Archive for November 2008

Feed The Pig

Has anyone seen the TV commercials with the talking guy dressed up as a pig and saying "Feed Me"?

It always ends with a fade-to-black and promotes a website – www.feedthepig.org

Well, it worked because I went and checked it out. I think it is a good site!

All this great stuff is part of a national campaign sponsored by the American Institute of Certified Public Accountants (AICPA) and The Advertising Council. The goal of the campaign is to encourage and help Americans aged 25 to 34 to take control of their personal finances.

You can check out their site HERE.

Should You Refinance?

I ran across a "Does It Pay To Refinance?" Calculator at CNN Money recently.

You can access it HERE.

This is an excellent tool to use if you are considering refinancing your mortgage!

How Much Will College Cost?

I read CNN Money's personal finance website everyday. I saw THIS GREAT TOOL, and thought I would share it with you.

The tool is called the "College Cost Finder". Just type in the college you are interested in, and it will tell you how much it currently costs to attend it.

If you have kids, feel free to shudder with cold chills for awhile. Then go to the TOOLS section and use the investment value calculator to figure out how much money you need to save every month so you will be ready to pay cash!

Home Equity Loan To Pay Off Debt?

One of the most common questions I am asked is:

"Should I get a home equity loan to pay off all of my non-house debt?"

Here is my response.

I am not a big fan of consolidating one's non-house debt into a home equity loan. This is for several reasons, and I have outlined those reasons below.

- This is addressing a symptom, not the root cause. This question is usually motivated by our need for immediate action. It is the same motivation that causes us to purchase a car and finance it for five years.

- Borrowing from home equity makes it more difficult to sell the house. This is especially true in today's house market. There are a ton of people who now owe more on their house than it can be sold for. Consequently, they become trapped in the house.

- Changing spending behavior is a process. If one runs out and consolidates their debts, it might remove the urgency from the need to change spending behavior. Changing one's spending behavior takes time. I am convinced that if I had obtained a home equity debt consolidation loan in December 2002, I would not have changed my spending behavior. However, because it took fourteen months to address our debt, our spending behavior was completely changed. We have never looked back!

Having spoken with thousands of people and working one-on-one with nearly one thousand people in the past two years, I am convinced that obtaining a home equity loan is not the best way to eliminate debt. The most common result from obtaining a home equity loan is less equity in the house and the consumer debt shows back up because the spending behavior was not changed.

This is, in fact, my own story. I obtained a debt consolidation loan to move a pile of credit card and consumer debt to one payment. After paying $315.60 a month for an eternity, I wanted to celebrate, but I could not. Why? Because while I had finally paid off the debt consolidation loan, I had not changed my spending behavior and my credit card debt had grown back to more than I had consolidated in the first place!

What do you think?

Related Tools/Articles

Marching To Debt Freedom – Couple #1 – Month 14

Introduction

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now over a year into their Debt Freedom March.

Couple #1's Thoughts This Month

It was a good month. We are upping the payment on the HELOC and are close to paying off car 2. With the financial world blowing up around us, it is such a great feeling not to have to make payments on all of that debt!

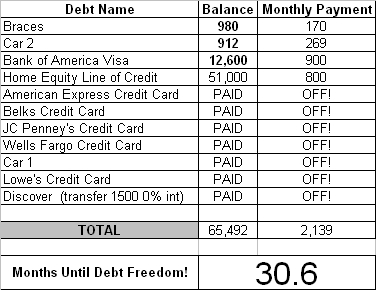

Updated Debt Freedom Date

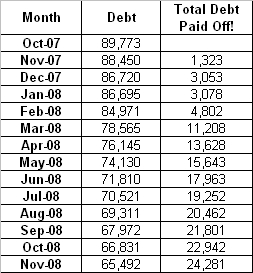

Month By Month Progress

Sangl Says …

Couple #1 is making huge strides toward debt freedom. It takes time, but it is awesome to see the progress being made!

Readers …

How is your Debt Freedom March progressing? You can get started on your own Debt Freedom March HERE.

Read Previous Monthly Updates For Couple #1 HERE