Budgeting When You Have Irregular Income

Do you have irregular income? Maybe it is seasonal or cyclical.

There is a large group of folks whose family economy is powered by irregular income.

Real estate agents, hair stylists, commissioned salesmen, and business owners all experience seasonal or cyclical income.

Folks who live with this type of income often tell me that it is impossible to budget. They say that they have no idea what they will make this month, so it is just impossible.

I say that not only is it possible, but that folks with irregular income need to be budgeting more than anyone!!!

In this post, I will explain how to prosper while earning irregular income. It is my goal to help you stop living the feast and famine lifestyle that is so often associated with irregular income. Here’s a hint – It’s EZ!!!

Step 1 – Recognize it!

To avoid living the feast/famine lifestyle, you must recognize that you have irregular income! If you have ever suffered during the “off” season, you KNOW what I am talking about! In order to stop having your life severely impacted by “off” seasons, you must prepare! It’s not enough to acknowledge you have irregular income, you have to decide to do something about it.

Question: If your family economy is powered by irregular income, what do you do to prepare for “off” seasons?

Step 2 – Determine monthly expenses

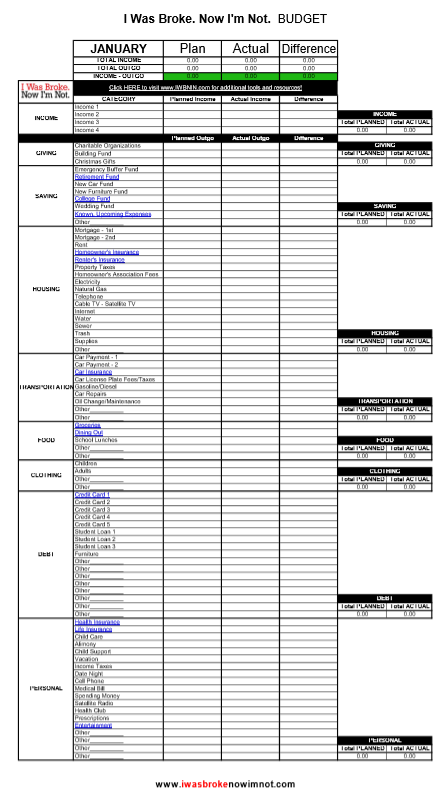

The next step is to determine how much money is necessary to make the household operate efficiently for each month. This is key to living free from the feast and famine lifestyle. To determine your monthly expenses, you should pull up a monthly budgeting form and do the following.

-

Fixed Expenses

Enter all your fixed expenses – house payment, utilities, gasoline, car payments, credit card payments, groceries, cell phone, childcare, etc. This also includes SAVING for retirement!

-

Variable Expenses

Enter the average of all your variable expenses – clothing, spending money, entertainment, dining out, etc.

-

Known, Upcoming Non-monthly Expenses

This is a KEY STEP!!! If you do not add in all of those known, non-monthly upcoming expenses, you will continue to live the feast/famine lifestyle (more likely the famine lifestyle!!!!). These types of expenses are BUDGET-BUSTERS. Here is what I do. I list all the known, upcoming non-monthly expenses and place their annual cost next to them. I then divide that number by twelve to determine how much I need to save per month.

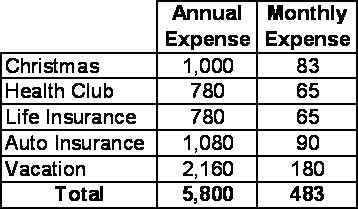

Example of Known, Upcoming Non-monthly Expenses

There are lots of expenses that we all have that are non-monthly, but we know how much they will cost us. Some examples are car insurance, car tags, life insurance, or gym memberships. In this example I have five annual expenses that I need to plan for. I would include a line item of $483 in my monthly budget for “Known, Upcoming Non-monthly Expenses”. This allows me to bring a stop to the feast, famine lifestyle by saving for items that I know are coming!!!

Want to read more about planning for known, upcoming non-monthly expenses? Click HERE.

You now have a monthly budget that will change very little through the year!

Question: What have been the biggest budget-busting expenses you have experienced?

You have successfully completed Step 2 – Determine monthly expenses!

