Kids & Money

Teach Your Kids About Money

It is so critically important for kids to have a sound platform of financial knowledge. Their knowledge of money (or lack of) will impact their spouse, their own children, their mental health, and their entire future. It can also affect you! Many parents are still being asked by their adult children for financial support because their kids never learned and internalized financial education and responsibility. That is why I want to help you learn how to teach your kids about money!

YOU have the primary responsibility for teaching your kids about money!

Who taught you how to manage money?

Think about this question for a moment.

In my own life, I completed kindergarten through high school without taking one class about money management. I then went to college for four years and received a bachelor degree without having one class focused on personal finances. I then went on to graduate school for another three years and received a masters degree – still without a single class about money management.

When you add it up, it is thirteen years of K-12 PLUS four years of undergraduate study PLUS three years of graduate study. That is twenty years of formal education without a class on money about how to manage money. Of course, I learned skill sets that enabled me to earn a lot of money, but I had no knowledge of what to do with it. I did find that I was really good at one money skill set: spending it.

So from who and how should we learn about money management?

Most of us obtain our financial education primarily from marketers and our parents. For better or worse, this is who educates us about money.

There were great things I learned from my parents, these include:

- The value of hard work

- Work = Get Paid; Don’t Work = Don’t Get Paid

- Compound interest is my friend if I am not paying on debt.

There were also some not-so-great things about money I learned from marketers, such as:

- If you want it now, go ahead and get it!

- I’ll always have a car payment.

- The use of debt can really help me win financially.

The bottom line is this: If we do not educate our children about money, who will? If we abdicate the responsibility to educate our children and we mismanage money ourselves, it should be no surprise when our children make stupid financial decisions and show up asking for our help to bail them out.

How have your parents influenced the way you manage money?

Walk the Talk

“Do as I say. Not as I do.”

I have hated that statement since the first time I heard it. A five-year-old child can see right through this statement. A mental note is made that “Mom does not even believe what she is telling me. That means whatever she just said is not very important.”

If you are a parent, you know you have been trapped before by this. I remember when we told my oldest daughter (when she was around the age of three) that the word “hate” was not a very good word and she should not use it. Of course, the dreadful moment arrived (probably 25 minutes later) when I said, “I HATE the stupid Colts! They can’t win the big game!”

Instantly, my daughter delivers the convicting statement: “DAD! You just said a bad word!”

Wow. It doesn’t get any worse than that. I just hate it when that happens! (pun intended!)

When it comes to personal finances, you have got to walk the talk. Model the way. Demonstrate and educate the steps you are taking to win with money. Share the challenges you are facing.

Here is how Jenn and I are “walking the talk” to teach our kids about money.

- We prepare a written budget every single month. Every. Single. Month. Teachable Moment: You must have a plan before spending any money. (Luke 14:28-30 is a great verse about planning)

- We utilize cash envelopes for the “impulsive” categories such as groceries, dining out, spending money, entertainment, and clothing. Our children clearly understand that money is a limited commodity and when it is gone, well, it’s gone! Teachable Moment: Self-discipline goes a long way toward ensuring success with money.

- We invest money every single month into our retirement plan (SIMPLE IRA for us – may be a 401(k), 403(b), 457, IRA, or Roth IRA for you) and 529 College Savings Plan. We actually show our children the 529 College Savings Plan statement every quarter. I remember showing it to my firstborn when she was four, and she had no idea how to read the number. She would say something like, “Is that more than four dollars?” My answer? “Yes. It is at least FIVE dollars!!!” Teachable Moment: You are so important to me that I am investing in your future (college – which wouldn’t even happen for another 14 years at that time!) AND Proverbs 13:11 is true. When you gather money little by little, it will grow!

- Every time Jenn and I plan our money, we split our money into three large categories – GIVE, SAVE, and SPEND. We use kit put together by Dave Ramsey that helps teach our children this concept. It is called Financial Peace Jr and it includes three envelopes that say “GIVE”, “SAVE”, and “SPEND” Every time our children earn money (No allowances in our house! We promote the “Work = Get Paid; Don’t Work = Don’t Get Paid” concept!), they split the money between the three envelopes. We have taught them that 10% should go into GIVE, 20% into SAVE, and that they can spend the rest. With a plan, of course. Teachable Moment: Life is grand when you are able to GIVE, SAVE, and SPEND!

There is NOTHING better than investing time into your children. The return on investment is so great! By walking what you talk about, you send a crystal clear message that this is extremely important.

