Archive for November 2010

SERIES: 5 Questions To Ask Before Spending Money

Welcome to the latest series on the wildly popular JosephSangl.com – 5 Questions To Ask Before Spending Money

It is my hope that this series will help provide you with practical questions to ask when preparing to spend a substantial amount of money. Practical questions that will help you truly understand the enormity of the decision and help you make the decision that is best for you and your family.

Question 2: Will this item INCREASE or DECREASE in value?”

Asking this simple question can prevent a lot of poor spending decisions!

Chewing gum goes down in value. So do cars, 4-wheelers, refrigerators, swimming pools, and clothes.

Businesses can go up in value. So can houses, land, antiques, mutual funds, company stocks, bonds, and intellectual property (patents, licenses, etc).

Here is what I KNOW: Not all of your purchases can be for items that increase in value, but if ALL of your purchases go down in value – something ain’t right!

BONUS: Find someone you know who is prospering with their investments. Invite them to lunch (pay for his/her lunch) and ask them to mentor you! They will probably LOVE IT!

SERIES: 5 Questions To Ask Before Spending Money

Welcome to the latest series on the wildly popular JosephSangl.com – 5 Questions To Ask Before Spending Money

It is my hope that this series will help provide you with practical questions to ask when preparing to spend a substantial amount of money. Practical questions that will help you truly understand the enormity of the decision and help you make the decision that is best for you and your family.

Question 1: “Do I need this?”

This can seem very basic, but as a “spender” I can get caught up in the “I WANT THIS!” moment and never stop to ask, “Do I need this?”

My garage is full of “I WANT THIS!” items that we never use. EVER! This includes a RC Airplane (it’s cool – but I don’t use it), bike (never ride it), tennis rackets (once every three years – not a priority), and many other items.

Pausing to ask, “Do I need this?”, can prevent a lot of poor spending decisions. I’m not saying that I never purchase things that are pure “wants” – I am saying that when I ask the key question, I make much smarter overall decisions.

BONUS: Wait overnight before answering the question! It is amazing the clarity that a good night of sleep will bring to a spending decision!

How To Have A Debt-Free Christmas

According to Sangl’s Dictionary, here is the definition of “Debt-Free Christmas.”

Debt-Free Christmas – noun The act of buying Christmas gifts without incurring any debt.

Here is the 1-2-3 steps that will ensure that you can have a Debt-Christmas of your own:

- Save money for Christmas throughout the year – save some money for Christmas every single paycheck.

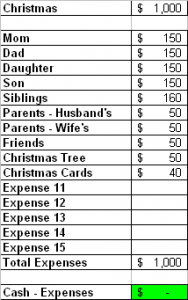

- In October/November, prepare a Mini-Budget for the money you have saved for Christmas. Click this link to pull the tool up: Mini-Budget Tool. See the picture below for a sample budget.

- Ensure that it balances to EXACTLY ZERO!

- Stick to the plan!

It is that simple!

Financial Truths

Here are some basic financial truths:

- Income – Outgo = Exactly Zero

- Consumer Debt is NEVER helpful long-term

- Saving a little every month trumps trying to save a lot once in awhile

- Automatic savings is far more consistent than relying on oneself to write a check every month

- A spending plan prepared BEFORE the month begins allows one to accomplish far more than one without a plan

- No one has ever cried that they had saved too much money, but many have cried over saving too little

- Retiring entirely dependent upon Social Security is far worse than retiring independent of Social Security

- Working together with your spouse on money will improve your marriage

- Prayer really works!

- Seeking wise counsel from those who have “been there – done that” always trumps “going it alone”

- Mutual funds are not the only way to build financial wealth

- Everyone CAN be debt-free – it is a choice

What are some other financial truths you would share?