THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

5 Tips To Win With Your Money in 2016

Every single day, I wake up thinking about how to help people prosper with their finances. It’s for this reason that I’m hosting a free online event called “How To Make This Year The BEST YEAR YET” on Thursday, January 14th, at 8:00 PM Eastern Time. I’ll share more details below, but first I want…

Read MoreThe Details Behind Term Life Insurance Application Process

Many people may know that they need term life insurance, but they do not clearly understand how the process works. In the presence of unanswered questions, many people make a choice (a poor one) to do nothing. My hope is that this post will help answer your questions about the term life insurance application process!…

Read More10 Ways You and Your Spouse Can Work Together To Make Better Financial Decisions

Our team is a huge fan of Stronger Marriages and it’s an honor to be featured as a guest on their blog today! Make sure you check it out HERE – 10 Ways You and Your Spouse Can Work Together To Make Better Financial Decisions

Read MoreHow to Locate Incredible Mutual Funds

Locating a Mutual Fund can be overwhelming if you don’t know where to look. In this post, I’m showing you the three-part approach I use. Once I have determined the category of mutual funds that meets my criteria, it is time for me to review actual mutual funds. Here’s the three-part approach: Mutual Fund Screens…

Read MoreDifferent Types of Mutual Funds

There are literally THOUSANDS of mutual funds available in the marketplace today. Each mutual fund is usually assigned to a particular family of mutual funds. Here are some common categories of mutual funds… International Stock Fund Aggressive Growth Stock Fund Growth Stock Fund Growth & Income Stock Fund Equity-Income Fund Balanced Fund Bond Fund Value…

Read MoreEstablish Investment Goals

Goals! I love GOALS!! My goals spur me to save and invest. Today, I’m sharing about how my personal investment goals guide my mutual fund choices. First you should know a couple of things about me. I view my investments as money that I will not touch for at least five years. I prefer mutual…

Read MoreAbout Joe

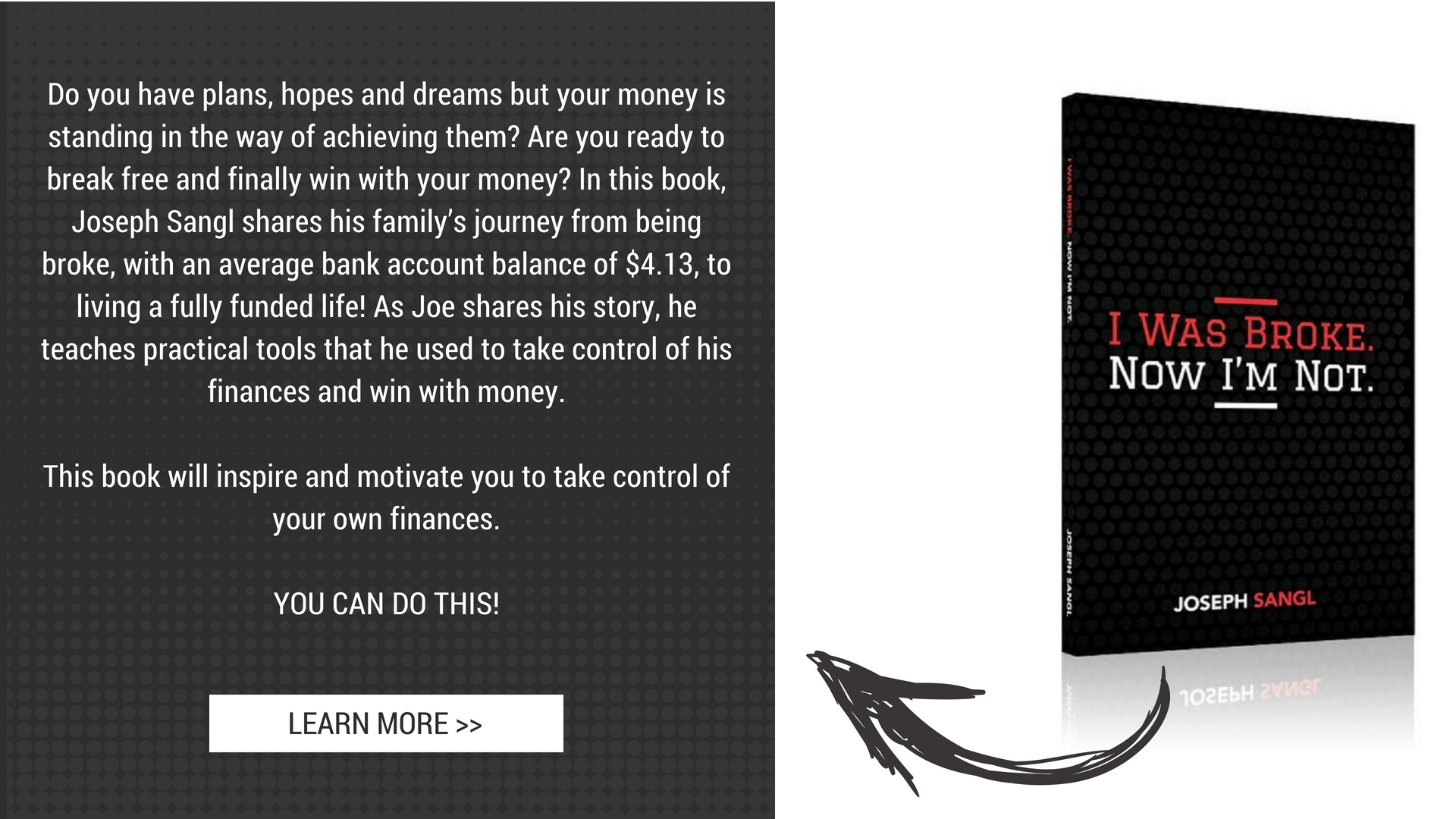

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

He is the founder of I Was Broke. Now I’m Not., the president and CEO of INJOY Stewardship Solutions, and Co-Founder of Fully Funded.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.