Get Your Finances Organized!

It is extremely important to have your finances organized. In fact, I believe that lack of organization is one of the top reasons that people do not reach the peak of their financial potential. I am excited about this post, especially because we have a FREE tool to help!

Some of you may hear the word organize and your heart flutters with excitement, while others are probably filled with dread just by the sound of the word. Wherever you are on the spectrum, you can and NEED to get your finances organized. For your own sake, and for the sake of those you love.

Step One Understand why you are doing this in the first place

Let’s face it – we are all extremely busy. The last thing we need to do is initiate another paperwork process just for the sake of what “might” happen. I believe, however, that this process is an extremely valuable step toward maximizing one’s financial potential. If you take the time to complete the steps in this post, you will discover areas where your financial plan is lacking AND also where you are winning (which is very satisfying to see).

Here are some reasons to get organized financially:

- Control: It is hard for the finances to run out of control when you are focusing this intently on your financial affairs.

- Improved financial focus: We tend to improve that which we focus our attention on.

- We WILL die some day: Our family will appreciate a clearly organized set of financial affairs.

Organization and a great financial plan are two of the keys to the reason that Jenn and I have been able to experience financial freedom!

Step Two Prepare a list of all of your financial accounts

If you are a slightly, or very disorganized person (like I used to be!), this is probably going to be the most difficult part of the entire organizational process. It is important to gather together your financial statements so you can easily prepare a one or two page document that details your entire financial picture.

To speed up the process, we are PUMPED to provide a FREE TOOL for you to consolidate all of your information in one place – our Financial Accounts Form. You can download a copy from our Organizational Tools page on the IWB website.

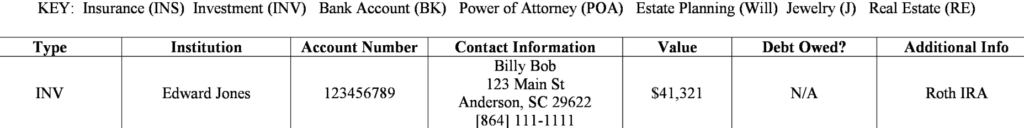

Below is a sample of how the information can be written into the file.

Step Three Information to include on your Financial Accounts Form

This form is meant to be the be-all to end-all location for your entire financial picture. When you are looking for key financial information, you won’t have to go far because it is all contained within this file. When you pass away, it allows your estate executor to easily understand what they are dealing with.

Here are the key items to include in your Financial Accounts Form.

-

Investment Accounts

Include your 401(k), 403(b), 457, TSP, Roth IRA, IRA, stock, bond, and mutual fund investments.

-

Bank Accounts

Include checking, savings, money market, CDs, and any other accounts held at a bank or credit union.

-

Real Estate

If you own real estate, be sure to list the addresses and the financial status of these holdings.

-

Will

According to Bankrate.com, 58% of Americans do not have a written will. Have one, and include it’s location and your assigned executor on this document.

-

Power of Attorney

Healthcare POA, Limited POA, or other legal assignments of responsibility should be included in this document.

-

Insurance Policies

Include life insurance – be sure to include policies provided through your workplace. Also include insurance on key possessions owned.

-

Jewelry (or other valuables)

If you have valuable possessions, be sure to list them and their locations.

-

Safe Deposit Box

If you have one, indicate it on this document and include its location!

I know. I know. This can seem overwhelming, but it is absolutely worth the effort to put this together!

Step Four Make sure you are budgeting

Having your accounts listed out and your financial affairs in order is so important. What good does that do you though if you aren’t organized with the money that you spend?

Budgeting is another important step to making sure you are financially organized. If you haven’t started budgeting yet I suggest you check out my post “How Do I Budget?” It’s chalk full of tips on getting started along with free tools to make it easier for you.

Budgeting is part of being organized with the money that comes in and what goes out of your account each month. Taking control of this sets you up for financial success.

Step Five Where to Find Free or Cheap Resources

- Check your local hospital for free healthcare power of attorney forms.

For instance, our county hospital provides links to South Carolina’s free power of attorney form. Check your local hospital system’s website to see if they have the same available. They may also offer advanced directives. An advanced directives form takes the pressure off of your loved ones to make care decisions for you if you aren’t able to communicate your desires yourself.

- Some county library websites will also offer free legal forms, including those that are state specific.

- Several free legal documents (including power of attorney and a basic will) are located HERE

If you have substantial assets (including sizable term life insurance policies), I highly recommend that you meet with an attorney to have them review your documents to make sure everything is well organized and accurate. It may cost you up front, however it will give you peace of mind and save your loved ones in the long run.

Where else have you found great free (or cheap) legal documents?

Get Your Finances Organized!

Those Type A people reading this are probably chomping at the bit to get this done (if they haven’t already started). However, I know this may not be everyone’s idea of fun. Don’t delay though!

My hope is that as you’ve seen the benefits of having your finances organized it will keep you motivated to see it through. Getting organized may seem like a daunting task, but you should feel better equipped for it now.

As you organize your accounts and records not only will it help your loved ones in the long run, but it will become easier for you to understand your current financial position. This will help you as you make monthly decisions in your budget and set you up for success with your finances.

This may be a time consuming task your first go round, but after you have this set up it will be easy to update and maintain it going forward.