Budgeting

Are You Stuck Financially?

Have you ever been stuck financially? I mean STUCK. Do you feel so stuck that you can’t even gain any traction to get control of your finances?

Perhaps you have no income because you have lost your job. Maybe you are in college and accumulating debt to pay for it. Perhaps your spouse spends money faster than you make it. Or maybe you are just lost when it comes to managing money. It might even be the fact that you have so much unsecured debt that you feel that the creditors should just change the amount owed to a cool $1,000,000 because it might as well be that much! Maybe you are disabled, and can’t figure out what to do to earn more money.

If this is you, this post is for you! In this post, I will be sharing steps you can take to become “unSTUCK”.

I am FIRED UP!

Step One: Why are you stuck financially?

It is important to understand why you are stuck financially. There are some situations that have definite ends to them (college) and other situations that have indefinite ends to them (job loss, disability, and overwhelming debt).

Why are you stuck?

Write it down on paper. Right now. Write “I am stuck financially because … “.

When I encounter situations where I don’t know what to do, I start writing. Writing enables me to put all of my thoughts on paper.

After writing all of my jumbled thoughts down, I set it aside for awhile. After a day or two, I revisit what I have written and identify the repetitive thoughts. This helps me identify the core issue.

Why are you stuck or what caused you to be stuck in the past?

Step Two: Plan what you have!

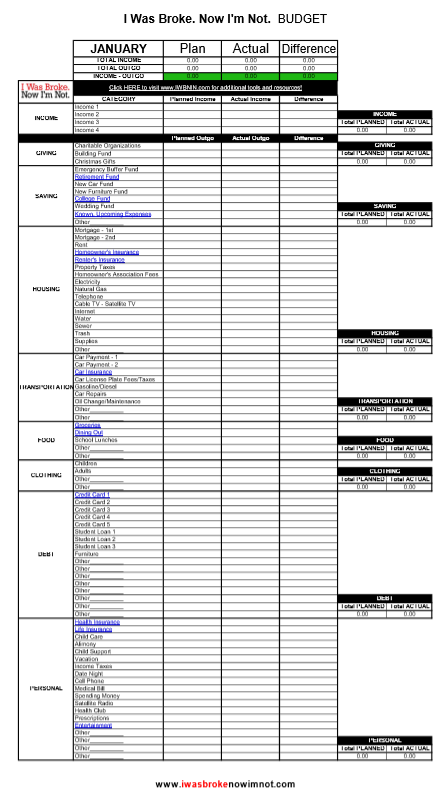

Now that you have written down the reasons that you are stuck, it is time to prepare a written spending plan.

Yes, a budget. Here is something I have learned – managed money goes farther than money that isn’t managed.

I know that what you have is limited. In some cases, VERY limited. BUT, it is imperative that you plan what you do have.

We offer free budget tools on the I Was Broke. Now I’m Not. website to help you start budgeting.

If you are paid once per month, this is the budget tool for you.

If you are paid multiple times per month (twice/month, bi-weekly, bi-monthly, weekly, etc.), this is the budget tool for you.

If you want to learn how to put together a great budget, you might want to read the “How Do I Budget?” post.

Step Three: Remember the priorities!

When you have an extremely limited amount of funds, it is important to remember the priorities. I have met a lot of people who have been tricked and shamed by credit card companies into paying the credit card bill instead of the house payment.

You have completed step two and planned what you do have, so now the next step is figuring out who gets paid and who does not.

My priorities are:

-

Essentials:

House payment (or rent), basic utilities, car payment, gasoline, and food. This does NOT include cable, internet, phone, restaurants, fashion clothes, etc.

-

Secured Debt:

If money remains after covering the essentials, then it is time to pay for the secured debts. If secured debts are not paid, the creditor has the right to come take the item. They will usually sell it at wholesale and come after the rest from guess who? So I would pay the secured debt next.

-

Unsecured Debt:

Creditors cannot immediately come take something from you so they can be paid later if the money runs out.

-

Fun:

This is last on the list. Besides I can have fun for free. Pickup basketball games, watching old movies, etc.

Who is the manager of YOUR money? It should be YOU! Not your creditors! YOU choose where it goes.

