Archive for July 2018

Long Term Care Insurance

Long term care insurance is something that many people could benefit from and it is definitely worth looking into. If you ever need long term care, it is a monstrous expense. It is an expense so large that in fact, many big name insurance companies have actually stopped providing it. Two out of ten adults will need long term care in a nursing home or other type of facility at some point in their lives and this on average costs between $6,000 and $10,000 PER MONTH!!

Because this expense is so huge, the government will force you to liquidate any and all assets you have before they will step in with any assistance. So any money in the bank, house, car or item of value, will have to go before Medicare or Medicaid will help to cover. How sad would it be to work your entire life, then get sick and all that you have worked for go to pay for long term care? Nothing left behind to your heirs. I definitely do not want my money spent that way if I can avoid it.

Jenn and I decided when we build our new house, to add in a “mother-in-law” type suite so that in the case that one of our parents fell ill, we could provide for them to prevent them from going into a nursing home. We even have large hallways that could accommodate a wheelchair if necessary.

If you think that this burden would be too much for your family to bear, you should look into long term care insurance.

========================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

SPECIAL OFFER: This month only, get your own copy of Joe’s book, I Was Broke. Now I’m Not. for 25% off plus free shipping! Get your copy HERE before July 31st!

“I can promise that if you read and apply what has been written here then you will eliminate financial regret from your life.” – Joe Sangl

Weekly Budget Tool

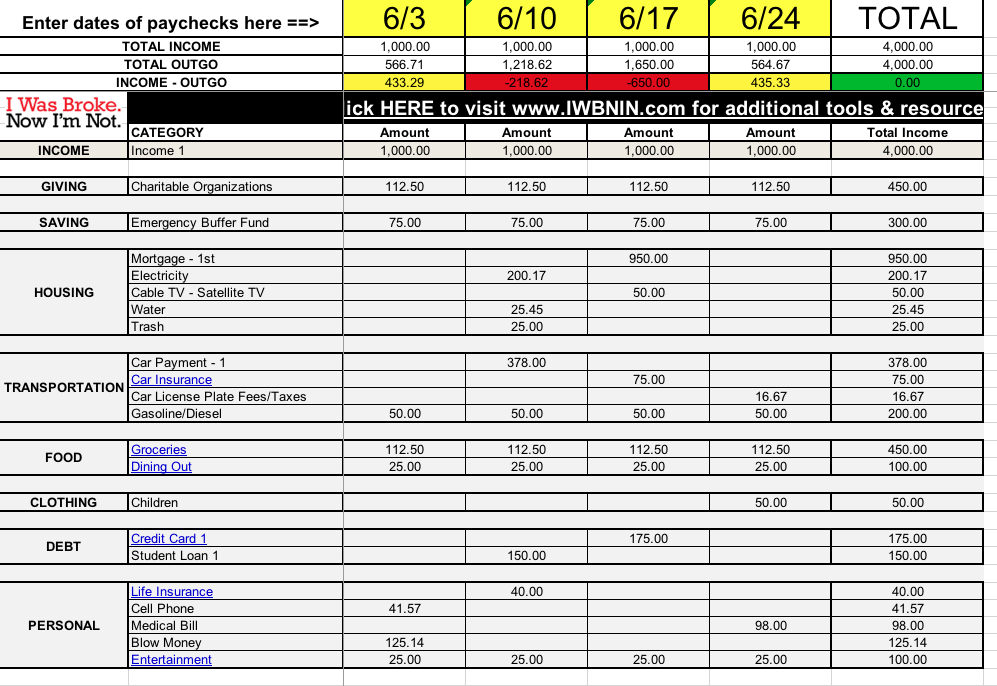

I have found that monthly budgeting is by far the simplest way to budget but that many people are unable to sit down and pay all of their bills at one time and be done with it. For most people, they must perform a delicate balancing act when paying their bills using each paycheck to pay certain bills. For many couples that are paid twice a month, one of the pay periods is a period of “feast” and the other pay period is a period of “famine.” A budget will resolve this issue!

Assume you are paid $1,000 per week take-home pay and you do not have enough money in the bank to pay all of your bills at once. You must balance your spending to align with the arrival with each paycheck. Using the Monthly Budget by Week tool, you can assign your planned expenses to pay periods in a way that allows each bill to be paid on time or early.

