THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

Teach Your Kids About Money

It is so critically important for kids to have a sound platform of financial knowledge. Their knowledge of money (or lack of) will impact their spouse, their own children, their mental health, and their entire future. It can also affect you! Many parents are still being asked by their adult children for financial support because…

Read MoreSetting Financial Goals

I am passionate about helping others accomplish far more than they ever thought possible with their personal finances. I know that the number one way that folks will win with their personal finances is to have a well-written plan and clearly defined goals. Setting financial goals will help you stick to your budget, and ultimately…

Read MoreAre You Stuck Financially?

Have you ever been stuck financially? I mean STUCK. Do you feel so stuck that you can’t even gain any traction to get control of your finances? Perhaps you have no income because you have lost your job. Maybe you are in college and accumulating debt to pay for it. Perhaps your spouse spends money…

Read More5 Questions to Ask Before Spending Money

Do you ever get caught in the cycle of “see it, want it, and buy it?” Before you spend you don’t stop to think through your purchase. Now you not only have a new gadget that’s all yours, but you also have a high monthly payment to go with. It is my hope that this…

Read MoreBack to School?

School supplies? What does school even look like this year? If you’re a parent, you are probably wondering what back-to-school will look like this year. Maybe you are waiting for your school district to announce their plans for the year, or possibly the year’s start has already been delayed. Parents are trying to decide…

Read MoreAbout Joe

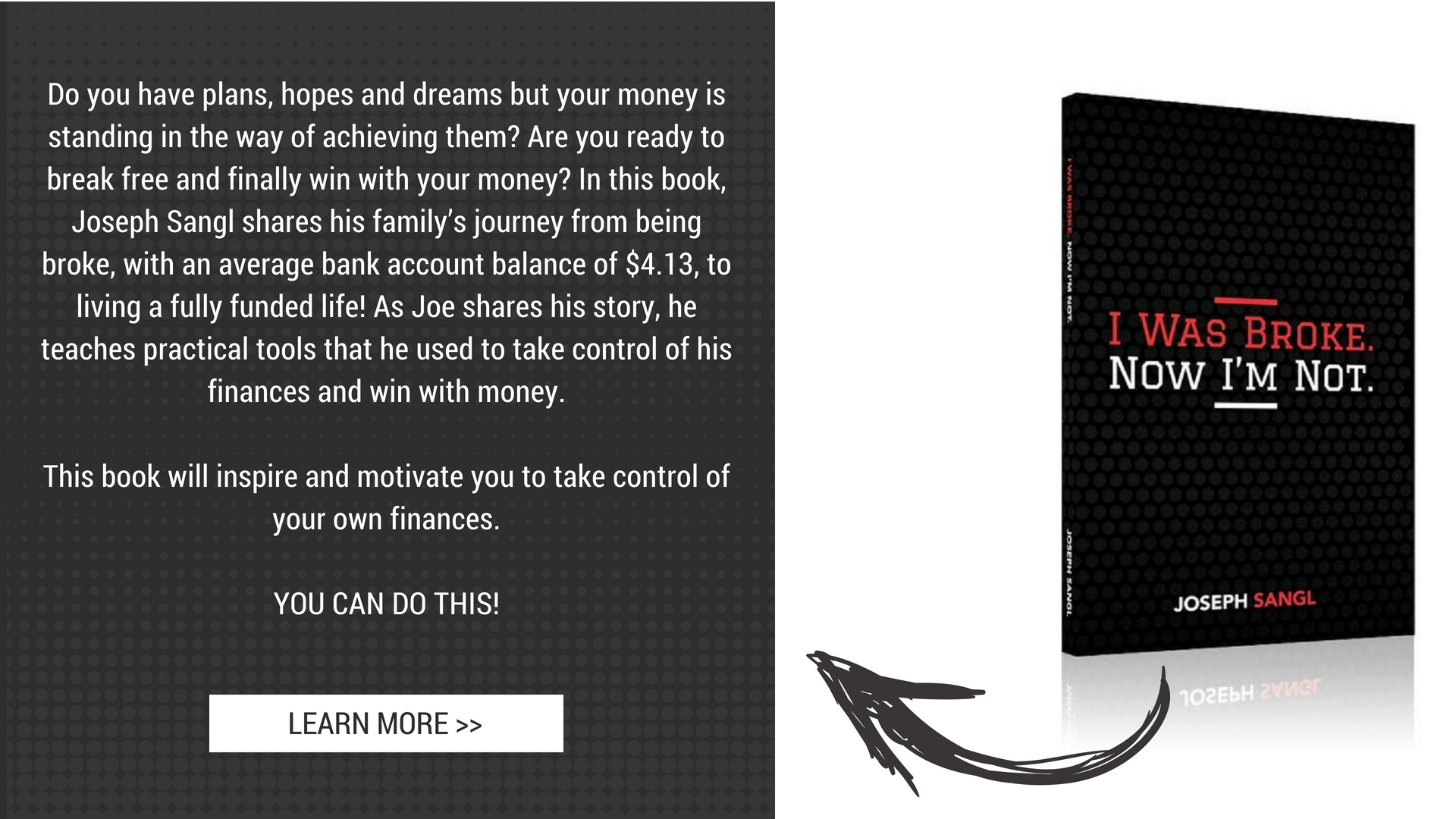

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

He is the founder of I Was Broke. Now I’m Not., the president and CEO of INJOY Stewardship Solutions, and Co-Founder of Fully Funded.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.