Even if you don’t have enough money to pay all of the bills, go ahead and put all of the bills into your spending plan. This is a KEY step! You need to clearly understand how large the gap is between your INCOME and your OUTGO.

I call this gap the “GO GET THIS” gap. That is the next step!

Step Four: Fill the “Go Get This” Gap!

I am sure that some read this as “Go work like crazy and earn more money”. I would certainly not disagree with working more and earning more! It is a GREAT way to fill in the “Go Get This” Gap.

But there are many more ways to fill in the gap! Here are quite a few.

-

Pray.

I am a Christ-follower, and I have seen the power of prayer.

-

If married, ensure that your spouse is on board.

There is POWER when you work TOGETHER on your finances! How do you get a spouse on board could be a year-long series, but it is so necessary. Jenn and I work together because we wrote down all of our earning and spending. When we saw that our OUTGO exceeded our INCOME, we knew that it was a serious issue! One strategy to try is to mail the kids off to Grandma & Grandpa’s (eliminate distractions) and tell your spouse that you want to talk to them about something that you really need them to hear. Something that is really important to you. Very important to you. And then show them your family’s finances planned out on paper. When you write out where you are stuck financially it tends to reduce the emotion towards each other. You have the opportunity to become a unified in your effort!

-

Govern your business.

If your business is struggling, it might be worth putting some “mileposts” in place. Mileposts are points one month, three months, six months, and twelve months away. An example of a milepost is “If we are at $5,000 sales in three months, we will keep the business. If it is at $3,000, we will keep it open for three more months. If it is less than $3,000, we are going to have to shut down the business.” The hardest thing in the world for an entrepreneur is to close their business. Tough, but necessary sometimes.

-

Sell something.

Maybe your house payment is eating you alive. Sell the house. It could be time to sell the motorcycle, the boat, the truck, the swing set, the four-wheeler, or the 50″ TV. Whatever you have of value that isn’t a “need” – it may be time to part with to help.

If you’re looking to sell something online check out Episode #106 of the Monday Money Tip Podcast for tips.

-

Reduce OUTGO.

Many times you can substantially lower your credit card payment just by calling them! I lowered my cable/internet bill by 75% just for calling! Get rid of the home telephone – you never use it anyway. Use cash envelopes for the categories you tend to spend impulsively (groceries, restaurants, shopping, entertainment, spending money). Call and get a new quote on your homeowner’s/auto insurance.

-

Chop up the credit cards!

If they are a crutch that keeps trapping you, it is time to chop them up. I chopped up my credit cards December 2002!

-

Make it a family effort!

There is NOTHING like a unified family. Nothing.

-

Pay secured debt before unsecured debt.

If you can’t pay everybody, consider paying just the secured debts. Call the unsecured companies and tell them that you will not be able to pay them this month, but that you fully intend to pay them. Tell the truth! There is power when you call someone and ask for help! They may or may not work with you, but when you are in bad shape financially you can’t pay them if you want to!

What are some other ways to fill in the “Go Get This” Gap?

Get Your Finances Organized!

It is extremely important to have your finances organized. In fact, I believe that lack of organization is one of the top reasons that people do not reach the peak of their financial potential. I am excited about this post, especially because we have a FREE tool to help!

Some of you may hear the word organize and your heart flutters with excitement, while others are probably filled with dread just by the sound of the word. Wherever you are on the spectrum, you can and NEED to get your finances organized. For your own sake, and for the sake of those you love.

Step One Understand why you are doing this in the first place

Let’s face it – we are all extremely busy. The last thing we need to do is initiate another paperwork process just for the sake of what “might” happen. I believe, however, that this process is an extremely valuable step toward maximizing one’s financial potential. If you take the time to complete the steps in this post, you will discover areas where your financial plan is lacking AND also where you are winning (which is very satisfying to see).

Here are some reasons to get organized financially:

- Control: It is hard for the finances to run out of control when you are focusing this intently on your financial affairs.

- Improved financial focus: We tend to improve that which we focus our attention on.

- We WILL die some day: Our family will appreciate a clearly organized set of financial affairs.

Organization and a great financial plan are two of the keys to the reason that Jenn and I have been able to experience financial freedom!

Step Two Prepare a list of all of your financial accounts

If you are a slightly, or very disorganized person (like I used to be!), this is probably going to be the most difficult part of the entire organizational process. It is important to gather together your financial statements so you can easily prepare a one or two page document that details your entire financial picture.