Now, you can see that your budget balances overall, but each week does not equal Exactly Zero (EZ). Because you are planning before the month begins, you can work to develop an EZ budget for each paycheck. Look for areas where expenses can be moved from their overspent paychecks to those that are underspent.

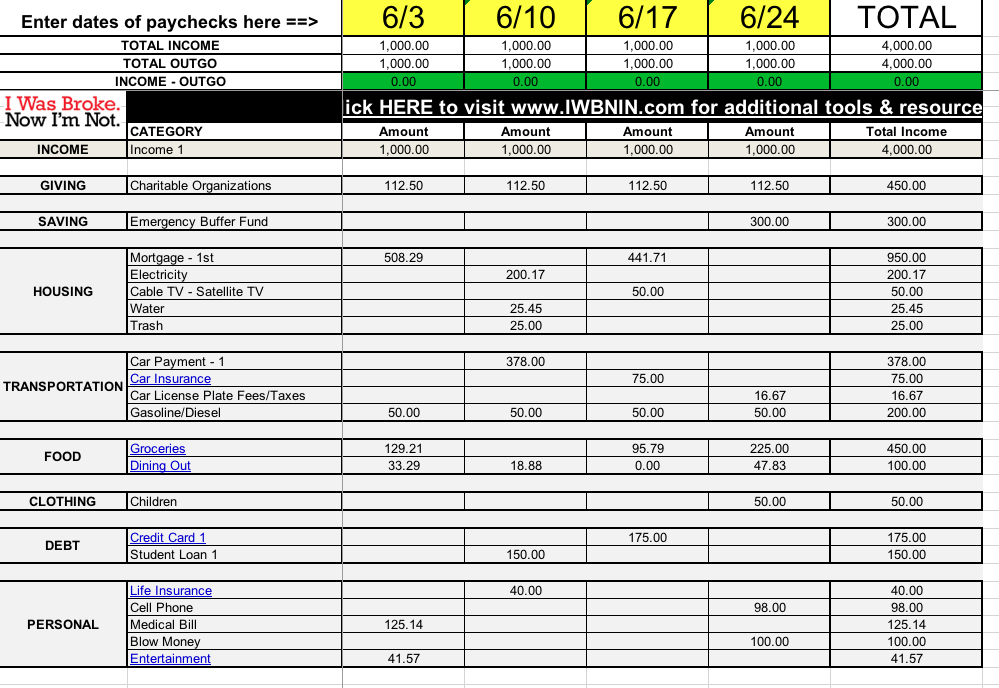

This will look differently depending on when each of your bills are due but as long as your income is enough to cover all of your bills, it will work.

Now you have an EZ Budget for every paycheck! All payments will be made on time and every single financial obligation has been met!

The beauty of this tool is that it puts you back in control! You might be thinking it is completely crazy to skip a week of grocery shopping. But you can easily go one week without purchasing groceries by using the food in your pantry and freezer. And you have a week to prepare for the week with no grocery money. Because you have planned before the month begins, you can identify any financial challenges before they happen.

This is the beauty of the budgeting process. You are able to manage your money instead of feeling like your money is managing you. You are telling your money where to go instead of wondering where it went!

=======================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

SPECIAL OFFER: Weekly budgeting can be confusing. Luckily for you, Joe has written an entire chapter dedicated to Weekly Budgeting in his book I Was Broke. Now I’m Not. This month only, get your own copy for 25% off plus free shipping! Get your copy HERE before July 31st!

“I can promise that if you read and apply what has been written here then you will eliminate financial regret from your life.” – Joe Sangl

Long Term Disability Insurance

Most people know they need life insurance, homeowners insurance and auto insurance. While these types of insurance are very important, this does not mean that you are completely covered. One of the other types of insurance that people forget is Long-Term Disability Insurance (LTD).

More than one in four of today’s 20-year-olds can expect to be out of work for at least a year because of a disabling condition before they reach the normal retirement age. Read that again. Yes, 25% of people who are only 20 years old will experience some type of disability that will put them out of work for at least one year before they retire. Long-Term Disability insurance is so important!

If I were to become disabled and lost the ability to speak, write, or perform the duties of my work, I would also lose my ability to produce an income by working. However, that does not mean that life stops costing money. I would somehow need to generate an income which will continue paying for ongoing expenses. LTD insurance helps me to transfer this risk. If I were to become disabled, LTD insurance would pay for 50 to 60 percent of my income until I am able to go back to work.

