THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

Maximize Your Tax Refund

It’s going to be a good day!! Who’s ready to talk about TAXES? In this episode of the Monday Money Tip Podcast, we’re talking about how to maximize your tax refund. Perhaps you receive a big tax refund, but somehow it disappears without making the impact you wish or thought it could. In this episode,…

Read MoreThe Power of Coaching

It’s Monday and a new episode of the Monday Money Tip Podcast is LIVE! In this episode, we’re talking about how to stay consistent with your finances. At the beginning of the year, we all get fired up about making changes, but then something happens, and it feels like we lose all of the progress…

Read More20/20 MONEY – Release Special

Happy Monday! Today is a HUGE DAY for several reasons. ONE: It’s my favorite day of the week because another episode of the Monday Money Tip Podcast is LIVE. TWO: It’s finally here! My new book, 20/20 MONEY: Gaining Clarity For Your Financial Future, is ready to release! Today on the podcast, we’re talking all about the…

Read MoreThe Saving Challenge

Happy Monday! It’s my favorite day of the week because another episode of the Monday Money Tip Podcast is LIVE! How are you when it comes to saving money? Would you say you’re a saver or a spender? Today on the podcast, we’re helping you discover ways to save money so you can break the…

Read MoreGreat Money Apps

It’s my favorite day of the week because another episode of the Monday Money Tip Podcast is LIVE! We live in a technology-driven world, and in today’s episode, we’re talking about our favorite money apps that can take your finances to the next level. Maybe we’ll share an app you already use, or perhaps you’ll…

Read MorePay Off Your House – EARLY!

Get fired up!! Another episode of the Monday Money Tip Podcast is LIVE! Today, we’re talking about paying off your house – EARLY! Can you really pay off your home in 10 years? Yes, you can, and we’ll show you how. In our Current Money Events segment, we’re discussing why and how you can pull…

Read MoreAbout Joe

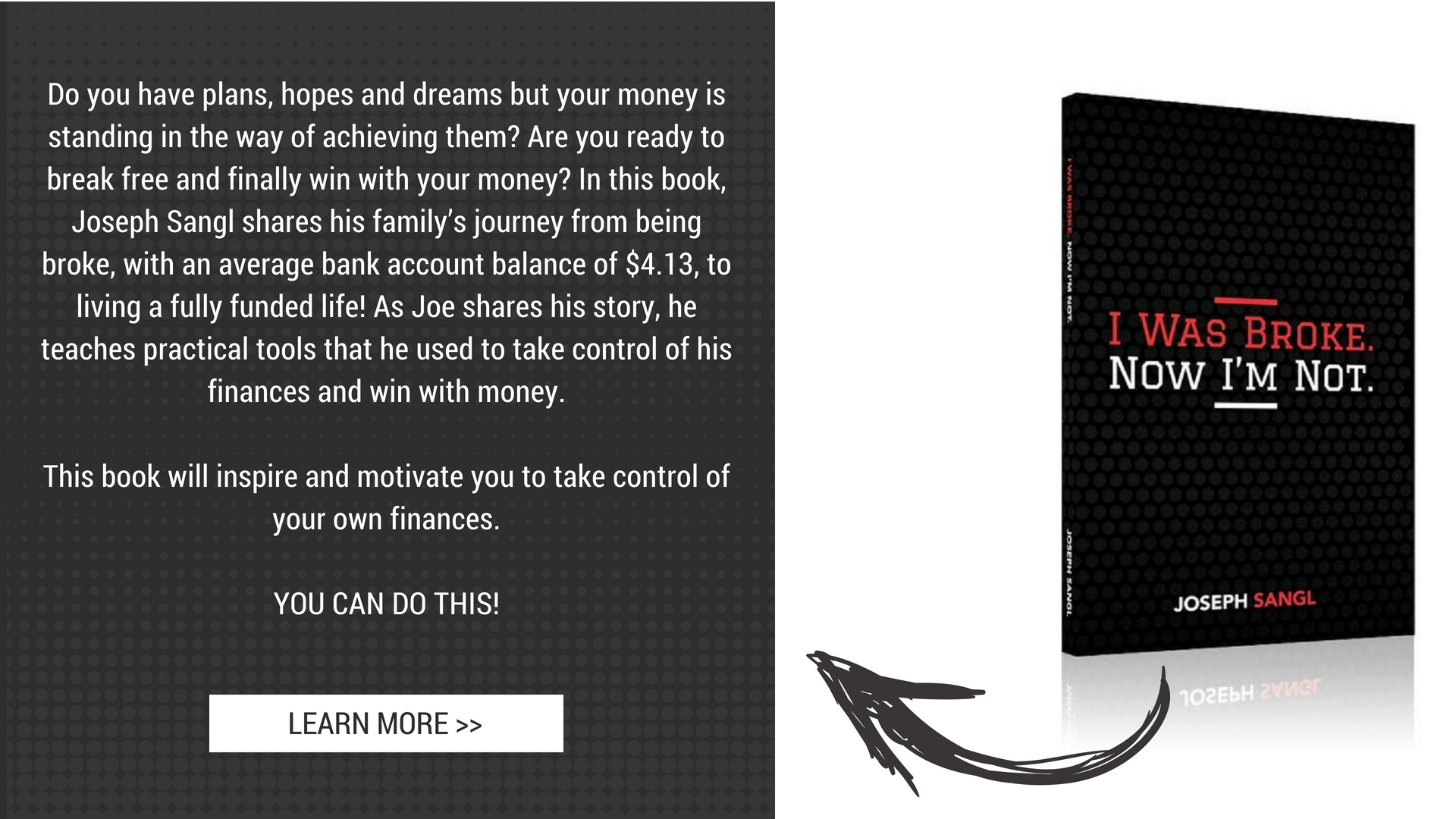

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

He is the founder of I Was Broke. Now I’m Not., the president and CEO of INJOY Stewardship Solutions, and Co-Founder of Fully Funded.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.