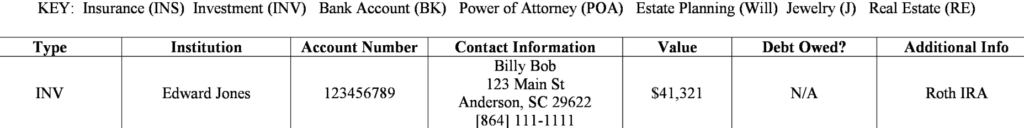

To speed up the process, we are PUMPED to provide a FREE TOOL for you to consolidate all of your information in one place – our Financial Accounts Form. You can download a copy from our Organizational Tools page on the IWB website.

Below is a sample of how the information can be written into the file.

Step Three Information to include on your Financial Accounts Form

This form is meant to be the be-all to end-all location for your entire financial picture. When you are looking for key financial information, you won’t have to go far because it is all contained within this file. When you pass away, it allows your estate executor to easily understand what they are dealing with.

Here are the key items to include in your Financial Accounts Form.

-

Investment Accounts

Include your 401(k), 403(b), 457, TSP, Roth IRA, IRA, stock, bond, and mutual fund investments.

-

Bank Accounts

Include checking, savings, money market, CDs, and any other accounts held at a bank or credit union.

-

Real Estate

If you own real estate, be sure to list the addresses and the financial status of these holdings.

-

Will

According to Bankrate.com, 58% of Americans do not have a written will. Have one, and include it’s location and your assigned executor on this document.

-

Power of Attorney

Healthcare POA, Limited POA, or other legal assignments of responsibility should be included in this document.

-

Insurance Policies

Include life insurance – be sure to include policies provided through your workplace. Also include insurance on key possessions owned.

-

Jewelry (or other valuables)

If you have valuable possessions, be sure to list them and their locations.

-

Safe Deposit Box

If you have one, indicate it on this document and include its location!

I know. I know. This can seem overwhelming, but it is absolutely worth the effort to put this together!

Step Four Make sure you are budgeting

Having your accounts listed out and your financial affairs in order is so important. What good does that do you though if you aren’t organized with the money that you spend?

Budgeting is another important step to making sure you are financially organized. If you haven’t started budgeting yet I suggest you check out my post “How Do I Budget?” It’s chalk full of tips on getting started along with free tools to make it easier for you.

Budgeting is part of being organized with the money that comes in and what goes out of your account each month. Taking control of this sets you up for financial success.

Step Five Where to Find Free or Cheap Resources

- Check your local hospital for free healthcare power of attorney forms.

For instance, our county hospital provides links to South Carolina’s free power of attorney form. Check your local hospital system’s website to see if they have the same available. They may also offer advanced directives. An advanced directives form takes the pressure off of your loved ones to make care decisions for you if you aren’t able to communicate your desires yourself.

- Some county library websites will also offer free legal forms, including those that are state specific.

- Several free legal documents (including power of attorney and a basic will) are located HERE

If you have substantial assets (including sizable term life insurance policies), I highly recommend that you meet with an attorney to have them review your documents to make sure everything is well organized and accurate. It may cost you up front, however it will give you peace of mind and save your loved ones in the long run.

Where else have you found great free (or cheap) legal documents?

Get Your Finances Organized!

Those Type A people reading this are probably chomping at the bit to get this done (if they haven’t already started). However, I know this may not be everyone’s idea of fun. Don’t delay though!

My hope is that as you’ve seen the benefits of having your finances organized it will keep you motivated to see it through. Getting organized may seem like a daunting task, but you should feel better equipped for it now.

As you organize your accounts and records not only will it help your loved ones in the long run, but it will become easier for you to understand your current financial position. This will help you as you make monthly decisions in your budget and set you up for success with your finances.

This may be a time consuming task your first go round, but after you have this set up it will be easy to update and maintain it going forward.

You Can Be Debt-Free

I have found that a vast majority of those who sign up to attend the Financial Learning Experience are living paycheck-to-paycheck AND carrying debt. In fact, statistics from surveys I have conducted show that 72% of those attending my classes are living paycheck-to-paycheck. Of those 72% living paycheck-to-paycheck, 24% are BEHIND on payments.

