Debt Freedom March – Couple #2 – Month 09

Introduction

This couple is THROUGH with debt! It has now been eight months since they announced that they were breaking up with debt. They have agreed to share their Debt Freedom March with everyone in the hopes to inspire others to do the same!

Here is this month's update.

What went well this month?

Everything went well. We have really got a handle on our budget, and we don't seem to have many struggles.

Challenges and struggles this month?

We both are in sales, so sometimes we have extra money come in that is not budgeted. Our goal is to put that money toward debt. This month we had a little extra money, and we did not put it toward debt… we used it as play money. We want to work on this for the future so we can shorten our Debt Freedom date. But, we didn't beat ourselves up for it. We work hard and enjoyed doing a little extra spending this month. We expect a bonus or two next month, and we are going to try and put a little bit of it toward debt. Wish us luck!

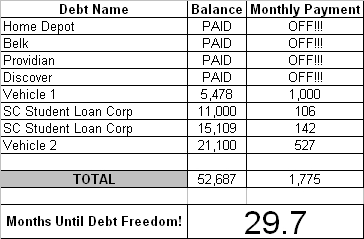

Here is their updated Debt Freedom Date calculation …

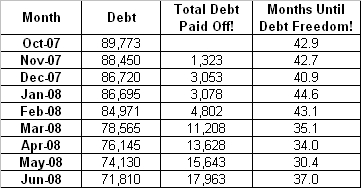

Month By Month Progress …

![]()

What has helped you stay on this Debt Freedom March?

There are several reasons why we have stuck to the plan. The Debt Freedom March has provided structure for our money. We have enjoyed paying our bills all at one time and not having to worry about paying bills again until the next month. We never worry about having "unexpected expenses" because we have the "known upcoming expenses" account set up. Another bonus is we don't noticed "pay day" anymore because we are not living paycheck to paycheck. All in all, this plan helps us feel in control of our money and our future. We are starting to see the light at the end of the tunnel, and that keeps us going along. We are looking forward to being debt free, and there is no way we are going to stop now.

How has this Debt Freedom March impacted your marriage relationship?

Luckily, we have always had the same view about how we spend our money and what we want for the future. Believe it or not… we have never fought about money. So, I guess I would have to say the debt freedom plan has helped us work as a team and look toward our future in a different way. We see ourselves having the life we want without the headache of worrying how we are going to pay for it. I am sure it has impacted us in other ways that we are not aware of at this time. But, I have no doubt that we will be able to look back in 10 years and see that sticking to the Debt Freedom March impacted our lives more that we could have ever imagined.

Sangl says …

Nine months ago, Couple #2 caught a vision of what life could be like without payments. In this nine month period, they have been able to knock fifteen months off their Debt Freedom Date! At this current rate, they will become debt-free in around eighteen months (January 2010) and it will have taken them only 27 months total to do it!

When they become debt-free, they will have freed up $1,775 in take-home pay every single month! How much does one have to earn to bring home $1,775? About $2,500 if their total tax rate is 30%! This means that they are going to give themselves a $30,000/year raise in about eighteen months!

I love this stuff!

Readers …

How much do you send to debt each month? Why not pay it off and give yourself a massive pay raise?

You can do this too! I share my story and teach these tools in my book, I Was Broke. Now I'm Not.

This stuff FIRES ME UP!!!!

Marching To Debt Freedom – Couple #1 – Month 09

Introduction

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now NINE months into their Debt Freedom March.

What went well this month?

Everything went reasonably well. We had a few unexpected bills but that is life. The rising cost of living is eating into our monthly budget a little but we are on track.

What were the challenges/struggles this month?

GAS, FOOD!!!

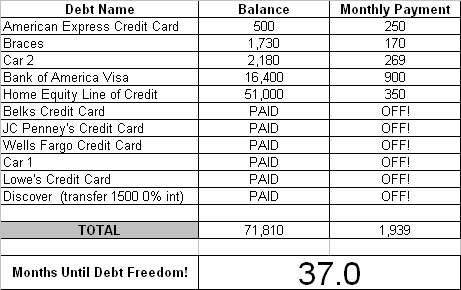

Updated Debt Freedom Date

Month By Month Progress

What has helped you stay on this Debt Freedom March?

The prize at the end of this is not being indebted to the leeches. I want to be free of the weight of debt. It is a cancer.

How has this Debt Freedom March impacted your marriage relationship?

It has created a sense of trust and unity. Together we are invincible, and we have a little change in our pocket.

Sangl says …

There are several success stories this month! Did you notice that Couple #1 paid off TWO credit cards this month? Lowe's and Discover both went into the "PAID OFF!" area this month. AWESOME! Also, they have paid off $17,963 in debt in just nine months. That is INCREDIBLE! That is a new car's worth of debt. Couple #1 could have continued living like they had in the past, and they would have been able to pay the bills fine. But they have caught a glimpse of what life is going to be like without debt, and nothing can stop them.