I prefer same skill disability insurance. If I were to lose my voice and was unable to fully recover my ability to speak and teach, I would not be able to do what I was created to do. I want insurance that will pay if I am unable to do that kind of work, not stop paying just because I am able to walk around again. In the insurance world, they call my preferred LTD policy “Own Occupation” insurance. The type I do not want is “Any Occupation.”

Long-Term Disability Insurance Tips:

- Ensure you clearly understand the policy

- Obtain this insurance – Do not allow a gap in coverage

- Make certain you obtain “Own Occupation”

- Ensure any LTD policy provided via your employer is portable – that it can be taken with you should you no longer be an employee of that company

===================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

SPECIAL OFFER: This month only, get your own copy of Joe’s book, I Was Broke. Now I’m Not. for 25% off plus free shipping! Get your copy HERE before July 31st!

“I can promise that if you read and apply what has been written here then you will eliminate financial regret from your life.” – Joe Sangl

MONDAY MONEY TIP PODCAST: What Type of Insurance Should I Have?

Welcome to Episode 15 of the Monday Money Tip Podcast! If you’ve listened to the last podcast then you know that our topic for July is Insurance. We all know we need car, home, and health insurance but are there any other areas of life that you should be covered? My co-host, Megan and I are here to tell you the importance of some other types of insurance that you may need at some point in your life. We will also share with you some tips for staying on budget this summer and the concept of a generational blessing.

It’s our goal at the end of each episode that you gain hope and encouragement in your financial journey, you’re equipped to take a next step, and that you’ve had FUN with us!

Find the Monday Money Tip Podcast HERE. Please let us know what you think by leaving us a rating!

NOW AVAILABLE TO DOWNLOAD:

iTunes

Stitcher

Spotify

Website

Email info@iwbnin.com to submit podcast questions or share success stories.

Show Notes

About the Episode:

- Joe talks about other important types of insurance besides car, home and health insurance.

- Joe and Megan share their tips for staying on budget this summer while also entertaining the kids.

- Hear a success story from Kathy who has made some changes in regards to her insurance and credit card debt.

- Joe shares a shocking statistic in regards to the odds of becoming disabled.

Resources:

Quote of the Day: “Start children off on the way they should go, and even when they are old they will not turn from it.” – Proverbs 22:6

Links:

MMT Podcast Episode 07

MMT Podcast Episode 08

IWBNIN Ladder

0% Balance Transfer Credit Cards

Lower Your Home & Auto Insurance

When was the last time you obtained quotes for your home and auto insurance? It is very, very important to carry both home and auto insurance. However, that does not mean that you should pay the highest dollar amount possible! Here are some tips to lower some of these costs and add some extra green to your budget.

Homeowners Insurance Tips:

- If you have auto insurance or some other insurance, ask for a “bundle” discount.

- Consider increasing the deductible to reduce your premium costs. If you are managing your money well and have built your emergency fund to at least three months of expenses (Rung #5), you may consider increasing your deductible. This can result in a substantially lower insurance premium.

- Example: If you increase your deductible from $500 to $1000 and the premium drops to $400 a year, this is probably a no-brainer. The premium is the only cost guaranteed to happen, and an event requiring the use of the insurance is not. If you are able to make it fourteen months without a claim, you will come out ahead financially. Even if a claim happens two years down the road, you will pay the $500 more in deductible, but you will have saved $800 in premiums (two years at $400 per year in reduced premiums due to increasing the deductible by $500).

- Shop around for the best rates every two years.

- Obtain a minimum of three quotes – one of them being from an independent insurance agency.

Auto Insurance Tips:

- Always have auto insurance.

- Bundle with other types of insurance to get discounts.

- Shop around for the best rates every two years.

- Obtain at least three quotes – one of them from an independent insurance agency.

- Obtain quotes with different deductibles.

- Obey the traffic laws.

- Be very cautious buying car insurance from family or friends without getting quotes from other places.

Try out some (or all!) of these tips and save some money today!

=======================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

SPECIAL OFFER: This month only, get your own copy of Joe’s book, I Was Broke. Now I’m Not. for 25% off plus free shipping! Get your copy HERE before July 31st!

“I can promise that if you read and apply what has been written here then you will eliminate financial regret from your life.” – Joe Sangl