Only 3% felt that they are doing well financially.

This is a NATIONAL problem. No matter where I go, I see the trappings of debt – marriages failing, stress, depression, and hopelessness. And all of this is happening in one of the wealthiest countries on the planet! This is entirely unacceptable!

So, as part of my crusade to help America become debt-free, I am going to share the process I followed to become debt-free.

Before I get started, I want to ask you these questions.

- Would you join me in my crusade?

- Would you share this with others?

- Would you commit to become debt-free?

I WANT YOU TO BECOME DEBT-FREE!!! It changes your life! It enables you accomplish far more than you ever thought possible with your personal finances! It allows you to go do exactly what you were put on earth to do – regardless of the income!

Step 1 – Understand WHY you want to be debt-free!

I believe this is the most important step in becoming debt-free! In the hundreds of financial counseling sessions I have held, it is amazing how many people do not have a plan for their lives.

I ask them, “Why do you want to win with your money?” and they stare at me like I am from outer-space.

“Why?” they stammer back at me.

Seriously, I believe that it is the first time that many of these people have ever seriously thought about what they want to accomplish with their lives. As a result, they are bumbling through life just “trying to make it through the day”.

What a miserable way to live!

I cannot overstate this fact – IF YOU AIM AT NOTHING, YOU WILL HIT IT EVERY SINGLE TIME!

Write out your hopes and dreams.

When Jenn and I wrote down our hopes and dreams on paper it opened our eyes to the fact that our money management (or lack of) was literally ROBBING us of our future! We wanted to move back to Anderson, SC to take a job that paid way less than what we were making, but every single dinner at Outback was robbing us of that opportunity. Every single debt payment went off to make the bank wealthy while at the same time robbing us of our God-given dreams!

That made me MAD! It made me FURIOUS! It made me realize how incredibly STUPID I was to be managing our money so crazily! I had $755 PER MONTH going out to pay car debt, credit card debt, and student loan debt. Add in the stupid house payment, and I had over $1,700 per month running off to make the bank wealthy!

By writing out our hopes/dreams on paper, Jenn and I were motivated to manage our money differently. It caused us to view debt differently.

Are you ready to get rid of your debt?

Take your first step today by print out THIS FORM and filling out your own hopes/dreams. If you are married, you need to do this separately and then take time to discuss it with each other.

By the way, one of my hopes/dreams is for you to become debt-free!

What has kept you from attacking your debt?

Step 2 – List your debts.

During financial counseling sessions, it is a guarantee for any person who has debt that I will calculate their debt freedom date. You should see people’s reactions as I put together a list of their debt! Their reactions relay to me the true facts of debt. Here are some very common reactions that I see or hear.

- Hiding their eyes

- “Oh no!”

- “I’ve never added it up.”

- “This is scary.”

- Moving to a defensive position as if to guard themselves against the debt

- Turn their head so they don’t have to look at the debt total

I KNOW that it can be scary to total up debt. The mere fact that it is so scary tells me two things:

1. People do not like debt.

2. People have not been paying attention to their finances and do not have a well-defined plan for their life. Otherwise, they would not have incurred most of the debt. It is literally ROBBING them of their financial future!

Here is what I say to them – “If you don’t know how many heads the dragon has or how large the dragon is, how can you effectively defeat it?”

It is time to slay the dragon. Use THIS FORM to prepare a well-organized list of your debt.

Why is it so scary to total up debt?

Step 3 – Calculate your debt-freedom date.

It is really very simple to calculate your Debt Freedom Date. You need two numbers to calculate your Debt Freedom Date – Total Debt Owed and Total Monthly Payments. I pretend that there is actually only one debt – with one big balance and one big monthly payment.

![]()

Look at the sample debt list below. This family will be debt-free in just 33 months!

In the TOOLS section, there is a free tool called the Debt Freedom Date Calculator. If you enter your debts and monthly payments into this tool, it will calculate your Debt Freedom Date for you! If you don’t have Microsoft Excel, click HERE for a web-friendly version.

How many months until you are debt-free?

Step 4 – Establish accountability to become debt-free.

The strongest among us can still fall to temptation! You could be making fantastic progress toward debt-freedom and then a new truck pulling a new boat passes you on the road. If you are not careful, you will also be pulling a new truck and boat down the road!