Are you “walking” what you are “talking”?

Provide Opportunities for Your Kids to Learn About Money

It is incredibly important that your children are able to apply what they are learning about money. When my oldest was around four years old, she was saving money for her first big purchase – a Care Bear. This purple Care Bear came with a DVD and everything. Can life be any better if one has a purple Care Bear? For my daughter, the answer was clear.

This bear had a selling price of around $18, so it took a long time for her to save up for this purchase. Now, this is a large purchase AND it is a Care Bear AND the money would do better in a mutual fund, but how can you have a teachable moment if you don’t let children have some running room?

So the big day arrived! $18 was saved, and it was time to make the purchase. Teachable Moment: If you save diligently, the day will come to make the purchase!

One evening, she and I had a “daddy-daughter date night” (we had one every month). She chose to eat at Ponderosa Steakhouse Buffet because they had unlimited amounts of mac-n-cheese, and then it was time to make the big purchase.

We went to Walmart, picked out the Care Bear and headed to the checkout counter. There was no one in line at the checkout, and she began counting out her money (nickels, dimes, and quarters). By the time she was done counting, we had over ten people standing in line behind us. I was so proud! My daughter had SAVED for this purchase! Teachable Moment For Parents: If you teach your children this stuff early and often, you will have the opportunity to stand back and watch your children win financially in the long run!

Flash forward three years. The Care Bear has now rested comfortably for at least a year at the bottom of the stuffed animal box. You can probably buy the same one at a yard sale for $1. Teachable Moment: It’s OK to buy stuff, but what would have happened to that $18 if you had put it in a mutual fund?

Provide the opportunities for your children to learn about money. It is AWESOME to watch them learn!

What opportunities are you providing your child to learn about money?

Teach the Core Principles!

Anyone who has attended a Financial Learning Experience (our live teaching event) knows the Four Core Principles by heart.

#1: There is POWER when you work TOGETHER on finances.

My children will know how to manage finances. Should they marry one day, my hope is that the example lived out in front of them by Jenn and I will inspire each of them to work together with their spouse to win with money. At most weddings, the minister pronounces that “the two become one.” This applies to finances too!

#2: Avoid the DEBT TRAP.

Bad debt is a wealth-killer. I remember the day one of my children borrowed a dollar from Grandma to buy something at Walmart. I said, “Oh my, you are now in debt! You are in DEBT to Grandma!” She got so upset that she almost cried! This sounds like I am a mean parent. Some would say it is cruel. I say that I am teaching her the realities of money, and that the borrower is indeed slave to the lender. (Proverbs 22:7)

#3: Have a PLAN for your life. This creates the REASON for you to plan your finances!

My children have plans for their lives. Early on, my eldest daughter had clear goals. She wanted to be a veterinarian, move to San Diego, work for the San Diego Zoo, and live in the round hotel. Of course, time has a way of changing plans, but she still has plans, hopes, and dreams. So do my other two children. I am intentionally raising my children to be dreamers and visionaries.

#4: Have FUN managing money TOGETHER!

It is not all about investing every single dollar. It is not all about living in a refrigerator box. The whole reason we all want to win with money is so we can accomplish our God-given plans, hopes, and dreams! I teach this to our children every single day. By the way, forsaking a high-paying corporate job to go to work for a church and moving nine hours away from family is a pretty good way to show my children that God-given dreams can be accomplished. Look at what this movement to help people win with money has accomplished since 2006!

Have you had a conversation about money with your kids this week?

This is a PROCESS, Not a One-Time Conversation

This is not a one-time conversation. Learning is a process. It happens over time. With multiple conversations. With both good and bad attitudes. In different situations. It is intentional.

What Jenn and I have taught our children so far has been intentional. We plan on keeping it that way. As we approach the next decade, we will teach them many more financial and life lessons. We have successfully raised on child to adulthood. The other two are on the way. It is a process. It requires commitment. Ultimately, it will be worth it when we see each child embark on their adult lives with financial confidence and become truly independent. I believe it is one of the greatest blessings any parent can bestow upon their children.

Lessons We Still Want to Teach Our Kids About Money

To wrap up this post, I thought I would share some of the lessons upcoming for our children. Some are new and some are continuations of lessons already in progress.

-

God is the owner. We are managers.

We are teaching them that everything we have is on loan from God. Luke 16:10 resounds through my head. There is a good potential for our children to be left with a great inheritance (something the Bible says we should do – Proverbs 13:22 shares that “a good man leaves an inheritance for his children’s children.” If we don’t teach them to be great managers, their lives could be ruined by the inheritance.