Now, of course, the trick is to have enough cash on hand every month to make this monthly budget work! Ahhhhh, that my friend leads us to step 3!

Step 3 – Save up three months’ worth of expenses

WHAT?!!!! I am sure that is what many of you are saying right now! Yes, I did say that you need to save up at least three months of expenses. Remember in step two that you calculated your monthly expenses? Multiply that number by three, and you have your savings target. I call this savings the “Known Slumps Fund”! You know that slumps are coming, so be prepared!!! This is HUGE in eliminating that horrible feast/famine lifestyle!

WHY?!!! You might be asking this question. Why on earth should I save up at least three months’ worth of expenses? Man, I am glad you asked that question!

How a “Known Slumps Fund” Works

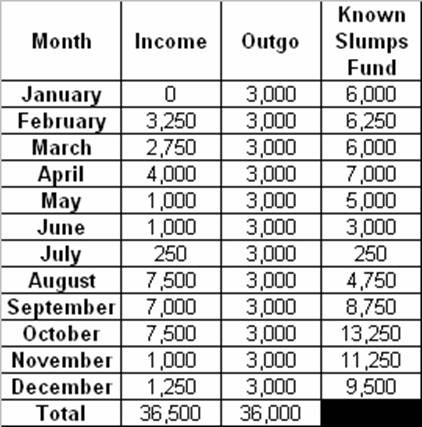

Let’s say that you have monthly expenses of $3,000. This means that you need to have at least $9,000 in your “Known Slumps Fund”.

Let’s look at a year’s worth of expenses. Now, it is easily seen that this person has earned enough to make it this year. They have taken in $36,500 for the year. BUT look at how irregular the income is! Have you seen something like that before in your business? This causes life to be CRAZY. In January, you are eating ramen noodles like they are going out of style. February through April are decent, but then it dies again May through July. Famine of the worst degree! All of the sudden, August through October are awesome! Feasts abound! Then November and December come in with back to back terrible incomes. Back to the ramen noodles!

What should you do? Get a “Known Slumps Fund” that equals three times your monthly expenses!

Let’s see what difference that makes!

When you look at this chart you realize the POWER of having three months expenses in the bank! Whether you have a $500 month or a $6,500 month, you live on $3,000 that month. That means that you get to EAT!!! You can save money (remember the monthly expenses includes retirement savings!). That means that you can have some fun each month!

The “Known Slumps Fund” absorbs the irregularities of your income! Fill up your “Known Slumps Fund” – it will take so much stress out of your life!!!

Question: Which is more important to you – debt reduction or funding your Known Slumps Fund?

Step 4 – Become personally debt-free and operate your business debt-free

Now, I am certain that you believe I have completely fell off my rocker. You might be saying, “Joe, you are crazy! There is no way I can do this!” Well, I have seen many people operate their business debt-free.

What are the advantages of operating a business debt-free? Let me count the ways!

- Monthly expense load drops! There are no interest payments to make!

- Your business can absorb downturns much more effectively. Again, there are no interest payments to absorb!

- Breathing room. It is amazing how much stress a pile of debt brings on.

- When you spend your own real money, you will manage it better. I don’t know why this is, but if I am spending someone else’s money (i.e. the banks) I am much more susceptible to make a riskier decision! When I am spending my money, I am much more likely to do thorough due diligence before doing a deal!

Question: What are some other advantages of operating a business debt-free?

Budgeting with Irregular Income is Possible

So, don’t let your irregular income keep you from budgeting. Recognize that you have seasonal or cyclical income so you can avoid the feast or famine lifestyle. Next determine what your monthly expenses are. These include your fixed monthly expenses, variable expenses, and your know upcoming non-monthly expenses. Then save up three month’s worth of expenses in a “Known Slumps Fund” to help you weather those months when your income dips drastically or stops. Finally, live personally debt-free and operate your business debt-free. This isn’t something you can achieve overnight, but this goal will help you make tough choices along the way to set yourself up for long term success. Remember, budgeting with irregular income is possible!

Looking for additional Personal Finance Resources? You can obtain free tools by clicking HERE and purchase books/materials by clicking HERE.