There are two key ways to ensure you are held accountable to your goal of debt-freedom!

If married, work together with your spouse. If unmarried, have someone you trust (someone who has won with their money) hold you accountable!

There is incredible power when you work together with your spouse toward debt-freedom! It is a common goal that will unify your marriage and cements your commitment to managing your resources together.

I have also found that when I have a bad case of the “I Wants” and “I Gotta-Have” Jenn does not. She shuts me down! Then, when Jenn gets a bad case of “I Really Want This” I do not. I shut her down! Why? Because we are not doing debt! We are THROUGH with it!!!

Plan your spending every single month!

Planned money goes farther than unplanned money! Every single month Jenn and I sit down TOGETHER and spend every single dollar on paper before we are paid. Don’t miss that – that was good! Every. Dollar. On. Paper. BEFORE. We. Are. Paid.

From the day that Jenn and I started budgeting, we have not incurred any new debt. In fact, we became debt-free (minus the house) in just 14 months!

I can tell you this. I HATED the idea of budgeting and now all I do is yell from the mountaintops about how important it is and how EZ it is to budget! There are FREE budget forms that are available HERE. Use one of them to start your journey to debt freedom!

Your budget will hold you accountable. I wouldn’t be surprised if it helped you free up $200 – $500 per month to attack your debt even harder. It did for me!

If you’re already debt-free, how did accountability help you stick to your debt-freedom plan?

Step 5 – Secure your debt-freedom.

Save at least $1,000 before attacking your debt!

I have seen so many people calculate their Debt Freedom Date and get all fired up about attacking their debt. They sell everything and everyone in sight. They can’t shut up about getting out of debt. It is all they talk about with their spouse. They have even sold their Clay Aiken AND Celine Dion albums!

Everything goes great for two months. They smile every time I see them. “This is awesome”, they tell me enthusiastically.

Five months later, they avoid me. When I ask them what is up, they say something like, “Well, Johnny broke his arm and the emergency room bill and doctor bills cost me $1,500. I had no savings so now I am right back where I was – falling back into more debt.”

How demoralizing is it to attack debt so fervently and then have to go right back into debt? It is AWFUL! Don’t do that! Instead, save up at least $1,000 into an emergency fund before attacking your debt and THEN you can attack your debt all you want!

What happens if you have an emergency pop up while you are attacking your debt? You can use the emergency fund to cover the expense. To replenish the emergency fund, slow down on the debt pay-off plan until you have the $1,000 back in the emergency fund!

By the way, if you have a house, kids, or more than one car I highly recommend $2,500 for your emergency fund.

Secure your debt freedom plan with your emergency fund!

Congratulations! You now know the process that Jenn and I used to become and STAY debt-free! You are now equipped!

What are you going to do now that you are equipped to become debt-free?

You can be debt-free!

I want to equip you to become debt-free! Jenn and I became debt-free in 14 months by following this process, and I can tell you this – there is NOTHING like living life without the trappings of debt!

Let’s review the steps to debt freedom.

Step 1 – Understand WHY you want to become debt-free! You greatly improve your chances of becoming debt-free when you understand the reasons that you are making sacrifices in lifestyle!

Step 2 – List your debts. If you don’t know how large the giant is, it makes it really difficult to understand the overall situation!

Step 3 – Calculate your Debt Freedom Date. When you have put together your Debt Freedom Date calculation, print it out! Put it on the refrigerator! As you pay off each debt, draw a big line through it! You will not believe the conversation this will start with your family and friends as they come over to visit.

Step 4 – Establish Accountability. If married, hold each other accountable. If unmarried, have someone who has won with their own money and has your best interest in mind.

Step 5 – Secure Your Debt Freedom. Before attacking your debt save at least $1,000, or $2,500 if you’re married with children, so you have an emergency fund.

I hope that you have taken the time to write out your plans, hopes, and dreams for your life. Knowing these will help you stay the course. It will motivate you to say no now so you can win later!

How Do I Stop Impulsive Spending?

Recently, I was teaching the Financial Learning Experience at my local church when I had a gentleman raise his hand and asked this question.

“How Do I Stop Being Impulsive?”

My answer? I don’t know to stop the impulsive nature, but I DO know how to control my impulse to spend recklessly.