-

Giving and saving are top priorities.

This lesson is already in process, but it will continue to be reinforced. There is nothing more satisfying than giving to a worthy cause and saving money for God-given hopes and dreams.

-

The fundamental business concept of “profit”.

It is amazing how many business owners forget this concept. Our children will know this concept forward and backward!

-

It is OK to wait to make a purchase.

Bad debt is not worth the immediate gratification. The gratification will go swiftly go away, but the debt will pay a visit monthly.

-

Learn the most powerful word in the English language – NO!

Already in progress on this lesson. It is so important to have self-control.

One of the greatest gifts you give your child(ren) is the gift of financial confidence. I encourage you to prepare a plan today on how you will intentionally invest in your children’s financial education.

What ideas have you put into practice as a result of this series?

If you are a parent of a high school or college student “What Everyone Should Know About Money” is a great resource for teaching your kids about money. You can find it for sale on the IWBNIN store.

Back to School?

School supplies? What does school even look like this year?

If you’re a parent, you are probably wondering what back-to-school will look like this year.

Maybe you are waiting for your school district to announce their plans for the year, or possibly the year’s start has already been delayed. Parents are trying to decide between a multitude of options – send the kids back to classrooms full time, hybrid schedules mixing in-person and online, eLearning through your school district, co-ops with other parents, or homeschooling.

There is a lot of uncertainty right now about what this school year will look like. So whatever you are gearing up for, we want to help.

Where do you start when it comes to scoring great deals on school supplies? Below is a list of tips and tricks for back-to-school shopping compiled by one of the I Was Broke. Now I’m Not. team members, Whitney Purcell, along with a few of our other moms. Whitney is a mom of two little girls (3 and 6) and has spent a great deal of time researching back-to-school deals.

When to Shop for School Supplies

Knowing when to shop can help you save a lot of money. We suggest checking to see if your state has a tax-free weekend and when retailers are planning to run specials.

Tax-Free Weekend

Shop during your state’s tax-free weekend is a great way to save money. You not only avoid paying sales tax on clothing and school supplies, but most retailers run specials that weekend as well.

Before you head out to do your shopping, do your research. Different states have different restrictions on what is tax-free. While most states include school supplies and clothing, you’ll want to check in advance. To see when your state’s tax-free weekend is and what it covers, click HERE.

If you are in a state that doesn’t offer a tax-free weekend, it could be worth driving to another state close by, especially if you need to purchase high priced items. Growing up in Kansas, we didn’t have a tax-free weekend, but Missouri was only a 30-minute drive, so going there to purchase back-to-school clothes and supplies was worth the trip.

This year some states, like Tennessee, are planning to have two tax-free weekends!

Store Specials

Another great time to shop is when a retailer is running specials. Check out stores like Target, Walmart, and office supply stores to see their specials. Typically this will start the beginning of August. Remember, you don’t have to purchase all of your supplies at one store – by shopping ahead of time, you can figure out where to buy what to save the most money.

You know Walgreens? Well, it isn’t just your drug store on every corner. Walgreens carries school supplies as well. While they aren’t the best priced, they offer great specials throughout the year, which includes deals on school supplies. Check out their weekly ads and coupons to see if school supplies are on there.

Where to Shop for School Supplies

You may feel like you are bombarded with options when it comes to where to shop. Don’t look past the unexpected locations, though.

First Get a Rebate

Before you use any of the store websites on our list, you should use Rakuten to get cashback your purchase. Once you sign up for a Rakuten account, you can add their browser app which will notify you when they have cashback for a participating retailer.

If you don’t like the browser extension, you can also go to their website before visiting an online store. For example, I just logged into my account, did a search for Target, and it came up with 1% cash back. I click on the Shop Now button and it takes me to Target’s website.

That’s it! Whatever I purchase I get 1% cash back. The amount of cashback varies greatly by store. I have seen as much as 22% cashback at some small retailers or on specific items, but it is usually around 2%-3%.

Target

Yes, I know this one may seem obvious, but I will be amiss if I didn’t mention it. Not only does Target offer great specials for back school, but it has wonderful clothing options for kids.

Did you know that their Cat & Jack line has a one year warranty? My daughter’s legging had a hole in them, so I took them back. I didn’t have a receipt, so they looked up the item number to verify when it was purchased and replaced them with no questions. Not only that, but they run wonderful specials for Black Friday each year, including summer clothes, so I stock up online and avoid the lines.

