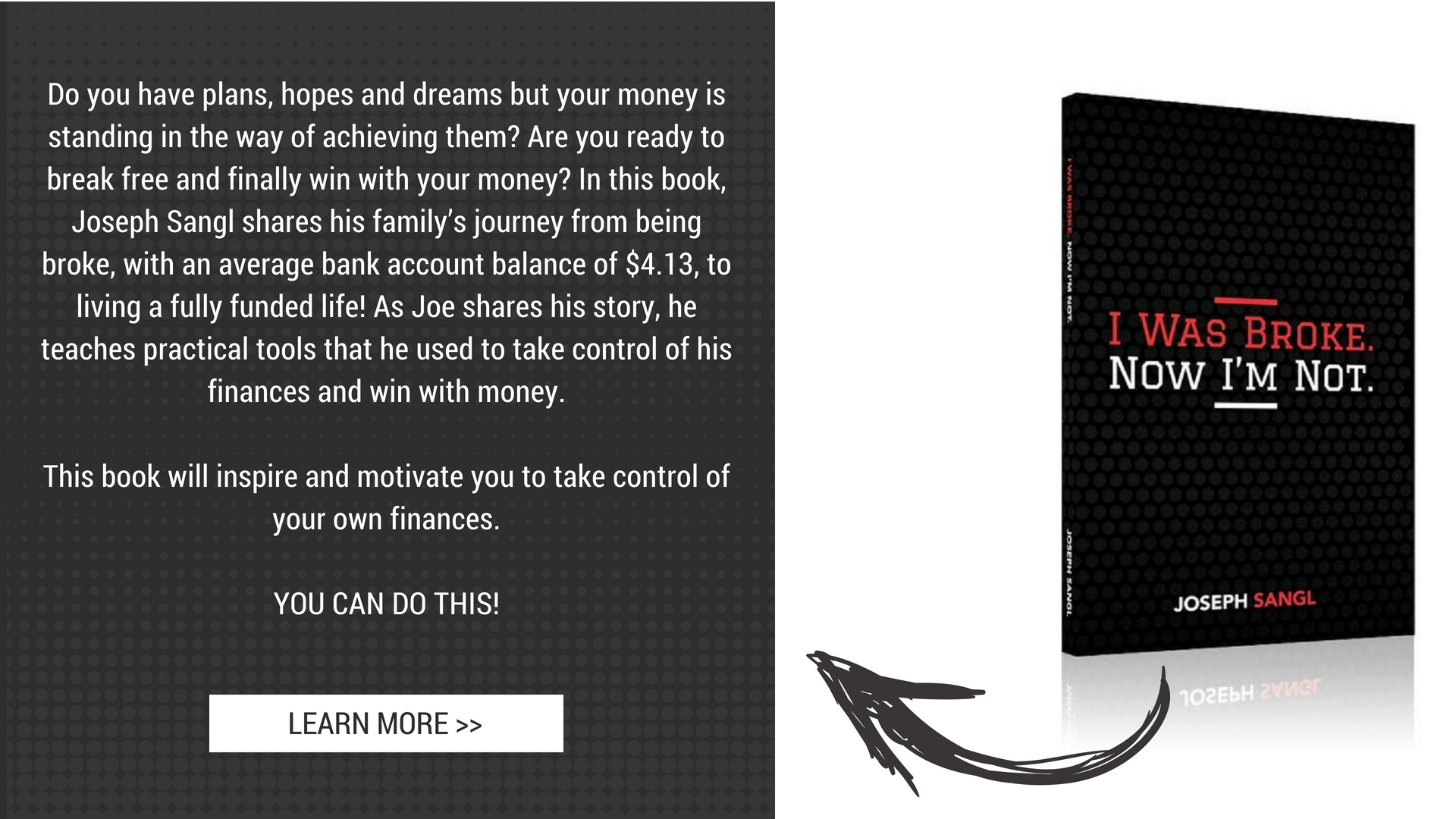

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

He is the founder of I Was Broke. Now I’m Not., the president and CEO of INJOY Stewardship Solutions, and Co-Founder of Fully Funded.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.