I am a SPENDER. I am the type of person who would go out and accidentally buy a truck. I am a spender to my very core. I like buying things. You could say impulsive spending comes naturally to me. The best way I’ve found to combat my impulse to spend is being intentional about my finances.

Here are some steps I have taken that helped me reign in my impulsive spending nature, and it has allowed us to win financially!

A Written Spending Plan

The first thing that helped me reign in my impulse to spend is putting together a written spending plan EVERY month BEFORE the month begins. Jenn and I continue to do this EVERY month BEFORE the month begins. Did you catch that? EVERY month.

The first thing that helped me reign in my impulse to spend is putting together a written spending plan EVERY month BEFORE the month begins. Jenn and I continue to do this EVERY month BEFORE the month begins. Did you catch that? EVERY month.

It reinforces the fact that we cannot flippantly spend our money and expect to succeed. When you have personally helped prepare the spending of your money on paper, you are much more aware about whether or not you can afford the “I WANT THAT!” item.

Having a written plan means that each month you have already told your money where to go on paper before the month even starts. Instead of wondering, “Can I afford this?” or thinking “Maybe it will be okay just this once,” you already know the answer. You know what you have allocated for each category, and if you spend impulsively how it will break the budget.

Jenn and I use the budget forms that are available on the TOOLS page of our website. If you want more information about how to start budgeting check out our post “How Do I Budget?” for tips on how to get started. Trust me, the word budget doesn’t have to send chills up your spine. I can, and it will help you win with you money!

Cash Envelopes

Like I said before, I am an impulsive spender, but even I will not impulsively spend money on the electric bill. I won’t impulsively purchase gasoline. I don’t impulsively send extra money to the cable company. There are some things that I am not going to impulsively spend money on.

However, there are some things that I am VERY impulsive about. Items like groceries, dining out, clothes, spending money, and entertainment. I can go through some money really fast with these items! Since I know that I am impulsive for these spending categories, I use cash envelopes.

However, there are some things that I am VERY impulsive about. Items like groceries, dining out, clothes, spending money, and entertainment. I can go through some money really fast with these items! Since I know that I am impulsive for these spending categories, I use cash envelopes.

At the start of the month we add up the amount we have put in the budget for these categories. We then pull that amount out in CASH. The rule is that we can not pull more money out from the bank AND we can not use the ATM or debit card. I can not overspend cash.

To read more about why I LOVE cash envelopes check out this post.

Chop Up Credit Cards

You may pay yours off every month, but the vast majority of Americans do not. I was part of the vast majority, and I had to admit that I was a completely loser with credit cards. I ran those stupid things up three different times. I was stupid with them. They really catered to my impulsive nature. So I did what had to be done and applied the scissor blades to them and shut the accounts down.

You may pay yours off every month, but the vast majority of Americans do not. I was part of the vast majority, and I had to admit that I was a completely loser with credit cards. I ran those stupid things up three different times. I was stupid with them. They really catered to my impulsive nature. So I did what had to be done and applied the scissor blades to them and shut the accounts down.

After years of not using credit cards I do have them again now. How do I keep myself in check? Well, I still don’t use them on things I am impulsive about. Can I use them to pay utility bills? Yes! Can I use them to book travel for work trips? Yes! Do I use them for my spending money that I have budgeted for each month? Absolutely NOT!

Many of you are like me – you need to kill the bad spending habits, and the only way to do that is to get rid of the card. If you are able to have them later on you have to make sure you have accountability in place – like a budget that you review with your spouse or not using them for things you are tempted to overspend on.

How do I eliminate the credit card debt I already have from impulsive spending?

Maybe you are thinking, “Joe, that sounds great, but I’ve already wracked up credit card debt.” If you have questions about how to pay off credit card debt check out our post “You Can Be Debt-Free.” You can also listen to our Monday Money Tip podcast episode on “0% Balance Transfer Credit Cards” or check out options of 0% balance transfer credit cards on our Next Steps page to see if they can help you eliminate your credit card debt.

If you are a fellow spender, what have you done to control your impulsive spending habits?

Let there be…TIME

Sometimes the best cure for the “I wants” is time. The moment we see it we want it, however if we wait to purchase sometimes the desire fads.