Bulleye’s Playground (formally the Dollar Spot) has great deals on classroom supplies. Some of these are geared more towards teachers this time of year, but that is great if you plan to homeschool or do eLearning. I’ve purchased pencils, workbooks, whiteboards, etc. for my kids there. They love being able to practice their letters and numbers using these inexpensive tools.

If your kids are going back to the classroom, this may be a great place to find gifts for your children’s teachers (and we all know they are deserve a great gift)! Remember, if you add a whole bunch of unnecessary items to your cart, you won’t be saving in the long run – something I have to remind myself of continually (with the help of my husband).

If your kids are going back to the classroom, this may be a great place to find gifts for your children’s teachers (and we all know they are deserve a great gift)! Remember, if you add a whole bunch of unnecessary items to your cart, you won’t be saving in the long run – something I have to remind myself of continually (with the help of my husband).

You can find Target’s weekly specials [HERE]. Deals vary by location, so make sure to check out the ads beforehand. At some locations they are offering Crayola markers and crayons for $0.99, kids scissors for $1.49, paint sets for $1.99, plastic folders for $0.50, and notebooks for $0.69. They also offer a 2-pack of kids’ fabric face masks for $4.

Aldi

I love Aldi! I love my low bill when I leave. I love the savings on my groceries. I also love their seasonal goods, including their school supplies this time of year.

Their weekly ads will show their specials, and when they expect to get items in stock. Aldi also gives you a sneak peek of what will be the next week’s specials so you can plan ahead. I suggest going on the first day the school supplies are stocked because these specialty items can sometimes sell out quickly. While some stores may restock, for some locations, once they are gone, that’s it.

Aldi is another excellent location for tissues and disinfecting wipes, which schools will most likely ask for in abundance this year.

I’ve also seen great deals on character backpacks, lunch boxes, insulated food containers, and kids reusable water bottles. They even have lunch storage containers with compartments for their entree and sides.

I’ve also seen great deals on character backpacks, lunch boxes, insulated food containers, and kids reusable water bottles. They even have lunch storage containers with compartments for their entree and sides.

If you need additional learning materials for at-home, Aldi offers educational puzzles and elementary age perforated page activity books. My daughter is working through their kindergarten book right now. They review letters, shapes, colors, and sight words. Aldi also had a summer review activity book this year.

Walmart

I’ll be the first to say that Walmart wasn’t my favorite place to shop. While they have low prices, our local Walmart always had long lines and not the best customer service.

However, when Walmart introduced its grocery pickup with a convenient app where I could do my grocery shopping in my sweatpants at home, I became a Walmart shopper.

Most moms will agree it is no fun running errands with kids in tow. In and out of the car seats in the heat – no, thank you! Getting Walmart’s low prices without standing in lines is a massive win in my book. Check out their back to school specials [HERE].

Dollar Stores

Check the Dollar Store, Family Dollar, or Dollar Tree for back-to-school items like basic calculators, planners, colored pencils, or clipboards. This will help you save money while still getting a great item. Most stores stock school supplies year-round, including name brand items at some.

Amazon

Amazon often has the lowest price on items, so make sure to check items against Amazon. I’ve found if you’re ordering multiple of an item (like glue, markers, etc.) they have better prices. It also saves you on spending extra money on gas running around town, especially if you’re already paying for Prime.

Amazon often has the lowest price on items, so make sure to check items against Amazon. I’ve found if you’re ordering multiple of an item (like glue, markers, etc.) they have better prices. It also saves you on spending extra money on gas running around town, especially if you’re already paying for Prime.

We’ve included an Amazon shopping list to help you get started, click HERE.

Office Supply Stores

Office supply stores can have a reputation for being a bit expensive. They offer such a wide range of products that their draw is they have everything you need, not that they are the most inexpensive. However, during back-to-school, they will run specials. I’ve seen sets of colored pencils on sale for half of what they are listed for at other retailers. Check out their ads. If you can pop in quickly for a few items while you’re running errands, it may be worth the trip.

Craft Stores

Check out stores like Michael’s, Hobby Lobby, or JOANN for school supplies.

BONUS – These stores usually have coupons that you can easily find online. I have the Michael’s and Hobby Lobby apps on my phone, so I can pull up their weekly coupon at checkout. If you don’t have the app, don’t worry about printing the coupons ahead on time, just make sure you have their website pulled up with the online coupon.

