Known, Upcoming Non-Monthly Expenses Calculator

Have you ever prepared a budget and faithfully followed it only to have it crushed in the middle of the month because of an expense you forgot about? Does Christmas seem to creep up on you every year? Have you had to suddenly replace the tires on your car? Chances are, you answered yes to at least one of these questions.

These budget busters are called “Known, Upcoming Non-Monthly Expenses.” The reason these expenses get forgotten is because they are non-monthly so they tend to be pushed to the back of the mind until the bill suddenly comes in the mail. But when they do finally appear, they can create a financial emergency causing you to either break your budget or go into debt.

Think about what non-monthly expenses you know will come up throughout the year. Here are a couple of common expenses that people have:

- Car tires need to be replaced

- Heating & Air goes out

- Christmas

- Vacation

- Life insurance premium

- Property taxes

- Health Insurance deductible

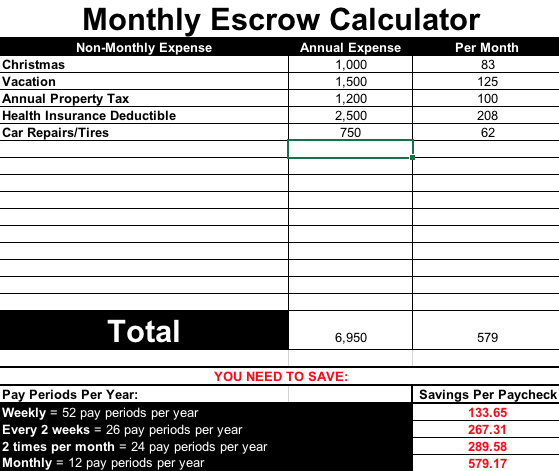

Once you have these expenses listed out, you can plan to save monthly for them in your regular budget. Check out our Known, Upcoming Non-Monthly Expenses Calculator to do this with ease. Below is an example of the calculator in action:

By knowing what these expenses are and saving for them monthly, you’ll no longer have to “come up” with the money when the bill arrives. You will simply be able to pay the bill in cash. A cool feature of this tool is that not only does it calculate what you would need to save per month, but it also calculates the amount based on different pay frequencies. If you get paid twice per month, you would need to save $289.58 out of each paycheck. For a bi-weekly frequency, you would save $267.31. Regardless of how often you get paid, you can save accordingly and have the money available when you need it.

Tips for using the tool:

- Be sure to recalculate your monthly savings number at least once per year.

- Don’t forget more long-term expenses such as college, weddings, vehicle replacement, and major home renovations.

- Make your savings for these expenses AUTOMATIC by establishing an auto-draft.

========================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

How To Have A Debt Free Christmas

What if I told you that you don’t have to go into debt Christmas shopping this year? That you can buy your gifts IN CASH and can avoid those dreaded credit card bills in January? Can you guess how you accomplish this? That’s right, a budget.

Christmas is a known, upcoming, non-monthly expense. That means that we know that Christmas comes on the same day every, single year and we should plan for it accordingly! In the Sangl household, we do this by saving a little bit for Christmas each month.

First, we decide how much we want to spend on Christmas altogether. Then, we create a list of every person or organization that we’re planning on buying a gift for and decide how much we plan to spend on each person. All that’s left to do is make that budget equal EXACTLY ZERO. Once you have your plan put together, you can do your Christmas shopping guilt-free!

You can download a copy of one of our FREE BUDGET TOOLS HERE.

========================================================================

For more tips on how to have a debt-free Christmas, check out our full episode of the Monday Money Tip Podcast HERE.

For more information on how to create a Christmas Mini-Budget, check out this related blog post.

Retirement Nest Egg Calculator

Do you know how much money you will need per year in retirement? Do you know how that number will be affected by inflation? I would encourage you to check out our Retirement Nest-Egg Calculator Tool. While it may trigger a shock to your system when you see the numbers, it can help you get into gear to retire well.