If today you see the shiny new motorcycle your neighbor just bought you may think “I want one.” Don’t run down the street to your local dealership and purchase it right away. If you wait a few weeks it will bring clarity. “That motorcycle is awesome, however I really would rather save up for a boat that my whole family can enjoy.”

The more time between the “I WANT THAT!” moment and the actual “Purchasing Decision” moment, the clearer the decision will be. Impulsivity can lead to buyers remorse, and a slue of unnecessary things filling your home that you really don’t need (or want for that matter).

Seek Advice

One of the best ways to stop impulsive spending is to seek guidance from someone you trust and wants to see you prosper. I’ve said this before and I’ll say it again (and again and again), find wise financial counsel. If you are married include your spouse.

Having someone else invested in seeing you succeed financially creates accountability and will encourage you along the way. It’s a lot easier to stay the course, and stop the impulsive spending when you know you are going to have to answer for the purchases you’ve made.

Stay The Course

We are ALL impulsive. It seems to be different things for each of us, but we all have a case of impulsiveness every now and then.

If you do get off course – make the rash purchase – don’t let it derail you. Tomorrow is a new day, and a new opportunity to make wise spending choices. Look at what lead to your impulse purchase, and think about ways to prevent something like that in the future.

I wonder if any of you out there would share some “near misses” where you almost made a horrible, snap-judgment financial decision but you did not. What helped you make the decision to back out? How does it feel now as you look back on the situation?

Budgeting When You Have Irregular Income

Do you have irregular income? Maybe it is seasonal or cyclical.

There is a large group of folks whose family economy is powered by irregular income.

Real estate agents, hair stylists, commissioned salesmen, and business owners all experience seasonal or cyclical income.

Folks who live with this type of income often tell me that it is impossible to budget. They say that they have no idea what they will make this month, so it is just impossible.

I say that not only is it possible, but that folks with irregular income need to be budgeting more than anyone!!!

In this post, I will explain how to prosper while earning irregular income. It is my goal to help you stop living the feast and famine lifestyle that is so often associated with irregular income. Here’s a hint – It’s EZ!!!

Step 1 – Recognize it!

To avoid living the feast/famine lifestyle, you must recognize that you have irregular income! If you have ever suffered during the “off” season, you KNOW what I am talking about! In order to stop having your life severely impacted by “off” seasons, you must prepare! It’s not enough to acknowledge you have irregular income, you have to decide to do something about it.

Question: If your family economy is powered by irregular income, what do you do to prepare for “off” seasons?

Step 2 – Determine monthly expenses

The next step is to determine how much money is necessary to make the household operate efficiently for each month. This is key to living free from the feast and famine lifestyle. To determine your monthly expenses, you should pull up a monthly budgeting form and do the following.

-

Fixed Expenses

Enter all your fixed expenses – house payment, utilities, gasoline, car payments, credit card payments, groceries, cell phone, childcare, etc. This also includes SAVING for retirement!

-

Variable Expenses

Enter the average of all your variable expenses – clothing, spending money, entertainment, dining out, etc.

-

Known, Upcoming Non-monthly Expenses

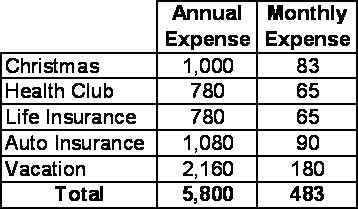

This is a KEY STEP!!! If you do not add in all of those known, non-monthly upcoming expenses, you will continue to live the feast/famine lifestyle (more likely the famine lifestyle!!!!). These types of expenses are BUDGET-BUSTERS. Here is what I do. I list all the known, upcoming non-monthly expenses and place their annual cost next to them. I then divide that number by twelve to determine how much I need to save per month.

Example of Known, Upcoming Non-monthly Expenses

There are lots of expenses that we all have that are non-monthly, but we know how much they will cost us. Some examples are car insurance, car tags, life insurance, or gym memberships. In this example I have five annual expenses that I need to plan for. I would include a line item of $483 in my monthly budget for “Known, Upcoming Non-monthly Expenses”. This allows me to bring a stop to the feast, famine lifestyle by saving for items that I know are coming!!!

Want to read more about planning for known, upcoming non-monthly expenses? Click HERE.

You now have a monthly budget that will change very little through the year!