How to Shop for School Supplies

We’ve talked about when and where to shop, but it’s also important to consider how you shop. If you buy everything in one location and pay no attention to the sales, you leave savings on the table.

Order in Bulk

If you have multiple kids or have a friend who is willing to split supplies, look at ordering in bulk to save money. Some retailers (ex. Amazon) will have a multi-pack of paints, sets of markers, scissors, etc. that you can purchase. Purchasing in bulk will help save you money per set.

This also applies to items like Clorox wipes, sanitizer, and tissues. If you buy a multi-pack, you save per item, and you can keep the extra for your household stock.

Look at What You Already Have

If you’re like me, you love a good deal. So when I see something on clearance that I know we will need soon, I will scoop it up. Don’t forget to check if you already have it at home before you buy more.

If you’re like me, you love a good deal. So when I see something on clearance that I know we will need soon, I will scoop it up. Don’t forget to check if you already have it at home before you buy more.

Since kids were sent home early last year, chances are there are some unused items they can take this year. For instance, I have a few glue sticks that my daughter never used. Look through last year’s supplies for unused items that you can reuse this year.

Generic Brands

Don’t shy away from generic brands. There is a stigma that generic is inferior to name brands. However, that is not the case.

Some generic brands may not be a good deal over time if you have to replace them quicker or don’t work well. However, some stores (ex: Target) are making quality products (markers, colored pencils, etc.) that will save you money but still deliver the performance that your child needs.

Store Pickups and Online Shopping

Schedule store pickups for your school shopping. By utilizing curbside pick up options from Walmart, Target, Aldi, and more, you can save yourself time and money.

If you don’t have to go into each store, you are more likely to shop around and choose different stores for the best prices on individual items. You can add them to your current grocery pick up, so it doesn’t cost you an extra trip.

If you want to avoid the stores altogether, we’ve included an Amazon shopping list with some of our suggestions. No running around town – just click HERE and send!

Coupons

COUPONS! Couponing may not be your normal habit, but back-to-school is a great time to look for coupons that could save you money on supplies.

COUPONS! Couponing may not be your normal habit, but back-to-school is a great time to look for coupons that could save you money on supplies.

Check magazines, newspapers, or online coupon sites for options. On our budgeting page on the I Was Broke. Now I’m Not. website, we have links to several online coupon sites. This is a great place to start.

If a store has an app (like Michael’s or Hobby Lobby that I mentioned earlier), check it before shopping to see if they have any special deals. You can find great deals and look for in-store coupons. For instance, the Target app will show you their weekly specials, and you can add Target Circle Offers to save even more.

Loyalty Rewards

As you’ve been purchasing items, you’ve been earning rewards at a lot of stores throughout the year. Look to see what stores you’ve earned reward points and exchange your points for school supplies, clothes, or shoes.

You may want to check if you have credit card points to redeem. If so, choose a store where you’ll do back-to-school shopping and get a gift card there. We’ve redeemed our points for Walmart and Target gift cards.

Price Matching

Does a store that you’re shopping at offer price matching? Stores like Staples, Target, Kohl’s, Office Max, and Office Depot offer price matching. Check each store to learn about its policy and restrictions.

Happy School Supply Shopping

I know making decisions about school during COVID-19 has been difficult and stressful for parents and school officials alike. So, however, and whenever your kids return to school this fall, we hope you find this helpful. Remember, there is no “right way” for everyone, so give yourself and others grace! Happy (and thrifty) shopping!

How have you saved money back to school shopping?

10 Money Lessons Every Parent Should Teach Their Child

One of the great gifts a parent can give their child is to teach and model life skills that will help them live a better life. Transferring excellent money management training and skills to your child will help them have financial confidence as they navigate life.

If you are wondering where to begin, start with the list below!

10 Money Lessons Every Parent Should Teach Their Child

- Monthly Budgeting The power of planning money before it is spent helps maximize each and every dollar.

- Consistent Saving Saved money prevents a lot of financial stress.

- The Power of Compound Interest Use compound interest calculator (like this simple one) to show them how time, rate of return, and amount invested will yield exponential results.

- Waiting Many terrible financial decisions are made impulsively. By learning this important lesson, your child can avoid many financial mistakes.

- Form Good Money Habits Good habits are just as difficult to break as bad ones. Help them “make it their habit” to budget, save, invest, and plan the rest.

- Generosity Generous living can help prevent greed and selfishness and positions your child to be a blessing to all who know them.

