Archive for March 2011

Joseph Sangl’s Current Investments

It has been over three years since I provided an update on the investments that I hold. Anyone who has attended a Financial Learning Experience has heard me say that it is important to INVEST money and to do so every single time you are paid money.

At the end of our live events, I am regularly asked or emailed the following question:

“What mutual funds do you recommend?”

My answer is always, “I don’t recommend mutual funds. I can only tell you the investments I own. In general, they have worked well for me. The investments you choose are up to you.”

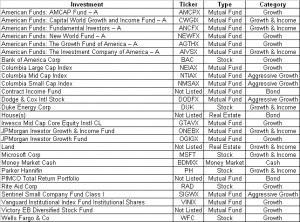

So today, for those inquring minds who want to know … I am publishing some of the mutual funds/investments that I own. Click the image to see a larger version.

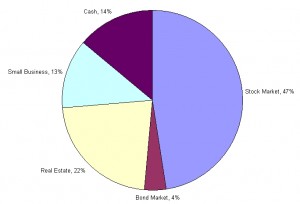

I have went even further in my analysis this time to indicate my portfolio diversification. Over the past several months, I have been writing and speaking to the fact that I am diversifying my investment portfolio to include land and real estate. The portfolio below indicates some of those decisions.

NOTES

- As you may have noticed during the latest recession, a rising tide will lift all ships and a lowering tide lowers all ships. If you have market funds, you saw this happen. There were many great companies that retained profitability throughout the market downturn, but their stock value was pummeled due to the overall market conditions. While I have been greatly diversified in my investment choices, I was diversified WITHIN the stock market. This is one of the reasons that I have made a focused effort to diversify my holdings beyond the open market.

- I believe it is important to maintain margin. Cash on hand is essential to the long-term success of any effort – personal, small business, or large business.

- Some of these funds are not open to the general market, which is why they do not have a “Ticker Symbol”, but I am able to invest in them through my previous employer’s 401(k) plan.

- One reason I hold so many mutual funds is because of a variety of 401(k), 403(b), Roth IRA, and 529 holdings – each plan has different mutual fund selections available.

- I do not “eat, sleep, and breathe” the stock market on a daily basis. I update my net worth once per month, but rarely jump in and out of funds. Day trading is definitely not for me.

Investment Junkies: What are your thoughts on my portfolio? What are some key funds that you really like that have worked well for you?

Looking for additional Personal Finance Resources? You can obtain FREE FINANCIAL TOOLS by clicking HERE and purchase books/materials by clicking HERE.

10 Reasons You Aren’t Winning With Your Money

As I travel this nation on this crusade to help people accomplish far more than they ever thought possible with their personal finances, I see many people who want to win with their money but they aren’t.

If that is you, read the list below to see if any of the below apply. The GOOD NEWS is that you CAN win with your money! Be sure to check out our FREE financial tools HERE.

In no particular order, here are the top reasons I see that people are not winning with their money.

- Inability to say NO (to themselves, spouse, and/or children)

- Shiny Stuff Syndrome

- Lack of financial education

- Spouses not working together

- Lack of giving (rarely do I see selfish people truly win with their money)

- No savings (it is impossible to win financially if you do not save)

- Unwilling to take risk with any investments

- Listening to the wrong (and broke) people

- Impulsive spending decisions

- Failure to carry health and disability insurance

Would you add any reasons to this list?

SERIES: Build The Wall – Part 4 – PROSPERITY

I am PUMPED about this new series on JosephSangl.com – “Build The Wall”! I truly believe that if people will do this, it has the potential to completely change their lives!

Build The Wall – Part 4 The wall leads to PROSPERITY!

When you build the wall, you position your life for prosperity.

Consider these facts that happen when you have built THE WALL:

- You can take a few financial risks when you see opportunity – because you have money available!

- You can absorb a job layoff without jeopardizing your retirement

- You can negotiate better deals with providers because you have the CONFIDENCE to do so

- You are much less likely to needlessly cut prices when you have financial margin

- You can be generous AT ALL TIMES

- You can fund dreams you never thought possible – dreams for you, your family, and for others – just because you can!

- You can make decisions based upon what is best for your family and your calling instead of “how much money will that make us?”

I have NEVER regretted the day that my bride and I began building THE WALL. Neither will you!

SERIES: Build The Wall – Part 3 – Stop Debt

I am PUMPED about this new series on JosephSangl.com – “Build The Wall”! I truly believe that if people will do this, it has the potential to completely change their lives!

Build The Wall – Part 3 The wall STOPS debt!

When you build the wall, you STOP acquiring debt! In fact, it is impossible to become and stay debt-free without building THE WALL.

If you truly want to remain debt-free, you need to build the wall. This way, the “life happens” events can happen and your wall can absorb those expenses. This allows you to remain focused on working toward funding your goals.

Think about it – if you have no savings and your refrigerator dies, you will finance a new refrigerator. You need a working refrigerator! This means you will have to turn to debt to fund the replacement fridge.

However, if you have THE WALL built with at least $2,500, you can purchase a new fridge WITH CASH MONEY and never lose focus on attacking your debt and other key goals!

Which of the following two scenarios will you choose for your life?

- No wall (with a serving of STRESS and sides of FRUSTRATION and ANGER)

- THE WALL (with a serving of CONFIDENCE and sides of PEACE and SATISFACTION)

As for me and my house, we will choose Scenario #2.

SERIES: Build The Wall – Part 2 – Protection

I am PUMPED about this new series on JosephSangl.com – “Build The Wall”! I truly believe that if people will do this, it has the potential to completely change their lives!

Build The Wall – Part 2 The wall offers PROTECTION!

When you have built a wall between you and the “life happens” events, you are protected from being distracted by those events. For example, when I was B-R-O-K-E I would be very distracted and frustrated by a car breakdown. Now, if I had faced reality, I would have known that my car would break down and would have prepared for it by building the wall. However, because I did not recognize reality, I did not have a wall built. This caused me inordinate amounts of stress as I dealt with a broken down vehicle, the annoying task of getting back and forth to work while it was being repaired, AND having to pay for it!

I will NEVER forget the day that I built the wall. I took an entire tax refund in 2003 and BUILT THE WALL. It wasn’t as fun as spending it on some nice purchase, but for the first time in my adult life I experienced financial margin. Financial margin equals PROTECTION.

This protection enabled me to breathe easier in a way I had never experienced before. It was so worth it!

BUILD THE WALL!

ACTION STEP: Build your starter wall with $2,500. Your ultimate goal is between $20,000 and $30,000.

YOU can do it!