Question: What have been the biggest budget-busting expenses you have experienced?

You have successfully completed Step 2 – Determine monthly expenses!

Now, of course, the trick is to have enough cash on hand every month to make this monthly budget work! Ahhhhh, that my friend leads us to step 3!

Step 3 – Save up three months’ worth of expenses

WHAT?!!!! I am sure that is what many of you are saying right now! Yes, I did say that you need to save up at least three months of expenses. Remember in step two that you calculated your monthly expenses? Multiply that number by three, and you have your savings target. I call this savings the “Known Slumps Fund”! You know that slumps are coming, so be prepared!!! This is HUGE in eliminating that horrible feast/famine lifestyle!

WHY?!!! You might be asking this question. Why on earth should I save up at least three months’ worth of expenses? Man, I am glad you asked that question!

How a “Known Slumps Fund” Works

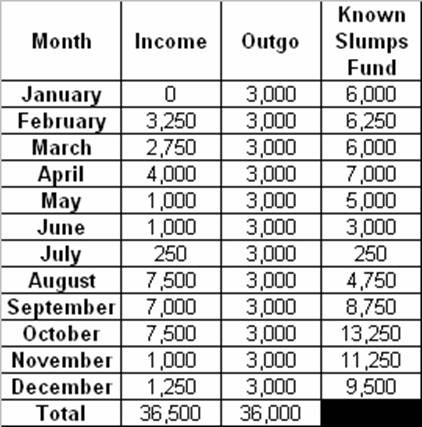

Let’s say that you have monthly expenses of $3,000. This means that you need to have at least $9,000 in your “Known Slumps Fund”.

Let’s look at a year’s worth of expenses. Now, it is easily seen that this person has earned enough to make it this year. They have taken in $36,500 for the year. BUT look at how irregular the income is! Have you seen something like that before in your business? This causes life to be CRAZY. In January, you are eating ramen noodles like they are going out of style. February through April are decent, but then it dies again May through July. Famine of the worst degree! All of the sudden, August through October are awesome! Feasts abound! Then November and December come in with back to back terrible incomes. Back to the ramen noodles!

What should you do? Get a “Known Slumps Fund” that equals three times your monthly expenses!

Let’s see what difference that makes!

When you look at this chart you realize the POWER of having three months expenses in the bank! Whether you have a $500 month or a $6,500 month, you live on $3,000 that month. That means that you get to EAT!!! You can save money (remember the monthly expenses includes retirement savings!). That means that you can have some fun each month!

The “Known Slumps Fund” absorbs the irregularities of your income! Fill up your “Known Slumps Fund” – it will take so much stress out of your life!!!

Question: Which is more important to you – debt reduction or funding your Known Slumps Fund?

Step 4 – Become personally debt-free and operate your business debt-free

Now, I am certain that you believe I have completely fell off my rocker. You might be saying, “Joe, you are crazy! There is no way I can do this!” Well, I have seen many people operate their business debt-free.

What are the advantages of operating a business debt-free? Let me count the ways!

- Monthly expense load drops! There are no interest payments to make!

- Your business can absorb downturns much more effectively. Again, there are no interest payments to absorb!

- Breathing room. It is amazing how much stress a pile of debt brings on.

- When you spend your own real money, you will manage it better. I don’t know why this is, but if I am spending someone else’s money (i.e. the banks) I am much more susceptible to make a riskier decision! When I am spending my money, I am much more likely to do thorough due diligence before doing a deal!

Question: What are some other advantages of operating a business debt-free?

Budgeting with Irregular Income is Possible

So, don’t let your irregular income keep you from budgeting. Recognize that you have seasonal or cyclical income so you can avoid the feast or famine lifestyle. Next determine what your monthly expenses are. These include your fixed monthly expenses, variable expenses, and your know upcoming non-monthly expenses. Then save up three month’s worth of expenses in a “Known Slumps Fund” to help you weather those months when your income dips drastically or stops. Finally, live personally debt-free and operate your business debt-free. This isn’t something you can achieve overnight, but this goal will help you make tough choices along the way to set yourself up for long term success. Remember, budgeting with irregular income is possible!

Looking for additional Personal Finance Resources? You can obtain free tools by clicking HERE and purchase books/materials by clicking HERE.