- Debt Discuss various types of debt: Installment debt (paying something off – a car, a home, etc) and Revolving debt (continuously accessible debt – a credit card or line of credit). Teach them how interest rates and payment terms affect their ability to pay off debt.

- Investing Show them various types of investments: mutual funds, stocks, bonds, real estate, precious metals, small business, franchise, and intellectual property

- Passive Income Demonstrate ways to generate income without having to work for it (dividends from stock ownership, rental income from commercial property, and business ownership income

- Net Worth Share specific ways to increase assets in a tax-advantaged manner.

I’ve never heard a parent say, “I educated my child too much about money.” However, I’ve heard tens of thousands say, “I wish I had learned this stuff before I entered the real world.”

Recommended Resource

![]() Joseph Sangl’s book: What Everyone Should Know About Money Before They Enter The Real World It is a perfect resource for young people – from high school students to those in their mid-20’s. It has been written with prevention in mind – to help young people become financially confident and avoid common financial mistakes.

Joseph Sangl’s book: What Everyone Should Know About Money Before They Enter The Real World It is a perfect resource for young people – from high school students to those in their mid-20’s. It has been written with prevention in mind – to help young people become financially confident and avoid common financial mistakes.

Kids & Money Tip: Dreams Should Drive Financial Decisions

NOTE: This is an except from my book for young people – What Everyone Should Know About Money Before They Enter The Real World. It is written for young people just beginning their money relationship. You can learn more and purchase this book and its related study guide HERE. By the way, this book makes an excellent Graduation Gift!

What do you want to accomplish during your lifetime? What have you been put on earth to do?

As you embark into life in the real world, there is no doubt that you have been asking yourself these questions. Sometimes these questions can cause one to feel overwhelmed or fearful. Other times, these questions can fill one with hope and joy. You may be experiencing all of these feelings.

Every person has hopes and dreams they want to achieve. I believe every person has been put on earth for a specific purpose, and I want you to accomplish your hopes and dreams. Most people, however, do not have a written plan for how they are going to achieve their dreams. In fact, more than 50 percent of people who attend one of our personal finance teaching experiences have never written their hopes and dreams on paper. This is very sad.

Henry Ford once said, “Fail to plan. Plan to fail.” This is an incredibly true statement.

I clearly remember the day I was teaching the Financial Learning Experience in a small town. I asked everyone in the room to write their hopes and dreams on paper. When they had finished this task, I asked them this question – “If this is the first time you have ever written down your hopes and dreams in your adult life, please raise your hand.”

As usual, more than half of the room raised a hand, but one person’s hand caught my attention more than the others. It was a man who was over 70 years old and still working a full-time factory job to produce an income for his family. He was working because he had to. I wonder if he would still be working full-time at 70 if he would have written down his hopes and dreams on paper when he was 18.

You have huge potential. What do you want to make sure you accomplish during your lifetime?

You see, it is these dreams which should drive your financial decisions. Not the other way around!

ACTIONS:

- Have the young person in your life ask some adults in their life, “What are your dreams?” Once they have asked several of them, determine how many of those adults are truly allowing their dreams to drive their money decisions and how many are stuck allowing their current financial situation to drive (or prevent) their dreams.

- Grab a copy of the book and study it together to help the young person in your life prevent financial mistakes.

Kids & Money Tip – The Rewards of Saving

One of the greatest lessons I learned from my parents as I grew up was saving money for a dream purchase.

When my twin and I were just turning into wonderful and perfect teenagers (a fact not exactly verified by our parents), we really wanted to purchase a motorcycle. We lived out in the country, and a motorcycle would be a great way to explore our farm and beyond. Our father came up with a great way for us to earn the money to purchase it.

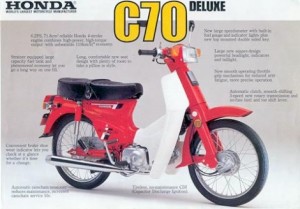

In one of the farm fields, we grew soybeans. The field was producing a fabulous crop of weeds that year. Dad said he would pay us one penny for every weed we pulled or cut down. We pulled enough weeds to buy the motorcycle. It was a Honda C-70 Passport, and it was awesome! Good planning and hard work – coupled with saving – led to a rewarding purchase.

One of the greatest things you could do for the children in your life is to help them fully grasp this concept as it will equip them with a key skill necessary to live a fully funded life.

NOTE: This is an except from my book for young people – What Everyone Should Know About Money Before They Enter The Real World. It is written for young people just beginning their money relationship. You can learn more and purchase this book and its related study guide HERE.