This is what this entire crusade is all about. Helping others accomplish far more than they ever thought possible with their personal finances! I LOVE THIS STUFF!

Readers …

What is your Debt Freedom Date? I hope it is zero or approaching it quickly!

Read Previous Monthly Updates For Couple #1 HERE

In my book that was released in January, I share the story of my Debt Freedom March and teach the exact tools that Jenn and I used to become debt-free. You can do it too! You can read the book's introduction HERE.

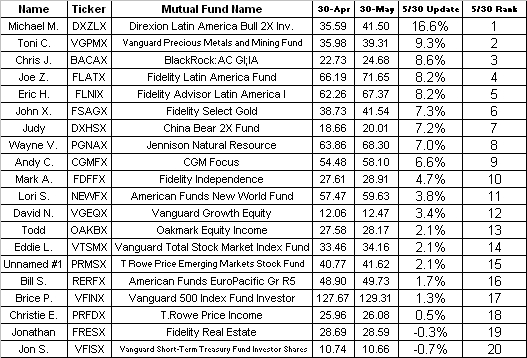

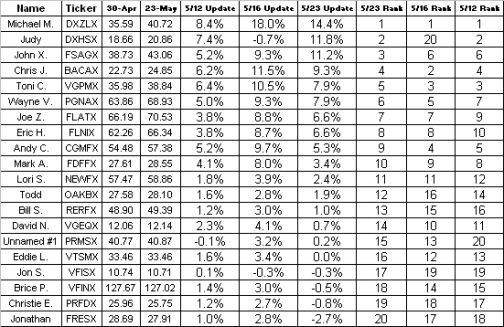

WINNER! Mutual Fund “You Pick ‘Em” Game

It was an exciting month to watch all of the mutual fund selections race each other. Thanks to all of the competitors who participated!

In the end, Michael (from New Hampshire) held the lead the entire month and walked away with the prize pack consisting ofL:

- "Financial Freedom Experience" T-Shirt

- Copy of I Was Broke. Now I'm Not.

- A blog post recognizing the winner's amazing ability

He chose the Direxion Latin America Bull 2X Inv [DXZLX] mutual fund, and it experienced an increase of 16.6%! That is in ONE MONTH! Incredible. Apparently, Michael has a special power to choose mutual funds that grow more in one month than most of mine do in one year.

Michael, your prize pack is on its way and your competitors all look up to you for your superior selection. Nice!

Here are the final standings.

I hope everyone learned from this contest! I would especially want each person to note the following:

- I view mutual funds as appropriate investments for the long term (five years or longer). Mutual funds go up and down in value over the short term, and tend to go up in value over the long term.

- Mutual funds can go up or down in a hurry. This is another reason that I hold my mutual funds for the long term. I am not good enough to predict when a mutual fund will experience rapid growth or when it will cease rapid loss. So I invest and let it ride. This strategy has worked well for me so far! I rebalance my portfolio once a year.

- Did you notice the variety of mutual funds in this contest? My hope is that each person will at least learn about the mutual funds available within one's 401(k) or similar retirement plan.

Readers: What have you learned as a result of watching this contest unfold? Please share your comment!

PODCAST: I Was Broke. Now I’m Not.

I do not know if you have checked out the "I Was Broke. Now I'm Not." podcast recently, but perhaps you should.

Top Five Reasons to check out the podcast

- It averages seven minutes in length. Never longer than ten minutes.

- I always answer a question asked by one of the JosephSangl.com readers.

- I always share a success story sent in by one of the JosephSangl.com readers.

- It is free.

- You might hear me yell, holler, and scream because I am so FIRED UP about what is happening through this crusade!

To subscribe to the podcast via iTunes, click HERE. If you do not have iTunes, you can download a mp3 by clicking HERE.

STANDINGS: Mutual Fund You Pick ‘Em Game [thru 5/23]

Here are the standings for the Mutual Fund "You Pick 'Em" Game with just one week remaining.

Michael M. has retained the lead, but took a hit over the past week and a couple of the competitors have closed the gap.

Judy's mutual fund selection, China Bear 2X Fund, has demonstrated what investing in a true international growth fund is like. In week one, it was #2 on the list. In week two, it dropped all of the way to #20. Now, it is back to #2! This is why I define an investment as money that I will leave alone for at least five years! I would have a heart attack if I was day-trading a fund like Judy's choice!

John X has closed the gap to hold #3 position after holding the #6 position the previous two weeks.

It is going to be a lot of fun to watch the performance over this last week to see who wins!