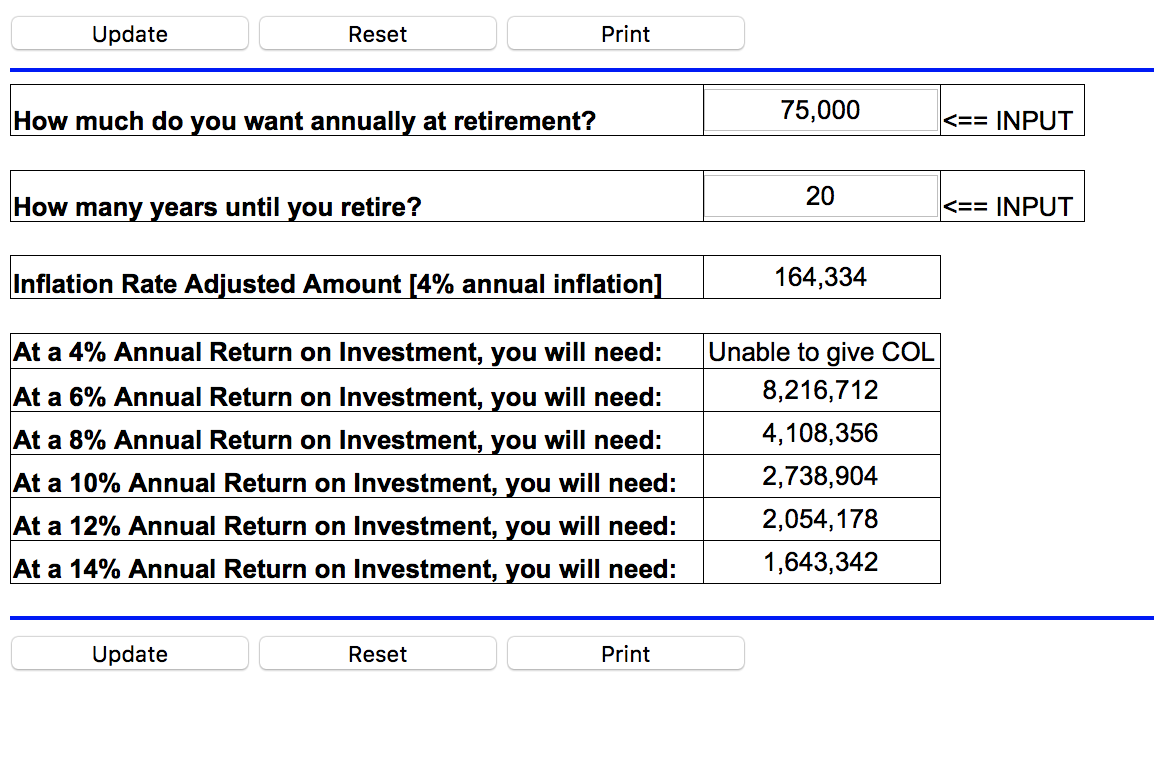

This calculator is incredibly easy to use and only needs two pieces of information from you! All you need to do is enter the amount of money you would like annually in retirement and how many years until you expect to retire. After that, the calculator will compute the amount of money that you need to have saved and how different annual rates of return will change that number.

Below you can see a calculation that I ran for an “annual amount I want” of $75,000 if I hypothetically retire in 20 years:

As you use this calculator, keep a couple of things in mind:

As you use this calculator, keep a couple of things in mind:

- The calculator assumes that you will never touch the principal.

- The calculator assumes that you will give your nest-egg a “cost-of-living-raise” of 4% each year.

- This calculator adjusts the “annual amount your want” for an average annual inflation of 4%.

So, at 4% annual inflation, I will need $164,334 per year in 20 years to have the same purchasing power that $75,000 has today.

The bottom six rows tell you what you need to have in your nest-egg at different rates of annual growth. At 8% annual return, I would need $4,108,356 when I retire. That number drops significantly if I expect growth of 12% and I would only need $2,054,178 when I retire.

These numbers may seem astronomical and you might feel like you will never build a nest-egg of that size. But remember, the power of compound interest can work in your favor! By starting early and investing consistently, you can watch your nest-egg grow to numbers you may have only dreamed of.

========================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

Benefits of an IRA

You have probably heard something at some point about making contributions into an Individual Retirement Account (IRA) to prepare for retirement. Retirement and investing can seem scary and difficult or only for the super rich but I’m here to tell you: That is a lie. You can (and should!) begin investing for retirement and an IRA is a fantastic way to do just that.

The most popular types of IRA’s are the Traditional IRA and the Roth IRA. These investment vehicles are great ways to accumulate retirement money although they differ in their taxation. You can learn more about their differences in our podcast, Roth vs. Traditional IRA.

When you decide to invest into an IRA, regardless of the one you choose, you can expect to experience a variety of benefits.

Taxation: When you invest into a Traditional IRA, those contributions are made with “pre-tax” dollars which means that you can deduct them from your income. In a Roth IRA, contributions are made with after-tax dollars. This means that while you will not get a tax deduction, you will not have to pay any taxes when you withdraw the money in retirement. The tax benefits of both accounts can provide great traction when accumulating money for retirement.

Automation: One of the reasons IRAs are so popular is because they allow you to automate your savings. These accounts are incredibly easy to start and with a simple bank draft, you can make sure that you are investing every single month.

Compound Interest: After you have set up your IRA and automate your contributions, you will eventually be able to see the 8th Wonder of the World: Compound Interest. This means that once you start adding money you will start earning interest on that money. And then interest on THAT money. Your money will begin to work for you.

These are only a few of the benefits that you’ll experience when investing into an IRA. Ultimately, you want to make sure that you are taking advantage of every benefit that you can when you’re trying to save money for retirement. Whether you are fast approaching retirement or just getting started in life, using one of these accounts can greatly help you accumulate money so you can live your best life when you eventually leave the workforce.

========================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

MONDAY MONEY TIP PODCAST: Roth vs. Traditional IRA

In Episode 23 of The Monday Money Tip Podcast, we’re discussing how to choose between a Roth and Traditional IRA/401k when saving for retirement. In addition, I have some updated information in regards to mortgage rates, savings rates and CD rates. We will also hear a success story from a woman who used a 0% credit card transfer and how it changed her debt freedom journey.

It’s our goal at the end of each episode that you gain hope and encouragement in your financial journey, you’re equipped to take a next step, and that you’ve had FUN with us!

Find the Monday Money Tip Podcast HERE. Please let us know what you think by leaving us a rating!

NOW AVAILABLE TO DOWNLOAD:

iTunes

Stitcher

Spotify

Website

Email info@iwbnin.com to ask questions or share success stories.

Show Notes

About the Episode:

- Hear Joe answer a question about whether to choose a Roth or Traditional 401k at work.

- Joe shares information about current mortgage rates, savings rates and CD rates.

- Megan shares a success story about a woman who gained traction in her debt freedom journey by using a 0% credit card transfer.

Resources:

IWBNIN Next Steps

Marcus by Goldman Sachs

Ally Bank

American Express

0% Credit Card Transfer

IWBNIN Ladder

IRS Website

Voya Retirement Calculator

Fidelity Retirement Calculator

Quote of the Day: “Whether you choose Roth or Traditional, what is most important is that you actually choose one and invest! BOTH are great decisions for your financial future.” – Joe Sangl